imaginima/iStock via Getty Images

Introduction

The other day, I discussed CubeSmart (CUBE), a fast-growing self-storage REIT. It’s one of the four self-storage stocks that I really like as high-yield dividend growth investments. In my dividend portfolio, I own Extra Space Storage (EXR), and Public Storage (PSA). The one we have barely discussed is Life Storage (NYSE:LSI), a stock I really started to like as it comes with a mix of great qualities. It has a high yield, strong dividend growth, and a fast-growing business model to back this all up – including a healthy balance sheet.

As macroeconomic woes and a hawkish Fed are pressuring the real estate market, I believe it’s important to discuss the best-of-breed companies as investors are working on their watchlists going into 2023.

I believe that LSI should be on everyone’s radar. As we’ll discuss in this article, it’s a good investment for retired investors as well as young investors looking for growth.

So, let’s get to it!

Growth In A Fragmented Industry

Whenever I own one or multiple stocks in a certain industry, people ask me, why didn’t you buy competitor XYX? That’s a valid question, as we only want to buy the best stocks in each industry.

In the case of self-storage, I can honestly say that I like all of my top 4 self-storage stocks. I wouldn’t lose sleep if my current two holdings were switched with the two holdings of my top 4 that I don’t own.

After all, they all have certain qualities that make them strong candidates.

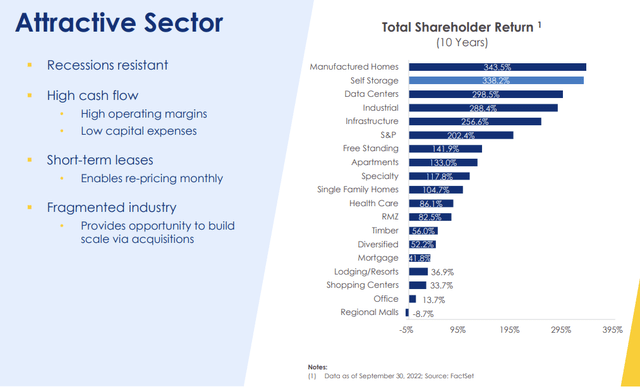

Life Storage, for example, is a prime example of innovation in a low-barrier REIT industry. Self-storage has extremely low entry barriers. Everyone with access to capital can buy storage facilities.

The trick is to turn it into a service that offers high-quality services. Once companies have figured that out, they can penetrate a highly fragmented market, unlocking tremendous value.

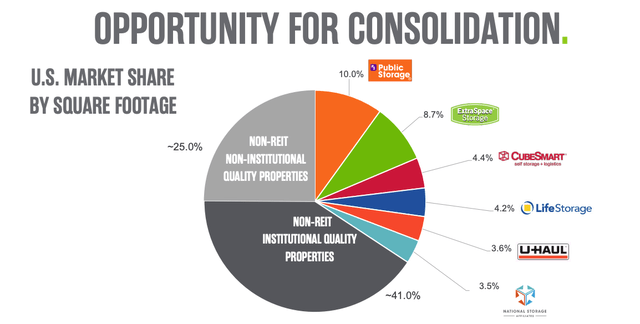

Using data from its peer Extra Space Storage, we see that the largest operator has a 10.0% market share. Life Storage has a 4.2% market share. Roughly 66% of the market is owned by non-REIT owners. A quarter of assets is held by non-REIT, non-institutional owners.

One of the things I often talk about is value-adding bulk real estate. I am a fan of “liquid” real estate assets in fragmented industries. Not only does this allow companies to generate steady market share gains, but it also allows for large sums of institutional money to flow into assets. That is a bit more tricky when dealing with larger, less liquid assets.

Using Life Storage numbers, we see that the two best-performing real estate industries over the past year are manufactured housing and self-storage. Both returned close to 340%. The S&P 500 returned 202%, which is already impressive.

Needless to say, both of these industries are bulk industries that allow operators to quickly expand operations. And to toot my own horn, I have heavily promoted these industries over the past few years.

What Makes Life Storage Special

Life Storage is my prime example whenever I discuss mini-warehousing solutions. One of the many benefits that come with self-storage is the fact that these assets are basically mini warehouses very close to city centers and residential areas. It’s the perfect solution for companies looking to speed up same-day deliveries.

Life Storage has been on top of this emerging trend since the very start as it understands the value one can generate from otherwise boring storage boxes.

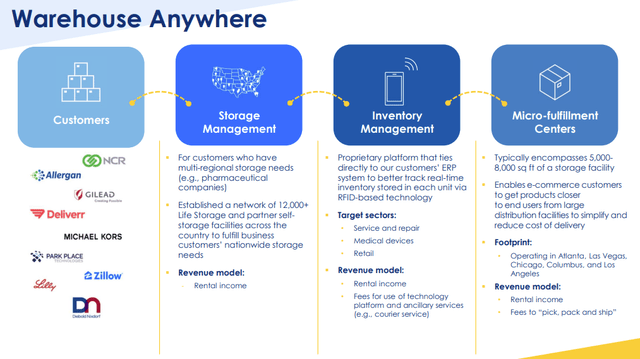

What the company calls “Warehouse Anywhere” is a business-to-business solution, allowing client products to come closer to customers. This includes last-mile delivery to end-users.

According to the company:

Warehouse Anywhere is Life Storage’s proprietary intelligent and technologically advanced warehousing solution that provides third-party logistics (3PL) through a forward-deployed, unmanned model combining storage asset management with a proprietary inventory management application across a network of more than 12,000 Life Storage or partner facilities. Warehouse Anywhere also retrofits storage units in select Life Storage facilities to create micro-fulfillment centers that are equipped with needed infrastructure and technology to place e-commerce customers’ inventory and fulfillment orders from numerous online marketplaces and platforms

Essentially, it’s a business model that allows to eventually grow revenues beyond traditional rental income to income based on technology usage and everything related to last-mile storage operations.

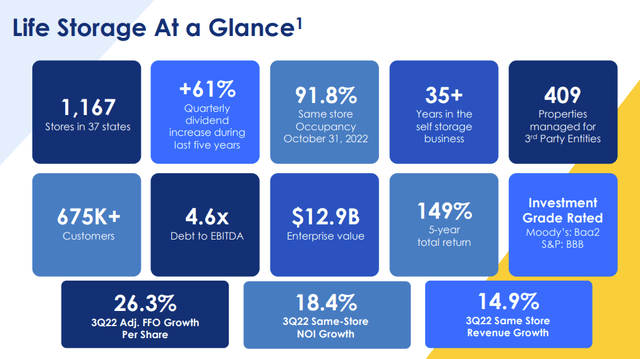

With that said, Life Storage’s bread and butter is traditional self-storage. The company operates close to 1,200 stores in 37 states, servicing close to 700,000 customers.

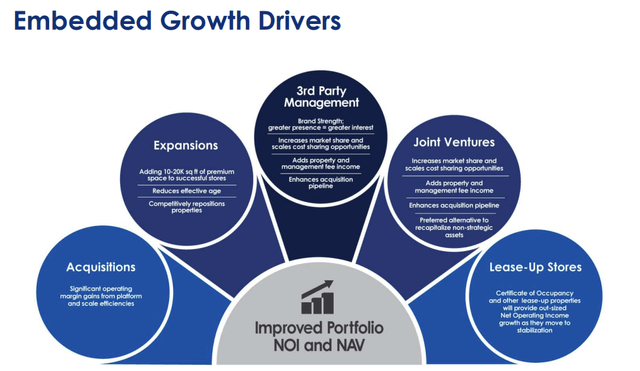

Roughly 758 of its 1,167 facilities are wholly owned. The others are joint ventures or managed assets. This allows for lower-risk income and the option to expand through assets and partners known to the company.

Third-party and JV-managed properties are two of the company’s five growth pillars.

The company’s largest market is Greater NYC, where it generates 7.9% of its revenues. Chicago accounts for 6.8% of revenues. Houston accounts for 5.3% of revenues. All other major markets have less than 5% exposure.

40% of its portfolio is located in 20 of the top 25 fastest-growing markets in the United States. 60% of assets are in the Sun Belt region.

LSI’s markets are expected to enjoy 4.1% population growth between 2022 and 2027. This beats all competitors. Moreover, average household income is expected to be stronger in areas dominated by LSI.

In the past few years, LSI has accelerated growth. Between 2010 and 2015, the company boosted its store count by 44%. Since 2016, the store count has been boosted by 115%. In 2021 alone, LSI spent close to $1.7 billion on acquisitions, adding 112 new stores.

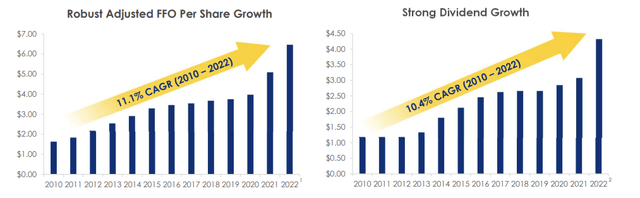

As a result of acquired and internal growth (i.e., pricing), the company has grown adjusted funds from operations by 11.1% per year between 2010 and 2022.

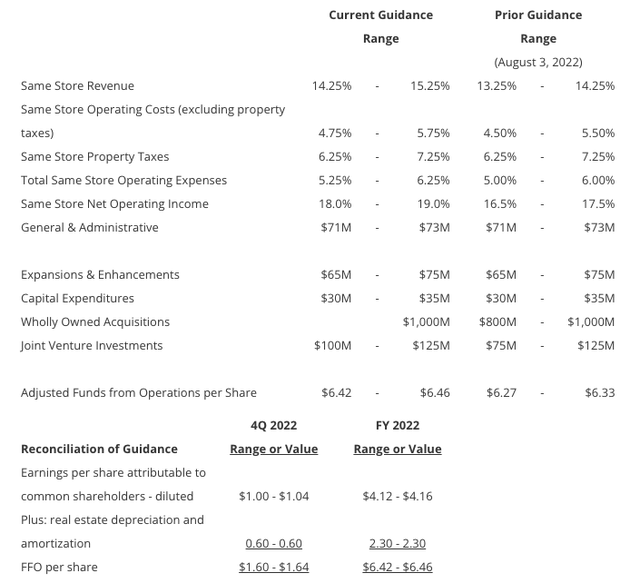

In its third quarter of 2022, the company generated 26.3% adjusted FFO per share growth. Same-store revenue was up 14.9%, boosting same-store net operating income by 18.4%.

As a result, the company boosted its 2022 full-year guidance.

As we look towards the full-year, we now estimate our adjusted funds from operations per share to increase to a midpoint of $6.44 for the year, which would be 27% growth from 2021.

This guidance puts the valuation at 16.5x AFFO. That’s just 2 points above the sector median. Note that the sector median covers the entire real estate sector, including mostly slower-growing industries. This valuation is very fair and the result of significant stock price weakness.

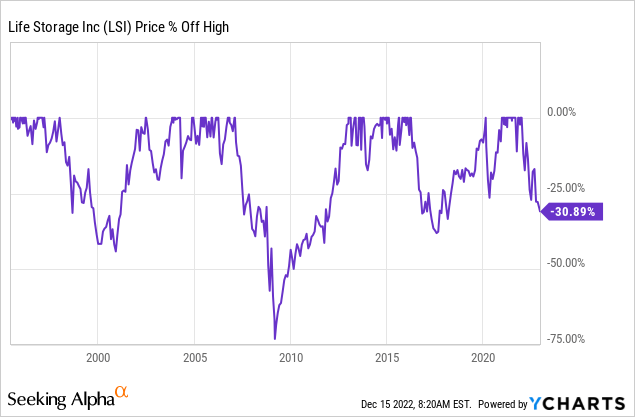

On a monthly-closing basis, it’s one of the five worst sell-offs since the company’s IPO.

In this case, the market is digesting a move to higher rates, higher inflation, and a long-term hawkish Fed. If you’re interested, I covered this new investment era in a recent article.

That said, the yield has come up, and it’s a quality dividend.

The LSI Dividend + Balance Sheet

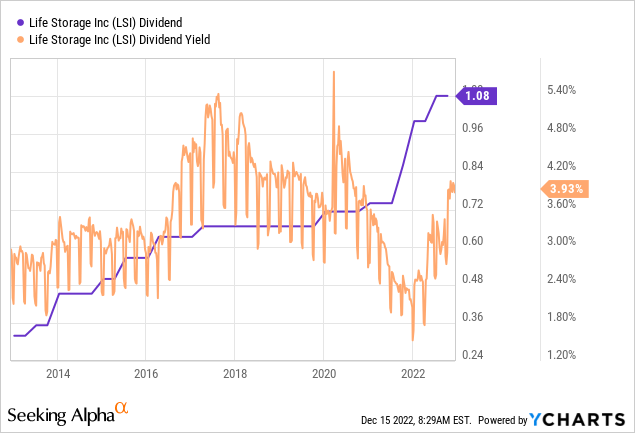

LSI shares currently pay a $1.08 per share per quarter dividend. That’s $4.32 per year. This translates to a 4.1% dividend yield.

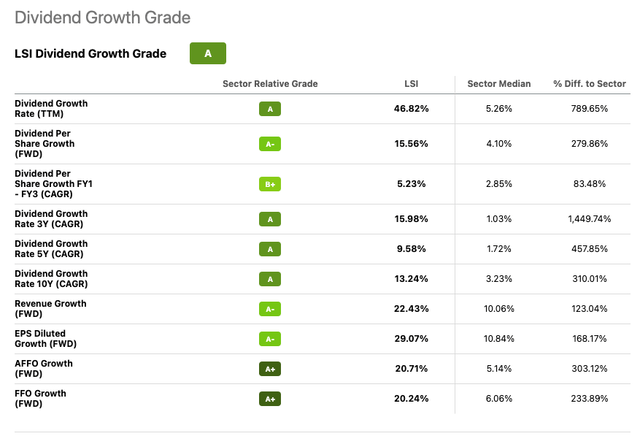

Not only does LSI come with a great yield, but it also has high dividend growth. Over the past ten years, the average annual dividend growth rate was 13.2%. On a three-year basis, that number is even higher at 16.0%. Hence, the company scores an A compared to the real estate sector.

Needless to say, when real estate price growth is weaker, dividend growth will be weaker. Most dividend growth was generated in the years after 2012 and 2020 (pandemic).

These are the latest hikes:

- July 2022: +8.0%

- January 2022: +16.3%

- October 2021: +16.2%

- January 2020: +7.0%

Dividend safety is high. The company’s AFFO payout ratio is 72%. That is in line with the sector median. The FAD (funds available for distribution) payout ratio is 60.3%. That’s 620 basis points below the sector median.

Moreover, dividend safety is about balance sheet safety. Especially in these times. The company has a BBB-rated balance sheet. The weighted average interest rate on its debt is just 3.4%, The average maturity is 5.8 years with no major maturities until 2026. This buys the company a lot of time.

86% of the company’s debt is fixed-rate debt.

The leverage ratio is just 4.6x, which is one of the lowest I’ve seen in a long time.

Takeaway

As we head into 2023, I think the LSI ticker is a good one to keep a close eye on. This self-storage giant offers tremendous opportunities for income-oriented and dividend-growth investors. The company has a high yield of more than 4.0%, its business model supports high growth, and its financials protect the company against high rates.

While I do not expect the stock to take off anytime soon due to lasting Fed hawkishness and macroeconomic challenges pressuring property prices (and self-storage demand), I’m happy that investors are finally in a good situation to buy stocks like LSI at great valuations.

In other words, if you’re looking for quality dividend growth, I think LSI might be right for you.

(Dis)agree? Let me know in the comments!

Be the first to comment