jetcityimage

Investment Thesis

Snap-on (NYSE:SNA) is a consistent compounder. The company steadily grows its revenue and improves its profitability. It pays out a reliable dividend that compounds at a high rate. I also believe that tailwinds in the vehicle repair market reduce the risk of this investment. The company has high demand and a very conservative balance sheet.

The company has modest long-term revenue growth. It is a somewhat unambitious investment. But I think that the risk to reward is favorable. This may be a good addition to a defensive dividend growth portfolio.

A Steady Growth Outlook

Snap-on is a steady growth story. The company has increased its EBIT at a 9% CAGR over the past ten years. This isn’t an extremely high growth rate, but the business’s consistency is impressive.

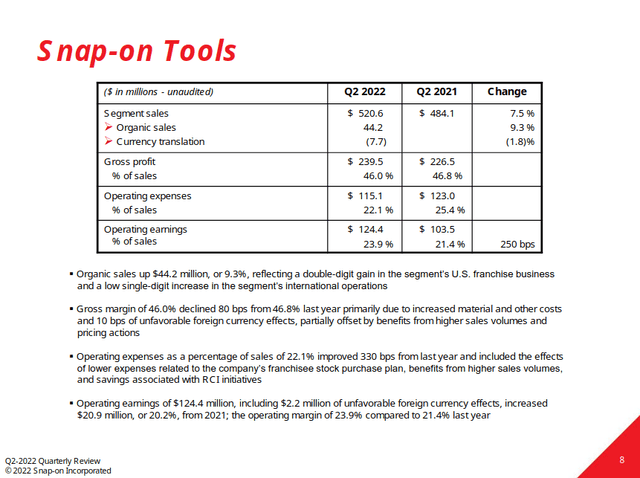

The company is most exposed to the automotive market. The business calls its vehicle service and repair tools segment the Snap-on Tools Group. It generates 46% of Snap-on’s revenue and over half of its operating profit. The segment reported 9.3% organic growth year over year and it is up 28% over 2019 levels. This is strong growth, and I believe it’s likely to continue.

Snap-on Q2 Quarterly Financial Review

I believe that the fundamentals for the auto repair market are strong. Ongoing chip shortages continue to drag on new car supplies. These shortages will likely continue through 2023. At the same time, prices of used cars are soaring.

One of the greatest risks to the company is a decline in the vehicle repair market. But I think that there are long-term tailwinds to this market. Cars are usually a nondiscretionary expense. Consumers looking to save will usually choose to repair an existing car before buying a new one. At the same time, the average age of US cars is increasing. For these reasons, I believe that this segment will be more resilient if consumer spending pulls back.

Snap-on’s other segments also have high exposure to the professional and industrial markets. This should make the company more resistant to consumer spending headwinds. The business’s customers include government, aerospace, transportation, and vehicle repair. The company’s top line has been cyclical in the past, but I believe that there is a smaller risk of downside right now.

High Demand And Solid Profitability

Snap-on’s profitability is also promising. The company reports consistent gross margins above 50%. It has a solid EBIT margin of 28%, up almost 10 percentage points over the past decade. This is strong compared to a lot of other tool companies. I will point out how Snap-on sells its products through its franchised mobile van channel. This model guarantees the business an ongoing fee. It also reduces some risks related to expansion. This boosts Snap-on’s margins and adds flexibility to its cost structure.

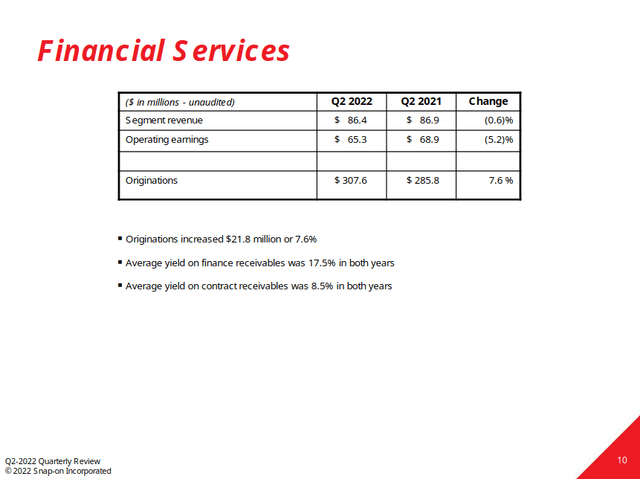

Snap-on Q2 Quarterly Financial Review

The company’s financial services segment has also helped boost profitability. This segment finances the purchases and leases of the business’s products. It has grown at a five-year CAGR of 35% and generates high margins. I like how management has found ways to further boost its profit.

I’m impressed that Snap-on has maintained these margins even as industry headwinds increase. Commodity inflation has been a major issue for many industrial companies. But Snap-on has held its gross margins and reduced its operating expenditures year over year. On their last earnings call, management was asked about the balance between volume and price increases.

Looking at our factories, we know we have products in demand. There is rolling off there and our guys are up to their eyeballs in demand. So we know that’s a positive situation. The other thing is it’s hard, because you know we have list prices. But the list prices don’t — are very from product to product and they come out on an average, you might say your raising sales 3.5% or something like that but products…

So it’s hard for us to say. I would say the minority of the increases in pricing and the majority is in volume for us. We think that’s the situation in this situation in our environment. Now, that varies from Group to Group and so on.

The positive demand outlook should also reduce the risk of product liquidations. Across consumer markets, companies are having to liquidate excess inventory. This hurts gross margins and can significantly reduce profitability. But Snap-on is reporting that its inventory turns are above prepandemic levels. This further reduces the risk of a severe drawdown.

Good Returns At A Reasonable Valuation

Snap-on is trading at a reasonable valuation. The company has a forward P/E of 12.5 times and a forward EV/EBITDA of 9 times. It is effective at reinvesting its capital, generating an ROIC of 13.5%. The business has a very conservative balance sheet with no nonoperating debt.

The company has a strong track record of returning cash to shareholders. The company pays out a regular dividend yielding 2.7%. This is well covered by the business’s free cash flow. The dividend has grown very quickly, compounding at a 15% CAGR over the last 10 years. At a forward payout ratio of under 35%, I think that the dividend has room to grow.

In addition to this dividend, the company also has a solid share repurchase plan. The business usually repurchases about 1% to 3% of its shares each year. Management is conservative with their cash management. Almost all of these returns are covered by free cash flow alone.

The company doesn’t have very high long-term revenue growth. The company’s ten-year top line CAGR of 4.5% is low. But I believe that the favorable price and balance sheet make up for this. Overall, I think that this is a reasonable valuation for a company with this profile.

Final Verdict

Overall, I think that Snap-on has an impressive financial profile. I believe that the risk to reward of this investment is favorable. The company’s slower top-line growth makes this a less ambitious investment. But I think that this is a good dividend growth stock for a more defensive portfolio.

Be the first to comment