Roy Rochlin/Getty Images Entertainment

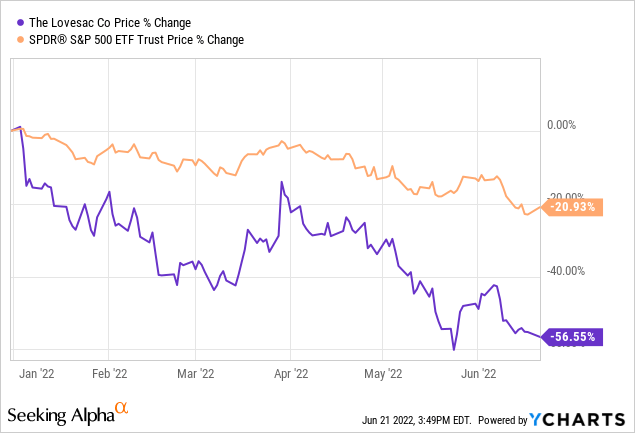

Lovesac (NASDAQ:LOVE) has exhibited strong sales growth and improving margins since it became a public company. Despite the solid financial performance, the firm has lost as much as 55% of its market value year to date, compared to the 22% decline of the broader market.

Although we like Lovesac’s business, we believe that firms, which are selling durable, discretionary products, are likely to face significant headwinds in the near term due to the difficult macroeconomic environment. For this reason, we believe that LOVE is currently not a buy.

In this article, we will take a look at the first quarter financial results of the firm and highlight what we like and what we do not like about Lovesac.

First quarter financial results

In the first quarter, the firm has reported a net sales growth of as much as 56%, which was fueled by growth through all of the company’s distribution channels. Showroom net sales increased by 65.9% year over year, primarily driven by the lower promotional discounting and the expansion of retail locations, including the addition of 31 new showrooms, 13 kiosks and 2 mobile concierges.

The Easter promotional campaign of the firm has also significantly contributed to the sales growth, not only in showrooms but also on the internet. Internet net sales have increased by as much as 24.1%, compared to the prior-year period.

Sales through other channels (including pop-up stores and shop-in-shops) have almost doubled, driven by the success of the online pop-up shop on Costco.com and the opening of 18 new Best Buy shop-in shops.

Although the gross profit of the firm has increased year over year, reaching $66.1 million in the first quarter, the gross margin has declined by 450 basis points. Even though the firm managed to increase its product margin by 160 bps, it was more than offset by the 640 bps increase in the total distribution and related tariff expenses, mainly driven by the higher inbound transportation costs.

Further, the company has managed to reduce both SG&A expenses and marketing expenses (in terms of percent of net sales) compared to the year-ago quarter.

Net income has declined by about 10% compared to the same period in the previous year, which was driven by the $0.7 million recorded provision for income taxes, in contrast with the $0.2 million in the year-ago quarter.

All in all, we believe that LOVE is successfully implementing its growth strategy and as a result rapidly growing its sales through all distribution channels. As the firm is still relatively young, we are not concerned that most of the growth is driven by the opening of new points of sales. We also like that the firm has managed to make its marketing and advertisement campaigns more efficient through improved performance of their media activities.

Valuation

The stock price of LOVE has plummeted in 2022, declining more than 55%. This decrease has definitely made LOVE’s stock more attractive from a valuation point of view, based on a set of traditional price multiples.

The P/E Non-GAAP (‘FWD’) is about 8.9x compared with the consumer discretionary sector median of 10.8x. In terms of EV / EBITDA (‘FWD’) a similar trend can be observed.

On one hand, Lovesac appears undervalued, not only because of the relatively low multiples but also because of the double-digit sales growth it has exhibited during the last quarter, combined with the improving product margins. Also, analysts are expecting the rapid growth to continue in the near term.

On the other hand, despite the optimistic forecasts of the analysts, we are concerned about the demand for Lovesac’s products and therefore about their potential growth in the near term.

Let us take a look now what factors raise concern for us in the near term.

Macroeconomic environment

There are several macroeconomic factors that could create or continue creating headwinds for the firm in the near term. In the first quarter results, we have already seen that increased transportation costs are putting a significant downward pressure on the firm’s margins.

