Justin Sullivan

I don’t know if there are more loyal shareholders out there than those of AT&T (NYSE:T). You’d think a company of this caliber would take it easier on them. After a shocking Q2 report that showed projected cash flows being slashed by $2 billion to a Q3 report that showed promising growth and excellent debt reduction, I don’t blame shareholders for being confused. Many of said loyal shareholders rely on the dividend for income, and that being at risk can’t be fun for any of them. Let’s dive into the dividend and where it could be headed.

How Is That Dividend?

It’s secure. Which is what you want to hear. Currently paying out $1.12 per share annually, it is well covered (55%) by earnings. On current pricing, this works out to about a 5.8% yield, which is pretty good compared to the general market. AT&T is so heavily owned by the general public and institutions (dividend funds) and that’s both good and bad. On one hand, so many shareholders are likely deep in the red and will just continue to hold for the dividend to help fund their current lifestyle. On the other, they could get fed up with what’s been happening and look to move their money elsewhere in a market like we are in right now. While I think it’s more likely the first scenario plays out, anything is possible.

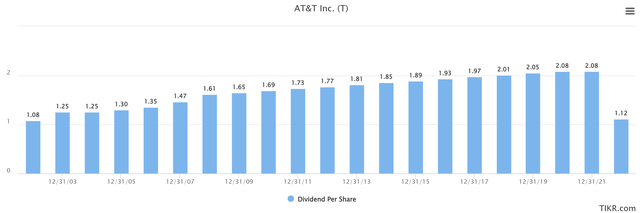

AT&T does have a rich increase history, can we expect that to continue? There is a reputation to uphold after all. In all honesty, I’m not sure. But this is what I do know. Looking below we can see that they have increased the dividend every single year. The blip is due to the spin-off, which we all knew was coming. So naturally, they should be increasing the dividend every year going forward right?

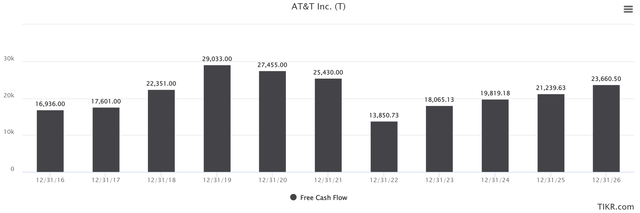

Well, let’s dive into what we know. It started in Q2 when we saw cash flow guidance of $16 billion get slashed by $2 billion, which lead to the stock falling over 7% in one day. Fast forward to Q3 results and we saw the company post solid results and the stock rebounded off the lows accordingly. The two important things to keep an eye on are net debt, and free cash flow.

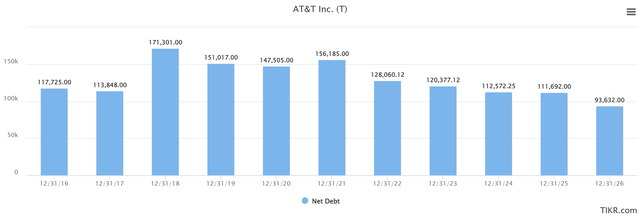

Starting with net debt. One of the big concerns for years is the debt that AT&T has taken on for various reasons. One of the big reasons behind the most recent spin-offs was to focus the company on what’s important and paying down debt. Looking below we can see where that is headed, and we saw Q3 end up at $131.33 billion. With the goal of a leverage ratio of 2.5x, there is still room to go. Based on the projections below, that would happen in 2024/2025. It is expected the ratio falls to just over 3.0x by the year-end of 2022. The concern here is that something changes and the company starts to use its revolving credit for one thing or another which would be a red flag. For reference, the last time the leverage ratio was under 2.5x, was in 2017. As long as we see cash flows used to pay down debt, play on.

Next up, cash flows. As mentioned, cash flows were a big reason for the big decline we saw after the Q2 announcement. But, after strong results in Q3 across the board, all seems to be forgotten. While it’s still projected that cash flows come in around $14 billion on the year, it’s the growth that is enticing. The key feature here is that the chart above and the chart below are moving in opposite directions.

So what does this all add up to? I fully believe we will see another increase in 2023. If you asked me after the Q2 results, I would have argued the other way. But after seeing the Q3 results, I do think we will see an increase in the next year so long as everything that is in action, stays in action. If this company makes the wrong move with debt one more time, I think a lot of long-term shareholders could dump their shares and move on. This dividend giant is here to stay.

