JHVEPhoto

Company Introduction

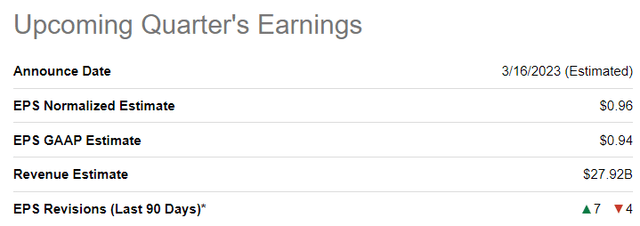

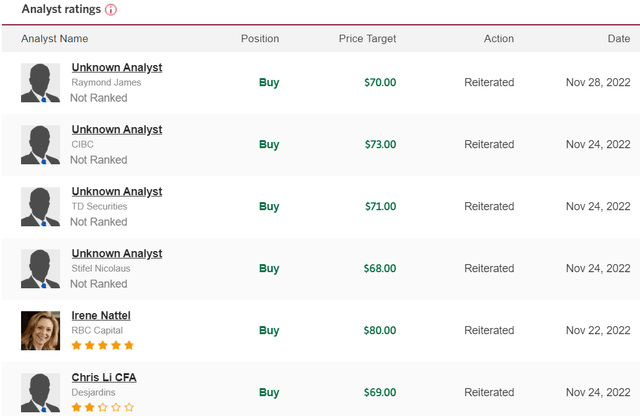

Alimentation Couche-Tard (TSX:ATD:CA) (OTCPK:ANCUF), founded in 1980, is a global leader in retail convenience and gas sales. The company operates in 24 countries and territories, with over 14,300 stores – of which ~11,000 offer transportation fuel. Over the years, ATD:CA has had several brands within its portfolio, but they have recently streamlined the majority of their operations under three brands: Couche-Tard, Indo, and Circle K. Around 122,000 people are employed throughout its network and the vision for the company is to make customer’s lives a little easier, a nod to their core competencies of ready to eat consumables and road fuel. ATD:CA is a resilient company that has succeeded in both good times and bad and remains undervalued today. The stock should rise to $79 per share within 18 months, supported by a FY2023 EV/EBITDA of 17, a FY2023 P/E of 27.3 and a forward P/E of 25.2.

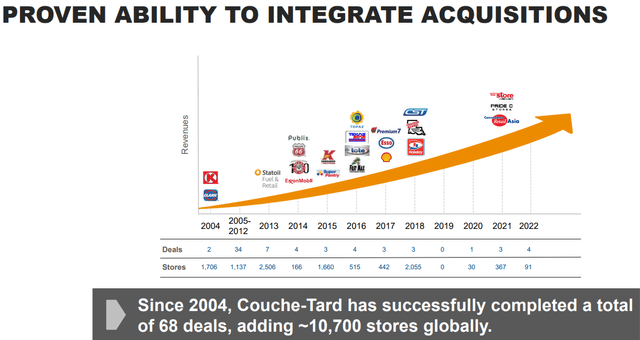

In their last full year of operations (fiscal year as of April 24, 2022), the company generated $62.8Bn in revenue and $2.7Bn in net earnings. ATD:CA’s management has remained intact throughout their recent success; Brian Hannasch has been CEO since 2014 and the company’s founder, Alain Bouchard, remains the chairperson today. Since 2004, the company has completed 68 deals and added about 10,700 stores to its network. The stock has risen over 85% in the last 5 years and the company remains a strong pick for 2023. With a tight cost base, a diversified revenue mix, proven management, strong brands, and a diversified strategy to tackle an electric vehicle (EV) future, ATD:CA should be on your 2023 stock watchlist.

Recent Quarterly Results and Upcoming Trends

ATD:CA recently announced quarterly earnings on Nov. 23, 2022 that were within expectations, as evidenced by a lack of share price move post release. The company reported revenue of $4.1Bn and net earnings of $810MM, up substantially from last years $693MM in the same period. Same-store merchandise revenues increased 5.6% in the U.S., 2.9% globally, and decreased 1.5% in Canada; though excluding tobacco, Canada same store sales were up slightly year over year. The main source of the jump in earnings was higher fuel prices, as ATD:CA’s margin of $0.49 per gallon rose almost $0.13 from last year. These results contributed to noticeable increases in key investment metrics, including return on equity and return on capital employed, both of which reached 22.7% and 16.4%, up 30 basis points and 50 basis points compared to Q1 of FY2023. The company improved their leverage ratio to 1.2x, 11 basis points lower than Q1 and also repurchased $205MM of shares during the quarter. Even with these impressive results that saw analysts improve their forecasts, there are other key measures that the company is executing on that led to success in 2022 that should propel them further in 2023.

