annavaczi/iStock via Getty Images

Investment Thesis

Alliance Resource Partners (NASDAQ:ARLP) has 2 problems. In the first case, its operations focus on thermal coal. And thermal coal is about to be phased out in the US.

The second problem is that management could be construed as embarking on empire-building, diworsification projections, the investing in green energy projects.

These two considerations should be part of the investment thesis, undoubtedly. Nevertheless, I maintain that paying approximately 6x next year’s free cash flow is cheap enough that this isn’t a serious concern for investors. Plus, investors will probably also get a 14% yield too.

There’s a lot of nuance here, so let’s get to it!

ARLP, Faces 2 Problems

There are a lot of mixed messages when it comes to our energy supply. On the one hand, very few countries want to rely on thermal coal for their energy supply. All of you reading this know that thermal coal is the dirtiest of all fossil fuels.

Indeed, there’s a meaningful push from all corners to phase out the use of thermal coal, completely. And the sooner it gets phased out, the better.

What’s more, of ARLP’s sales for the full year 2021, 82% came from thermal sales. So, as investors, we are presented with a problem. Why?

Because ARLP predominantly sells to U.S. electric utilities. And if the U.S. is intent on phasing out its use of thermal coal, that means that ARLP’s main customer base will no longer be demanding its products.

Now, the big question that ARLP has to face and provide clarity to investors on is whether ARLP will look to increase its sales to international markets? Or will it look to empire build and diworsify into transition energy projects?

To give you some context, consider this quote from ARLP’s Q3 2022 earnings call,

We remain interested in the EV infrastructure market and our new ventures team continues to evaluate opportunities to work with Francis Energy and others in this growing sector.

What the quote above makes reference to is ARLP’s investment in Francis Renewable Energy, LLC (“Francis”). That is, the installation, management and operation of metered-for-fee, public-access electric vehicle (“EV”) charging stations.

Accordingly, for anyone invested in coal commodity companies, perhaps the scariest thing a management team can do is move away from its core expertise and go off empire-building.

After all, the incentive of management is to do everything in its power to ensure it can continue to get executive compensation. So, what should investors now do?

This is my belief. I believe that irrespective of the anecdotal evidence of thermal coal being phased out, I believe that thermal coal will remain in high demand for at least another 5 years. Why?

whitetundra.ca

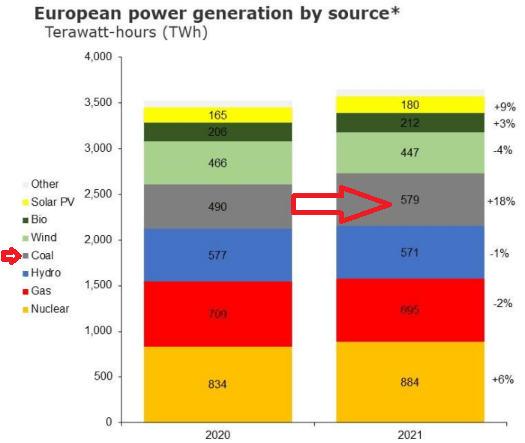

Think about it. Internationally, thermal coal is not a nice to have energy source. It’s the cheapest fossil fuel. It offers reliable access to base load energy. As you can see in the graphic above, back in 2021, before the Ukraine invasion, coal demand was up 18% y/y. Surprising, right?

For all the talk about thermal coal being phased out, the facts don’t back up that narrative.

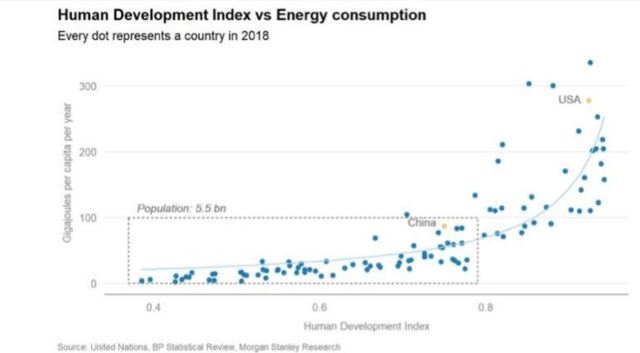

Next, consider this graphic showing energy consumption for 5.5 billion people in the world.

The data is several years out now. But it shows that the U.S. is one of the countries that consume the most energy. But if we were to imagine that the rest of the world would over time consume similar levels of energy to the U.S., these countries will need substantial access to affordable reliable energy.

And that energy could come from renewables. But that’s just one energy source. There’s going to be coal, oil, natural gas, and nuclear, to mention several key energy sources, supplementing the overall supply side.

ARLP Stock Valuation – Forward Yield Could Reach 14%

As I noted in my previous article, at the start of 2022, ARLP’s cash distribution was annualized at $1.00. Next, by Q3 2022, its cash distribution jumped and annualizes at $2.00. And the year isn’t even finished.

Also, keep in mind that throughout 2022, ARLP had to aggressively work to bring down its net debt position. As it stood at the end of Q3 2022, its net debt position was $150 million.

Thus, if ARLP doesn’t have to be as aggressive in paying down its debt in 2023, this would further support my estimate that by this time next year, ARLP’s cash distribution could reach $3.00.

The Bottom Line

There are clear reasons to be uninterested in ARLP. The most obvious is that 2022 was likely to be an anomaly, where thermal coal prices shot up and those prices are unlikely to be seen again in 2023.

That being said, for now, as we enter 2023, I continue to believe that if ARLP is able to sort out many of the logistic issues it endured in 2022, even with lower thermal coal prices, through more coal volume sales, ARLP is likely to see somewhat similar levels of free cash flow as 2022.

That would put the stock priced at about 6x next year’s free cash flow.

Be the first to comment