BT Series

Introduction

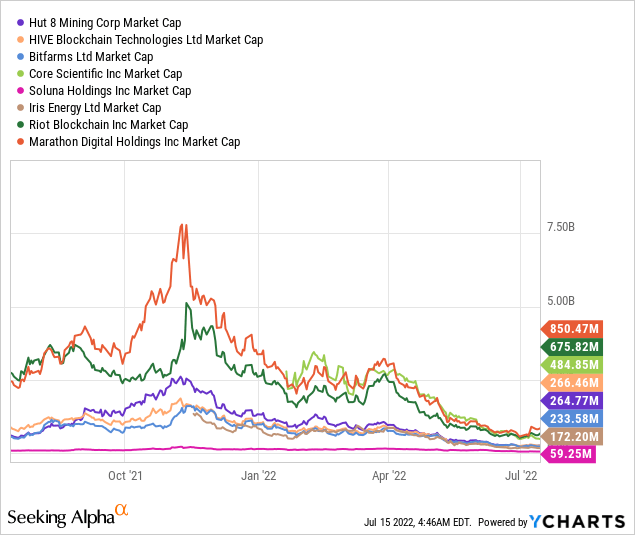

In our previous coverage on Hut 8 Mining (NASDAQ:HUT), despite taking a liking to the company, we explicitly stated that we’ll hold off our investment in it as we expect a large decline in HUT due to economic fundamentals. We also stated that HUT is fairly priced back then assuming Bitcoin stays above $50,000 and HUT achieves its targeted 6 EH/s mining capacity by mid of 2022. We did not expect Bitcoin to hold above $50,000 due to our thesis on its halving cycle.

Our concerns were proven valid as the economy is nearing the official definition of a recession, Bitcoin broke below $20,000, and HUT failed to achieve its targeted 6 EH/s by mid of 2022. As a result, HUT suffered a 75% decline since our last coverage at the beginning of 2022.

With HUT trading at only a $260m market cap, should investors start adding positions to HUT?

HUT is Holding True to Its HODL Strategy

HUT has made it clear in every quarterly report that it has retained 100% of its mined Bitcoins. As a result, HUT’s Bitcoin reserve is one of the biggest in the sector with 7,406 Bitcoins as of the end of June 2022 despite trailing in mining capacity (Table 1).

Tablet 1. Bitcoin Reserves and Built-up Mining Capacity ~June 2022

Source: Author

* Not that we know of

At this point, HUT’s Bitcoin reserve is only trailing behind MARA. Even then, HUT is expected to exceed MARA in 3 quarters assuming HUT continues its 2022Q1 production numbers.

According to HUT, HUT is still retaining 100% of its Bitcoin mined in June despite Bitcoin trading at the $20,000 level. This commitment cannot be understated. During this period, BITF was forced to liquidated more than half of its Bitcoin reserves. MARA had to cut operating capacity from its 3.9 EH/s built-up capacity in 2022Q1 to only 0.7 EH/s assumeably due to their inefficiencies to be profitable at the current Bitcoin price. RIOT had to sell 70% of its Bitcoin mined.

It is impossible for a Bitcoin mining company not to be bullish on Bitcoin. Hence, if the company believes that Bitcoin will appreciate in value in future, it does not make sense to sell it now and it is in the company’s interest to retain and HODL as much Bitcoin as possible. We also use Bitcoin reserve as a key metric in our valuation framework early on.

So, kudos to HUT for such commitment to its HODL strategy.

How does HUT HODL 100% of Bitcoins mined?

The business mining business has many costs such as electricity, hosting, wages, consultations, and etc. However, it only has 1 significant stream of revenue, the Bitcoin reward. HIVE has 3 (mining, hosting, and high performance computing (HPC)), but revenue from hosting and HPC is negligible at this point.

Logically speaking, HUT will have to sell at least part of the Bitcoins mined to cover the expenses, what is left can be retained in its reserves. However, HUT retains 100% of its Bitcoin mined. So how does HUT cover its expenses? Even with operating efficiency at the highest level, HUT would have to sell some of its Bitcoin mined to cover costs.

Based on our experience, HUT would need to have superior cost control to pull this off. Else, HUT would need to use leverage or dilute shareholders.

How is HUT’s cost control?

We find that HUT does not have superior cost control (Table 2). Since 2021Q1, HUT’s operating cost per BTC mined is consistent around the $14,000 level on average. When other business costs are included (which we should), HUT’s total all-in business cost is consistently around the $37,000 level on average. HUT’s total all-in business cast cost (excluding depreciation and stock-based compensation) is around the $28,000 level on average.