In the recent executive call, management was upbeat about the company’s prospects going forward. Brian Hannasch, CEO, highlighted that ATD:CA continues to generate robust fuel margins across all platforms. The company also showcased impressive growth in their Fresh Food, Fast program, an offering focusing on providing customers with more healthy ready to eat options. Same-store sales jumped over 20% from the prior year and the initiative is now live in 4,200 stores globally. This quarter, ATD:CA also launched $5 Pizza Fridays in select locations; options include ready or to go pizzas for just $5 on Fridays. Management also mentioned that their Sip & Save beverage subscriber mark, an initiative that allows customers to unlimited drinks for $5.99 a month, jumped to 420,000 users. Sip & Save is impressive, because its unique, it assists their vision of making customers lives a little easier, and it spawns customer traction in a low volume, high margin business.

However, executives cautioned that fuel volume demand fell globally, with the largest drop coming from the Euro region. Same-store transportation fuel volume declined 1.9% in the U.S., 6.3% in Europe and 6.5% in Canada. To combat this, ATD:CA has deepened their relationship with fuel providers in the areas where demand remains strong. Management highlighted the recent acquisition of 4 Jacksonville, U.S. fuel terminals in a 50-50 joint venture with Musket to be a situation that supported increased penetration in a high demand region. In Sweden, the company’s EV fast charging network achieved a significant milestone, as the first speed charging port for heavy trucks opened in Sweden. Overall, leadership provided several updates to its global strategy, and continued to show why ATD:CA remains a top pick in the convenience sales space.

Industry & Peer Overview

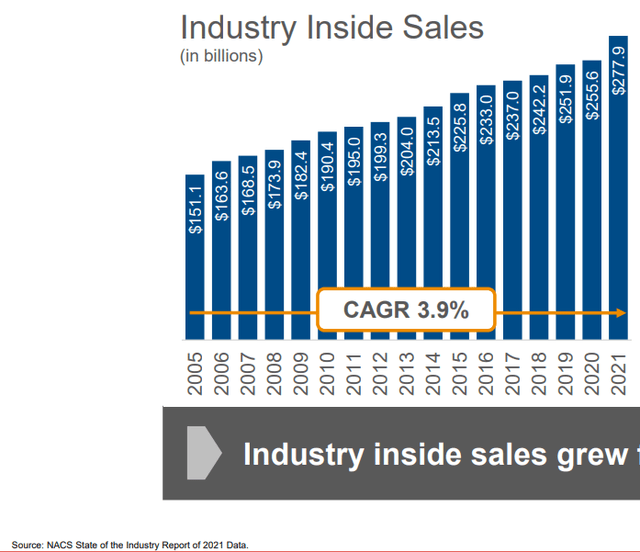

ATD:CA generates revenue from two key areas: fuel transportation and convenience merchandise. The total addressable global market for inside store sales was $278Bn and has grown at a CAGR of almost 4% since 2005. Meanwhile, the transportation fuel sales market reached $11Bn in 2021, and may almost double by 2031, according to Alliance Market Research. Both of these areas have varying levels of demand globally, which allows ATD:CA to tailor their products in different locations.

NACS State of the Industry Report 2021

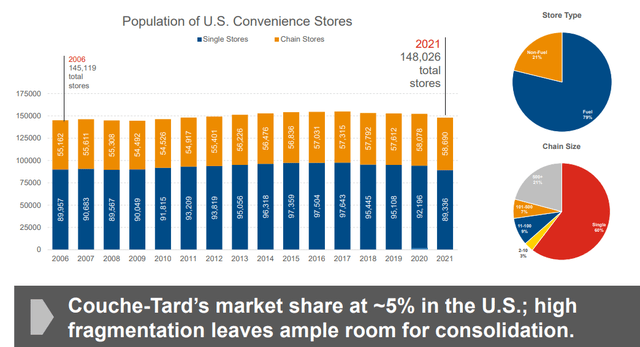

The company has chain competitors, including Seven & i Holdings (OTCPK:SVNDF), the parent company of 7Eleven, Casey’s General Stores (CASY) and many smaller regional chains and mom and pop shops. These competitors sell similar goods and services to ATD:CA. While both key competitors have strengths, notably CASY, ATD:CA has a distinct advantage on each. SVNDF does not have a strong presence in fuel sales, with only 15% of storefronts offering gas. This has led ATD:CA to differentiate in Asia and provides them a unique opportunity in the coming years to strengthen their brand as a place customers can get both fuel and merchandise in Asia. While CASY has similarly strong financial metrics to ATD:CA, they have a high forward P/E ratio of 23, well above ATD:CA’s ratio of 16 and their store count is much lower at just 2,400. ATD:CA also has a stronger EBIT margin, at 5.55%, which outpaces both chains. In a fragmented and large global market, ATD:CA’s history of impressive profitability and growth gives them the edge to capture market share from peers.

