outline205/iStock via Getty Images

Earnings of Commerce Bancshares, Inc (NASDAQ:CBSH) will most probably decline this year relative to last year because of higher provision expenses. On the other hand, economic strength will likely drive loan growth, which will, in turn, support the bottom line. Further, the net interest margin is moderately sensitive to interest rate changes. Therefore, the margin will likely expand in the year ahead. Overall, I am expecting Commerce Bancshares to report earnings of $3.82 per share in 2022, down 11% year-over-year. Compared to my last report on Commerce Bancshares, I have revised upwards my earnings estimate mostly because I have reduced my estimate for the provision expense. The year-end target price suggests a significant downside from the current market price. Based on the total expected return, I’m adopting a hold rating on Commerce Bancshares.

First Quarter’s Loan Growth Trend Likely to Continue

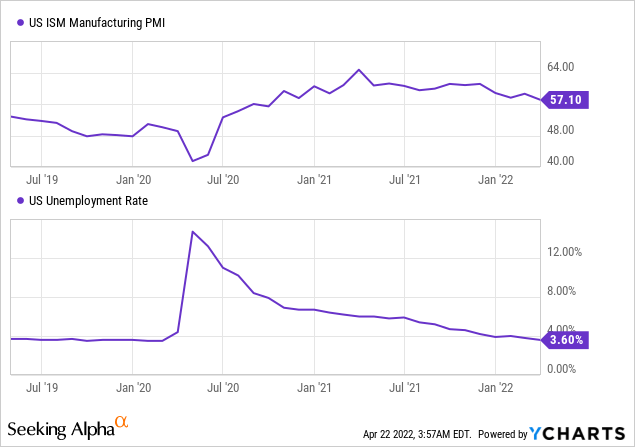

After a large decline in the loan portfolio size last year, the portfolio grew by an impressive 2% in the first quarter of 2022, or 8% annualized. Loan growth will most probably remain strong in the year ahead due to economic factors. Commerce Bancshares operates in Missouri, Kansas, Illinois, Oklahoma, and Colorado. The economic performances of these states vary widely; therefore, to gauge product demand, it is more appropriate to consider the national economic metrics rather than statewide economic metrics. The nation appears well on the path of economic growth, as can be seen from the PMI index and unemployment rates.

Further, I don’t think that monetary tightening will have any material recessionary effects on the economy.

Moreover, the upcoming forgiveness of Paycheck Protection Program (“PPP”) loans will barely have any effect on loan growth. PPP loans outstanding totaled $53.4 million at the end of March 2022, representing just 0.3% of total loans, according to details given in the earnings release. Overall, I’m expecting the loan portfolio to increase by 5% in 2022 from the end of 2021. Further, I’m expecting loan growth to outpace deposit growth this year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 13,824 | 13,980 | 14,577 | 16,109 | 15,026 | 15,789 | |||

| Growth of Net Loans | 4.3% | 1.1% | 4.3% | 10.5% | (6.7)% | 5.1% | |||

| Other Earning Assets | 9,688 | 10,113 | 9,988 | 15,288 | 20,299 | 18,389 | |||

| Deposits | 20,425 | 20,324 | 20,520 | 26,947 | 29,813 | 29,939 | |||

| Borrowings and Sub-Debt | 1,509 | 1,965 | 1,853 | 2,099 | 3,036 | 2,190 | |||

| Common equity | 2,572 | 2,787 | 2,990 | 3,397 | 3,437 | 3,208 | |||

| Book Value Per Share ($) | 22.9 | 24.8 | 26.0 | 29.1 | 28.4 | 26.6 | |||

| Tangible BVPS ($) | 21.6 | 23.5 | 24.7 | 27.9 | 27.1 | 25.3 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Balance Sheet Positioning Makes the Margin Moderately Rate-Sensitive

Commerce Bancshares’ net interest margin is quite sensitive to rate changes thanks to the following factors.

- Around 53% of the loan portfolio is based on variable rates, according to details given in the earnings presentation.

- Commerce Bancshares has historically experienced a very low deposit beta of only 12%, as mentioned in the presentation. This means that a 100-basis points increase in interest rates can increase the average deposit cost by only 12 basis points.

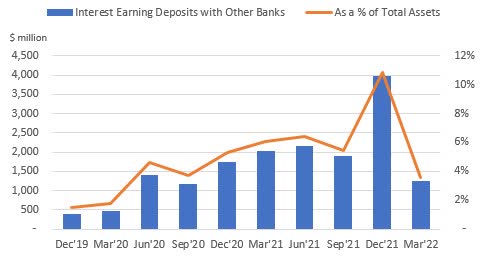

- Commerce Bancshares has a large amount of cash equivalents on its books. Interest-earning deposits with other banks declined in the first quarter but remained well above the pre-pandemic level (see chart below). Commerce Bancshares can quickly deploy this excess cash into higher-yielding securities as interest rates increase.

SEC Filings

On the other hand, the sizable securities portfolio is likely to make the average yield on earning assets upward sticky. The company’s securities portfolio is almost as large as the loan portfolio. As mentioned in the presentation, these securities carry an average duration of 3.6 years. Therefore, we can expect much less than a third of the portfolio to re-price this year.

The management’s interest-rate sensitivity analysis shows that a 100-basis points gradual hike in interest rate can add $33.5 million to $39.5 million of net interest income over twelve months. To put these numbers in perspective, $33.5 million is 4.0% of the net interest income for 2021, and $39.5 million is 4.7% of the net interest income for 2021.

Considering these factors, I’m expecting the net interest margin to increase by twelve basis points in the remainder of the year from 2.45% in the first quarter of 2022.

Higher Net Provision Expense to Drag Earnings

Commerce Bancshares pleasantly surprised me by booking a large provision reversal in the first quarter of 2022. Further provision reversals cannot be ruled out as the reserve for loan losses is quite high relative to the loan portfolio’s credit risk. According to details given in the earnings release, non-accrual loans made up just 0.05% of total loans, while allowances made up 0.87% of total loans at the end of March 2022.

Meanwhile, the anticipated loan additions discussed above will require proportionate provisioning for expected loan losses. Overall, I’m expecting the provision expense, net of reversals, to be higher than last year but below the pre-pandemic average. I’m expecting a net provision expense of $20 million in 2022, representing 0.13% of total loans. In comparison, the company reported an average net provision expense of 0.17% of total loans from 2017 to 2019.

In my last report on Commerce Bancshares, I estimated a net provision expense of $32 million for 2022. I have now revised downwards my provisioning expectations because Commerce Bancshares beat my estimate for the first quarter of 2022.

Expecting Earnings to Decline by 11% Year-Over-Year

The higher net provision expense will likely be the chief contributor to an earnings decline this year relative to last year. On the other hand, decent loan growth and margin expansion will likely support the bottom line. Overall, I’m expecting Commerce Bancshares to report earnings of $3.82 per share in 2022, down 11% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 734 | 824 | 821 | 830 | 835 | 845 | |||

| Provision for loan losses | 45 | 43 | 50 | 137 | (66) | 20 | |||

| Non-interest income | 461 | 501 | 525 | 506 | 560 | 569 | |||

| Non-interest expense | 744 | 738 | 767 | 768 | 806 | 829 | |||

| Net income – Common Sh. | 310 | 425 | 412 | 339 | 526 | 461 | |||

| EPS – Diluted ($) | 2.76 | 3.78 | 3.58 | 2.91 | 4.31 | 3.82 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

In my last report on Commerce Bancshares, I estimated earnings of $3.67 per share for 2022. I have increased my earnings estimate mostly because I have reduced my estimate for the provision expense. Further, I have tweaked down the non-interest expense estimate and increased the non-interest income estimate based on the company’s performance in the first quarter of 2022.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Maintaining a Hold Rating

Commerce Bancshares is offering a dividend yield of 1.5% at the current quarterly dividend rate of $0.265 per share. The earnings and dividend estimates suggest a payout ratio of 28% for 2022, which is in line with the five-year average of 30%. Therefore, I’m not expecting any change in the dividend level in the remainder of this year.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Commerce Bancshares. The stock has traded at an average P/TB ratio of 2.28 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 21.6 | 23.5 | 24.7 | 27.9 | 27.1 | |

| Average Market Price ($) | 48.7 | 55.2 | 55.1 | 55.5 | 69.7 | |

| Historical P/TB | 2.26x | 2.35x | 2.23x | 1.99x | 2.57x | 2.28x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $25.3 gives a target price of $57.7 for the end of 2022. This price target implies a 20.9% downside from the April 21 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.08x | 2.18x | 2.28x | 2.38x | 2.48x |

| TBVPS – Dec 2022 ($) | 25.3 | 25.3 | 25.3 | 25.3 | 25.3 |

| Target Price ($) | 52.7 | 55.2 | 57.7 | 60.3 | 62.8 |

| Market Price ($) | 73.0 | 73.0 | 73.0 | 73.0 | 73.0 |

| Upside/(Downside) | (27.8)% | (24.4)% | (20.9)% | (17.4)% | (14.0)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 16.6x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.76 | 3.78 | 3.58 | 2.91 | 4.31 | |

| Average Market Price ($) | 48.7 | 55.2 | 55.1 | 55.5 | 69.7 | |

| Historical P/E | 17.7x | 14.6x | 15.4x | 19.1x | 16.2x | 16.6x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.82 gives a target price of $63.4 for the end of 2022. This price target implies a 13.1% downside from the April 21 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 14.6x | 15.6x | 16.6x | 17.6x | 18.6x |

| EPS 2022 ($) | 3.82 | 3.82 | 3.82 | 3.82 | 3.82 |

| Target Price ($) | 55.8 | 59.6 | 63.4 | 67.2 | 71.1 |

| Market Price ($) | 73.0 | 73.0 | 73.0 | 73.0 | 73.0 |

| Upside/(Downside) | (23.6)% | (18.4)% | (13.1)% | (7.9)% | (2.6)% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $60.6, which implies a 17% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 15.6%. The expected return is not low enough for a sell rating. Hence, I’m adopting a neutral rating on Commerce Bancshares.

Be the first to comment