hapabapa/iStock Editorial via Getty Images

Thesis

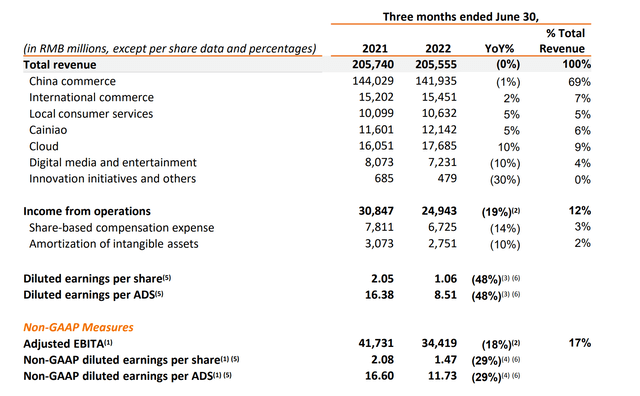

Alibaba Group (NYSE:BABA) reported its FY Q1 earnings release (“ER”) on August 4, 2022, for the calendar June quarter of 2022. Total revenues were flat compared to a year ago (RMB205B or $30.7B) as you can see from the following chart below. Its Cloud segment continued to report a double-digit 10% YoY growth, but the growth was canceled out largely by the 1% decline in its China Commerce segment. In terms of the bottom line, it earned $1.75 a share with one-time items excluded, beating analysts’ consensus of $1.56 a share but suffering a large YoY decline. Implications of all these had been already thoroughly analyzed by other SA authors by this point and I won’t further add on anymore.

In this article, I will just examine the BABA investment from a different perspective: the perspective of asset valuation. More particularly, I will examine the clarity of its asset’s valuation given the recent development of its Ant Group. And we will dive right in.

Ant Group

In my view, the most significant development surrounding the Ant Group was Jack Ma’s recent plan to cede his control. According to the following Reuters report (HONG KONG/BEIJING, July 28, slightly edited by me):

Chinese billionaire Jack Ma plans to cede control of Ant Group… after a regulatory crackdown that scuppered its $37 billion IPO in 2020 and led to a forced restructuring of the financial technology behemoth. Ant has informed regulators of Ma’s intention as it prepares to restructure into a financial holding company, the report said, adding regulators didn’t demand the change but have given their blessing.

Jack Ma’s control of the group was considered to be the main reason why the IPO was a miscarriage at the last minute a few years back. And recently (back in June), a Bloomberg report broke the news that the Ant Group was to apply for a key license as soon as the same month, signaling the revival of its IPO attempt. Jack Ma’s ceding of control might delay the IPO by up to 3 years. Chinese regulations require a three-year wait period on the A-share market after a major change in key leadership, two years on the Shanghai STAR market, and one year in Hong Kong.

However, for long-term investors who don’t mind a delay of 1 to 3 years (which really is not that long), my view is that Jack Ma’s ceding of control paved the road for the IPO and adds clarity to BABA’s asset valuation, as to be detailed next.

BABA’s Asset valuation

It is no secret that BABA’s valuation is compressed and many SA articles (including some of my own) have analyzed the compression already. Here, I will take the approach of an asset valuation. To me, this is the most conservative estimate as it does not involve too many projected earnings and only considers the current assets.

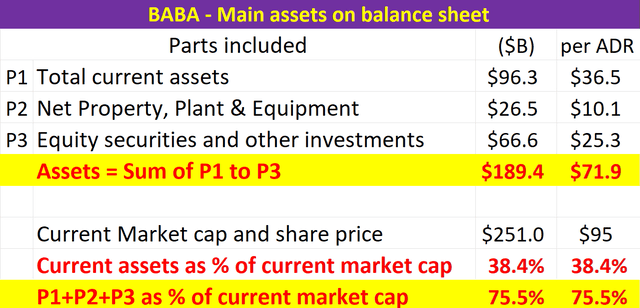

The main assets for BABA as of its latest release are the following:

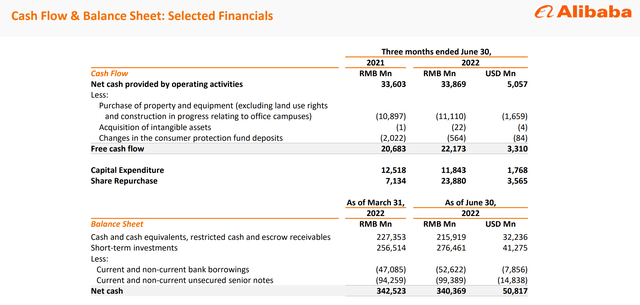

- $96.3B of current assets (out of which $50.8B are cash and equivalents short-term investments as you can see from the chart below)

- $26.5B of Net Property, Plant & Equipment

- $66.6 of Long-Term Investments (of which the Ant Group is one of the most significant items)

If we add these above three parts (as shown in the table below), the total assets are worth $189.4B, or $71.9 per ADR. With its current market cap of $251B (or a share price of $95 per ADR), these assets represent about ¾ of its total market cap already. And note the current assets represent more than 38% of the total market cap alone.

Of course, it carries some other assets besides these three and also liabilities. To wit, its total assets add to $255B, and total liabilities add up to around $91B, resulting in total equity of $162B.

So, the three parts we considered are a bit higher than its total equity (by about $27B), which is totally within the margin of uncertainty in my view. The margin uncertainty is even wider considering the growth potential of these long-term assets in a couple of years (say 1 to 3 years). And here I will just focus on the Ant Group again. Ant Group was considered the most valued unlisted company in the world back in 2018 with an anticipated IPO valued at around $315 billion. After the failed IPO and the regulation changes, its valuation shrank some still remain in the 150 billion to over $200 billion. For example, Warburg Pincus LLC valued Ant at about $220 billion based on a comparable company analysis.

Out of the multitude of equity investments in BABA’s portfolio, I am optimistic that many of them would eventually become unicorns and worth more than what they are now. But the main point here is that, even just considering their current valuation, BABA’s valuation is already attractive from an asset point of view – that is, with all its future earnings ignored.

Final thoughts and other risks

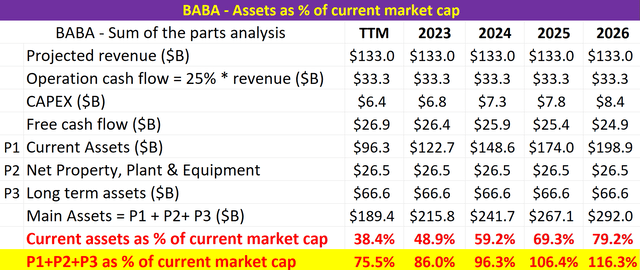

Then just for speculation, the following table considers its future earnings under some very conservative assumptions. For example, I am assuming its revenues to stagnate at the current level, its operating cash flow to stay stagnant too while its CAPEX grows, and its equity investments show no price appreciation. And finally, the key and the most conservative assumption is that it only hoards cash from now on. So, the only item that grows is its cash holding as you can see from line P1 in the table. And you can see that at its current valuation, it would become a pure asset purchase in a few years.

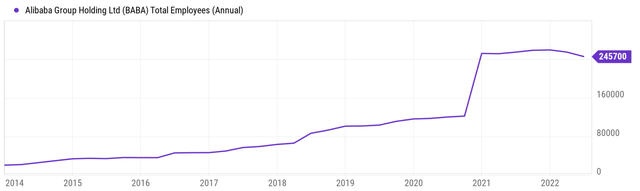

Finally, risks. Of course, the valuation compression is for good reasons. Delisting is a realistic possibility. Recently, 5 Chinese companies just announced that they intend to delist their ADR from the NYSE as Beijing and Washington’s tension grows over audit requirements. Domestically and internally, BABA may be over-expanded in the past few years and the overall China economy can face a slowdown. Its recent plan to reduce personnel count serves as the latest signal for these risks. Its total personnel stood at 245.7K, signaling about a 10k trimming from the peak level at the end of March. But overall, you can see that the company might have expanded too fast in the recent few years. Its total headcounts expanded by more than 3x since 2018 and may need time to digest the overcapacity.

Be the first to comment