solarseven/iStock via Getty Images

Introduction

I wrote about Viatris (NASDAQ:VTRS) twice over the past 15 months. In the first article, I believed investors should in Pfizer (PFE) should keep their shares in Viatris following the spin-off, and in the second one, I believed that the company at the current valuation was a strong buy, as the company has initiated a dividend, focused on growing it, and promised to aim for growth to support future dividend growth and eventually multiple expansion.

Since I wrote the first one shares of Viatris are down 41%, and since I wrote the second one shares are down 15%. Part of becoming a better investor is analyzing your mistakes, and I am willing to do exactly that. This is especially important as most of my dividend growth investments have been good to me. Acknowledging mistakes and learning from them will help me improve even more.

I gave too much credit to the company’s management. They offered a plan that looked good on paper, but with a very little track record, I could not assess their execution. Following their deal with Biocon, and their decisions to initiate buybacks I started seeing some warning signs, that became increasingly stronger.

Viatris operates as a healthcare company worldwide. The company operates in four segments: Developed Markets, Greater China, JANZ, and Emerging Markets. It offers prescription brand drugs, generic drugs, complex generic drugs, biosimilars, and active pharmaceutical ingredients. The company offers drugs in various therapeutic areas, including non-communicable and infectious diseases and biosimilars in the areas of oncology, immunology, endocrinology, ophthalmology, and dermatology.

Fundamentals

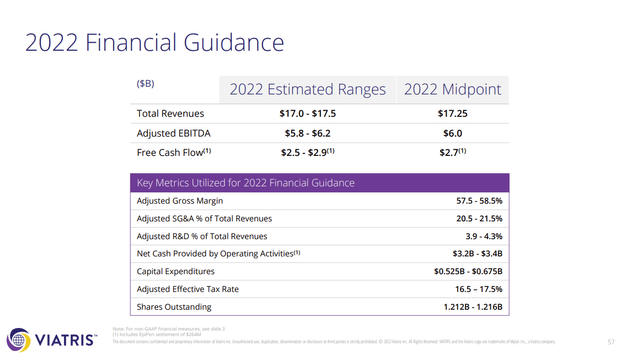

The company is new and therefore we have very limited abilities to learn from its past, as the spin-off only occurred recently. However, we already have some observations from the results of 2021 compared to 2020, and the guidance for 2022. This is not a very promising observation. The company has decided to sell its biosimilar business, and the company’s guidance now guides for both revenue decline and EBITDA decline in 2022.

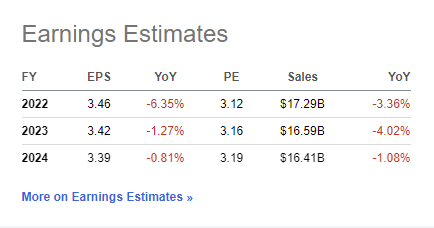

The company is guiding for a 3.5% decline in sales as well as an almost 7% decline in the company’s EBITDA. The company’s deteriorating fundamentals are not expected to change in the medium term. The consensus of analysts, as seen on Seeking Alpha adopts the company’s guidance for 2022. Moreover, it expects an additional decline in the company’s sales and earnings in 2023, and 2024. Therefore, investors have a prolonged period to deal with deteriorating fundamentals.

Seeking Alpha

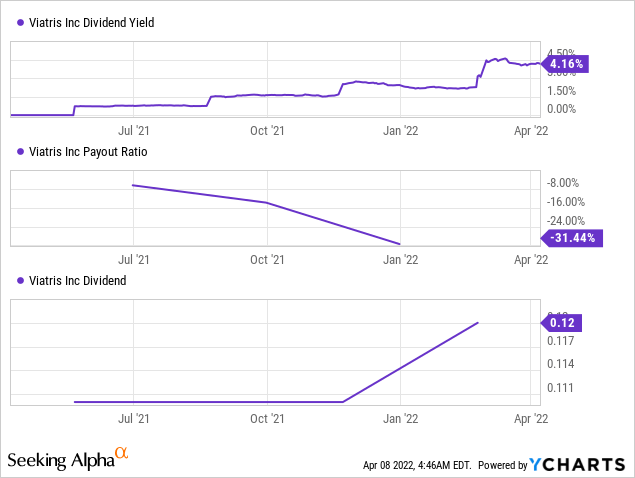

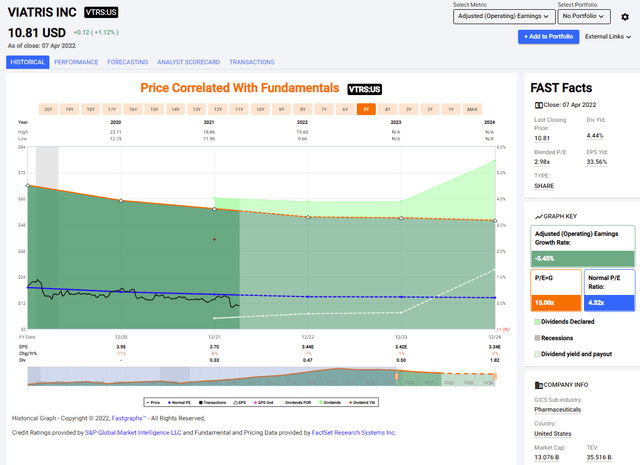

The company has initiated a dividend and even increased it once already by 9%. The company is paying only 14% of its 2022 earnings estimates in the form of dividends. However, the dividend yield is still compelling at 4.4%. It happens due to the company’s extremely low valuation. The company can pay less than 15% of its earnings as dividends, and still offer a competitive yield in the pharmaceutical business.

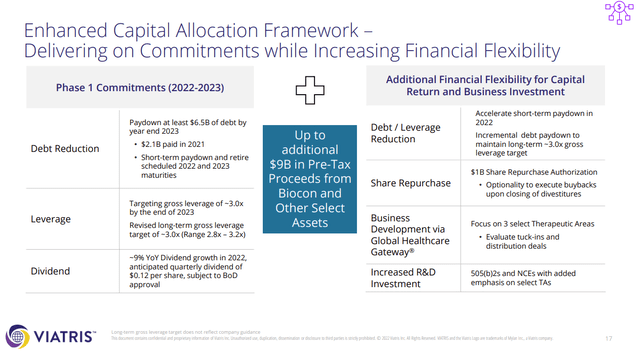

Debt is also a significant burden on Viatris. The company still has to deal with the debt it received in the spin-off. The company paid over $2B over the last twelve months, and it intends to pay similar amounts in 2022 and 2023 to make the balance sheet more flexible and allow for additional investment in growth.

Valuation

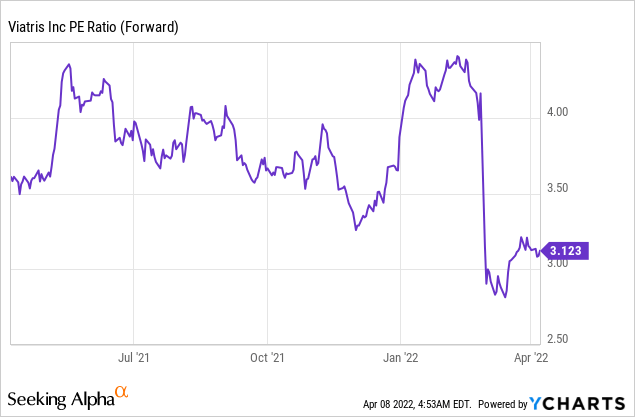

The current P/E ratio is almost at its lowest over the last twelve months. If you thought Viatris was cheap when its P/E ratio was 4, it is now even cheaper. However, there is a reason for that valuation and the management struggles to offer a path to growth that is both sustainable, and in the short and medium-term.

The graph below from Fastgraphs also shows, that while the company is cheap indeed, it has always been on the cheap side, and for a reason. The company shows a continuous decline in its EPS since the spin-off, and besides promises for growth, there seem to be very few reasons to believe that Viatris is going to grow in the medium term. In the past, I was giving the management too much credit, yet its execution has made me more critical.

To conclude, the company is extremely cheap at the current valuation. A P/E of 3 is not something we see very often, however, there is a reason for that. The company is struggling to grow, and in fact, it shrinks. Both sales and EPS are declining and are expected to continue to decline while the management offers very little leadership and shows incoherent execution which makes me question whether this is indeed a value play.

Incoherent execution

The biosimilar deal was the main reason for the loss of confidence in the company’s management. The company has struck a deal with its partner Biocon to sell its biosimilar portfolio. Viatris will receive up to $3.3B, and some of it will be in cash while the rest will be in stock which will give Viatris at least 13% ownership in Biocon.

The biosimilar realm is very promising, and Viatris said that it sold this business since it is better to be a fully integrated company, at its core and not rely on partners. Now Biocon will have a fully integrated biosimilar business, and Viatris will be an investor. In this transaction, Viatris is losing its control over Humira’s biosimilar drug. Humira is the highest-selling drug in the world, and this could be a significant opportunity.

While I am not sure this was the right deal for Viatris, I am convinced that the proceeds from the deal show an inability to decide what the company’s path is for the future. If Viatris doesn’t want to maintain its biosimilar business, owning shares in Biocon makes very little sense.

If the company thinks that the biosimilar portfolio is promising, then it should either buy the Biocon business or at least have enough equity in Biocon to control the company. The result is that Viatris is stuck in the limbo as it has neither control of the biosimilar business nor Biocon, and it didn’t get more cash to invest in other plausible investments. Viatris is not a holding company, and owning ~15% of a company makes very little sense to me.

What is Viatris going to do with the proceeds? It is still unclear. The company is promising long-term growth and investments in its core business. The company is focusing on ophthalmology, dermatology, and gastrointestinal. However, most of these investments will only come to fruition in 2024 and onward.

In the meantime, the company is authorizing stock buybacks, which again make very little sense. Buybacks are great, and as a dividend growth investor, I am a fan of buybacks. However, buybacks must come in addition to the dividend and when the business is well-performing.

At the moment the business suffered from deteriorating fundamentals. Therefore, buybacks will increase investors’ ownership in a declining company, which makes very little sense. IBM (IBM) has done exactly that mistake, where it spent billions on buybacks when its core business was struggling. Therefore, I am not a fan of these buybacks and believe that the funds should have been directed towards either investments or debt reduction to finish the needed deleveraging ahead of schedule.

Conclusions

I believe that Viatris is a hold at the moment. The company’s vision is farsighted, and its short-term moves are disappointing. The low valuation is the company’s main reason for investment, but it is hard to figure out which event will unlock the value and allow for multiple expansions.

While I believe that in the long-term around 10 years from now, there will be value being unlocked, the current weakness in fundamentals is overshadowing it, and the management’s actions don’t give confidence in my opinion. It will take time before the current pipeline and additional R&D investments will turn into real growth.

Be the first to comment