By sector standards, HUT’s cost structure are considerably high (Table 3). The sector’s average all-in business cost per BTC is in the $30,000 level. HUT’s is 30% higher than sector average.

Table 2. HUT’s Business Costs

| Quarter | Bitcoin Mining Operation Cost ($mil) | Depreciation ($mil) | General and Admin ($mil) | Share-based comps ($mil) | Total Cost ($mil) |

| 2022Q1 | 13.00 | 14.15 | 9.00 | 1.00 | 37.15 |

| 2021Q4 | 13.31 | 7.15 | 9.23 | 1.96 | 31.66 |

| 2021Q3 | 12.31 | 4.00 | 6.62 | 2.15 | 25.08 |

| 2021Q2 | 10.62 | 2.31 | 4.92 | 1.36 | 19.21 |

| 2021Q1 | 11.23 | 4.46 | 2.95 | 2.12 | 20.76 |

Source: Author, HUT

Table 3. HUT Business Costs per BTC

| Quarter | Bitcoins mined | Total Cost Per BTC | Operating Cost per BTC | Total Cash Cost Per BTC |

| 2022Q1 | 942 | 39,441.45 | 13,800.42 | 23,354.56 |

| 2021Q4 | 789 | 40,120.89 | 16,866.53 | 28,565.85 |

| 2021Q3 | 905 | 27,709.31 | 13,599.66 | 20,909.48 |

| 2021Q2 | 553 | 34,729.45 | 19,195.99 | 28,098.48 |

| 2021Q1 | 538 | 38,584.50 | 20,875.04 | 26,351.16 |

Source: Author, HUT

Table 4. All-in Business Cost Comparison

Source: Author, HUT

Therefore, HUT’s HODL strategy isn’t made possible through superior operation efficiency. Worse still, HUT’s cost structure is considerably high compared to sector standards.

Some might argue that HUT’s cost structure can be improved as HUT scales operations. Conceptually HUT should, all other Bitcoin companies also should. But there is a strong support that cost does not reduce with scale.

When we observe the sector as a whole (Table 5), scale does not reduce cost materially. The same observation can be made when observing individual mining companies. HUT’s (Table 3) , BITF’s (Table 6) , HIVE’s, MARA’s, and RIOT’s costs per BTC are consistent despite increasing capacity (or mining more BTC). We explained this in detail here.

Table 5. Cost did not reduce with scale

| Company | Bitcoin Reserve (June 2022) | Built-up Mining Capacity | All-in Business Cost Per BTC Equivalent mined |

| IREN | -* | 1 | $39,355.00 |

| SLNH | -* | 1.021 | $54,000-$64500* |

| HIVE | 3687 (3239 BTC + 7667 ETH) | 2.17 | $22,500 |

| HUT | 7406 | 2.78 | $39,441.45 |

| BITF | 3,144 | 3.6 | $34,340.00 |

| RIOT | 6.654 | 4.4 | $30,800.00 |

| MARA | 10.055 | 3.9 | $31,700.00 |

| CORZ | 1,959 | 8.3 | $35,816.00 |

Table 6. BITF’s All-in Business Cost per BTC Since 2021Q1

| QR | Bitcoins Mined | Cost of Revenue ($mil) | General & Administrative ($mil) | Financial Expense ($mil) | Business Cost ($mil) | Business Cost per BTC ($) |

| 2022Q1 | 961 | 23.3 | 13,843 | -4 | 33 | 34,340 |

| 2021Q4 | 1,045 | 20.62 | 18.93 | -2.932 | 36.6 | 35,000 |

| 2021Q3 | 1,051 | 15.3 | 10.884 | -0.62 | 25.564 | 24.323 |

| 2021Q2 | 759 | 13.332 | 10.607 | 1.127 | 25.1 | 33,025 |

| 2021Q1 | 598 | 9.12 | 2.819 | 23.425 | 35.364 | 59,137 |

Source: Author

Material Risk of Halting Mining Operations?

Based on this cost structure, there is a material risk that HUT could halt its Bitcoin mining operation.

It is one thing of be making losses on the overall business, and another thing to be making losses on operation. Making losses on operation implies that it is no longer viable for HUT to mine Bitcoin and should therefore halt operations, much like MARA for reducing operation from 3.9 EH/s to only 0.7 EH/s in June.

