Lilas Gh/iStock via Getty Images

Bassett (NASDAQ:BSET) reported Q1 [ended February] which significantly exceeded Street as well as our expectations. On 15.9% revenue growth, the company reported +43% EPS growth to $0.57 [versus $0.40] which was materially above Street consensus of $0.36 [one analyst]. Recently, the company has sold all of the assets of the Zenith Freight Lines, a wholly-owned subsidiary of Bassett, to J.B. Hunt Transport Services, for $87 million which tells us that Bassett is back to being a pure play furniture manufacturer, wholesaler and retailer. The company will have $10.20 per share in net cash after taking into account the proceeds from the sale of Zenith and the special dividend [$1.50 per share]. This cash balance currently represents an impressive 61% of the stock price.

While BSET’s stock’s total return is approximately +55% since our initial Seeking Alpha recommendation [much ahead of the Russell 2000 index] in September 2020, the stock is nonetheless down nearly 50% from its highs of last year. There are numerous positives for the stock, but also some significant concerns, which makes it a tricky cyclical company to analyze when the economic and interest rate outlook is uncertain.

On balance, we still believe the stock is undervalued, and positive drivers for furniture demand include some permanent WFH [work from home] effect even post Covid, people migrating out of large cities and high tax states for numerous reasons, the Millennial generation buying houses, still low interest rates in a historical context, etc. A strong housing market and record price increases would tend to validate our positive housing thesis, in our opinion. But concerns are weighing on all cyclical stocks, including rising interest rates and inflation, recessionary risks, US consumers spending being impacted by inflation, and rising house prices possibly crowding out furniture budgets, etc.

Given BSET’s huge net cash position and low valuation levels, we think the downside risk is mitigated, and overall risk-reward is still favorable.

1Q results: Strong backlog, solid revenue and EPS growth

Bassett reported revenue of $117.9 million which exceeded the expectations [Street at $109.7] of the market even with ongoing supply chain constraints. In addition, the sale of its Zenith Freight Lines for $87mn [~$65mn after tax], will further boost net cash to $10.20 [after adjusting for the special dividend]. The net sales for this quarter were up 16% YoY while incoming orders fell 6.8% from the pandemic-related increase in 1Q21, although orders were still up more than 25% from pre-pandemic levels. The wholesale backlog increased by 16% YoY to $78.1 million. Furthermore, wholesale shipments grew 19% and operating income of $6.5 million was 16% more than the previous year.

Diluted earnings per share of $0.44 compared to $0.37 for last year represented a 19% increase and earnings per share stands at $0.57 which includes $0.13 per share from Zenith Logistics which is now part of income from discontinued operation. Due to rising raw material and inbound freight costs, the gross margin decreased by 380 basis points [from 52.5% to 48.7%]. This inability to keep pace with the incessant inflationary pressures cost between 150 to 200 basis points in consolidated operating margins for the quarter. The most significant factor was rising material costs in the company’s upholstery operations, as nearly every raw material used in the production of a sofa, chair, or sectional has increased in price over the last eighteen months. Recognizing this, the company has raised the wholesale price for the sixth time in 15 months. On the other hand, corporate retail profits tripled to $3.4 million in the period as higher gross margins in segment and leverage from delivering order backlog combined to produce better results. Additionally, Bassett’s wholesale backlog increased to $78.1 million as compared to the $67.5 million of 1Q21. As the company looks to 2023, they expect the backlog to come down in upcoming months as raw material supplies get streamlined.

Supply chain issues still continued to impact the company in the quarter, but we believe that this is only temporary as Bassett looks to fulfil its record backlogs. Once Covid-19 eases globally, which it already has started to, these supply chain issues will greatly deteriorate and cease to be a risk for Bassett.

Sale of Zenith assets to increase net cash

Bassett has also announced the sale of its Zenith Freight Line business to a subsidiary of JB Hunt Transport Services for $87mn. Net of taxes, Bassett expects to net approximately $65mn in cash from this sale. This will take net cash per share of Bassett up to a huge $10.20 after adjusting for a special dividend, which is 61% of the stock price. Currently, the board has announced a special dividend, regular dividend and an increase in share repurchase authorization.

12.2% dividend yield in 2022, huge special dividend

The Board of Directors has declared a Special Dividend of $1.50 per share of common stock to shareholders of record at the close of business on March 23, 2022. Including the regular annual dividend of $0.56 per share, the full-year 2022 dividend [regular plus special] is now $2.06, for a huge 12.2% dividend yield. This is the second Special Dividend paid by BSET during the past three years – please see the following chart. Investors should note that BSET will still have $10.20 in net cash per share even after the special payout a few days back.

