Art Wager

Introduction

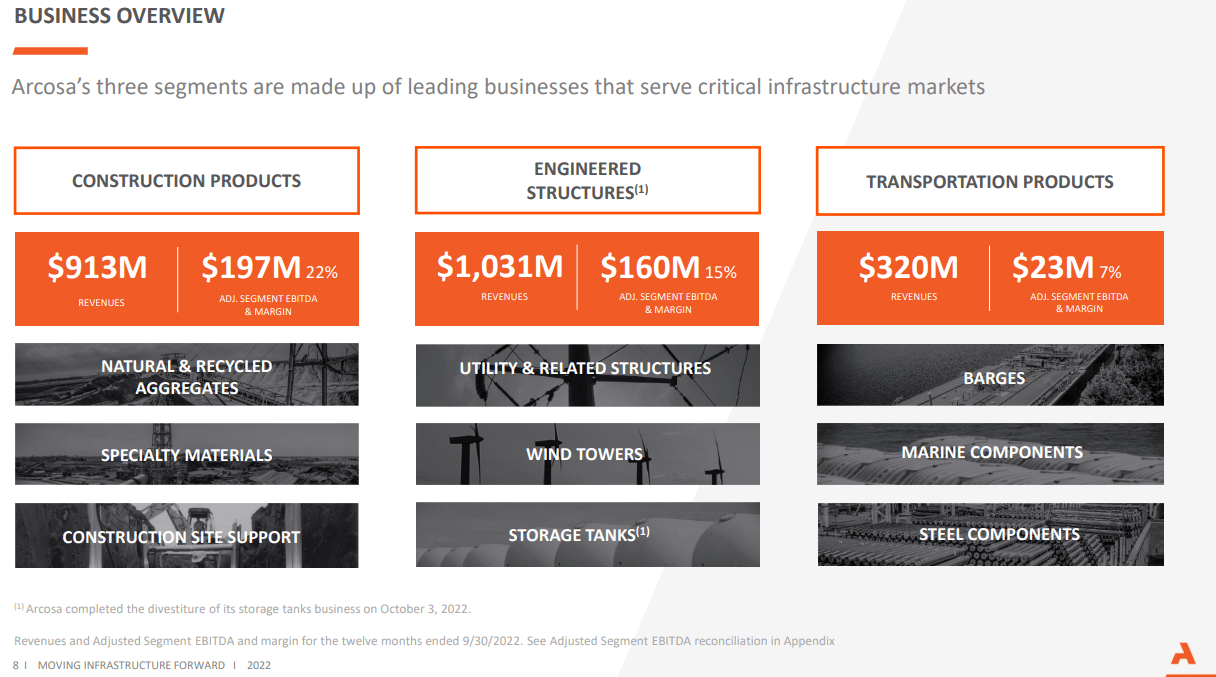

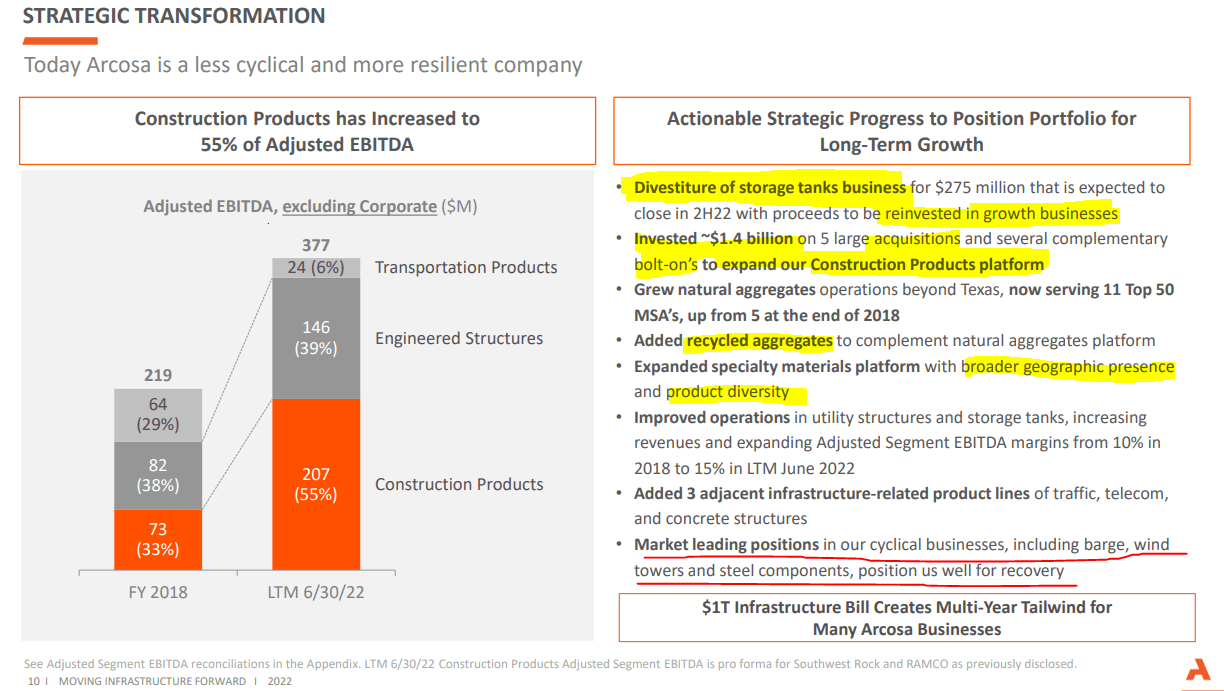

Arcosa, Inc. (NYSE:ACA) is a diversified company that provides services and materials to serve various parts of the infrastructure industry. Many of these are fairly niche and offer high-enough margins to support a bullish case, but one particular segment is far weaker than the others. As Arcosa is a spin-off themselves, from Trinity Industries (TRN) in 2018, they should be able to continue working on improving the core segments and shedding off weak assets.

If these assets indeed are sold or spun off, the company should be able to earn a good amount of cash to invest in their non-cyclical growth segments. This will help bolster growth segments just as the bear cycle subsides and infrastructure spending bills stimulate the core markets. However, the stimulus may be enough to support the long-term thesis regardless of whether the transportation unit gets sold or not.

Arcosa Presentation

The Weak Link Segment

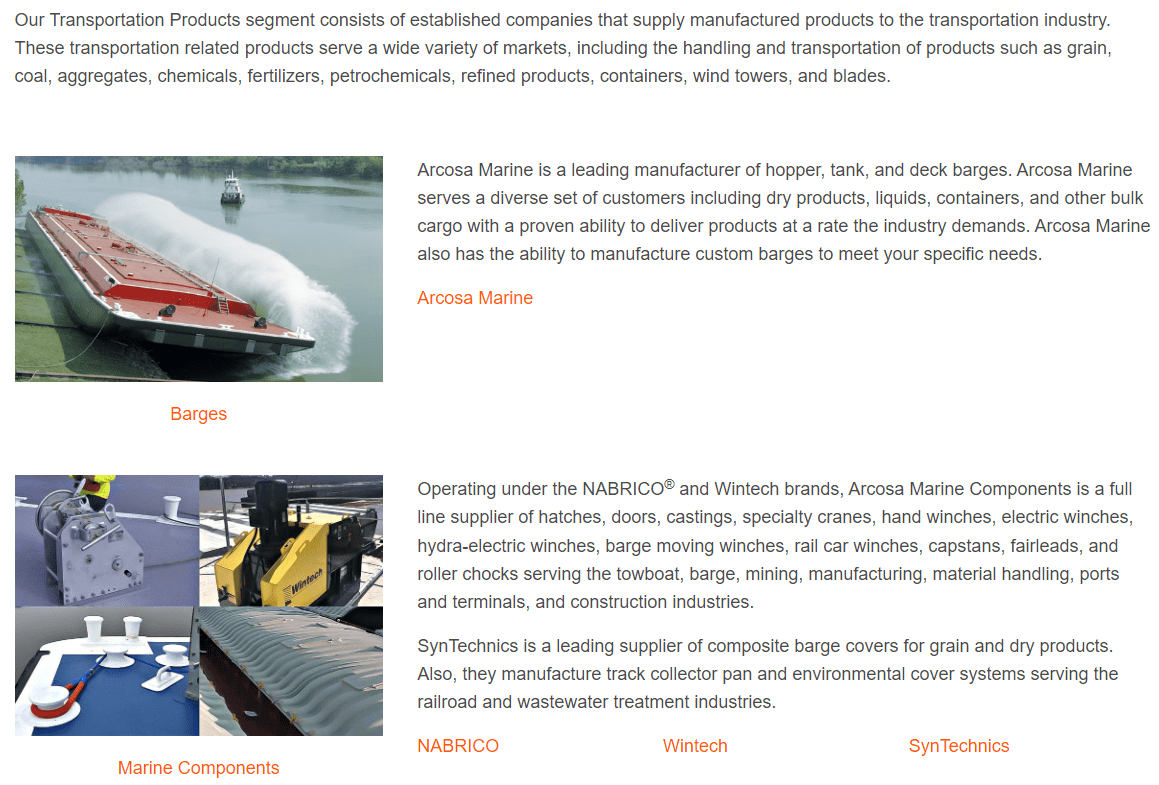

Arcosa has three major revenue segments, Construction Products, Engineered Structures, and Transportation Products. I believe that more harm than good is being provided by the transport segment and the assets should be sold off. In particular, the fact is that the major sales product of river barges and parts is at significant risk as long as the Mississippi is unnavigable.

Considering that many other weak segments have been sold off over the past few years, I believe that it is likely that this segment is next to be put on the chopping block. Although, management seems to remain hesitant and believes in a secular revival in the coming years (due to a bearish cycle and low inventory over the past few years).

Arcosa Presentation

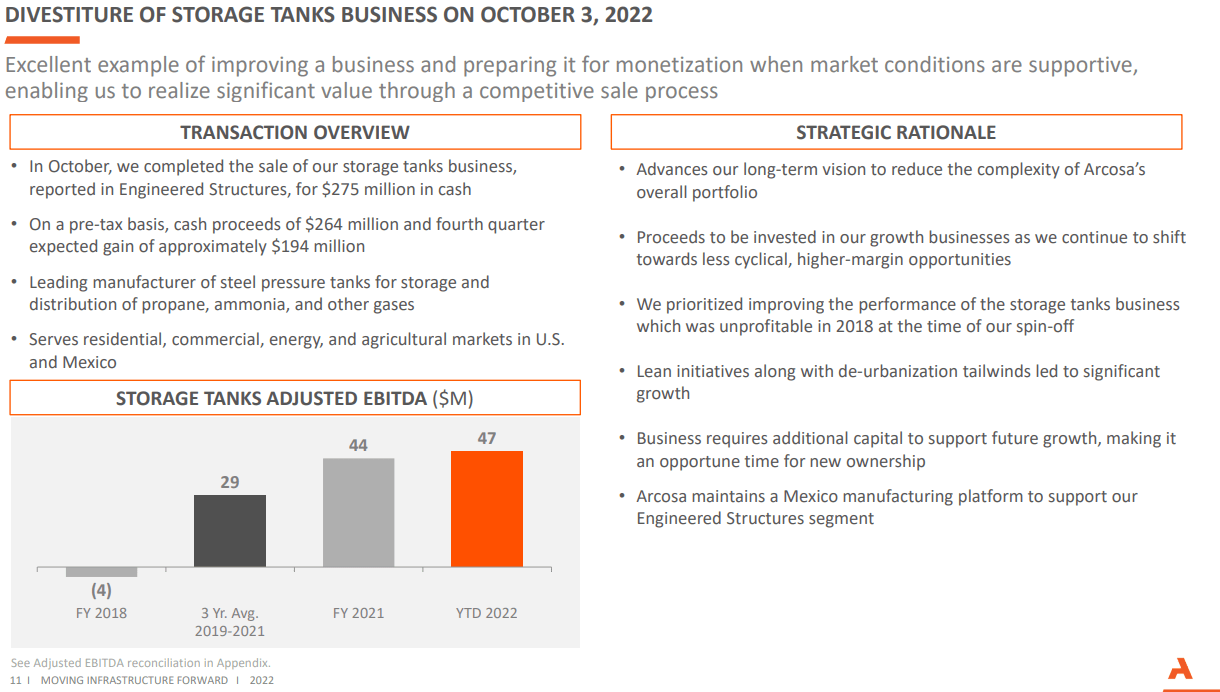

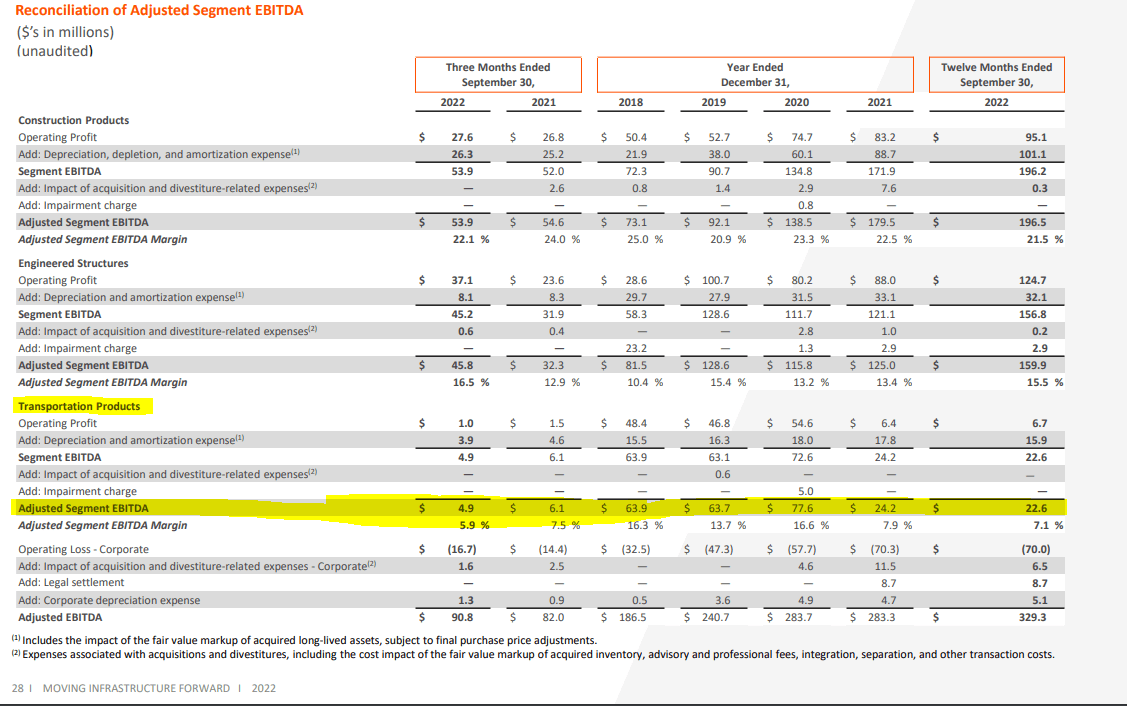

Let us do the math and see the value that may be accrued if that potential deal goes through based on the recent sale of the storage tank business. That sale was able to be completed at 5.85x EBITDA, or a total of $275 million USD. This means the transportation segment can earn over $150 million USD if sold at a similar price. Also, the sale price may increase due to the fact that current EBITDA of $24.2 is ~2.5x less than the average of 2018-2021. Considering that fact, the asset may be sold for up to $300-$400 million if purchasers believe a bull market is coming (and the Mississippi refills).

Current management insights are as follows:

Unusually low water levels on the Mississippi River system fortunately had no impact on financial results for our barge business during the quarter, and we have maintained relatively normal operations thus far in the fourth quarter. We continue to monitor the potential for future shipment delays or production inefficiencies, if water levels become too low to launch newly built barges.

Our barge backlog stood at $129 million at the end of the quarter, about flat with year ago levels, as we continue to replace shipments with new orders to sustain our manufacturing flexibility, while we await a broader cyclical recovery.

Arcosa Presentation

Arcosa Presentation

The sale can also be beneficial as Arcosa prepares for the future. As an example, the current storage tank profits will be funneled into growth businesses that are set to have tailwinds from infrastructure spending. Also, the sales profits could be funneled into additional acquisitions that will improve the revenue mix, rather than drag on growth. Or, importantly, the potential sale value of ~$300-$400 million would be able to reduce total debt in half, despite the relatively low leverage levels that the company currently sees. I am always a fan of low debt, so that may entice me to begin a position.

Arcosa Presentation

The Steady Course

If my hypothesized deal does not go through, especially with management quiet on the idea, investors don’t really have to worry. This is due to the fact that: 1. The transportation segment is a small portion of total revenues, and 2. There have yet to be any issues in regards to the low river levels on demand. Also, the main businesses of engineered structures and construction products have the ability to perform well regardless of economic scenario. When these facts are combined with the windfall of infrastructure spending and the IRA, investors can look forward to a secular growth period coming out of this bear market. As stated on the call by CEO Carillo:

I am pleased with our solid financial performance this year, which is evident in our significantly improved earnings and cash flow as well as in the strength of our balance sheet. At the same time, we have advanced our strategic objectives, expanding our geographic footprint in recycled aggregates with the ramp acquisition, while reducing the cyclicality and simplifying our portfolio through the timely divestiture of the storage tank business.

Turning to the macroeconomic environment, we continue to monitor and stay ahead of inflationary pressures while still remaining price competitive in our markets. Meanwhile, we have experienced an improvement in labor availability easing some of the labor related constraints we faced earlier in the year. We’re encouraged by the positive fundamentals in our infrastructure businesses, yet to remain mindful of the potential impacts arising from the heightened economic uncertainty and higher interest rates.

Conclusion

This uncertainty in the short-term prevents me from pulling the trigger on Arcosa, Inc. as an investment. However, peak pessimism may be arriving soon and it may be time to consider a position. Unfortunately, Arcosa is trading at an elevated valuation, partially thanks to the improved business structure over the past few years. The fact is that the share price has increased 30% from lows seen just a few months ago, and that would have been a much better time to enter. I recommend looking for financial indicators of both elevated growth and profitability, perhaps in the next few quarters, and hope that the share price does not increase further.

However, current investors should look forward to a relatively stable short-term horizon as the potential for strong tailwinds from infrastructure spending clouds the risk of economic weakness. As a specialty investment, I believe that timing is everything, and it is not worth taking the bet on Arcosa, Inc. at the moment for those without a position. However, the environment can change quickly, so investors can keep an eye on developments.

Thanks for reading.

Be the first to comment