jetcityimage

Investment Thesis

Wayfair (NYSE:W) had a period of explosive growth during the pandemic. The company’s revenue skyrocketed, and the business even became profitable. But these trends are now in reverse. The company’s top line is declining, and the business is now unprofitable. I think that the company’s operating model may help it survive. But this is still a very high risk investment. I’m avoiding this stock right now.

Reversing Pandemic Growth

Wayfair’s explosive pandemic growth trends are now fully in reverse. In the last quarter, the company reported a 15% decline in revenue year over year. This is its second negative year over year comparable. The business expects the third quarter to be down by 10%.

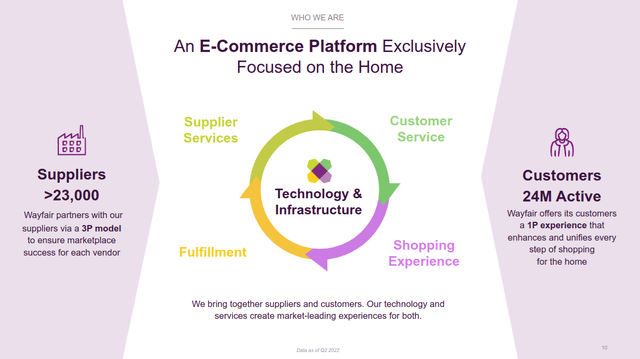

The company’s active customers declined to about 24,000, down from over 33,000 in early 2021. This is the lowest number of active customers since before the pandemic. Orders fulfilled were down by about 30% year over year.

The company is facing a number of secular headwinds. The home goods market that the company operates in is contracting. Economic headwinds have caused consumers to reduce large purchases of durable goods. Additionally, many home goods sales were likely connected to the hot housing market. The housing market is cooling fast, removing a major source of demand.

Wayfair Q2 2022 Investor Presentation

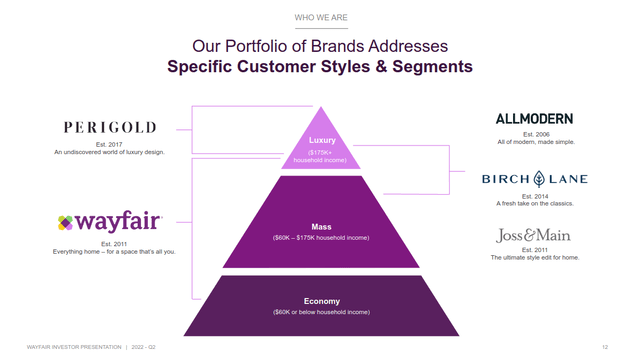

The company has broad exposure to most price points in the home goods market. This could be a risk to the business. The company’s largest offering is its mass market Wayfair.com segment. This segment is reporting a major decline in demand. The company’s luxury segments are still reporting strong demand, but these offerings are still in early growth phases. Management has argued they may benefit from consumers trading down. This may help reduce revenue declines, but Wayfair’s top line can still drop significantly from here.

I also think that Wayfair’s dependence on heavy advertising expenses is a major risk. The company spent about 42% of its gross profit on advertising last quarter. Additionally, Wayfair expects its advertising expenses as a percentage of revenue to increase further as secular tailwinds deteriorate.

Overall, I think that there’s serious reason to question the company’s sustainability. The business is going to have to survive this economic pullback. Even after the economy recovers, it’s unclear if the company’s growth trajectory will ever return.

How Is Wayfair’s Financial Health?

Wayfair’s financial health is questionable. The company lost cash running its core operations in three of the last four quarters. Over the past year, it burned over half a billion dollars. The business’s operating income was negative 26% of its gross profit. This isn’t good for a marketplace business with limited options to boost gross margins.

Wayfair is slowing operating expense growth to address these issues. The company initiated a hiring freeze and started cutting its workforce.

Wayfair has a net debt position of $2.25 billion. This is a surprisingly high amount of debt for a growth company. Its balance sheet reports $3.1 billion in long-term debt. This debt is low interest and management is pushing maturities far into the future. But it will likely reduce Wayfair’s financing options.

Wayfair Q2 2022 Investor Presentation

There are some positives as well. Wayfair’s operating model gives it some more financial flexibility. The company keeps very little inventory on hand. Because of this, it likely won’t be forced to take heavy markdowns. This will at least stabilize Wayfair’s gross margins. Management discussed these dynamics on their last earnings call.

However, unlike traditional retailers whose cost bases weighs on their pricing decisions and can become a liability in a softening macro, the advantage of our platform model is that by taking minimal inventory risk ourselves, our gross margin can remain resilient. We then have the ability to drive our gross margins higher through capturing incremental efficiencies and in this environment from some potential relief on transportation costs…

As I said, we are increasing our cost efficiency focus across all facets of Wayfair in an ongoing manner. In companies of our size and scale, these opportunities take a quarter or two to begin to unlock. But we are highly confident that they will not only help us reach our financial goals, but also make Wayfair’s execution even tighter.

This operating model makes the company more resilient to economic headwinds. But its online only business model is still an additional risk. The pandemic caused a lot of home goods spending to move online. This trend is reversing, which is hurting Wayfair’s revenue.

For example, the company benefited from lockdowns keeping people at home. As the economy has reopened, consumers are going back to physical stores. Competitors with a large physical presence such as Williams-Sonoma (WSM) are reporting an acceleration in demand. Wayfair’s management seems to believe these trends will continue. The company is still moving forward with its plans to create physical stores. These efforts are continuing even as management is heavily cutting operating expenses.

The Valuation Isn’t That Cheap

Wayfair is trading at an enterprise value to gross profit of about 1.7 times. The company is currently targeting a mid-single-digit adjusted EBITDA margin. At a 5% adjusted EBITDA margin, the company would trade at an EV to forward adjusted EBITDA of over nine times. I think that this valuation is expensive considering the major risks to the company.

Wayfair also has relatively high stock-based compensation expenses. These are excluded from adjusted EBITDA calculations. During the last quarter alone, the company paid out $129 million in its own shares. At the current run rate, the company will pay out over 14% of its market cap in shares every year.

The company has expanded its shares outstanding by 13% since the pandemic. This is after accounting for over $750 million in share repurchases mostly at prices above $200 a share. I don’t think that the company is set to return a lot of cash to shareholders in the near future.

Final Verdict

I don’t believe Wayfair is going bankrupt in the next few years. The company’s business model is more resilient than its competitors. But this alone doesn’t make the company a good investment.

The company is facing severe growth headwinds. Revenue and customer counts are declining. Even after shares have dropped 90%, I don’t believe that the valuation creates a favorable risk to reward. For these reasons, I strongly recommend avoiding this stock for the time being.

Be the first to comment