Chris Hondros

Goldman Sachs Group (NYSE:GS) recently reported its second quarter earnings that outperformed expectations. The bank beat estimates for EPS and revenue comfortably due to the firm continuing to support clients amid an evolving macroeconomic environment. Operating expenses fell slightly, while net interest income missed estimates by over 4%. Looking into each of the divisions of the firm, Goldman Sachs’ Global Markets division generated the highest revenue at $6.47 billion. The company also announced that it will raise its dividend by 25% for 3Q22, which means that the payout is still consistently growing and could be attractive for dividend investors. Goldman Sachs is ranked at the top for its mergers and acquisitions. However, this could be troubling as M&A declined for the first time in 8 quarters in 1Q22, and it is continuing to fall throughout the industry. Goldman Sachs is slightly overvalued and GS stock is down almost 17% YTD. Momentum could bring the stock down further, especially in a bear market when less deals are made. Therefore, GS stock may not be the best option for investors.

Goldman Sachs Beat Q2 Earnings Estimates

Goldman Sachs released its second quarter earnings on July 18 and surpassed forecasts. Normalized EPS came in at $7.73 which beat estimates by $1.12. Revenue came out to $11.86 billion which is down 23% from a year ago but beat analyst estimates by $1.17 billion. The firm’s second quarter also had an ROE of 10.6% and an ROTE of 11.4%. Operating expenses were $7.65 billion which is down from $7.72 billion in 1Q22 and $8.64 billion in 2Q21. Compensation and benefits expense of $3.70 billion fell from $4.08 billion in 1Q22 and from $5.26 billion in 2Q21. Net interest income came out to $1.73 billion which missed estimates by 4.42%

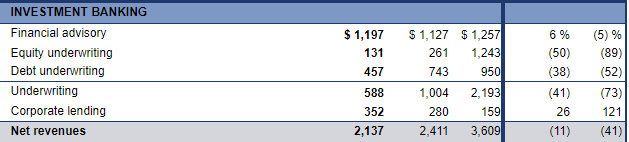

Goldman Sachs generally strong second quarter can be better understood by looking deeper into how each segment of the bank performed. In the second quarter, Goldman Sachs’ Investment Banking division generated $2.13 billion in revenue. This declined by 11% Q/Q and 41% Y/Y. Financial advisory came out to $1.2 billion for 2Q22 which increased 6% from $1.13 billion in 1Q22, but decreased 5% from $1.26 billion a year ago. Equity underwriting was $131 million in the second quarter, as it decreased 50% from 261 million in 1Q22, and down 89% from $1.24 billion in the year ago quarter. These developments were caused by lower volumes and transactions.

GS Investment Banking Division (Goldman Sachs SEC Filing)

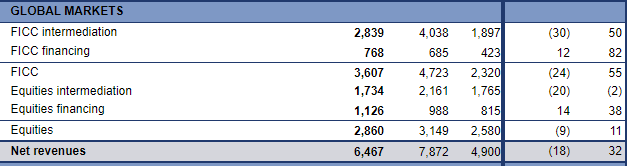

In the second quarter, Goldman Sachs’ Global Markets division generated $6.47 billion in revenue. This declined by 18% Q/Q and increased by 32% Y/Y. FICC revenue of $3.61 billion dropped by 24% Q/Q, but has rose by 55% Y/Y. Equities revenue of $2.86 billion decreased by 9% from the previous quarter while rising 11% from a year ago. These were caused by higher fixed income sales as rising interest rates have caused bonds to become more attractive.

GS Global Markets Segment (Goldman Sachs SEC Filing)

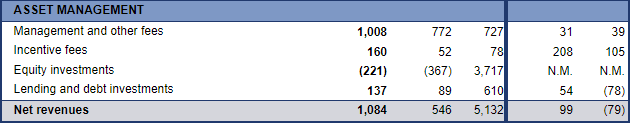

Asset Management net revenue of $1.08 billion increased 99% from 1Q22, but fell 79% from the year ago quarter. The Y/Y drop indicated net losses in equity investments and significantly lower net revenue in lending and debt investments. This was slightly neutralized by higher management and other fees. Asset management changes in the second quarter can be attributed to volatile global prices, losses from investments, and mark-downs on debt securities.

GS Asset Management Segment (Goldman Sachs SEC Filing)

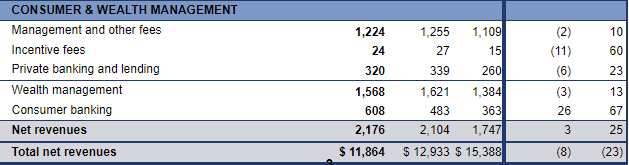

Goldman Sachs’ Consumer & Wealth Management division generated $2.18 billion in revenue. This was 25% higher than 2Q21 and 3% more than 1Q22 revenues. Wealth management came to be $1.57 billion in the second quarter, which was 3% less than 1Q22 and 13% higher than 2Q21. Consumer banking was $608 million which was an increase from $483 million in 1Q22 and another increase from $363 million in 2Q21. Consumer & Wealth Management changes can be attributed to higher fees and greater revenues in private banking and lending.

GS Consumer & Wealth Management Segment (Goldman Sachs SEC Filing)

Dividends Will Spike By 25%

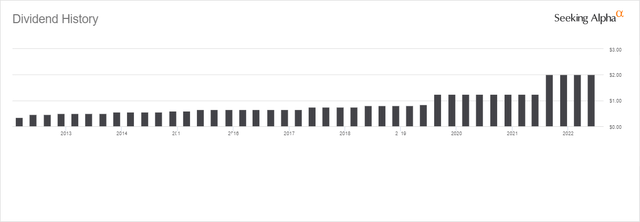

With Goldman Sachs’ recent earnings report, the firm also declared a quarterly dividend of $2.50 for 3Q22, which is up 25% from its previous payout. The firm pays a $10.00 annual dividend which equates to a 2.66% dividend yield. It has paid a dividend for 22 consecutive years and the payments have been trending up over the years. This consistency is very impressive and proves the dividend to be sustainable.

GS Dividend History (Seeking Alpha)

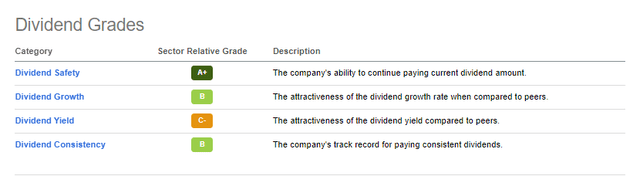

The dividend is fairly safe and could continue to grow considering the recent declaration of a 25% increase. Therefore, Goldman Sachs could be a very attractive value option for dividend investors.

GS Dividend Grades (Seeking Alpha)

Ranked At The Top Of Mergers and Acquisitions

Goldman Sachs ranked at the top with announced and completed mergers and acquisitions and in worldwide equity and equity related offerings and common stock offerings for the YTD. The firm is known for its mergers and acquisitions, as this is a key aspect of the company. In 2020 and 2021, Goldman Sachs also ranked first out of all financial advisers in total deal value for mergers and acquisitions. The firm similarly ranked third in 2021 and first in 2020 in total volume of these deals.

US M&A Top Financial Advisers (GlobalData Financial Deals Database)

However, mergers and acquisition are on the decline which could bring some trouble to Goldman Sachs. Mergers and acquisitions fell for the first time in the last 8 quarters in 1Q22 to 2,502 deals. With mergers and acquisition deals dropping throughout the industry, Goldman Sachs could struggle in the upcoming quarters. However, the firm managed to increase its book value in 2Q22 by 2.9%, which is a great sign for the direction of the company.

Valuation

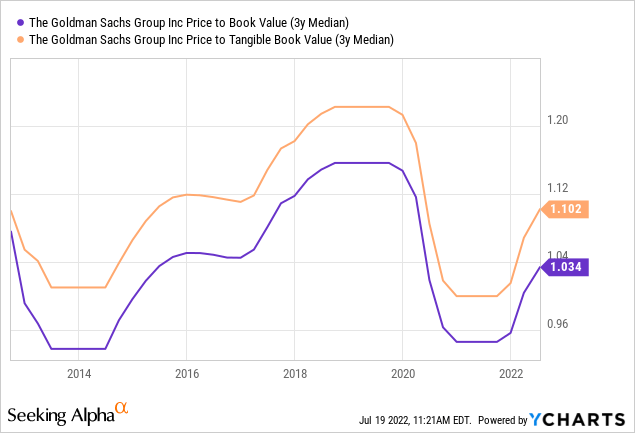

Book value per share in the second quarter increased to $301.88, while the tangible book value per share came in at $278.75. These reflect a book value of 1.04 and 1.13 which are in line with the historical multiples of the company.

By multiplying the historical multiples for book value and tangible book value of Goldman Sachs and the recently reported current values of these multiples from 2Q22, we can come to two price targets. Averaging these targets together, brings us to a final price target of $309.66. Dividing this price target by the current share price of GS stock, implies a downside of 1.64%.

The Takeaway For Investors

Goldman Sachs has recently reported its second quarter earnings which outperformed expectations. Most notably, the Global Markets division performed the best, generating $6.47 billion in revenue. The firm also declared it will raise its dividend by 25% in the third quarter. Goldman Sachs is ranked at the top in terms of mergers and acquisitions, however M&A is down throughout the industry which is due to the bear market. GS stock is down nearly 17% YTD, which could drop further due to momentum. The firm is slightly overvalued by 1.64%, which is why I believe investors could wait for the share price to drop more. Therefore, I will apply a Hold rating to GS stock.

Be the first to comment