Artyom_Anikeev

Airbus SE (OTCPK:EADSF, OTCPK:EADSY) is delivering aircraft to customers at a higher rate than competitor The Boeing Company (BA). Boeing is on the way back, but expectations for its delivery volumes have been higher given the hundreds of aircraft it has prepared and that require only minor completion work. It is also facing challenges stabilizing its production rate at 31 aircraft per month. While Airbus is aiming to increase production to as many as 75 aircraft per month for its popular Airbus A320neo family, the European jet maker is facing significant challenges delivering aircraft in line with its production rate. Moreover, Airbus is actually pushing supplier shipments from 2022 into 2023, suggesting that there is a mismatch between the communicated production rate and the actual production rate.

That is where Airbus and Boeing face a challenge. Due to staff shortages as well as pressure on materials supply, it is difficult to increase and sustain production rates. For quite some time, I have pointed out that the delivery target that Airbus is aiming for might not be realistic. With several weeks remaining in 2022, I revisit the topic to see how realistic it is to assume the delivery target will be reached.

Delivery Target Has Been Lowered

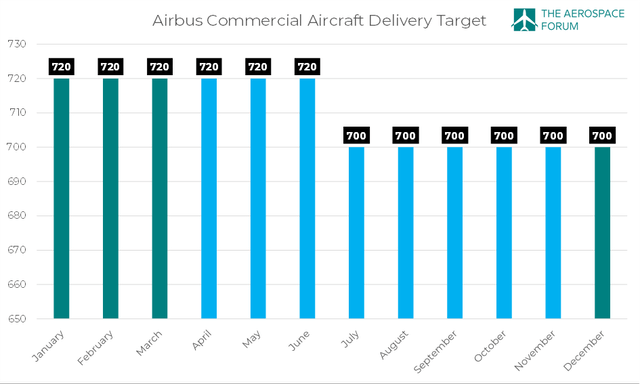

Airbus commercial aircraft delivery target (The Aerospace Forum)

In the order and delivery report for April, I already noted that delivery numbers were under pressure, as Airbus A320neo deliveries were below targeted production levels. A month later, delivery numbers had not ticked up to satisfactory levels and I expressed doubt that the delivery numbers would be met:

Doubting Airbus’s ability to meet its delivery target has proven to be a dangerous thing to do in the past years as the jet maker always seemed to reach its target somehow, but at this point, I have significant doubts about the company’s ability to reach its delivery target.

In the months after that, I continued expressing my expectation that Airbus would lower its delivery target, and that has happened. In its Q2 2022 earnings, the European jet maker lowered its delivery target from 720 jets to around 700. While the delivery target was lowered, my doubts on the ability to meet that target continued, as the cut to the target was less than I expected while the monthly numbers were also not indicative of a strong recovery or surge in deliveries.

The figure with the communicated delivery targets shows that my doubts on the delivery target were correct. In blue, I have also marked the months in which I expressed doubts on the delivery target being achievable. That was driven by our data insights, which at no point indicated that Airbus would be able to achieve its delivery target.

Airbus Needs Year-End Delivery Surge

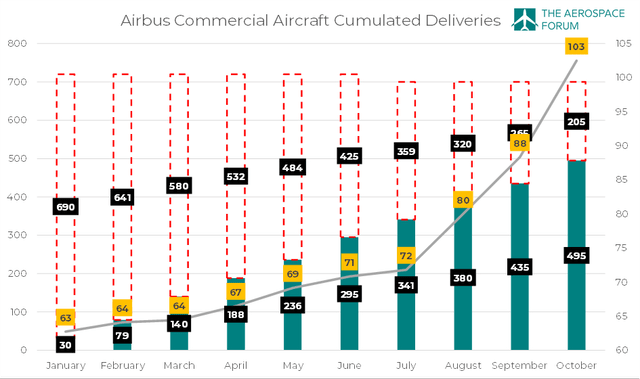

Cumulated deliveries Airbus commercial aircraft (The Aerospace Forum)

What can be seen is the cumulated deliveries in green, which until the end of October stood at 495 aircraft. The dotted number marks the remaining deliveries, while the grey line indicates the average monthly deliveries required to reach the delivery target. What can be seen is that the average monthly deliveries required has been increasing each month this year. This means that there has been no moment this year that on a linearized basis Airbus was aligned with the delivery target.

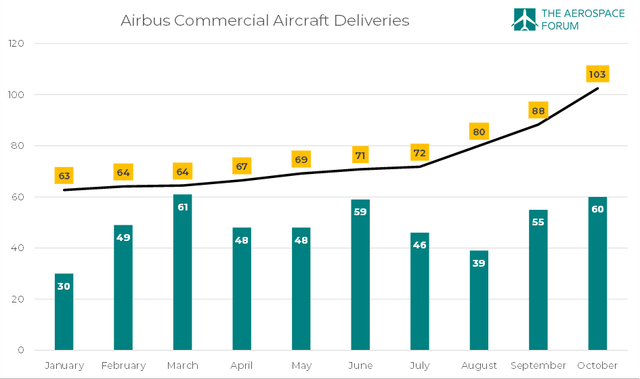

Monthly Airbus aircraft deliveries (The Aerospace Forum)

We can better visualize how challenging meeting the delivery target is by plotting the monthly deliveries against the average deliveries required per month for the remainder of the year. We see that, especially coming out of the summer, that the delivery target has started looking less and less likely even though the delivery target was reduces in July from 720 units to 700 units. There has been no month in which the required delivery numbers exceeded the average required. The highest delivery number during the first 10 months of the year was 61 aircraft, while the lowest average number of deliveries required was 63 aircraft. Throughout the year, we see that each quarter from start to end there was an increase in the delivery numbers, only to fall back in the first month of the subsequent quarter. That is the nature of deliveries in a constrained supply chain space where jet makers still try to bolster the quarterly results.

October showed a positive divergence of that trend, as the first month of Q4 started with delivery numbers exceeding that of the preceding month.

Airbus: A Master Of Year-End Deliveries

With a positive note on the October 2022 deliveries, the question starts boiling whether Airbus can make its delivery target after all. I’ve been following orders and deliveries for years, and what can be said for Airbus is that they have some end-of-year magic that usually enables them to meet the year-end target. Just extrapolating the ramp up from September towards year-end suggests the target will be missed by approximately 70 units, but that is not the way I want to look at it.

I actually want to look at it in several other ways. The first one is using the unofficial data on deliveries we have for November. Using past data, we come up with an estimate for November, and for December deliveries we will utilize two methods. The other way will be to use estimates for November and December combined based on past performance for those months.

Now, one thing should be noted, and that is the obvious point that we won’t know what the full-0year figures look like until Airbus releases the numbers for December. However, using this approach I want to look at what I think Airbus can achieve based on insights and analytics of data.

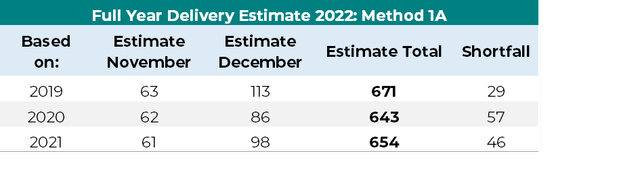

So, we are already 24 days into November at the time of writing, and in those 24 days 40 aircraft have been delivered. Using the delivery patterns from preceding years, this would indicate 61 to 63 deliveries. In this first method, which I will call 1A, the estimated December deliveries are calculated using the ratio of December deliveries in previous years and deliveries in November. This would give us between 655 and 675 deliveries, missing the target of 700 deliveries.

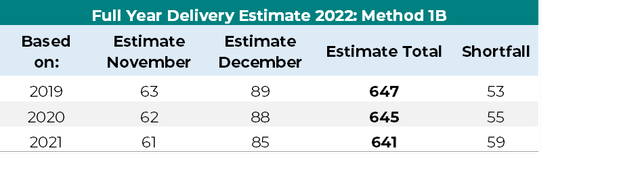

In the second method, called 1B, the December estimate is calculated using the share of deliveries of December deliveries in previous years measured against total deliveries. Using this method, we would get to 640-650 deliveries, missing the target by 50 to 60 aircraft.

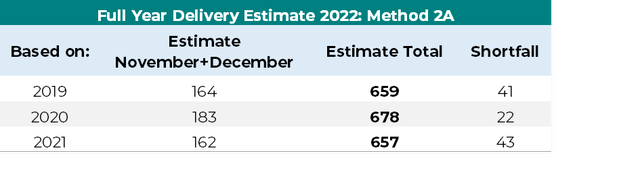

The method called 2A uses the November and December deliveries as a fraction of the total deliveries to estimate full year deliveries. What we see is that, in this case, the shortfall would be 22 units at the lowest point and 43 at the highest point.

Conclusion: Airbus Can Still Reach The Delivery Target

Really looking at the data, one would say there is no way that Airbus can reach its target. I still deem it more likely that the delivery numbers will end up around 650 on the low side – which has been my expectation for most of the year – and 675-685 on the high side.

That is not to say that Airbus will miss the target. The company has a history of reaching targets that did not seem achievable. If the company cannot physically hand over aircraft to customers, it could elect to contractually deliver aircraft and meet the target. However, there also is the chance that the company will reach the target because past data is not a guarantee for future or current performance. For instance, in Method 2A using the 2020 numbers, Airbus would get quite close. In 2020, the late-year push was driven by Airbus enforcing the purchase agreement amid a pandemic.

If you look at what Airbus needs, then realistically Airbus needs pre-pandemic delivery numbers to reach the target. The company has guided for around 700 aircraft which is a vague thing to do. Overall, should Airbus miss the target, it should not come as a surprise. I would consider it an extremely positive surprise if they achieve anything above 685.

Be the first to comment