Phynart Studio/E+ via Getty Images

Investment Thesis

Algoma Steel (NASDAQ:ASTL) is a steel producer. Given the solid steel prices at present, this led Algoma to print a significant amount of free cash flow.

Furthermore, together with its Q1 2023 outlook for another resounding period ahead, this has allowed Algoma, a debt-free steel company to announce a large repurchase of its shares.

Algoma is expected to buy back approximately a third of its market cap within 30 days.

I rate this stock a buy.

Algoma Steel’s Near-Term Prospects

Algoma Steel is an integrated primary steel producer. It is a producer of hot and cold rolled steel sheet and plate products.

Being a commodity company, the macro aspects that affected Algoma have been the same as the elements we’ve heard from its peers.

Factors such as logistical supply chain constraints and COVID-related challenges have impacted its Q4 2022 results, leading to shipping volumes being down sequentially by 1% from Q3 2022 and 12% y/y.

That being said, given the strong pricing environment experienced in the quarter, despite working off lower shipping volumes, Algoma’s revenues were still up 50% y/y.

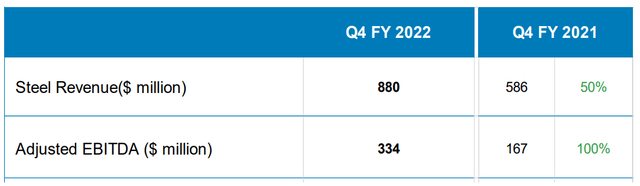

Algoma Q4 2022 presentation

Being a steel producer, with very high fixed costs, ultimately leads to very high operating leverage. Accordingly, small changes in its revenue line have pronounced implications on its EBITDA line.

Indeed, as you can see above, Algoma’s EBITDA line soared by 100% y/y. Not bad for a commodity company. Note that the figures in the table are in Canadian dollars.

Moreover, from a free cash flow perspective, Algoma’s free cash flow jumped from CAD 112 million last year to CAD 351 million in the current quarter.

For a business that’s valued at approximately $1 billion, for it to make approximately $272 million (in USD) of free cash flow in a 90-day period implies that the business must be seriously undervalued.

Next, we’ll talk about Algoma’s balance sheet.

Strong Financial Footing

Algoma has approximately CAD 915 million of cash equivalents on its balance sheet. Furthermore, back in Q4 2021, Algoma paid down CAD 358 million of outstanding senior secured long-term debt.

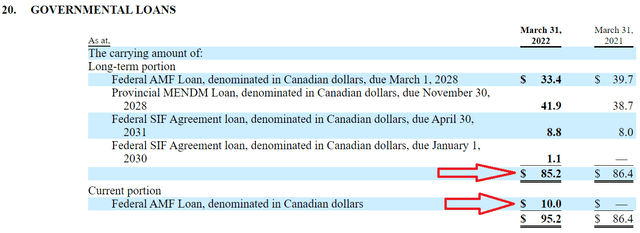

This implies that Algoma has approximately CAD 85 million worth of government loans outstanding.

Algoma SEC filing

Of the CAD 85 million of government loans outstanding, a very small payment will be made over the next twelve months of CAD 10 million. But these loans carry rates of approximately 2.5% and are not getting in the way of its balance sheet. These are operational government loans.

In sum, Algoma’s balance sheet has a net cash position of approximately $915 million, leaving this free cash flow generating business in a very strong position to launch its massive share repurchase program.

Capital Allocation Policy: Bull Case

Algoma will launch at the end of June a Substantial Issuer Bid (“SIB“). This is where Algoma will have a “modified Dutch auction” that looks to repurchase as many shares as possible.

The way this works is that Algoma will, over a short period of time, notify the market of its intention to repurchase shares. Shareholders then look to tender or hand over their shares at a small premium to the trading price.

Algoma goes through all the tenders, starting at the lowest price, and moves up the pricing ladder until it has exhausted its total decided capital allocation.

In this case, Algoma will look to repurchase $400 million worth of shares. And to do so at the smallest premium possible. The pricing range of the SIB, or share repurchase program, will be announced at the end of June.

ASTL Stock Valuation – Very Cheaply Priced

Looking ahead to the current quarter, Algoma believes its EBITDA could be CAD 345 or approximately $245 million (in USD).

If we assume roughly similar EBITDA to free cash flow generation as we saw in Q4 2022, this could see Algoma reporting approximately $260 million of free cash flow (in USD).

Consequently, assuming that steel prices didn’t compress significantly, we could see Algoma reporting slightly more than $800 million of free cash flow in 2022.

This would put the stock priced at approximately 1.5x free cash flow.

Premortem: Investment Risks

Steel prices are extremely volatile and tied to global economic growth.

With higher interest rates now on the cards, this leads to the economy slowing down, which in turn leads to steel prices coming down, as a surplus emerges.

If steel prices rapidly fall and stay depressed, repurchasing a large portion of Algoma’s shares could in hindsight turn out to have been made at the top of the cycle.

The Bottom Line

My bull case is focused on the $400 million share repurchase program. I’ve afforded no consideration to Algoma’s 2% dividend yield or its Normal Course Issuer Bid, where Algoma could actually repurchase approximately 5% of its shares over the coming year.

However, clearly, those two capital allocation policies are also meaningful.

If one believes that steel prices remain relatively flat at current prices over the next twelve months, investors holding onto the stock will see Algoma’s EPS figures soar over the coming year.

With that in mind, I believe that paying approximately 1.5x free cash flows makes tremendous sense.

Be the first to comment