Bet_Noire

Overview

Hims & Hers Health (NYSE:HIMS) is a telehealth company. They offer virtual doctor appointments and prescriptions via these appointments. As an example, someone can fill out a form and then set up an appointment with a physician, upon which they will be prescribed a drug for whatever may ail them.

On 11/8/2022, the stock gained 19.70% in the wake of its latest earnings report. We will look into the earnings report further to see if this appreciation was warranted and if this stock could still represent a buying opportunity.

Earnings

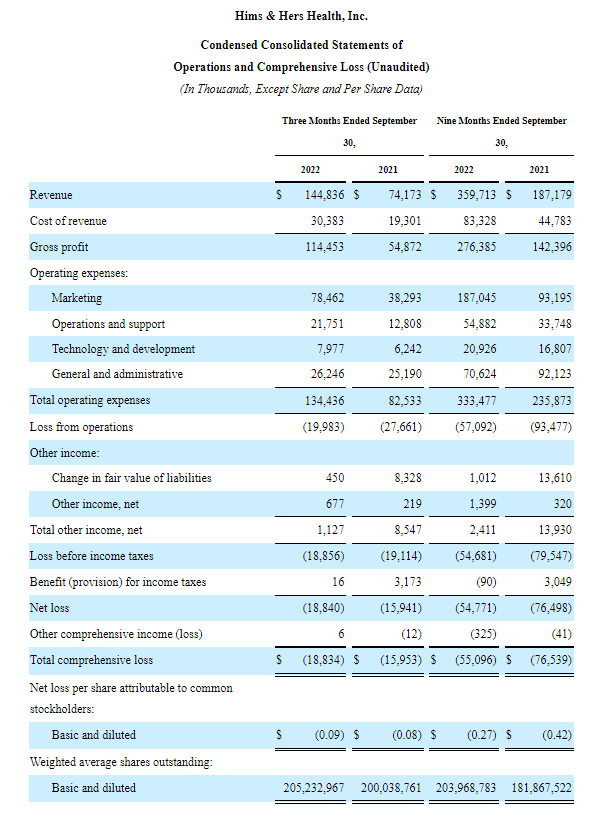

As a matter of context, this is a growth company that is not yet profitable. The recent earnings print for Q3 2022 beat Wall Street estimates on both EPS as well as revenue. GAAP EPS came in at -$0.09, $0.01 above consensus, and quarterly revenues were $14.51M above consensus.

In the wake of this earnings report the company upgraded guidance and received several upgrades by Wall Street analysts. This makes sense at face value, as the firm was able to grow revenues 95.27% YoY. Its cost of revenues showed a reasonable increase that doesn’t appear to require further investigation. Looking further down the income statement, we see a fairly flat cost structure apart from the Marketing line item, which increased by 104.9% YoY.

This is certainly something to note, as the company basically doubled its marketing expenditures in order to double its revenues. The $144M in revenue it generated came along with an extra $40M in marketing spend. Since the other elements of its cost structure remained relatively flat, this appears to still be an economic investment decision. Nonetheless, If the company has to continue doing this in order to scale revenues, that will negatively impact its capacity to generate consistent profits. It is too early in this firm’s growth cycle to arrive at a conclusive view on that, however.

Looking further down the income statement, we see that the company’s net loss per share actually increased by $0.01 this past quarter, coming in at -$0.09 as opposed to Q3 2021’s -$0.08. This is likely due to the intricacies of accrual accounting, notably that the company repriced its liabilities during Q3 2021 (Change in Fair Value of Liabilities). A clearer picture emerges from looking at the firm’s Net Loss from Operations, which was only 72% of what it was in Q3 2021. This is a good sign as far as the firm’s business model is concerned.

SeekingAlpha.com HIMS 10-Q 11.8.2022

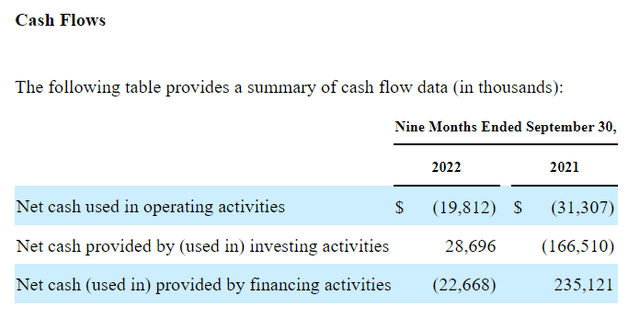

Overall the income statement looks as it should for a growth company headed to profitability. Looking over to the cash flows, things get more complex. Note that we do not have the quarter-by-quarter data since this is a quarterly update and not the year-end 10-K.

SeekingAlpha.com HIMS 10-Q 11.8.2022

The company was able to reduce its operating cash loss to 63.2% of the comparable period, which I consider a good showing. The other line items pertain to the firm’s financing activities and won’t be covered within the scope of this article.

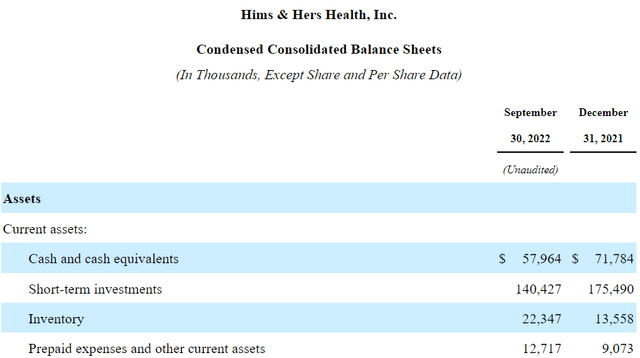

Taking a quick look at the balance sheet we see that the company has less cash than it did during the same reporting period last year, but isn’t at a level low enough to warrant concern. The company also has short term investments of $140M. As per the accounting definition, these are investments that can readily be converted into cash.

SeekingAlpha.com HIMS 10-Q 11.8.2022

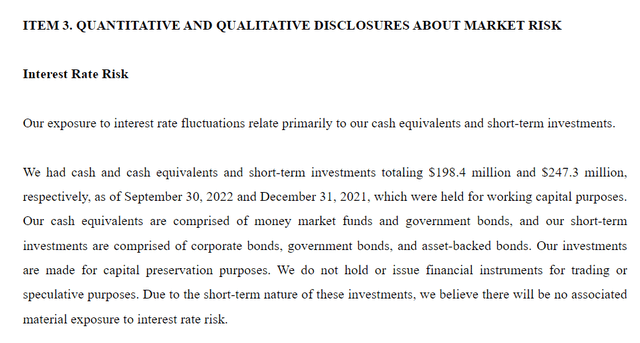

True to this, the filing states that the firm has its short-term investments in “corporate bonds, government bonds, and asset-backed bonds”. While this may be done to hedge against inflation, it arouses my skepticism to see such a degree of financial activity in a non-financial company. Corporate history is rife with poor decisions made along these lines. Additionally, this makes the company that much more sensitive to the current rates environment. This company has close to triple its cash within these cash equivalents. In my opinion, management has created a complexity and a risk to their business through this. I acknowledge the ongoing inflationary environment, but I will again note how this has gone quite wrong for companies in the past.

SeekingAlpha.com HIMS 10-Q 11.8.2022

Overall, the finances of the company appear a bit more complex than they should – but the overall picture is still quite good. The savvy investor should note this firm’s idiosyncratic risk due to its overexposure to rates.

Additionally, this company faces another material risk that is unique to the telehealth space: government regulation. Telehealth is an actively legislated topic, which can be seen from a quick look the topic at congress.gov. At present there are multiple bills pending around this topic; a cursory glance shows that most are actually aimed at deregulating the space further.

Yet, that may not persist forever. The risks inherent in prescribing drugs virtually, and the nature of any business that does so, become apparent upon a few moments reflection. It is not out of the question that Congress at one point ends up going in the other direction. This is something that an investor in any business of this nature should continue to pay attention to.

Conclusion

Overall I think this business will achieve profitability as expected, furthering appreciation in its stock; it looks like a buy at present.

However, the long-term foundations of this company are something that I have much less conviction about. It may be the case that it cannot maintain present revenue levels/growth without significant marketing expenditure. Additionally, the regulatory picture is an evolving one and could at one point turn against the telehealth business wherein this company operates; stay tuned.

Be the first to comment