Commodity prices

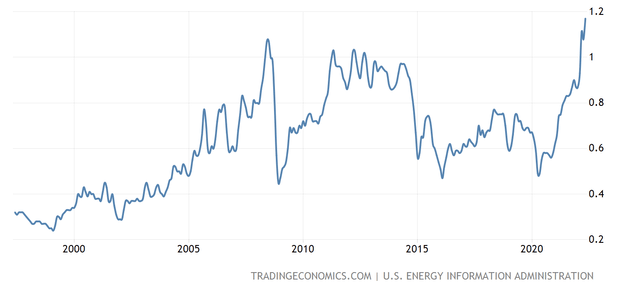

In February 2022, oil and gas prices have skyrocketed as Russia invaded Ukraine. Since then, these prices have remained elevated, putting a substantial upward pressure on gasoline prices and therefore on freight costs.

Gasoline prices (USD/L) (Tradingeconomics.com)

Although there have been several positive pieces of news concerning the increase of oil supplies in the second half of the year, no material effect on oil prices has been seen so far. On the other hand, the gas supplies to several European countries from Russia have been reduced, while there are also supply disruptions of LNG from the U.S. to Europe due to the Freeport LNG plant incident.

For these reasons, Europe’s energy security remains uncertain in the near term, and energy prices and gasoline prices are expected to remain elevated in the near term.

We believe that these high prices will likely to continue having a negative impact on LOVE’s margins and overall financial performance.

Declining consumer confidence

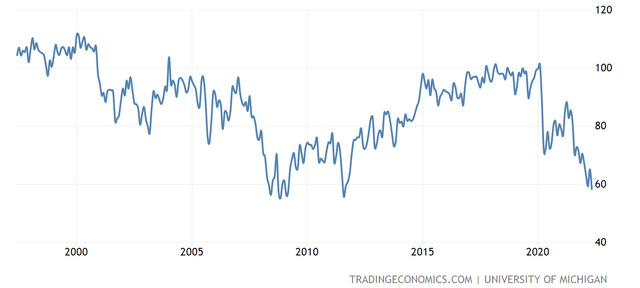

U.S. consumer confidence has been steadily declining in the last few months, reaching its lowest reading in the last 10 years, and even approaching levels seen during the financial crisis of 2008-2009. Although consumer spending has remained high so far, we believe that the low consumer confidence will eventually lead to a change in the spending behavior of the consumer.

U.S. Consumer confidence (Tradingeconomics.com)

In times of low confidence, consumers are likely to delay or completely cut purchases on durable, non-essential items. As Lovesac designs, manufactures and sells furniture, we believe that there is a high likelihood of decreasing demand for the firm’s products in the near term.

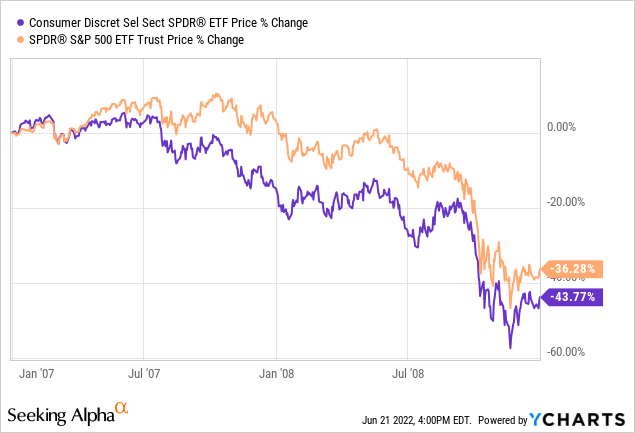

By looking at the performance of the SPDR Consumer Discretionary ETF (XLY), we can see that it has underperformed the broader market (SPY) in the time frame of 2007-2009, by declining almost 60% from peak to trough.

Although LOVE’s share price is significantly down year to date, we believe that due to the near-term uncertainty, there may be further downside ahead.

All in all, we believe that as long as the trends in consumer confidence and energy prices do not change, we do not recommend investing in LOVE’s business.

Increasing number of share outstanding

Since its IPO, Lovesac’s number of shares outstanding has been steadily increasing. Although this is not uncommon for relatively young firms to gain access to capital by issuing shares, the dilution usually leads to the erosion of shareholder value. Especially in times of high volatility, we prefer to invest in businesses which have solid share repurchase programs and create value for shareholders by buying back shares.

Key takeaways

The company saw strong double-digit sales growth in the first quarter, fueled by growing sales across all channels.

Despite the improving product margin, increasing inbound transportation costs have resulted in a 450bps decline in the gross margin.

Although the valuation of LOVE appears attractive based on a set of traditional price multiples after the recent sell-off, we believe that due to the current macroeconomic headwinds, including low consumer confidence and elevated energy prices, LOVE’s stock is not currently a buy.

Be the first to comment