Company Strengths

ATD:CA has several key strengths that make them an envy in the convenience store space. They have three strong brands, they have a longstanding management team that has generated impressive results, and they have an integrated global strategy that embraces an EV future. In Quebec, where the company was founded, Couche-Tard remains the flagship convenience store brand in the province with over 650 stores. Meanwhile in Sweden and Denmark, the Ingo brand represents over 470 automated fuel sites. While these chains are smaller in scale, both are longstanding and trusted brands in their community, which has allowed them to thrive. The leading brand, Circle K, was acquired by ATD:CA in 2003, and at the time was one of the largest U.S. chains.

ATD:CA has successfully built Circle K into a global brand in almost two dozen countries and has continued to streamline operations by rebranding all global acquisitions into Circle K stores. About 60% of convenience stores in the U.S. are one-offs (see above photo), leaving just 7Eleven as a true competing brand at scale. This has allowed ATD:CA to provide multiple tailored loyalty programs. The crown jewel has been Sip & Save, which now has 420,000 subscribers that can access unlimited drinks for $5.99/month. The program provides a cross-selling opportunity in a low volume, high margin business to its fuel customers at an affordable cost. 7Eleven has its own subscription offering, but it’s focused on delivery, and doesn’t differentiate much from grocery stores. Circle K has also utilized technology to increase its standing with customers. The company recently saw the weighted volume of pre-purchased fuel per card jump ~5% since the implementation of Sales Cloud by Salesforce, which assists in tracking sales and analyzing cross-selling opportunities. The company was also one of the world’s best employers in 2021, as rated by Forbes. These key differentiators of streamlining all stores under 1 brand, tailoring promotions to best serve their clients, and utilizing technology are distinct advantages that ATD:CA continues to employ globally.

ATD:CA has had stable management for several years, which has allowed the company to flourish. ATD:CA has consistently been acquiring businesses as they have attempted to build a conglomerate. Along with their 68 acquisitions since 2005, the company has tried to acquire other large scale enterprises, notably Carrefour and Petro-Can, in the last two years. I believe this mindset of pushing the envelope has led to a culture of action within the company. New programs such as Fresh Food, Fast, have been well received and employees have rated the company well in employment metrics. ATD:CA’s management has been able to adapt to global trends, and they have a proven track record of creating shareholder value without over-levering.

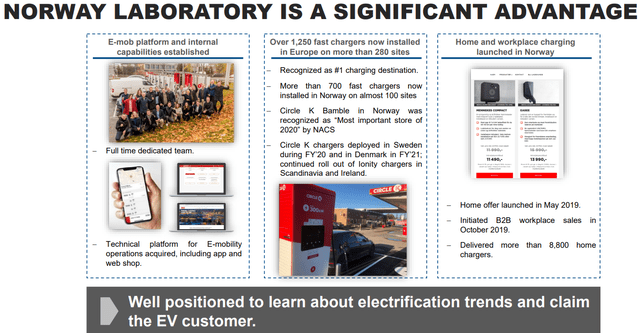

ATD:CA’s management also understands that an EV future is increasingly likely. Not only is the company adapting globally as the rollout continues, they are industry leaders in markets where EV’s are mainstream, notably Scandinavia. Circle K has an EV charging laboratory in Norway, and the company has expanded their sales channels to both at-home and public EV charging spaces. Recognizing that customers will charge their cars at home more often, ATD:CA has made home sales a key part of their sales strategy and has sold over 8,800 home chargers to date. The company now has over 1,250 fast chargers installed in Europe and continues to expand this network. By using this market as a testing ground for North America, they will have a distinct competitive advantage on customer data and will be able to optimally penetrate the market with EV chargers. ATD:CA plans to have 200 EV charging sites by 2024, and with knowledge sharing and expertise from Europe, I expect ATD:CA will be a leader at scale even with their road fuel business declining over time. With multiple strong brands, exemplary management, and an integrated strategy to tackle the future, I see ATD:CA rising to new heights and outperforming the market yet again in 2023.

Risks

ATD:CA has several risks that are inherent to the business, but two stand out that can’t be easily mitigated. The most important risk is the reliance on global oil prices. While the company is well positioned for a green fuel future, ATD:CA is reliant on gas prices for the next 5-10 years at minimum. Lower oil prices mean tighter margins on gas, which is still the main driver (~75%) of total revenues, but make up only ~50% in gross profits. Management must continue to cross-sell and drive new business in merchandising, while simultaneously transitioning its future network to EV charging.

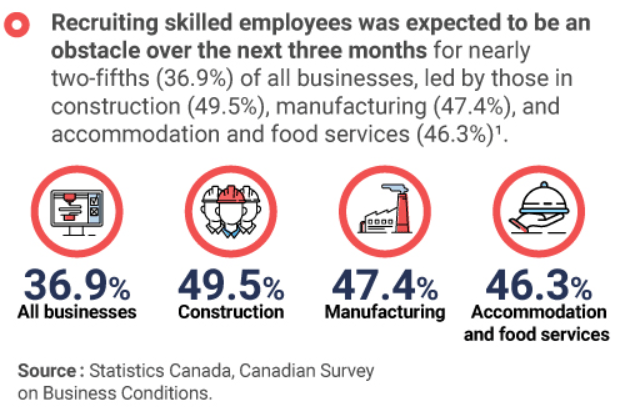

Another key risk is staffing stores, which executives highlighted on the earnings call. A global labor shortage continues to gain momentum post-COVID, as retirees and an aging population have led to a drop in qualified workers. While ATD:CA has improved their hiring practices through technological advances and social media outreach, this trend is difficult to overcome. This is especially notable in the retail space, where 46% of business in food services expect staffing challenges, almost 10% above the average in Canada. Another key issue regarding lack of staffing is retail theft. Both Target and Walmart have seen hundreds of millions of profits lost through theft this year. While self-serve cashiers and other technological advancements can reduce staffing costs over time, it remains to be seen if retail theft can be contained with a lack of physical presence.

Statistics Canada

Model Shows Upside

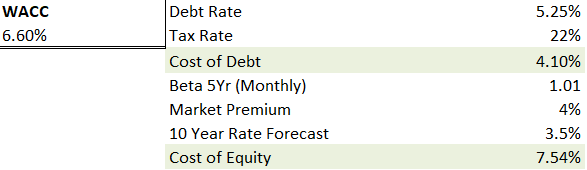

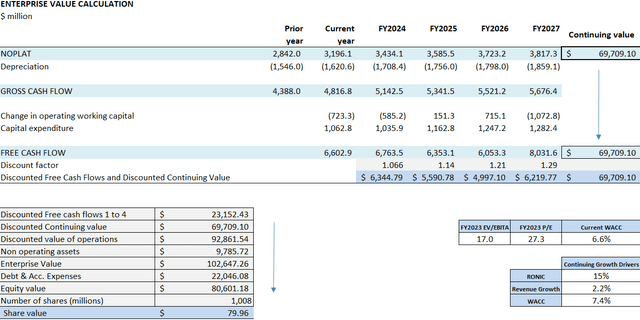

ATD:CA has had an impressive run this year, buoyed by strong quarterly merchandising results and high gas prices. While the company’s net cash position dropped, the company has sufficient liquidity to fund current growth plans. The model forecasts a current WACC of 6.6%. With rising rates, I anticipate the cost to raise rising above 5% should they attempt to leverage in this environment, given their previous debt issuances have coupon rates between 1.9%-4.5%.

Author WACC

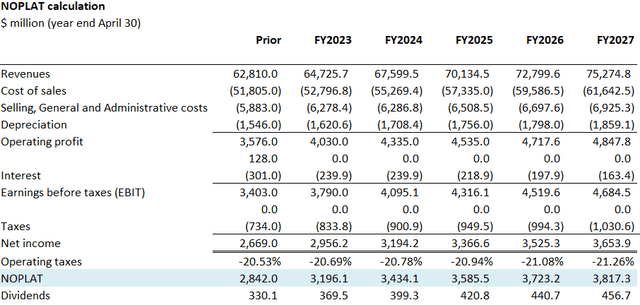

I forecast the continuing value of $69.5Bn, given a 3% revenue increase this year and blended revenue growth of ~3.5% for three years as same store sales growth continues to impress. I see the margins holding steady into the end of the year and hold other cost ratios mostly equal to historical figures, as the company has reigned in costs historically. With a terminal revenue rate of 2.15%, and a terminal WACC above 7%, a $79 share price (see below) can be supported by fundamentals.

Author Income Statement Forecast Author EV & Share Price Forecast

The share price is supported by a 27.3 P/E ratio on EPS of $2.93 in FY2023. The valuation of $79 per share showcases an FY2023 EV/EBITDA ratio of 17, in line with industry peers and analyst estimates.

Conclusion

ATD:CA remains a leader in convenience retail globally and is worth a buy at these levels. The company sports robust operations and continues to expand globally. Management has consistently delivered impressive returns on capital and the company has a history of good acquisitions. While global oil prices are a key risk, ATD:CA is primed to succeed in an EV future as not only a participant, but a leader thanks to their first mover position in Scandinavia, along with a state-of-the-art research hub in Norway. ATD:CA remains undervalued compared to peers and they operate in an industry ripe for consolidation. I see the company’s multiple slowly expanding over time, and I forecast a $79 share price target over a 12-18-month time frame.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment