simonkr/E+ via Getty Images

Goldman Sachs (GS) came out with a bearish note on lithium last month that forecasted lithium carbonate prices falling to $53,300 per tonne in 2023 from around $80,640 per tonne currently. Shocking the market was the forecast for prices to fall further to $11,000 per tonne in 2024 against a broader Wall Street consensus of $29,063 per tonne. Goldman expects China to lift their lithium production by 37% in 2023, with Chile and Australia also expected to lift production by 48%. Total global supply is forecasted to increase by 221 kilotonnes in 2023 and 321 kilotonnes in 2024, a supply surge that will face up against what’s now an economy-led slowdown in demand for battery electric vehicles. Lithium is the lightest metal and has the best electrochemical potential with the best energy density compared to weight. The metal will fully form the foundation for the long march towards a sustainable low-carbon economy.

The expected overcapacity is significantly at odds with forecasts that lithium demand from use cases ranging from short-duration energy storage systems to BEVs will lead to a marked supply gap for the foreseeable future. This was especially meant to be the case with the structural bottlenecks to the development of new lithium mines in certain geographies globally. In the United States, Albemarle (NYSE:ALB) Silver Peak lithium mine which produces just enough lithium for 80,000 vehicles a year remains the only mine operating in the US. Efforts to open new mines are ongoing but some have stalled. For example, the Thacker Pass lithium mine being developed by Lithium Americas (LAC) is currently locked in a legal battle with environmental and indigenous groups looking to block its development.

Lithium Prices Could Climb Higher

Rio Tinto’s (RIO) license for a proposed $2.4 billion Jadar lithium mine in Serbia was cancelled by the Serbian government after huge environmental protests. It would have become the largest lithium mine in Europe. Europe has essentially been written off as a player in the lithium space with London-listed Savannah Resources’ (OTCPK:SAVNF) plans to build its Barroso lithium mine in Portugal being beset by protests and a near six-year delay due to additional requests by the Portuguese environmental regulator.

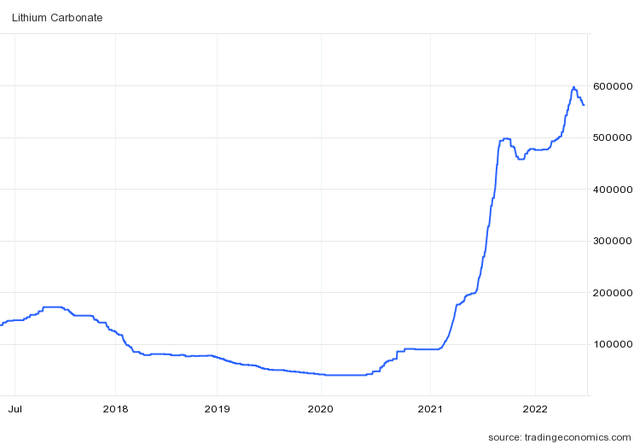

Lithium joined the broader commodity surge this year to reach new highs. Whilst there has been some retrenchment in recent weeks on the back of broader expectations of an economic slowdown, the commodity continues to trade at extremely elevated levels compared to its historical average. The partnership of higher energy prices with rising interest rates from a raft of central banks has led to a slowdown in the overall momentum of EV sales. Indeed, Volkswagen has stated that EV growth in Europe has gone off track.

Hence, whilst lithium demand will grow next year, its overall magnitude will likely be weaker than desired especially if the global economy falls into a recession. This sets the macro backdrop for Albemarle which is trading on record highs.

Goldman Is Likely Wrong

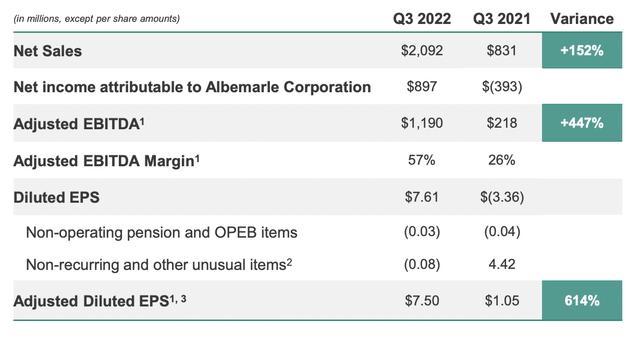

The company recently released earnings for its fiscal 2022 third quarter which saw revenue come in at $2.10 billion, up by 151% over the year-ago period but a miss of $120 million on consensus estimates. The company continues to benefit from the demand for lithium-ion batteries as the climate economy goes through generational growth set to be boosted by the Inflation Reduction Act.

Third quarter adjusted EBITDA was $1.2 billion, an increase of 447% from the year-ago comp with the growth in earnings far outpacing revenue growth. Albemarle expects revenue for the year to not be less than $7.1 billion with adjusted EBITDA to be between $3.3 billion to $3.5 billion, revised upward at the lower end from a range of $3.2 billion to $3.5 billion. The company wants to build on this strong performance and expects to generate positive free cash flow for the full year 2022. This is expected to continue through 2023 assuming lithium prices stay flat and against expected growth capex.

I’ve come to describe Albemarle as the Exxon Mobil (XOM) of lithium with the company increasingly developing its global footprint to fully ride the opportunities posed by the transition to zero-carbon technologies. The company closed its acquisition of a Chinese lithium conversion plant and completed the expansion of its Kemerton II lithium conversion project in Australia to more than double its lithium conversion capacity compared to fiscal 2021. Albemarle is also looking to invest $180 million in an advanced lithium technology facility in North Carolina. The company expects innovations from the facility to enable enhanced lithium recovery and introduce new forms of lithium to enable greater battery performance.

In the absence of any positive near-term news, we might see the common shares drift lower as a response to the broader stock market and economic malaise. I see this as an opportunity to start a position.

Be the first to comment