Obradovic/E+ via Getty Images

Note: The company reports its financials in CAD (with listings in US and Canada), so all numbers below are provided in CAD, unless indicated otherwise.

Last week, Canadian steel manufacturer Algoma Steel Group (NASDAQ:ASTL) announced that it will launch a substantial issuer’s bid (modified Dutch tender) for around US$400m/C$520m at the end of this month. Yesterday (21st of June), the company disclosed that the price range is set at US$8.75-US$10.25 per share. At the current price, the tender will allow ASTL to repurchase ~25% of its shares. The stock currently trades at the tender range midpoint (US$9.54). The tender is likely to be undersubscribed and priced at the higher limit for the following reasons:

-

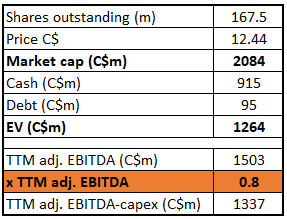

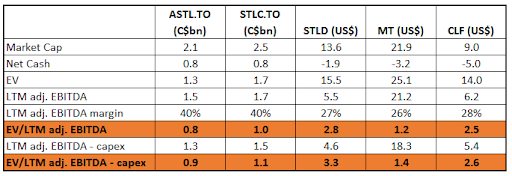

ASTL looks extremely cheap on past earnings trading at just 0.8x TTM adj. EBITDA. 40% of the market cap is in net cash. The company trades at a material discount to larger US peers (1.2x-2.8x adj. EBITDA) and even a small discount to a similar-sized Canadian peer STLC (1x TTM adj. EBITDA).

-

ASTL is investing in more advanced EAF furnace technology (electric arc vs blast) that is expected to come online in 2024. The new technology will substantially increase ASTL’s operational efficiency and should be a catalyst for it to re-rate as electric furnace producers tend to trade at higher valuation multiples than blast furnace producers (see more details below). Importantly, the investment required to transition to this newer technology is mostly financed by very cheap/free government loans. The peer STLC has no plans of making this transition, so it can be argued that ASTL should trade at a premium instead of the current small discount.

-

Overall, the whole steel manufacturing sector seems cheap now. It’s not unusual for cyclical commodity manufacturers to trade at depressed multiples during the peak of the cycle, however, ASTL is kind of the lowest of the low here and the market seems to be underestimating the future earnings power of the company.

-

The tender is very large and given the depressed valuation as well as the ongoing transition to EAF, there’s a chance that many shareholders will choose not to tender. ASTL’s substantial issuer’s bid might end up like the one of STLC’s – launched and completed in Jan’22, it was a smaller offer for 9-10% outstanding shares with a price range of C$31-C$37/share and ended up undersubscribed (65% of intended amount filled) and priced at the upper limit.

Since ASTL is incorporated in Canada, tendering foreign investors will be liable to pay withholding taxes on the difference between the tender price and paid-up capital. As the paid-up capital is fairly low here, at the higher tender price limit withholding taxes would amount to US$0.91 per share. For this reason, the tender is actionable for Canadian shareholders or other accounts that are not subject to these taxes.

The tender eliminates the risk that ASTL will be hoarding cash during the upcycle and spend it all on operational investments. Share repurchases are also highly accretive, so it is likely that the price will not drop after the tender expires.

Valuation

Algoma Steel Group manufactures and sells high quality hot and cold-rolled steel products to automotive, construction, and other end markets. Hot-rolled sheets make up 80% of production volume. The highest input cost is iron ore and coal (ASTL is an integrated producer and makes its own coke). Other inputs include scrap metal, alloys, and natural gas.

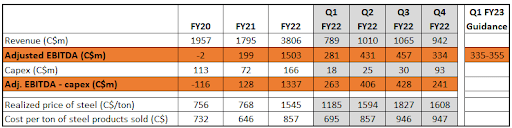

Due to the post-COVID steel price explosion, the company’s earnings skyrocketed. During the FY22 (ended Mar’22) ASTL generated C$1.5bn of adj. EBITDA – that is more than the current EV of C$1.3bn:

Algoma Steel Group Inc.

Algoma Steel Group Inc.

Steel prices are still holding up at C$1460/ton, however, HRC steel futures indicate that the commodity price is expected to retract to US$900/C$1170 in the upcoming months and settle around those levels for the next few years. This is probably one of the biggest risks the market sees with steel producers in general.