What Does The Price Say?

A lot has transpired since I last wrote on AT&T. While I know many just hold for the dividend, I do think knowing what to potentially expect with respect to price action in the future is important. Especially if you are looking for a safe place to put money in these uncertain times. So, is now a good time to get in? Let’s explore it from a technical perspective.

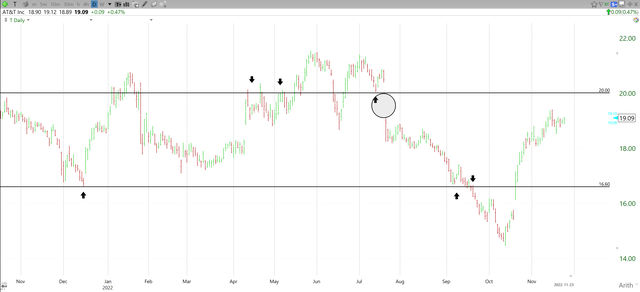

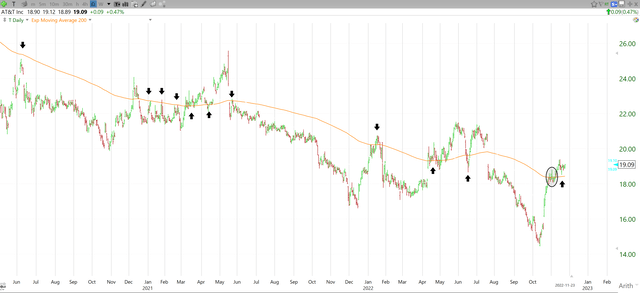

The first thing I see when looking at this chart is the massive gap that the Q2 earnings left back on July 21st when the stock fell over 7% in one day. Believe it or not, stocks have a tendency to fill these gaps down the road. This means that we will see $20-$21 sometime in the near future. While that’s not a huge run from where we sit today, it’s still something to look forward to.

The second thing I see here is clear support at $16.60. Meaning we can place a hard stop there. A break of $16.60 could easily send the stock down to the $14.50 level to re-test the lows we recently put in. Does this mean the bottom is in? While I’d love to tell you yes, the truth is I don’t know. But that’s why stops matter. Dividend or not, I have no interest in owning AT&T below $16.60 for that reason alone. While I think it’s probable that the bottom is in given the recent reaction the stock has had (up 30% in a month and a half), nothing is guaranteed in the market.

The other positive here is that the 200-day moving average is supporting the stock once again. Looking below, we can see the history behind this. While it’s not always perfect, it’s hard to deny that where the long-term moving average is trending, so is the stock. In the circled area we saw a pretty good battle between the bulls and the bears and based on the instant positive re-test, it appears the bulls have won, for now. So long as the 200-day moving average is below the share price, there is no reason to consider selling.

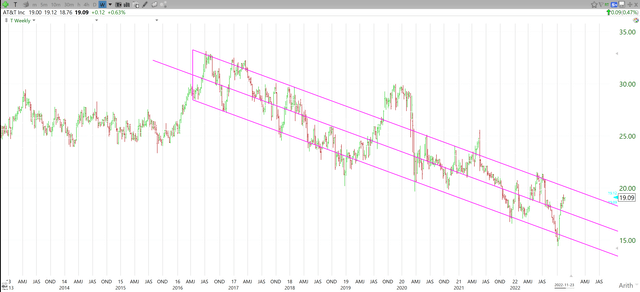

The one thing I don’t love about AT&T’s chart is the long-term downtrend it is in. Looking below we see a weekly chart. And while it looked like 2019 might be the end of it, the Covid crash brought us right back to the bottom end of the range. It’s hard to ignore this and might be worth waiting to see if we can somehow escape this ugly trend in the next couple of years.

Personally, I would still take the risk if I were looking for a “safe” quality dividend player. The stop is clear, and the 200-day is on the right side of the trade. The trend is always your friend and it’s not a great-looking one here, but with the two other major keys in place, I would be comfortable taking this position for the long term.

Wrap-Up

As you can see, while there has been plenty to stress about over the last year, things are still looking up overall. The good news here is that most AT&T shareholders already carry a long-term view on things which is why they are so loyal. However, that loyalty may be tested if they slip up with respect to the debt over the next couple of years. So long as the leverage ratio continues to decline and cash flows increase, there isn’t much to worry about here long term. The dividend will be safe and the increases will return.

Be the first to comment