herraez/iStock via Getty Images

Investment Thesis

Alcoa (NYSE:AA) has seen its share price sell-off of late, together with aluminum prices. The fear is that there is an overabundance of aluminum inventory together with a slowing economy.

Then compounding issues, Alcoa’s Q1 2022 EBITDA was a very working capital intensive quarter, making its free cash flow look bad relative to its EBITDA profile.

Still, putting aside the large increase in working capital Alcoa had last quarter, we are looking at a business that is becoming increasingly profitable and highly cash flow generative.

For now, analysts are still extremely gloomy about Alcoa. However, I contend that there’s a structural imbalance between the amount of supply in the market and demand.

This is going to lead to Alcoa delivering a very attractive return over the next twelve months.

Near-Term Prospects for Alcoa

Alcoa produces alumina, and aluminum products in the United States, and internationally.

Aluminum is used in nearly all manufacturing processes. From aerospace to automotive, including EVs, ships, high-speed trains, household appliances, smartphones, electrical wiring, etc.

Aluminum is a much needed basic material. We simply can’t move economies forward without this light metal.

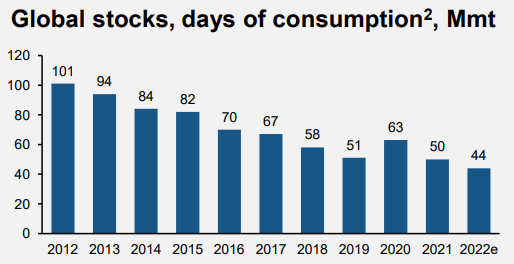

AA Q1 2022 presentation

What you can see above is an undeniable trend over the past decade. The amount of inventory days continues moving down over time. There was a temporary reversal in 2020, when the world hit pause.

But since then demand for aluminum has increased, as all the elements that were underway reverted back.

More recently, there have been Chinese lockdowns that have substantially impaired very near-term demand and added to supply disruption issues. Also, automotive demand has been reportedly weak of late.

And to be absolutely clear, it’s not that there is little consumer demand for automotive, it’s simply that the industry has had issues with getting ships supplied.

However, arguably most pertinent of all, lately there has been news that China is looking to increase its aluminum output. China saw its primary aluminum output increase by 10.9% y/y to 6.5 million tonnes in the month of April.

On the other hand, it’s thought that with Europe’s energy crisis, it makes it uneconomic to continue manufacturing aluminum. Consequently, a lot the Chinese production is being sent to Europe.

This is the main bearish thesis that readers need to be mindful about.

Simply put, there’s a few macro tailwinds and one macro headwind to be found in this investment, China’s aluminum production.

This is the big unknown. How much aluminum will China produce over the coming year?

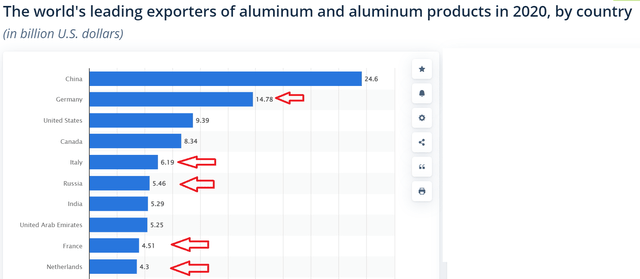

And will that be anywhere near enough to match demand? Other countries export aluminum, but by some distance. The biggest contributor to the equation is China. That’s where the focus on the bearish argument lies.

Meanwhile, on the other side of the equation, you have European countries that have also typically been large exporters. And of course, you also have Russia that has historically been a meaningful exporter of aluminum.

Russia doesn’t have clear export sanctions of aluminum. What is in place is its SWIFT international payments system blocked, making it difficult to pay for aluminum products from Russia.

Then, you have the other red arrows in the graphic above. Those are European peers. For those European peers, you have a massive increase in energy costs, that totally squeeze aluminum’s profit margins. This makes it less economical to manufacture and export aluminum – these dynamics have been addressed above.

Consequently, altogether, this combines in aluminum prices finding some support.

Again, I’m not declaring that there is to be a rapid squeeze on the market. Instead, what I’m more looking towards is a steady and stable price increase for aluminum that with time will continue to move higher with time.

Not immediately, but slowly, as inventories continue to dwindle. Furthermore, keep in mind that it takes 3 or 4 years to get substantial further supply back into the market. After all, you’ll have to get financing to build a plant, get permits, hire engineers, this all takes time.

The point to drive home here is that time is your friend. We all want to get paid, but it’s important to understand that we’re investing in a strong aluminum company that’s positioned in a country of relatively cheaper energy input costs. This makes Alcoa have a low-cost advantage relative to other Western countries.

To this point, during a recent conference call, Alcoa’s management said,

[…] when you think about the risks to supply, because Russia is such an important producer of aluminum; when you think about the fact that energy prices in Europe are exorbitantly high and are affecting already production in Europe, to me the risks are weighted towards not being able to have enough supply and to have a continue drawdown in inventories.

Hence, this comment echoes everything that I have discussed.

Balance Sheet Discussed

Alcoa’s balance sheet is very strong right now. That’s why I’m interested in investing in this commodity company.

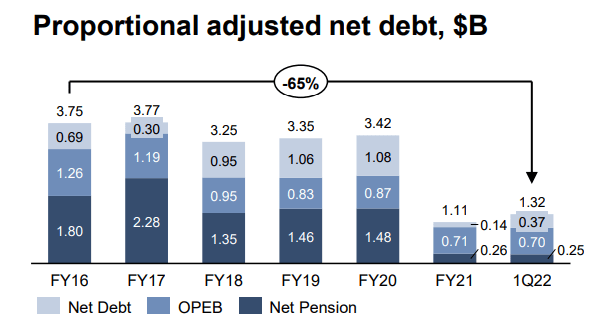

AA Q1 2022 presentation

As it stands right now, Alcoa has $1.3 billion of proportional net debt. For a business that is expected to generate more than $3.5 to $4 billion of EBITDA in 2022, you can see that its balance sheet is clearly not a problem.

I’ll address its potential profits in a moment, but before that, I want to discuss Alcoa’s debt stack.

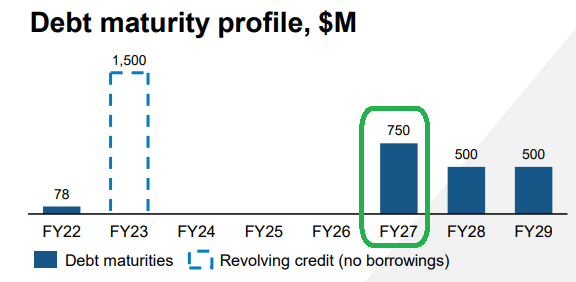

AA Q1 2022 presentation

As you can see above, Alcoa has no debt maturities until 2027. It has revolver, but no borrowings against it. Hence, for all intents, the business is in a very strong fiscal position.

This will allow Alcoa to ramp up its capital allocation strategy.

Capital Allocation Policy Discussed

On the one hand, one aspect that has been very frustrating about Alcoa has been its unclear capital return program. Management has talked about being opportunistic in investing for growth versus returning capital to shareholders.

I believe that if Alcoa comes out with a clear policy of its capital allocation strategy, the stock would be better rewarded.

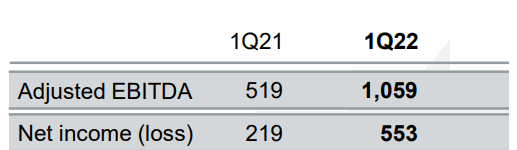

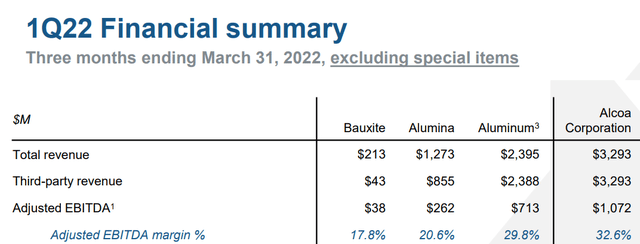

AA Q1 2022 earnings

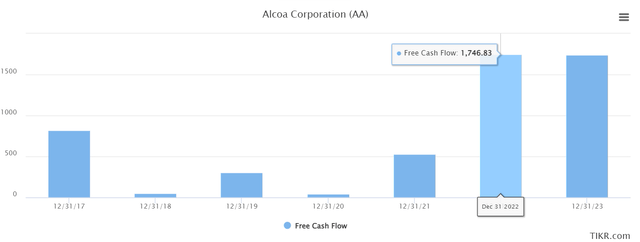

On the other hand, I believe that the context that got us here will continue to improve. Now, allow me add a qualifier. During Q1 2022, Alcoa’s free cash flow was not strong, given that it had a strong use of working capital.

During the earnings call, management said,

[…]we’re being conservative on the buybacks in the first quarter as we saw the working capital build during the first quarter.

And just to be clear, the working capital build was not a surprise to us, right? We typically see a working capital build in the first quarter. In this particular case, it was accentuated by the fact that pricing is as high as it was. So, as we build working capital in the first quarter, we were tempering the returns to shareholders in the first quarter.

With all this in mind, I believe that Alcoa could generate around $3.5 to $4 billion of EBITDA in 2022.

In fact, we already know that Q1 2022 saw Alcoa report $1 billion of EBITDA. We also heard on the recent call that Alcoa will make less EBITDA in Q2 than it was in Q1. Perhaps Alcoa makes approximately $800 million of EBITDA. This would bring the first half of 2022 to $1.8 billion.

If we assume that the second half of 2022 largely mirrors the first half, we could see around $3.5 billion to $4 billion of EBITDA in 2022.

How much of that will ultimately drop to free cash flow? I don’t know.

For now, the consensus points towards $1.7 billion of free cash flow in 2022. However, if the figure turns out to be slightly lighter and ends up being close to $1.5 billion of free cash flow, I still believe this is a very material amount of free cash flow.

AA Stock Valuation – Priced at 6x Free Cash Flow

If we estimate that Alcoa makes around $1.5 billion of free cash flow this year, this means that the business is priced at 6x free cash flow.

As you’ve read, my thesis has less to do with Alcoa ramping up production, but simply that with high inflation, costs increase across the board for all aluminum manufacturers. The first to affected will be the businesses with the weakest margins.

As you can see above, Alcoa has very high margins, giving the business plenty of staying power throughout the cycle.

Meanwhile, as aluminum prices start to move slowly higher, this will lead to Alcoa’s margins returning higher, leading to strong returns on invested capital.

The Bottom Line

Alcoa is very far from an exciting story. Alcoa sells aluminum products. However, I make the case that there’s a structural imbalance in aluminum around the world that is going to tighten over the coming months.

You have European peers that are struggling with high energy prices, while Alcoa’s US-based fully integrated facilities have a cost-differential advantage. This will allow Alcoa to have a competitive advantage against Western peers.

Also, even though I have no idea of how much excess inventory China ultimately exports, keep in mind that China has sought to cap its aluminum production as it looks to hit its decarbonization targets.

In sum, I believe that at around 8x this year’s free cash flows, Alcoa is attractively priced.

Be the first to comment