Srecko Stipovic/iStock via Getty Images

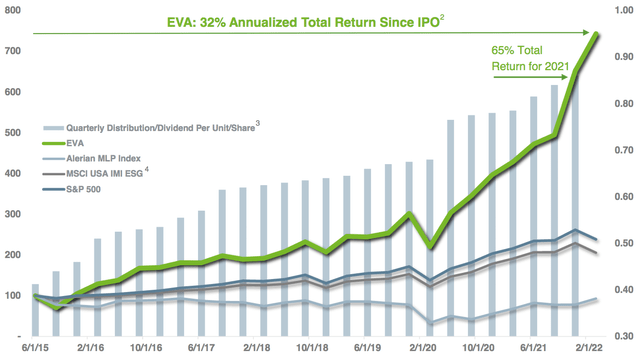

We were fortunate enough to have found Enviva (NYSE:EVA) early on in its upward trajectory from its IPO in 2015, having collected fat, increasing dividends along the way, in addition to price appreciation.

Since its early days, EVA has delivered a 32% annualized return. It has taken off over the last three years, outperforming the S&P 500 by 162% and the MSCI ESG Index by 160%, on a total return basis:

EVA site

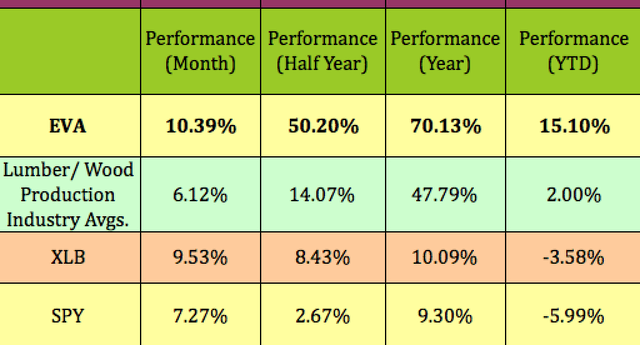

More recently, EVA has outperformed its industry, the Basic Materials sector, and the S&P 500 over the past year, half year, month, and so far in 2022:

Hidden Dividend Stocks Plus

Profile:

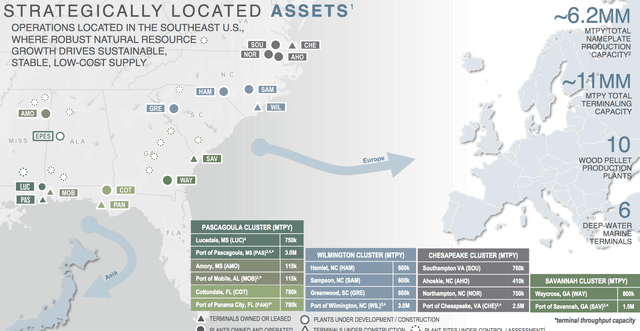

EVA’s wood pellet products are used as a substitute for coal in power generation and combined heat and power plants. It serves power generators in the United Kingdom, Europe, and Asia. It was founded in 2013, and is based in Maryland. Enviva owns and operates 10 plants with a combined production capacity of approximately 6.2M metric tons/year in Virginia, North Carolina, South Carolina, Georgia, Florida, and Mississippi.

In addition, Enviva exports wood pellets through its marine terminals at the Port of Chesapeake, Virginia, the Port of Wilmington, North Carolina, and the Port of Pascagoula, Mississippi, and from third-party marine terminals in Savannah, Georgia, Mobile, Alabama, and Panama City, Florida.

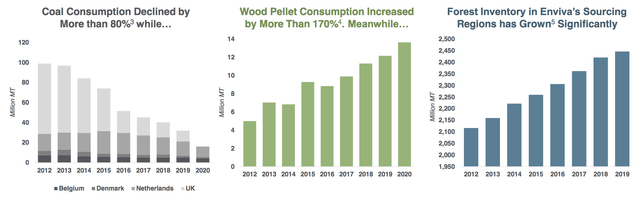

Wood pellet consumption has surged more than 170% in Belgium, Denmark, the Netherlands, and the UK, while coal consumption is down over 80%. At the same time, EVA’s management has seen forest inventory increase in its sourcing regions:

EVA site

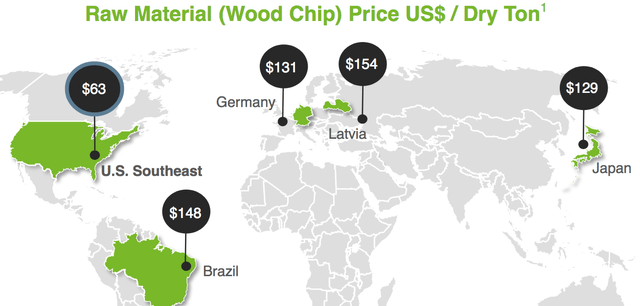

Cost Advantage:

EVA enjoys a major cost advantage over other producers – its raw materials cost less than 50% to 60% than that of its global competitors:

EVA site

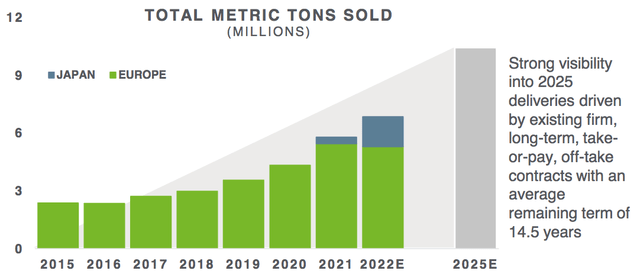

Management continued to increase production capacity through the years, aligning new plants with long-term contracts, which currently have an average remaining term of 14.5 years.

EVA site

They also integrated EVA’s operations, investing in shipping terminals and additional plants:

EVA site

C-Corp Conversion:

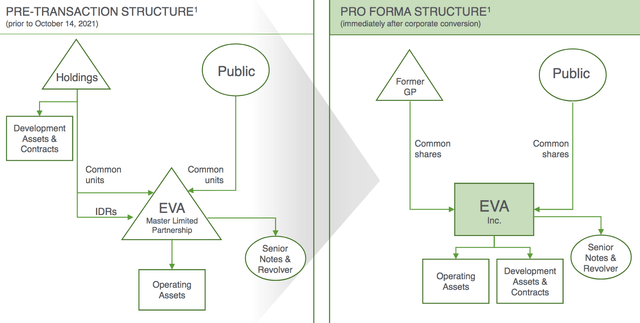

On Oct. 14, 2021, EVA acquired all of the ownership interests in Holdings the General Partner, in a Buy-in transaction, and eliminated its incentive distribution rights, or “IDRs,” in exchange for 16 million EVA common units.

Here’s a key point, as it relates to future dividend coverage:

The former owners of Holdings are now direct investors in EVA and have agreed to reinvest all dividends on 9 million of the 16 million units through the fourth quarter of 2024. This commitment translates into an expected further $100 million common equity investment in EVA.

IDRs were $19M in Q1-3 ’21, and would have been ~$27M for full-year 2021.

Holdings repaid its $325 million Term Loan B from cash on hand prior to the transaction announcement, and had no other material debt on its balance sheet.

EVA site

Earnings:

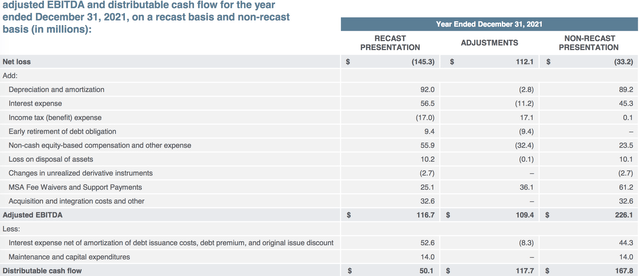

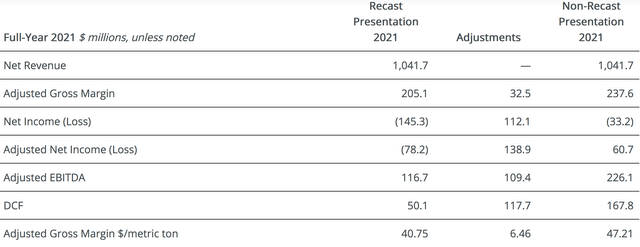

As a result of this GP Buy-In/C-Corp conversion, EVA was obligated to publish “recast” GAAP figures, which present a very confusing picture of EVA’s actual earnings and Distributable Cash Flow.

