Spencer Platt

A Quick Take On Allbirds

Allbirds (NASDAQ:BIRD) went public in November 2021, raising approximately $303 million in gross proceeds from an IPO that priced at $15.00 per share.

The firm sells eco-friendly footwear and accessories to consumers worldwide.

Until management reignites significant revenue growth while making meaningful progress toward operating breakeven, my outlook for BIRD is on Hold.

Allbirds Overview

San Francisco, California-based Allbirds was founded to develop footwear and apparel using naturally derived materials that aim to be more environmentally sound.

BIRD is a public benefit corporation, or PBC, which means that management and the board may take into account other considerations than stockholders when making decisions for the company.

Management is headed by co-founder and co-CEO’s Joseph Zwillinger and Timothy Brown, who have been with the firm since inception and were previously Vice President of Industrial Products at TerraVia (Zwillinger) and Manager in the Innovation Strategy and Business Development Department at Redscout (Brown).

The company’s primary offerings include:

The firm sells its products directly to consumers via its online website presence and to a lesser extent through its few dozen company-owned retail store locations and other retail partners.

Allbirds’ Market and Competition

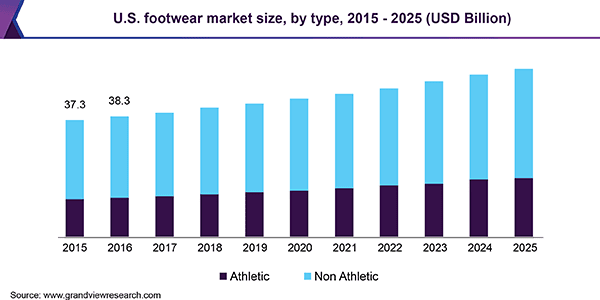

According to a 2019 market research report by Grand View Research, the global market for footwear of all types was an estimated $207.6 billion in 2018 and is forecast to reach $270 billion by 2025.

This represents a forecast CAGR of 3.8% from 2019 to 2025.

The main drivers for this expected growth are a growing demand for comfortable and convenient footwear as well as innovative designs and more advanced fabrications.

Also, below is a historical and projected future growth trajectory for the U.S. footwear market, by shoe type:

U.S. Footwear Market (Grand View Research)

Major competitive or other industry participants include:

-

Lee Cooper

-

Adidas

-

PUMA

-

Nike

-

Ecco Sko

-

Crocs

-

Amazon

-

Others

Allbirds’ Recent Financial Performance

-

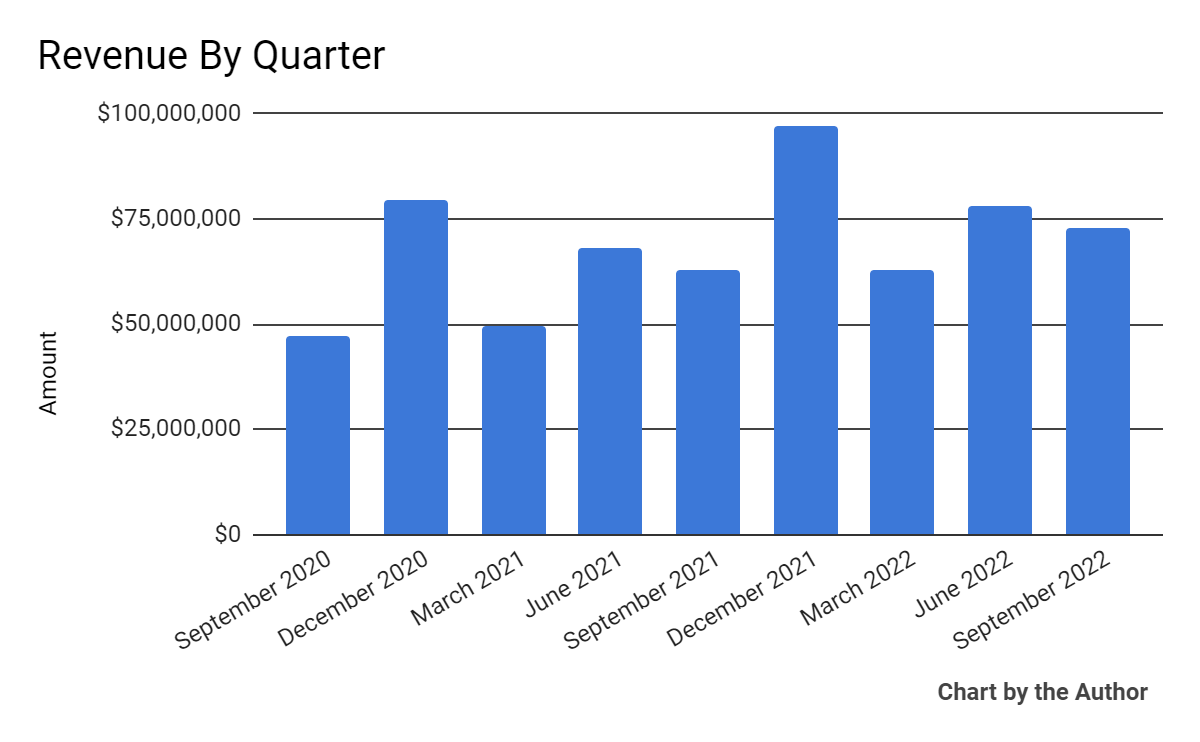

Total revenue by quarter has grown according to the following trajectory:

9 Quarter Total Revenue (Seeking Alpha)

-

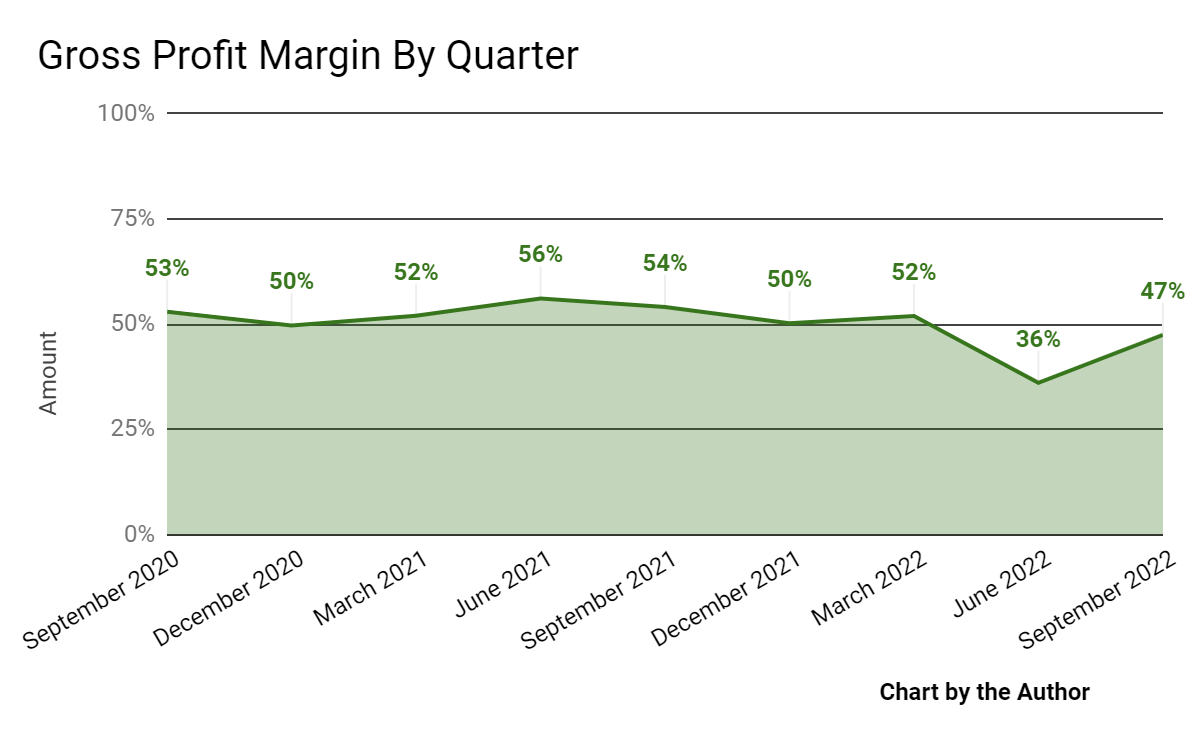

Gross profit margin by quarter has dropped in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

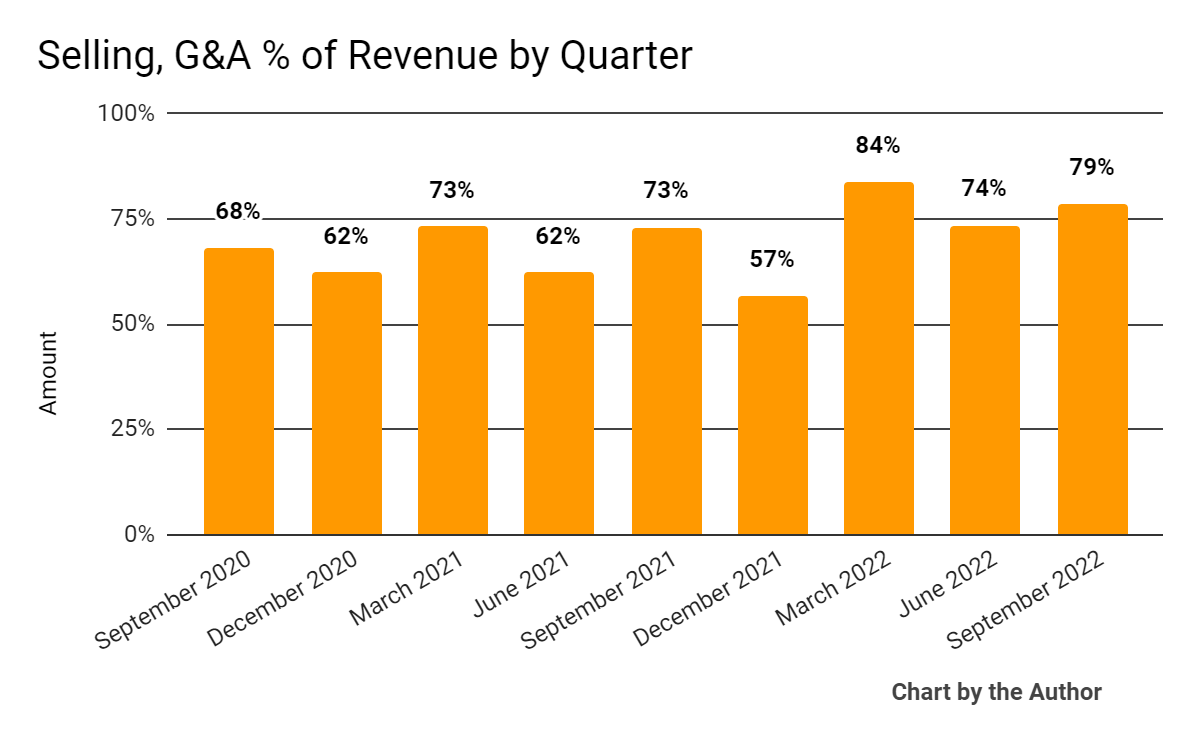

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent quarters, a negative signal:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

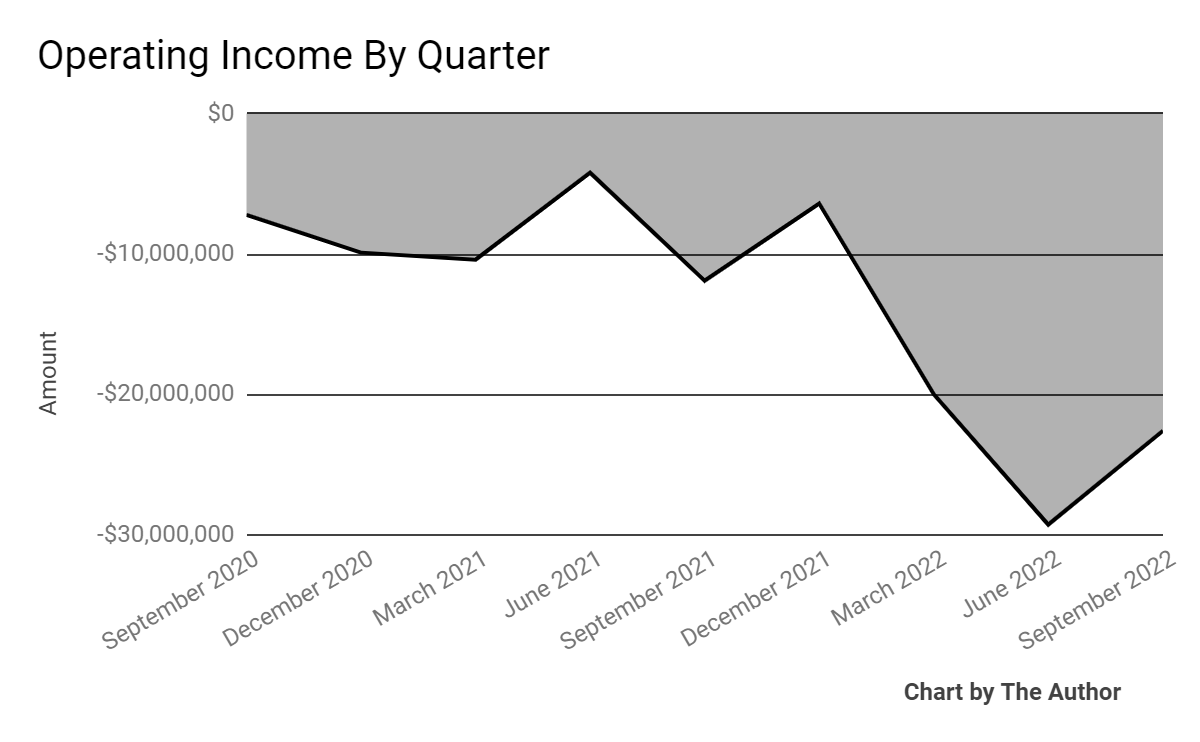

Operating losses by quarter have worsened recently:

9 Quarter Operating Income (Seeking Alpha)

-

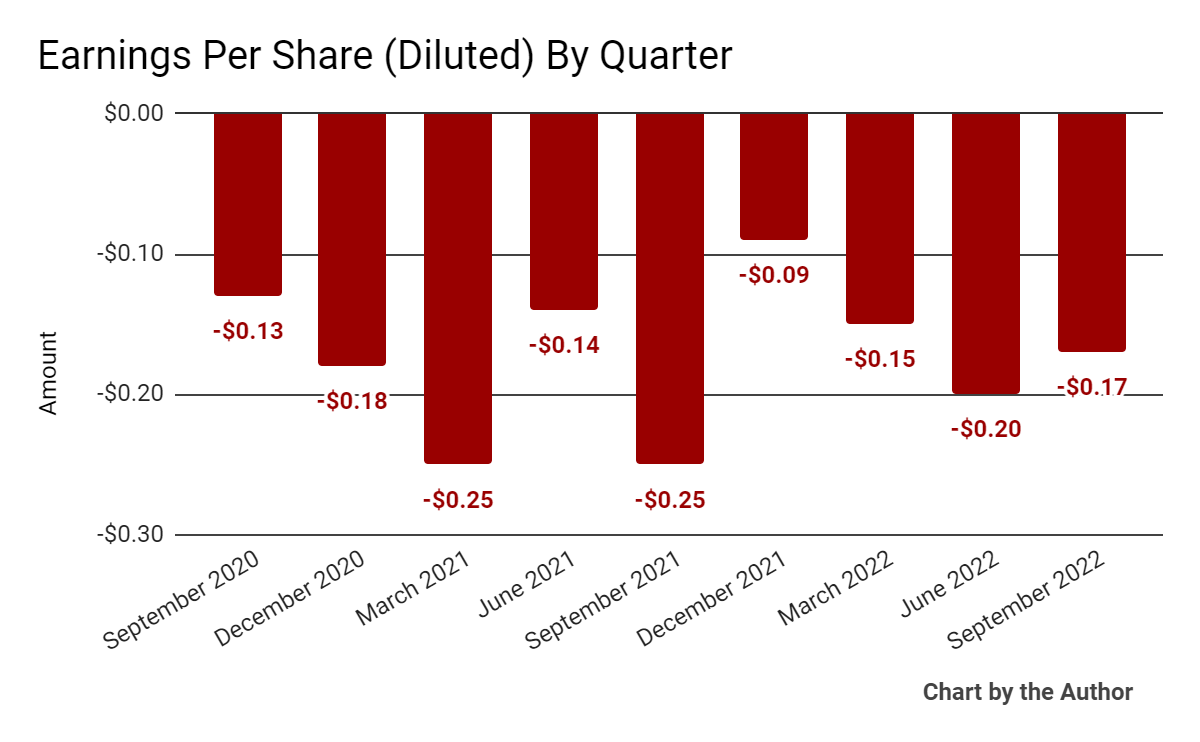

Earnings per share (Diluted) have remained substantially negative, as the chart shows here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

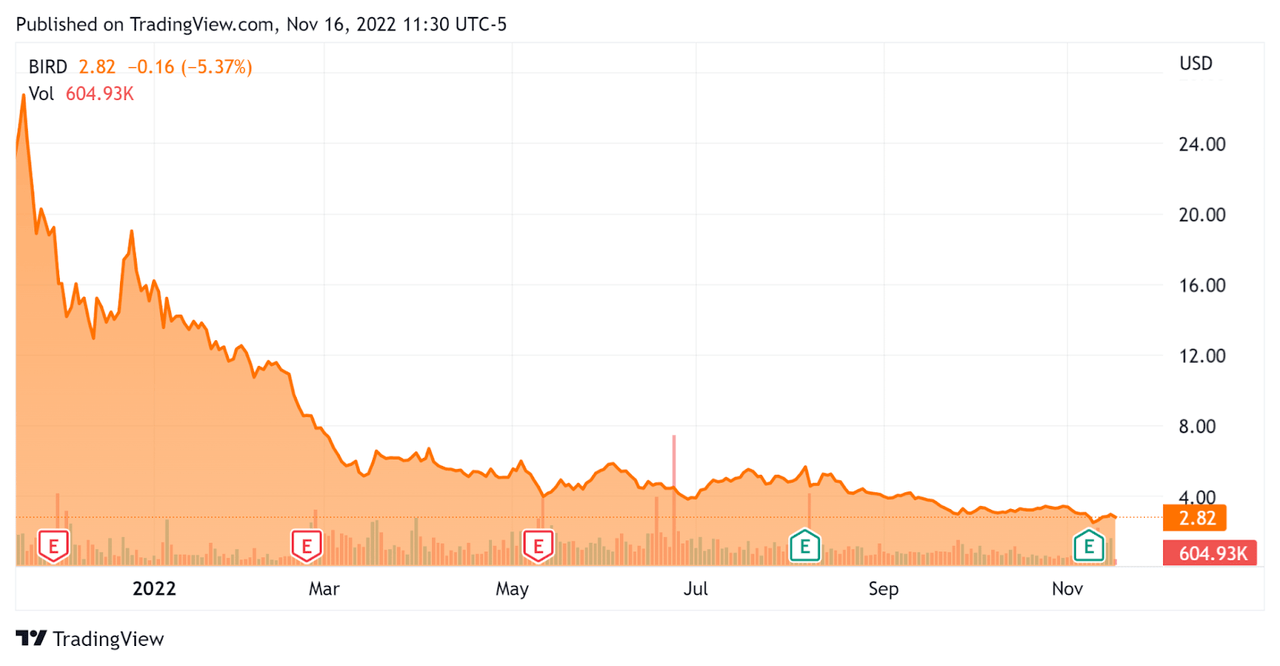

Since its IPO, BIRD’s stock price has fallen 87.5% vs. the U.S. S&P 500 index’ drop of around 15.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Allbirds

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.79 |

|

Revenue Growth Rate |

19.8% |

|

Net Income Margin |

-28.0% |

|

GAAP EBITDA % |

-16.9% |

|

Market Capitalization |

$427,150,000 |

|

Enterprise Value |

$246,420,000 |

|

Operating Cash Flow |

-$87,510,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.61 |

(Source – Seeking Alpha)

Commentary On Allbirds

In its last earnings call (Source – Seeking Alpha) covering Q3 2022’s results, management highlighted the persistent inflation impacts on its business, worsening foreign exchange headwinds due to a strong US dollar and continued COVID lockdowns in China.

In response, management said it has taken the opportunity to “streamline processes and optimize our cost structure… while also investing in a customer experience that we believe best positions our business for continued growth…”

The holiday period ahead is expected to be “the most promotional we’ve experienced since launching the company in 2016.”

That translates into greater price discounting which is likely to put increasing downward pressure on revenue.

As to its financial results, revenue rose by 15% year-over-year, or 19% in constant currency.

Gross margin dropped to 47% during the quarter, down sharply from 54% in the same quarter in 2021.

SG&A rose significantly year-over-year, while operating losses also worsened dramatically.

For the balance sheet, the company finished the quarter with cash and equivalents of $180.7 million and no debt.

Over the trailing twelve months, free cash used was a whopping $119 million, with $31.5 million in capital expenditures.

Looking ahead, management reiterated its full year 2022 guidance targets, with revenue expected to increase 12% over 2021 at the midpoint of the range and continued heavy losses.

Regarding valuation, the market is valuing the company at an EV/Revenue multiple of around 0.8x, punishing it significantly for its substantial and increasing operating losses and battle with inflation and too much inventory.

The primary risk to the company’s outlook is a U.S. and EU recession in 2023, which most economists agree will occur or has already begun, reducing discretionary spending from lower end consumers but affecting higher end consumption less so.

Until management reignites significant revenue growth while making meaningful progress toward operating breakeven, my outlook for BIRD is on Hold.

Be the first to comment