Lauri Patterson/E+ via Getty Images

Overview

Krispy Kreme (NASDAQ:DNUT) is a doughnut company. It has several revenue channels, including direct ownership of retail locations, royalties via franchising, and selling doughnut-making equipment.

Founded in 1937 in North Carolina, Krispy Kreme first went public in 2000. It returned to private ownership in 2016 and subsequently returned to the public markets in July 2021, trading on the NASDAQ exchange.

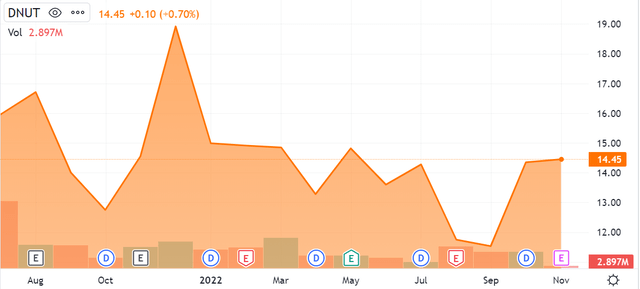

SeekingAlpha.com DNUT 11.7.2022

While remaining a consistently selling brand throughout its lifespan, it would have been a stretch to call it a growth stock or something with high upside potential for an investor.

Nonetheless, the company’s recent announcement of a pilot with McDonald’s (MCD) has caught my attention. Followers of McDonald’s know that the company has been trying to sell desserts/coffee for some time now, namely via its ‘McCafe’ offering. First set up in Australia back in 1993, McCafe is now a common component of neighborhood McDonald’s chains.

Yet, having tried McCafe and its dessert offerings on several occasions, I have found myself underwhelmed. Having previously tried Krispy Kreme doughnuts as well, I am confident in asserting that these doughnuts taste better than the desserts that McDonald’s has thus far brought to the table.

This is where I see potential opportunity. McDonald’s is looking to continue selling desserts, and it has an unrivaled distribution network through its 38,000 locations around the globe. If Krispy Kreme can establish itself in this distribution network, it could experience significant revenue growth and subsequent appreciation for its stock.

I would classify this as an event-driven trading opportunity centered around a novel distribution opportunity – let’s take a deeper look.

Further Thoughts

McDonald’s presents a good distribution opportunity for obvious reasons. In addition to this, it has continued to display growth with a recent earnings beat as well as continuing revenue growth.

Additionally, McDonald’s is well positioned to consume more ‘wallet share’ in the current environment. Wallet share is a metric that refers to how much the average consumer spends at the company in question. Given the current inflationary period and concomitant economic situation, it is sensible that many consumers may opt for the cheaper option – which is more often than not McDonald’s. A recent report on Seeking Alpha describes this secular trend in more detail.

Taken together this means McDonald’s is well positioned to continue bringing in customers. Going back to Krispy Kreme, we now simply need to check if it is profitable to sell doughnuts. Certainly it isn’t rocket science.

Things get a bit tricky here as selling doughnuts appears less profitable than one may expect. While Krispy Kreme is generally able to earn an operating income each quarter, it seems to be subject to a relatively fixed cost structure.

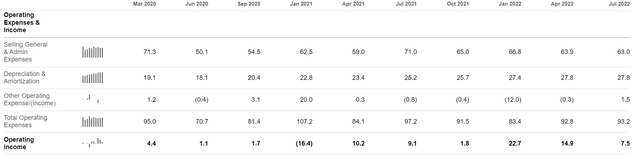

SeekingAlpha.com DNUT 11.7.2022

This makes sense as it has to pay rent on its retail locations as well as invest in equipment. This fact is reflected in the company’s significant capital expenditures and overall loss of cash to maintaining its operations:

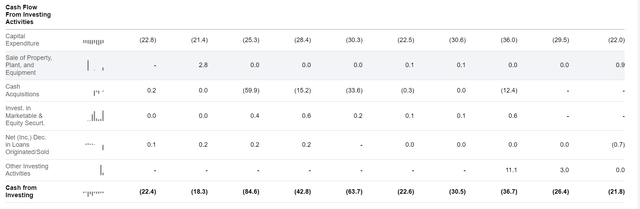

SeekingAlpha.com DNUT 11.7.2022

Those factors have created a situation wherein the company has posted poor EPS results for 10 quarters running, almost always negative:

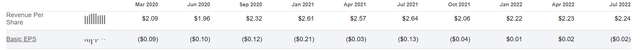

SeekingAlpha.com DNUT 11.7.2022

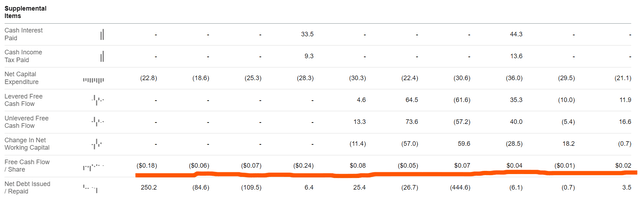

Looking at the cash side of the books, we see a company that usually operates at the cusp of free cash flow – sometimes positive, frequently negative. This is illustrated via the free cash flow per share metric seen below:

SeekingAlpha.com DNUT 11.7.2022

Qualifying this, it would be a concern if this company was never able to post a positive free cash flow per share. Since it does do so occasionally, however, it stands to reason that it may benefit from a higher-margin business.

The partnership with McDonald’s could very well be this higher-margin business, but it also very well could not be. Ultimately McDonald’s will be taking a healthy cut of the profits, and Krispy Kreme will have to expend further capital expenditures in order to meet the demand. If there will be success through that partnership, it will come from a significant amount of up-front investment.

Conclusion

Krispy Kreme is at an interesting inflection point. I have found throughout my career that McDonald’s is usually a good bet, in good times and in bad. If Kreme’s doughnuts gain traction, I am confident that it will turn into a significant revenue driver for the firm – possibly a multiple of their overall revenues.

Yet, there are counterfactors to consider – such as the requisite capital expenditure and ongoing pressure on the consumer. This consumer pressure should drive more people to McDonald’s vis-à-vis other brands, but it may also make them stick to just getting the burger – and skipping dessert.

Since I don’t have strong conviction on either side of this, I think it is fair to call it a hold. The opportunity here is real, and it makes sense on a product and secular trend level. The picture overall, however, is too complex to arrive at a firm buy or sell decision. For followers of either brand it makes sense to continue paying close attention to developments between these two brands.

Be the first to comment