“We believe the Non-Recast Presentation provides investors with relevant information to evaluate Enviva’s financial and operating performance because it reflects Enviva’s actual and historically reported performance on a standalone basis through the closing date of the GP Buy-In and performance on a consolidated basis from the closing date until year-end. The Non-Recast Presentation does not reflect the recast of our historical results required under GAAP due to the GP Buy-In and accordingly is considered non-GAAP.” (EVA site)

There’s a ~$110M variance in Adjusted EBITDA, and a $117M variance in Distributable Cash Flow, DCF, between the GAAP Recast and the non-GAAP non-Recast figures presented by management.

Taking the GAAP figures as gospel would certainly get EVA investors’ stomachs churning – they show just $50M in DCF for full year 2021, far below the ~$157M that EVA paid in 2021 for distributions.

EVA site

The recasting exercise, which disregarded the fact that EVA was a standalone entity for over three quarters in 2021, (before the mid-October ’21 Buy-In), didn’t affect revenue, which grew 19% in 2021, but it heavily impacted Net Income, Adjusted Income, DCF, and Adjusted EBITDA:

EVA site

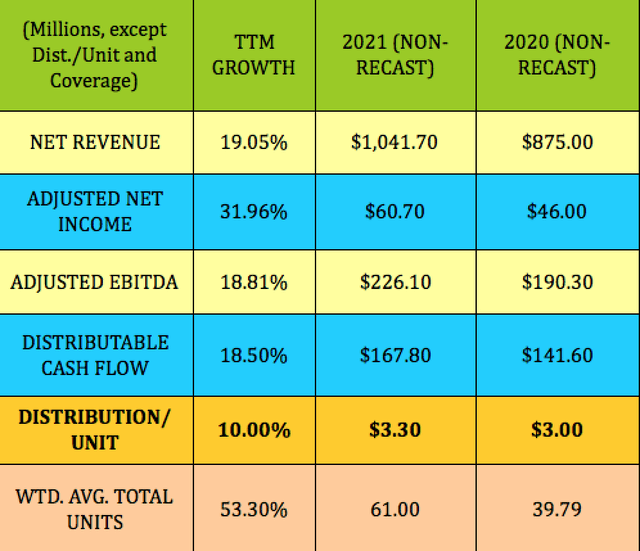

Here are the full-year 2021 Non-Recast results, which represent Enviva’s actual earnings, as a standalone company, up until the Buy-In; plus the consolidated results thereafter.

You may have dashed to the kitchen for a stiff drink after seeing the recast figures – these ones should ease your heartbeats per minute a tad.

Revenue and Adjusted EBITDA rose ~19%. DCF rose 18.5% in 2021, giving management the backing to raise the distributions/unit by 10%. The Buy-In deal raised the share count by ~53%, which leaves us with some further “splaining” to do, when it comes to 2022’s dividends.

Hidden Dividend Stocks Plus

Dividends:

Although its dividend yield is lower than the high dividend stocks we regularly cover in our articles, that’s due more to EVA’s surge in price, than dividend growth – management has raised the quarterly dividend for 26 straight quarters, with a five-year dividend growth rate of ~10%.

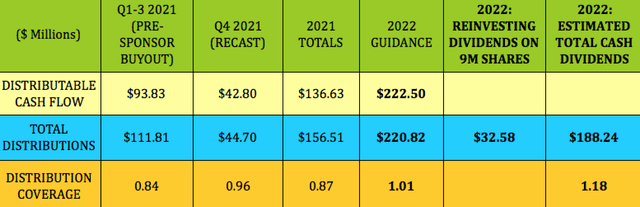

In Q1-3 ’21, EVA had $93.83M in DCF, but paid out $111.81, giving a sub-1x coverage rate of .84x. Using the Recast Q4 ’21 figures, as a consolidated company, EVA paid out $44.7M in dividends, and generated $42.8M in DCF, for a .96x coverage ratio. Those 2 columns combined amounted an .87x coverage figure for full year 2021.

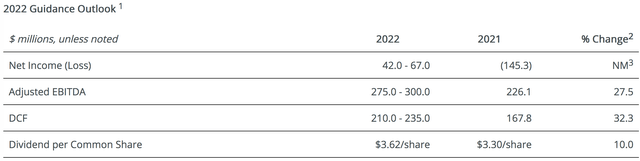

Management guided to $3.62/share for 2022 dividends, a 9.7% increase vs. $3.30 in 2021.

2022 guidance also calls for “27% year-over-year growth in adjusted EBITDA and 32% year-over-year growth in DCF. Based on the visibility and durability of its long-term contracted cash flows, Enviva is planning to increase full-year 2022 dividends by 10% as compared to 2021.” (EVA site)

“We expect the shape of our adjusted EBITDA profile during 2022 to look a lot like prior years, with the back half of the year a big step up over the first half and Q2 a step up over Q1, our seasonally softest quarter.” (Q4 ’21 call)

EVA site

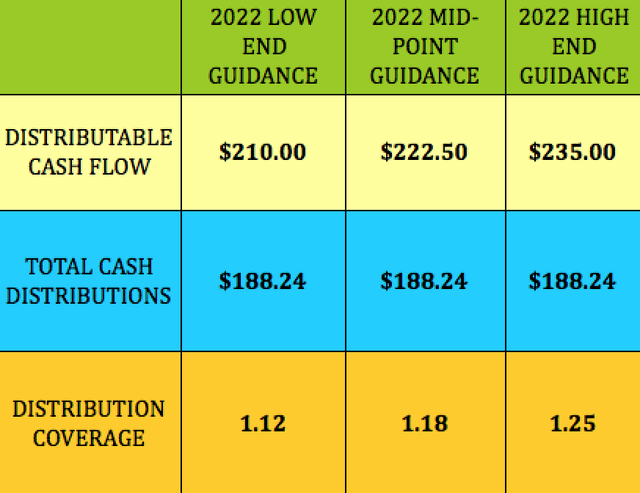

61M shares times $3.62/share = $220.82M in total distributions for 2022.

The midpoint of 2022 DCF guidance is for $222.50M, which implies a 1.01x distribution coverage factor.

However, let’s remember that the new “Holders” common share owners committed to reinvesting 9M of their 16M shares.

That equals $32.58M/year, so EVA’s total Cash Distributions for 2022 should only be $188M, implying a 2022 Distribution Coverage factor of 1.18x.

We’ve seen other companies’ GP’s reinvest or waive their dividends in the past during fixed periods – USA Compression Partners LP is one example of this.

Hidden Dividend Stocks Plus

Breaking the guidance down further to the low and high ends gives us a range of 1.12x at the low end, to 1.25x at the high end, for EVA’s 2022 Cash Distributions coverage.

Hidden Dividend Stocks Plus

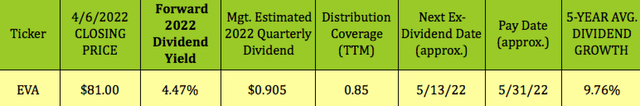

At its 4/6/22 $81.00 closing price, EVA yields 4.47%, based upon the average $0.905/share quarterly dividend management projected for 2022. EVA should go ex-dividend next on ~5/13/22, with a ~5/31/22 pay date.

EVA’s five-year average dividend growth rate is 9.76%.

EVA site

Tailwinds:

With Europe as its biggest sales region, we wondered if the Russian invasion of Ukraine has had any effect on EVA’s business. The effect has been limited so far, centering on providing some additional pellet supplies to existing customers, but it does add even more demand to an already strong demand situation in Europe.

“A number of our major counterparties in Europe described that they are no longer going to participate in the procurement of commodities from Russia. And what that does is that obviously creates a short position relative to conventional or other commodities that they might have been procuring.”

“Demand is accelerating, which gives us the opportunity to similarly accelerate our plans to double the size of our company by building six new plants over the next 5 years, each at a very attractive project investment multiple of approximately five times adjusted EBITDA.” (Q4 ’21 call)

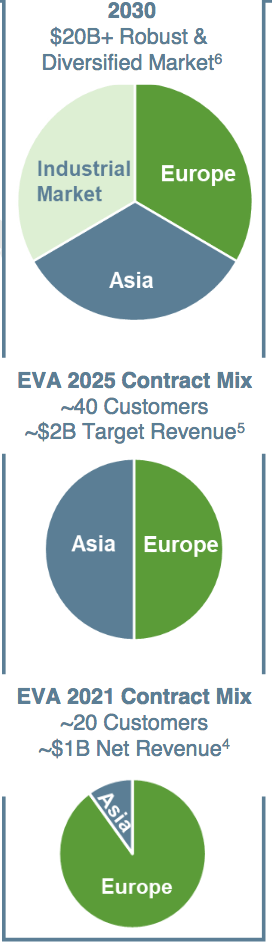

Industrial wood pellet usage continues to grow – management sees it hitting ~ a third of total revenue by 2030. EVA’s contracted 2025 mix shows 40 customers, split evenly between Europe and Asia, with ~$2b in revenue, 2x its 2021 customer base and its revenue of ~$1B.

Part of that industrial growth forecast is in aviation biojet fuel: “The industrial sector, the sustainable aviation fuel sector, when you look at the total addressable market, the IEA would suggest that to reach net zero by 2050, you need 15% of biojet in the mix by 2030 and 40% by 2050. That’s a total addressable market for us between 100 million and 300 million metric tons per year wood pellets.” (Q4 ’21 call)

EVA site

Management also sees two potential tailwinds from its low ownership percentages by international investors and index-linked ESG investors:

“EVA’s current international investor ownership is less than 10%, whereas ESG peer companies see over 30% international holdings. EVA’s current passive investor ownership is less than 5%, whereas index-linked holdings for ESG peer companies are more than 25%.” (EVA site)

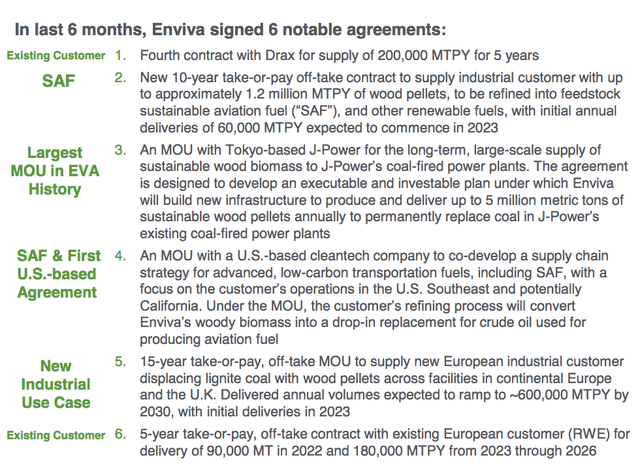

New Business and Growth Projects:

In addition to new business in Europe and Japan, management also signed an MOU, a memo of understanding, with a US company to co-develop a supply chain strategy to supply low-carbon fuels, including aviation fuel, to the Southeast and potentially California.

Management anticipates that demand required from a fully ramped customer facility in the Southeast or in California may require as much as the equivalent output of one of EVA’s large-scale wood pellet production facilities.

EVA site

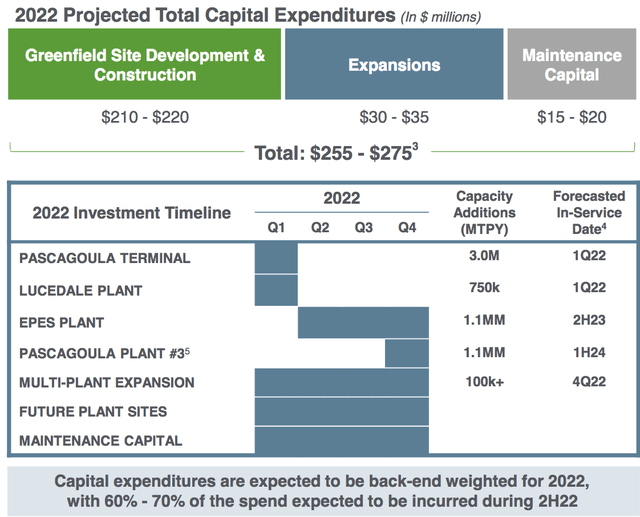

Another plus for EVA’s operations is that they require minimal maintenance capex, with $15-$20M forecast for 2022. The lion’s share of capex, $210-$220M, will go toward site development, with $30-$35M going to expansions of existing plants:

EVA site

Valuations:

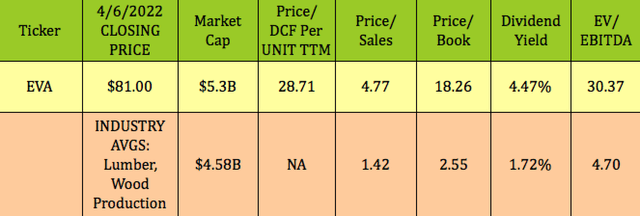

With the out-performance that EVA has enjoyed, it was up 65% in 2021, it’s not surprising that it commands premium valuations vs. other lumber and wood producers. The standout figure, of course, is its dividend yield, which is 4.47%, even after its big price rise.

Hidden Dividend Stocks Plus

Profitability and Leverage:

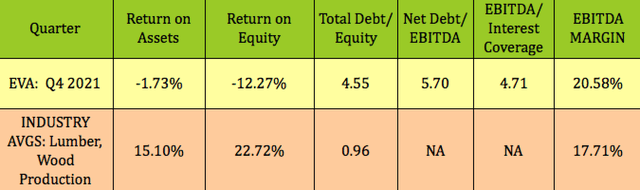

EVA’s non-recast Net Income for full year 2021 was -$33.2M, which pushed EVA’s ROA and ROE into the red for the time being, but we should see them improve in 2022.

Hidden Dividend Stocks Plus

Debt and Liquidity:

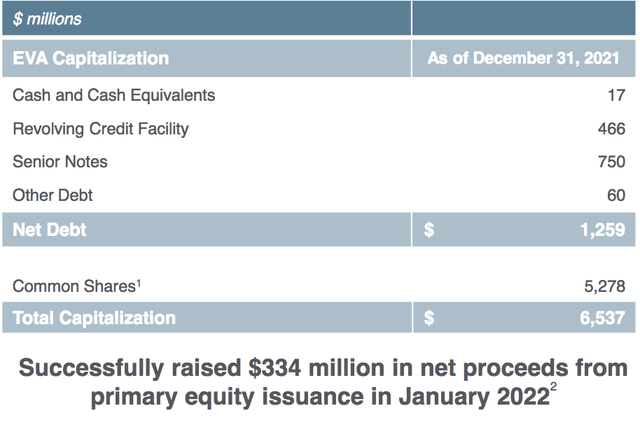

In Q4 ’21, management amended and restated EVA’s senior secured revolving credit facility and increased the facility’s size from $525 million to $570 million. The transaction closed on Dec. 17, 2021.

EVA site

Enviva’s liquidity as of December 31, 2021, which included cash on hand and availability under its $570 million revolving credit facility, was $117 million.

Parting Thoughts:

Management has guided this company to strong growth since its IPO. We believe that they wouldn’t even consider raising the dividend again if they thought they couldn’t cover it. It looks like EVA has its 10% dividend growth covered for 2022.

Like many industry leaders, EVA gets premium valuations relative to its industry due to its strong growth and sound management. EVA may not be a screaming buy right now, but it should certainly be on prospective new investors’ watch lists. With the current volatility in the market and the world, you may get a chance to jump on this wood pile at a lower price during the next market fire sale.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment