Sakorn Sukkasemsakorn

Investment Thesis

Kinder Morgan (NYSE:KMI) is a midstream, energy infrastructure company. KMI operates pipelines and storage facilities for natural gas, crude oil, and refined products.

60% of KMI’s business is tied to natural gas. Hence, what happens within natural gas impacts KMI, for better or worse.

This Wednesday, after the close, KMI will report its Q4 2022 results. I provide a discussion of how investors should think about its 6% dividend yield.

What’s at Play Right Now?

As a reminder, the advantage of investing in a midstream energy company is that their business model isn’t fully exposed to natural gas and oil prices. Kinder Morgan’s revenues are driven through long-term contracts and fee-based services.

We can think of KMI as a toll operator, where its revenues come from the amount of volume passing through its network of pipes, rather than directly associated with natural gas prices.

That being said, there is a fair amount of correlation between demand for natural gas, crude oil, NGL passing through its network, and its revenues.

Recall close to 60% of KMI’s operations are driven by its exposure to natural gas. Thus, if one believes that natural gas will continue to play a key role in our energy security, then KMI will continue to positively benefit from this dynamic.

Hence, even though natural gas prices have recently sold off, this shouldn’t immediately impact KMI’s near-term prospects.

This leads me to my core argument facing KMI’s prospects.

The Core of the Thesis

Over the next several years, as countries around the world increase their exposure to renewable energy, natural gas will be a bridge in their energy transition. Why?

Because renewables are still nascent energy sources, not to mention highly intermittent. Accordingly, to ensure flexible reliability to baseload energy, natural gas will continue to play a key role.

At the core of the thesis, I believe that the demand for natural gas will continue to climb over the next several years, even as countries around the world work towards decreasing their fossil fuel consumption.

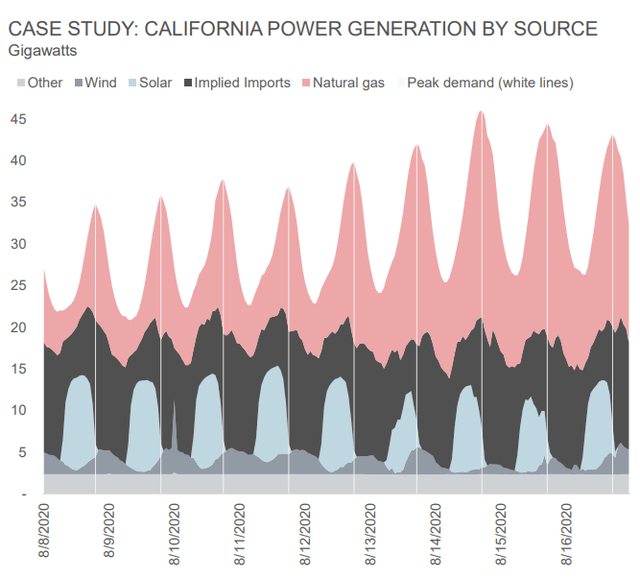

Below we can see a case study that echoes this thesis.

In the above graphic, we can see when California had a heat wave in 2020. When there was peak demand for energy, renewables were producing below their normal generation levels.

And the baseload energy that was there to meet demand was natural gas. Now, keep in mind, not all countries around the world that depend on natural gas are as prosperous as the state of California and so far along their energy transition. For most countries, natural gas will continue to play a very large role.

Kinder Morgan’s Dividend Yield, 6%

In the past 6 years, through different energy cycles, KMI has self-funded all its capex requirements and dividend payouts.

This means that even though KMI carries a significant amount of leverage at 4x its EBITDA, this isn’t getting in the way of its dividend payout.

On the other hand, the one aspect to keep in mind is that KMI has $3.2 billion of debt maturing this year. This means that for 2023, investors are unlikely to see any further increases to KMI’s dividend.

On yet the other hand, presently, KMI’s yield reaches 6%. Hence, given both its high dividend, plus the fact that it’s exposed to a secular growing energy source, for the most part, I believe that investors here will continue to get the best of both worlds.

The Bottom Line

The one-line summary is this, Kinder Morgan is cheaply valued, and well-positioned for 2023, with an attractive dividend.

The more nuanced thesis remarks that Kinder Morgan carries a fair amount of leverage. And even though this leverage is considered manageable, it does get in the way of KMI substantially further increasing its dividend yield.

On yet the other hand, natural gas is often seen as the ”greenest” of the burning fossil fuels. That implies that the demand for natural gas will not be phased out any time soon, and may continue to steadily increase for a considerable number of years.

Thereby basically ensuring that shareholders will continue to receive a steadily growing dividend.

Be the first to comment