Clive Brunskill/Getty Images News

What happened?

UK news tabloid Daily Star just reported that Apple Inc. (NASDAQ:AAPL) is interested in acquiring Manchester United plc (NYSE:MANU) for £5.8 billion ($7 billion), as United owners the Glazer family are exploring a sale in response to fans who no longer want them running the show. The article states that the deal could potentially include Apple funding a whole new stadium for future matches.

As of writing, shares of Manchester United are up 26%, with call option trading volume up 97% on Wednesday. The football club currently has a market cap of $3.1 billion. If the deal miraculously goes through, traders on the news might easily get a double on their investments.

Where’s the synergy?

The only synergy I see is Apple TV securing streaming rights for football matches involving Manchester United, similar to how Amazon (AMZN) paid $1 billion to be the only streaming provider for Thursday Night Football. Other than that, there’s really not much that will benefit Apple’s core business, which involves selling iPhones and trying to monetize its 2 billion global iOS installed base via services such as the app store, music and iCloud.

Apple TV isn’t exactly the leader in the streaming space, which is highly competitive with players like Netflix (NFLX), Disney+ (DIS), and a number other AVOD providers including Tubi (FOX, FOXA) and Peacock (CMCSA). Streaming is a highly fragmented industry and will likely remain so in the future (here’s why). With a market share of just 6%, Apple TV is unlikely to increase its market share by any meaningful amount through buying a football club for $7 billion.

With very little synergy that comes at an astronomically high cost, Apple buying Manchester United is equivalent to Chinese art marrying French rap. As a result, common sense suggests this is going to be a situation where 1 plus 1 equals less than 1.

Is football a good business anyway?

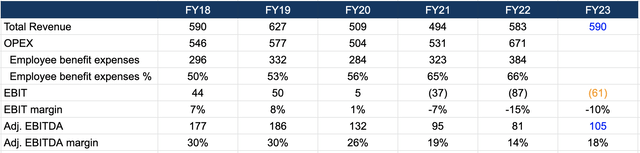

Football is a sexy business, but not necessarily a very profitable one. The success of Manchester United depends on the team winning and hardcore fans spending, which essentially hinges on acquiring and retaining the best players in the market. In pre-COVID years, Manchester United’s employee benefit expenses (mostly player salaries) easily made up 50%+ of total revenue.

Company data, mgmt guidance, consensus estimates

In FY22 (June), employee benefit expenses made up 66% of total revenue, a primary reason why operating margin was a negative-15% even though revenue had largely recovered to pre-Covid levels. For FY23, management guided revenue of £590 million (+1.2% YoY) and adj. EBITDA of £105 million at the midpoint (+29% YoY). However, if we strip out all the financial shenanigans such as amortization, operating margin is expected to be another negative 10% for the year, as management will continue to invest in new players.

Granted, Manchester United is the third-most popular football club behind Real Madrid and Barcelona. The club has over 1 billion fans worldwide, and while management is committed to keeping general admission tickets affordable, season tickets and Executive Club could still provide some upside. There are also new opportunities for the Broadcast division in new sports rights in streaming. But given the nature of the business, high player compensations are likely to weigh on the bottom-line going forward.

What if the deal does go through?

I would be an immediate seller of Apple’s shares if the company does say yes to such an outrageously irrelevant acquisition that will likely do more harm than good. Given Apple’s business model and history of financial discipline, however, I seriously doubt Tim Cook and Luca Maestri will do anything so silly. While Apple has yet to publicly respond to the rumor, the news already appears to be false according to MacRumors.

At the end of the day, Apple is a consumer electronics business with a wide moat, and directing corporate resources to non-core ventures is likely to create more questions than answers down the road. While I agree that Apple is now at a very mature stage and growth has to come from somewhere else, I see a better path for Apple management to generate shareholder value through simple, good-old-fashioned buybacks. As boring as this may sound, boring is good in this environment.

Be the first to comment