HUT’s operating cost is around $13,800 in 2022Q1 but averages to be around $17,000. Operating cost is primarily electricity cost but also includes costs related to personnel, network monitoring, software licensing, equipment repair, and maintenance, which are all critical to the Bitcoin mining operation.

On the other hand, Bitcoin is trading at around the $20,000 level and we expect Bitcoin to decline to as low of $10,000 based on its decade-old halving cycle and economic fundamentals. Should Bitcoin reach this price level, HUT will risk halting mining operations temporarily.

Is HUT’s HODL Strategy Funded through Liabilities and Dilution?

We think that’s the case, but primarily dilution.

HUT’s total liabilities were consistently around $20mil up til 2021Q3. In 2021Q4 and 2022Q1, HUT’s total liabilities suddenly increased to about $150mil and $100mil respectively. This large increase in total liabilities is mainly contributed by warrants liability ($100mil) and loans payable ($30mil).

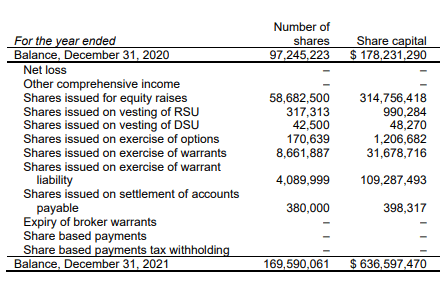

Warrants are used to raise capital. HUT can raise capital by selling warrants to investors and raise another round of capital when investors exercise the warrants to buy shares from HUT. But the warranty liability is not the data that gave away how HUT funds its HODL strategy and expansion plan. It is the shares outstanding (Figure 1).

HUT had just diluted investors 74.4% (increase in shares outstanding) just in 2021. This means that investors lost 40% of HUT’s future upside or their claim on HUT’s assets and profits or in 2021.

Comparatively, BITF shareholders suffered 38% dilution (increase in shares outstanding) while CORZ has 66% potential dilution (increase in shares outstanding) risk over an unspecified amount time.

This momentum is likely to continue in 2022 as HUT announced its at-the-market (ATM) equity offering program to raise $65mil of capital. If HUT were to conclude its ATM offering as of the time of writing, HUT would need to issue additional 42.7mil shares or ~25% dilution (increase in shares outstanding) based on 2021Q4 shares outstanding.

On a side note, HUT just raised CAD$32.5mil in 2022Q1 but we’re unsure whether the capital raised is part of the ATM offering announced.

Table 7. HUT’s increasing Shares Outstanding and Total Liability

| QR(CY) | Shares Outstanding (MIL) | Total Liability ($mil) |

| 2022Q1 | 174.2 | 79.23 |

| 2021Q4 | 170 | 119.04 |

| 2021Q3 | 164.4 | 16.85 |

| 2021Q2 | 143.3 | 11.01 |

| 2021Q1 | 118.6 | 17.69 |

Source: Author

Figure 1. HUT suffered 74.4% in 2021 (HUT)

Verdict

We showed that HUT is not profitable when Bitcoin is trading below $40,000. This means that its market cap relative to hard assets is more important for HUT to be investable.

The total value of assets (Cash, reserves, plant and equipment, deposits and prepaids) ($633mil) in excess of total liabilities ($79.23, could be lesser as majority is warrant liability) is $553.77mil. This is more than 2x higher than its market cap. This safety of margin even exceeded IREN’s 88%. Although its business efficiency isn’t as good as HIVE’s, this safety of margin should be able to compel many investors to invest in HUT.

However, the main problem for us is its dilution problem. HUT’s HODL strategy is a double edge sword. On one hand, HUT is in poised to take advantage of any Bitcoin upside movement. On the other hand, HUT is severely diluting shareholders. 74.4% increase in shares outstanding equates to about 40% less shareholder claim on assets or return. Theoretically, this implies that even if HUT manages to increase its market cap increase by 40%, its share price wouldn’t increase. To put this into perspective, the S&P provides investors only 8%-10% return annually. But if Bitcoin appreciates faster than HUT’s dilution, this shouldn’t be a problem anymore.

At the moment, HUT’s Bitcoin reserve in excess of liability is already worth more than its market cap. This means that investors are getting its cash, plant and equipment, deposits and prepaids, and businesses (mining, hosting, HPC) for free. This is indeed very hard to ignore. Therefore, we maintain our stance that HUT is just like holding Bitcoin, but only better.

Due to our $10,000 Bitcoin thesis, we’ll continue to delay our investment into HUT alongside HIVE and IREN.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment