jane/iStock via Getty Images

Digital displays and other similar technologies are borderline ubiquitous throughout modern society. The ability to easily display information in various circumstances can be incredibly valuable. And one company that operates in this space that has a rather interesting operating history is Daktronics (NASDAQ:DAKT). In recent years, the financial picture of the company has been a bit volatile. But this doesn’t mean that the company represents a bad opportunity for long-term investors. Given how cheap shares are today, both on an absolute basis and relative to other similar firms, it could very well offer some decent upside for investors moving forward. Because of this, I have decided to rate the enterprise a soft ‘buy’, reflecting my belief that it will likely outperform the broader market for the foreseeable future.

A sign to invest in?

According to the management team at Daktronics, the company designs and produces electronic scoreboards, programmable display systems, and large screen video displays that are used for sporting, commercial, and transportation applications. The company’s line of offerings is fairly robust, with scoreboards for instance ranging from small ones all the way up to large ones. Some of the electronic displays it produces cost millions of dollars, and the company’s display systems also include control, timing, and sound system applications to them. In addition to producing and selling these systems, the company also engages in other activities. For instance, it also participates in what it refers to as technical contracting. In these kinds of arrangements, it operates as a technical contractor for larger display system installations that require custom designs and innovative product solutions. The firm also offers professional services such as event support, content creation, product maintenance, marketing assistance, hardware and software training, control room design, and even continuing Technical Support training for operators. Some of the company’s revenue also comes from the offering of limited warranties for its products, with some of these extending up to 10 years.

The full range of the company’s products includes video displays and even video walls, scoreboards and timing systems, message displays, intelligent transportation systems dynamic message signs, mass transit signs, sound systems, digital billboards, digital street furniture, digit and price displays, indoor dynamic messaging systems and indoor LCD signs, and software and controllers associated with its other technologies. The most obscure of these product lines must be the digital street furniture. According to management, these are LED displays that can be placed on sidewalks and in other areas aimed at helping relay valuable information to those passing by.

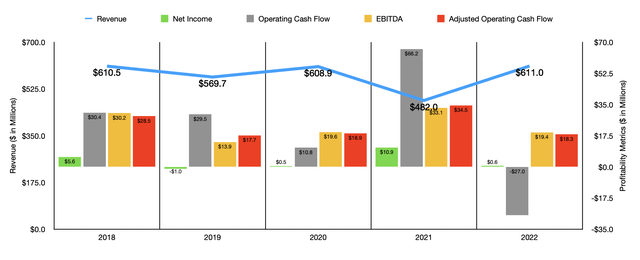

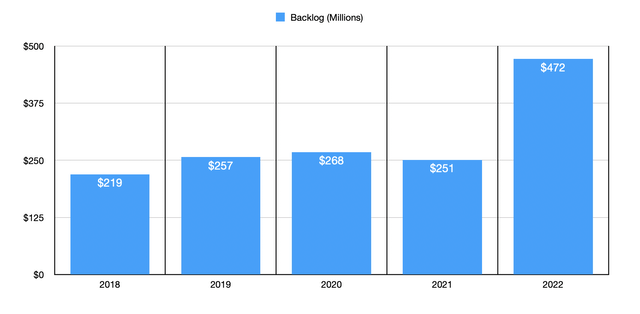

Over the past five years, the financial picture for the company has been rather interesting. Between 2018 and 2022, sales largely were within a fairly narrow range of between $569.7 million and $611 million. The only exception was in 2021 when sales dropped to $482 million because of the COVID-19 pandemic. For context, the high year was in 2021. The increase in revenue from 2020 to 2021 was driven by strength across the board. But undoubtedly the bright spot for the company involved products and services that fell under the Live Events category. Sales there jumped by 39.2% year over year, accounting for 43.5% of the total increase in revenue year over year. It just so happens that total orders for the Live Events category also experienced the greatest growth, with the year-over-year increase totaling 99.7%. For that year, this category accounted for 47.5% of the year-over-year improvement in orders for the company. Management attributed much of this upside to increase order volume caused by strong demand for the company’s products. What’s more, they expect the demand to continue from across the board, with 2023 looking particularly bullish. Unfortunately, the company has not provided specific guidance for what that year might look like. But with backlog at a multi-year high of $471.6 million, it’s likely that the 2023 fiscal year will prove to be a good year for investors.

Just like revenue, profitability has not really shown any clear trend. Over the past five years, net income has ranged from a low point of negative $1 million to a high point of $10.9 million. Operating cash flow had shown similar uncertainty, with a range of between negative $27 million and positive $66.2 million. If we adjust for changes in working capital, that range changes to between $17.7 million and $34.5 million. Meanwhile, EBITDA should be between $10.9 million and $33.1 million.

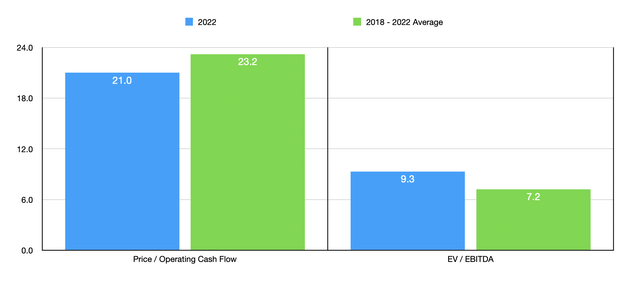

No guidance has been provided when it comes to the 2023 fiscal year. But for the purpose of this article, I’ve decided to value the company based on 2022 results in two different ways. The first is to compare the data to the results from 2022. And the second is to average out results for the past five years. Taking the first approach, the firm is trading at a price to adjusted operating cash flow multiple of 9.3. This compares to the 7.2 reading that we get if we rely on the five-year average. Meanwhile, the EV to EBITDA multiple should be 7.6. That compares to the 6.4 reading that we get if we rely on average results for the past five years.

The company is aided on the EV to EBITDA front because it currently has no debt and has cash and cash equivalents of $22 million. This also means that the firm has very little debt in the near term, even if its financial position worsens because of a potential slowdown. Also, as part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, four of the companies had positive results, with their multiples ranging from between 3.9 and 111.2. In this case, only one of the companies was cheaper than our prospect. Using the EV to EBITDA approach for the five companies, we ended up with a range of between 12.5 and 51.1. In this case, our prospect was the cheapest of the group.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Daktronics | 9.3 | 7.6 |

| Luna Innovations (LUNA) | 40.7 | 20.4 |

| Iteris (ITI) | N/A | 14.6 |

| nLIGHT (LASR) | 3.9 | 51.1 |

| National Instruments Corporation (NATI) | 111.2 | 23.1 |

| OSI Systems (OSIS) | 33.0 | 12.5 |

Takeaway

Based on the data provided, I am definitely intrigued by the value proposition that Daktronics offers. To be absolutely clear, I do not see this firm as a home run. The absence of real material growth in recent years is one such reason. Having said that, the stock still does look cheap and likely offers some upside potential for long-oriented investors. And because of that, I have decided to rate the business a ‘buy’ for now.

Be the first to comment