Bloomberg

The company has also increased share repurchase authorization to $40 million [25% of the current market cap]. The Special Dividend and share repurchases will give Bassett flexibility regarding discipline capital allocation. Rob Spilman, Chairman and CEO said, “Although we are in uncertain times with increased fuel costs, rampant inflation, and the war in Ukraine, the housing market and home furnishings demand remain relatively strong. We will use our operating cash flow and our balance sheet to more aggressively invest in our business. Meanwhile, we will continue to be opportunistic with share repurchases while continuing to evaluate our capital allocation strategy.”

BSET has dropped from $35.00 to $16.00

BSET has dropped over 50% in the last year, largely due to Covid-19-induced supply chain issues. Since these supply chain and logistical concerns are temporary, we feel that Bassett will rebound from these lows. Asia’s shipping ports and ocean vessel containers are opening up and this is a good sign that exports are picking up. We strongly believe that at around $16.00, Bassett is a buying opportunity given the favorable outlook ahead for this company. The company has been having record backlogs for their wholesale division and soon these backlog orders will be fulfilled.

Key downside risks

Rising Interest Rates: According to the Mortgage Bankers Association’s seasonally adjusted index, total mortgage application volume declined further 6% last week compared to the prior week. If borrowing rates continue to rise, we may see a further drop in home purchases which is not good news for furniture companies.

Increasing Inflation: A commodity trading business, as we all know, has a higher correlation with market inflation. Increasing raw material prices put downward pressure on the company’s margins, as it did in the previous quarter. However, this is not the sole effect of inflation on the commodity market. Another effect is a reduction in consumer consumption. US personal consumption expenditures (PCE) surged 6.4% in February over the past year, the Commerce Department reported. This increasing inflation is not a favorable scenario for Bassett.

Recession: Many economists believe the United States will enter a recession next year as the Federal Reserve raises interest rates to combat rising inflation. If this turns out to be the case, consumers will stop purchasing high-priced furniture.

Real estate market: Housing boom continues

The U.S. has seen a record housing market with residential homes seeing an unprecedented surge in demand. Currently, the demand for houses is outstripping supply, with 30-year fixed mortgage rates still hovering around 4.9%. Lower inventory on the market has led to increased prices, but still demand remains resilient. The strong job market and rapid wage growth is supporting housing demand despite the increasing rates and appreciation in home prices, but purchasing activity is being restrained by insufficient for-sale inventory.

The U.S. housing market has been on an upward trend due to millennials starting families, remote workers looking to relocate, and the prospect of rising mortgage rates fueling a buying frenzy before it becomes even more costly to borrow.

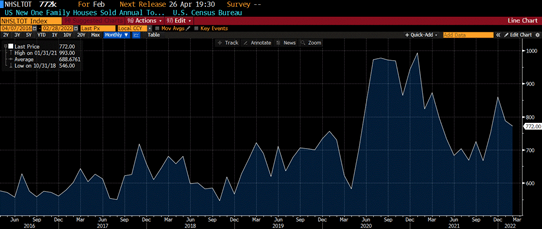

Bloomberg

The NHSLTOT Index which is computed by taking the number of houses sold in the US and dividing it by the seasonally adjusted number of houses sold in the USA. The graph illustrates that housing demand is still high, and it is too early to claim that the housing market has hit a saturation point.

Valuations and price target

This company has been building their cash on the balance sheet at a rapid pace. Even factoring in recent uncertainties regarding rising interest rates, slowing consumer spending, and overall inflationary pressures, the stock appears to us to be just too cheap. Adjusted for the large net cash balance of $10.20 per share, the operating business is trading at just $6.60 per share, or a 3.3x ex-cash P/E on our forward $2.00 EPS estimate [after deducting after-tax interest expense].

Our target price remains unchanged for Bassett at $28.50, representing 70% upside from the current market price. We reached this price target by taking a conservative P/E multiple of 14.6x. Because of the downside risks, we are not adding back net cash and are keeping our target price conservative.

Conclusion

Bassett still looks incredibly cheap. The company is trading at an ex-cash P/E of ~3.3x [8.37x normal P/E] which makes it very undervalued and a great buying opportunity. The stock has dropped as a result of the belief that home purchases are declining; however, we still believe the stock is undervalued, and positive drivers for furniture demand include some permanent WFH [work from home] effect even post Covid, people migrating out of large cities and high tax states for numerous reasons, the Millennial generation buying houses, still low interest rates in a historical context, etc. Given BSET’s huge net cash position and low valuation levels, we think the downside risk is mitigated, and overall risk-reward is still favorable. Even though the stock price has gone down, Bassett still looks inexpensive from every angle and is still attractive to buy given the attractive macro environment that is still present. Because of the downside risks, we are not adding back net cash and are keeping our target price conservative. As a result of this, we believe the stock has 70% upside from the current market price.

Be the first to comment