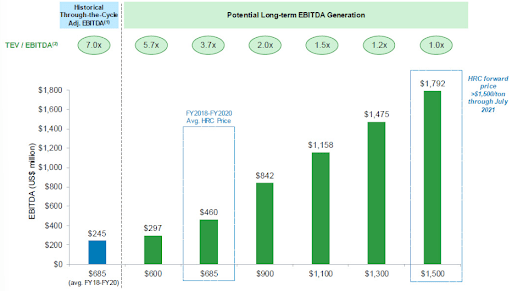

However, the market might be underestimating the future earnings power of ASTL. In a May’21 presentation, ASTL provided its EBITDA estimates at various steel price levels – at US$900/C$1170/ton HRC steel ASTL should be making US$842m/C$1100m of EBITDA annually, or almost the whole of today’s EV in a single year. It is worth noting that the input costs used in this presentation (see below) were not detailed, meanwhile the actual input costs have spiked up materially. So it’s likely that these EBITDA estimates are no longer relevant.

Algoma Steel Group Inc. Investor Presentation, May 2021

In the recent conf. call management noted that input cost pressures are likely to continue. Since the end of Q4 FY22 (March’22), the price of iron ore (one of the major inputs) has been trending down slightly, however, the main risk here is the rise of coal prices. Coal prices are soaring and in the same conf. call management said that ASTL cost sensitivity to coal prices is very material – C$100/ton of coal price increase results in +C$50/ton of costs increase. On a quick glance, since Q4 the coal prices have increased by around C$130/ton on average, so I guess going forward, costs per ton of steel sold can be estimated somewhere around C$1010.

On my quick back-of-the-envelope calculations using 2.3mt production, C$1170/t steel price, and C$1010/t costs, ASTL should still generate around C$350m of EBITDA annually. This should be directionally correct given that in FY21 the realised price/costs spread was C$122/ton and the firm still generated C$200m of adj. EBITDA. Even if the earnings settle at C$300m, that’s still only 4x EBITDA relative to today’s EV. Keep in mind that I’m estimating the input prices to stay consistently elevated, which might be too conservative given that coal futures indicate a price correction of 30% by mid-2023.

One more positive is that the company seems to have a certain price lag for the products it sells (this VIC author says 3-4months), hence, the strong Q1 FY23 guidance (see table above). Assuming that input costs remain stable at current levels, ASTL earnings might remain elevated for one or two quarters even after steel prices continue to tumble.

Comparison with peers

ASTL trades at a discount to its peers – the discount was even higher before the tender announcement:

Company Financial Statements

The large-cap US peers on the right side of the table are obviously less comparable. By the way, the cheapest one of the US peers – MT – has been buying shares aggressively (10% already this year) in the open market.

STLC, on the other hand, is a very similar size Canadian steel manufacturer with an identical cash position and LTM margins. Both stocks seem cheap.

EAF transition

The important difference between them is that ASTL is currently investing in a more advanced steel melting technology – an electric arc furnace (EAF) vs the legacy blast furnace (which STLC also operates with). Full transition is expected in 2024. EAFs use electricity as the main source of energy instead of coke while the main source of input is scrap metal versus iron ore. EAFs are also more efficient and will eventually increase ASTL’s annual raw steel production capacity by 30%, reduce manufacturing costs, and is expected to uplift ASTL’s annual adj. EBITDA by C$150m.

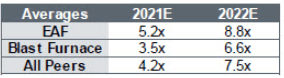

That is why EAF producers generally sport higher multiples versus blast furnace peers. As illustrated below in TEV/EBITDA table from ASTL’s May’21 presentation:

Algoma Steel Group Inc. Investor Presentation, May 2021

The project is expected to cost C$700m. More than half of the investment (C$420m) is/will be financed by very cheap/free government loans. The remaining portion will be funded by ASTL cash.

Summary

In my view, the company remains clearly undervalued despite its ongoing transition. Given this, the ongoing tender is very likely to be undersubscribed and priced at the upper limit, as was the case with peer STLC back in January. As the tender expires on the 27th of July, this set-up potentially offers investors (who are not eligible to Canadian withholding taxes) a short-term 7% upside.

Be the first to comment