Andrew Braun/iStock Editorial via Getty Images

Alibaba Group Holding Limited’s (NYSE:BABA) stock dropped below $100 again following the recent news that Warren Buffet’s “lieutenant” Charlie Munger slashed his stake in the Chinese e-commerce giant by 50%. In Q1, Mr. Munger’s Daily Journal reduced its Alibaba position from around 600,000 shares to 300,000 shares. After the sale, the Alibaba stake accounted for approximately 15% of the company’s equity portfolio. If we use the recent stock price of $95, Mr. Munger’s stake in the company is still a formidable $28.5 million. However, why are we emphasizing what one investor is doing with his Alibaba position? Why don’t we look at other top holders of the company’s stock?

Moreover, shouldn’t we look at the company’s fundamentals to gauge whether Alibaba’s business is a good buy at its current valuation? What about the positive tone coming out of Chinese regulators? Once we put aside the noise, we see that Alibaba is probably going through a transitory phase, after which the stock will likely recover and move substantially higher as we advance.

The Munger Effect

Why is it that Charlie Munger has such an oversized effect on Alibaba? Mr. Munger is a prominent investor and is Warren Buffet’s “Lieutenant” in many ways. Mr. Munger has been interested in Alibaba for a long time and has said that the company is undervalued. Furthermore, Mr. Munger has expressed his faith in China and the country’s ability to create a constructive economic environment for Chinese companies.

“The Chinese government will allow businesses to flourish,” Charlie Munger said in March 2021. “They changed communism. They accepted Adam Smith and added it to their communism, and now we have ‘Communism with Chinese Characteristics,’ which is China with a free market and a bunch of billionaires.”

Mr. Munger believes that market-leading Chinese companies can continue to grow and flourish. So, why did he reduce his stake in China’s e-commerce giant? I don’t know, and only Charlie Munger may have the answer to this question. However, does it matter? Mr. Munger still holds a sizeable stake in the company (15% of portfolio equity). Moreover, I would not emphasize Charlie Munger’s position in Alibaba too much. Why don’t we look at the top holders instead?

Let’s Look At Some Top Holders

If you think that Charlie Munger’s position in Alibaba is significant at $28.5 million, let’s look at the real top holders of Alibaba’s stock.

- 1. Japan’s SoftBank owns about 25% of Alibaba’s stock, making it by far the biggest Alibaba shareholder. The bank invested $20 million in Alibaba in 2000, and now has a stake worth tens of billions of dollars.

- 2. Jack (Yun) Ma – While The company’s founder Jack Ma has reduced his stake in the company in recent years, Alibaba’s creator still owns several percent of his company, putting his stake at about $7 billion or more going by today’s stock price.

- 3. The Vanguard Group reportedly holds around 2.6% of the company’s outstanding shares, and has seven funds with positions in Alibaba. This allocation puts the company’s Alibaba stake at around $7 billion.

- 4. Goldman Sachs (GS) – Another top holder in Alibaba is Goldman Sachs. The renowned investment bank owns about 1.5% of the shares outstanding, equating to a position of nearly $4 billion going by today’s depressed stock price.

Other top holders include JPMorgan (JPM), Morgan Stanley (MS), HSBC, and other major global banking institutions. Now, we are looking at holdings in the billions here, which dwarf Charlie Munger’s investment in Alibaba. Therefore, it may not matter that much what Mr. Munger does with his Alibaba stake. We see many institutions expressing confidence in Alibaba by investing billions into the company. I want to emphasize Goldman Sachs’ “the smartest guys in the room” massive stake here. In my view, the investment bank’s massive $4 billion stake in Alibaba is much more foretelling than Charly Munger’s investment and is about 150 times its size.

Positive News Sidelined

Why are we emphasizing Charlie Munger’s sale of 300,000 so much when we should be paying far more attention to the positive news flow coming out of the CCP? We recently received some very positive news about Alibaba, and the stock jumped. The market quickly forgot that Chinese regulators called for a closure on the tech crackdown and reiterated their support for Chinese IPOs abroad.

Moreover, “We believe that through joint effort, both sides will, as soon as possible, be able to make arrangements for cooperation in line with the two countries’ legal and regulatory requirements,” the Chinese securities regulator’s statement said, according to a CNBC translation.

In prior articles, I’ve written on Chinese Communist Party “CCP” regulations. The CCP does not have anything to gain by wrecking its best and brightest tech companies, including Alibaba. The government wants to control big business to an extent, as China is a centrally planned economy. However, the CCP does not want to weaken its economy and markets, causing panic among its country’s investing community. Therefore, we’re seeing a walk-back of the tech regulation, pressure on international IPOs, and an apparent willingness to work with U.S. regulators to comply with international accounting requirements.

Alibaba’s stock dropped primarily because of the perpetual negative news flow over the last 18 months. Investors dumped shares mainly because of more stringent regulations and delisting concerns. However, we now see the Chinese authorities change their tone, but the company’s stock is still 70% below its 2020 highs. The CCP’s public declaration of its support for its tech companies and its willingness to work with U.S. lawmakers is a massive step in the right direction, and it alleviates much of the risk associated with owning Alibaba stock. We will likely see a shift towards a more positive sentiment and news flow in future quarters, and the company’s stock should react positively to this dynamic as we advance.

With Alibaba, You Get Growth And Value

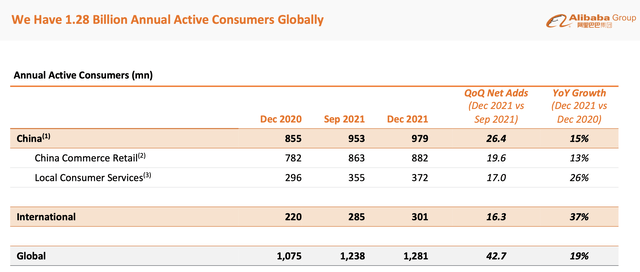

Alibaba’s market cap is about $257 billion, which is a long way off the high of nearly $900 billion. Yet, the company has a remarkable 1.28 billion annual active consumers “AACs.”

Annual Active Consumer Growth

Alibaba’s AACs grew at 19% globally and 37% internationally YoY. This dynamic illustrates Alibaba’s growth outside its domestic market in China and implies that the company can continue expanding overseas in future years.

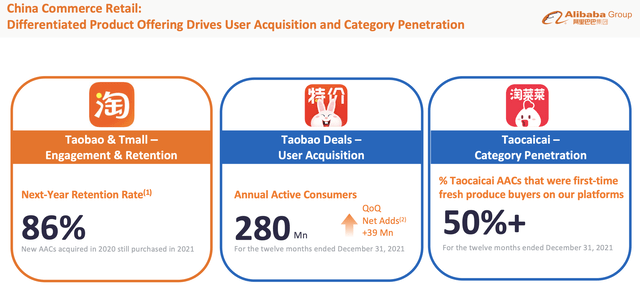

China Commerce Retail Growth

Commerce retail (Alibabagroup.com)

We see robust growth in Alibaba’s China commerce retail segment. The company now has 280 million AACs in this space, showing a significant increase of 39 million net adds QoQ.

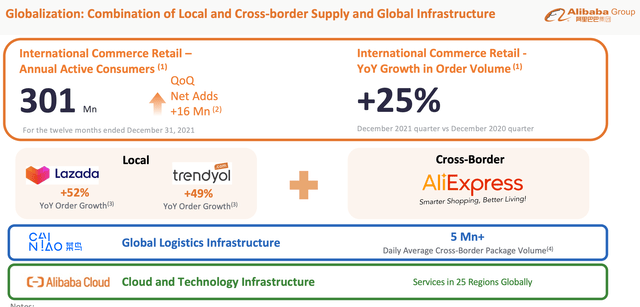

Expanding Globally

We see continued growth internationally in Alibaba’s international commerce retail segment. The company added 16 million new ACCs QoQ and now has over 300 million AACs outside China. The company is also expanding its global logistics, technology, and cloud infrastructure.

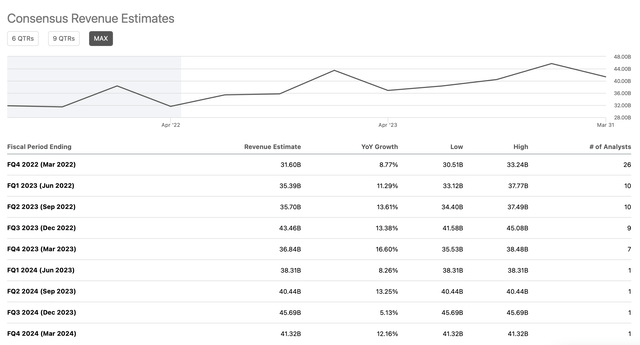

Alibaba locked in $133 billion in revenues last year, and the company should bring in around $154 billion in revenues this year. This estimate puts the company’s YoY revenue growth rate at about 16%, relatively healthy for a dominant, market-leading company in Alibaba’s position.

Revenue Estimates

Furthermore, we should continue seeing low double-digit revenue growth in future years. As Alibaba continues expanding its international retail, cloud segment, and other secondary business, the company should continue delivering health revenue growth numbers. Moreover, as Alibaba moves away from its recent difficult transitory phase, the company should improve efficiency, increase profitability, and provide healthy EPS growth.

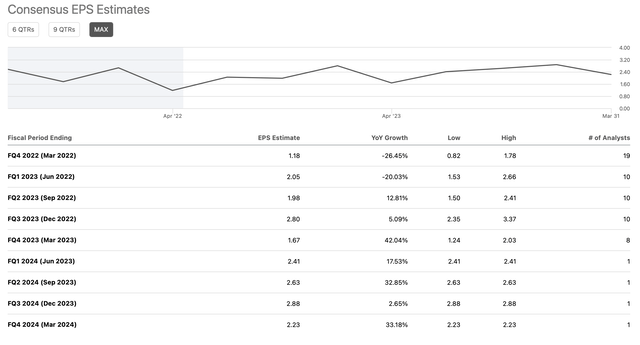

EPS Estimates

A YoY decrease in EPS forecasts highlights the difficult transitory phase. Alibaba went through several issues over the last year and a half, but earnings will likely bounce back soon. The company is probably at a low point earnings-wise now, and this is typically the best time to invest in a stock.

Last year (“TTM”), Alibaba earned approximately $8.50, putting the company’s TTM P/E ratio at around 11. Analysts anticipate a slight earnings decline to about $8.30 this year. If we see this little dip in EPS, Alibaba is trading at approximately 11.3 times this year’s EPS estimates. Next year, EPS estimates are about $10, which puts Alibaba’s forward P/E ratio at just 9.3.

Furthermore, forward estimates are likely lowballed due to the problematic phase Alibaba is going through right now. I suspect we can see upward revisions, and Alibaba can earn towards the higher range of analysts’ forecasts this year. My EPS estimate is $8.80 this year, putting Alibaba’s P/E ratio at just 10.6 now. Additionally, I suspect that we can achieve a healthy EPS growth of approximately 20% ($10.56 in EPS) in 2023, putting the company’s forward P/E ratio below 9.

The Bottom Line: Substantial Upside Potential

Alibaba is cheap here. Consensus estimates point to a low valuation, but slightly more optimistic estimates put the company in the dirt-cheap camp. Next year, Alibaba could deliver approximately $10.56 in EPS, putting its forward P/E ratio below 9. Moreover, the company has growth prospects and should provide about 16% YoY revenue growth this year.

I suspect we can see low double-digit revenue growth in future years. While the company is going through a difficult transition, its earnings should rebound, and Alibaba should return to healthy EPS growth in the coming years. Rather than emphasizing Mr. Munger’s Alibaba holdings, we should focus on the company’s top holders, its fundamentals, and the positive developments coming out of the CCP. Once we see the company’s earnings stabilize and recover, we should see Alibaba’s P/E multiple expand. From a forward P/E ratio below 9, we can probably see an expansion to about 18, implying a 100% up-move in the company’s stock is plausible within the next 12-18 months.

- Alibaba 1-year price target: $150

- Alibaba 3-year price target range: $250-350

Risks To Alibaba

While I’m bullish on Alibaba, various factors could occur that may derail my bullish thesis for the company. For instance, the CCP could resume its tough stance and clamp down further on Alibaba and other Chinese tech giants. Moreover, despite the optimistic tone from Chinese authorities, U.S. regulators could still decide to delist the company’s ADRs. Increased competition could impact Alibaba’s growth and profits. The company’s growth could be worse than my current anticipation. Also, Alibaba’s profitability could continue to struggle for various reasons.

There are multiple risks to this investment, so shares are very cheap right now. In my view, Alibaba remains an elevated risk/high reward investment, and investors should carefully examine the risks before opening a position in Alibaba stock.

Be the first to comment