Marco Bello

This story was originally written on August 9 for subscribers of Reading The Markets, an SA Marketplace service. It was updated and modified on the morning of August 12.

The ARKK ETF (NYSEARCA:ARKK) has rocketed higher, rising by more than 40% since the middle of June. But those massive gains may be almost over, with a potential pullback in the coming weeks.

The ETF has been driven higher as a risk-on mentality has hit the market due to nominal and real yield plunging as investors have focused on the potential for a dovish FED pivot. But despite the CPI and PPI reports missing estimates, sticky measures of inflation are showing no signs of easing.

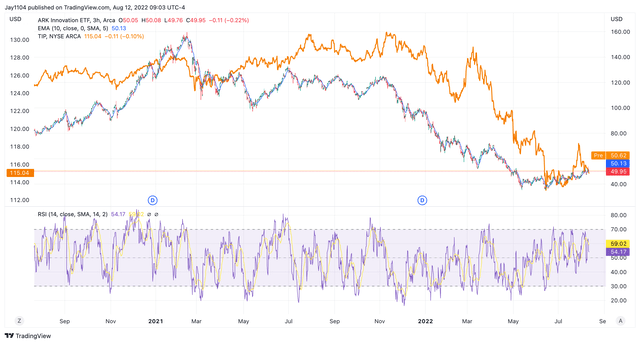

The Atlanta Fed 12-month Sticky CPI showed a new cycle high in July, which now stands at 5.8%. This helped nominal and real yields to rise. The ARKK ETF has benefited when real yields fall and has suffered when real yields rise. This is visible when comparing the ARKK ETF to the TIP ETF.

Additionally, the Fed minutes from the July FOMC meeting are due on August 17 and are likely to shed a lot of light on how the Fed thinks and whether a “dovish” pivot is something the committee is even considering.

Y2K Still Unfolding

It is also worth being aware that the ARKK ETF is following a similar path to the NASDAQ 100 dot.com bust of 2000. When overlaying the ARKK ETF of today with the NDX of 2000, one can see the patterns in both are very similar. The timing of the analog isn’t perfect, but it could suggest that the recent rally in the ARKK was just a dead cat bounce and is due to turn lower again.

Of course, this is not to say that the ARKK ETF is on a preset course because it isn’t. The ETF could easily break from the relationship with the NDX of 2000 at any point, but it is worth being aware that the decline in ARKK may be far from over.

Bloomberg

Betting Shares Fall

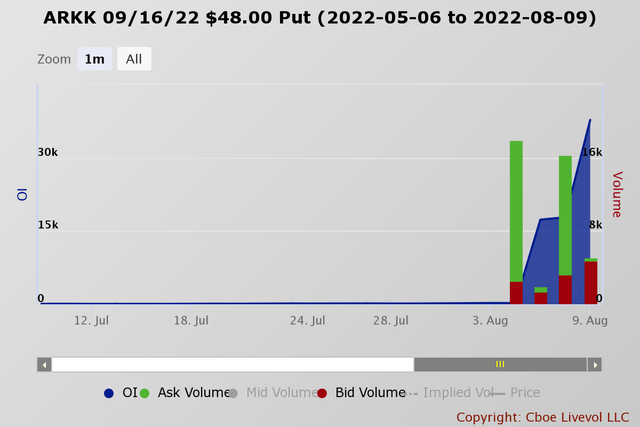

Someone is betting the declines in the ARKK aren’t over and will likely give back some of these recent gains. The open interest for the ARKK September 16 $48 puts rose by 17,100 contracts on August 5 and 19,900 contracts on August 9.

The data shows that the first lot of 17,100 contracts were bought on the ASK for around $3.10 to $3.35 per contract. Meanwhile, the second lot of 19,900 contracts were bought on the ASK for around $2.30 to $2.50 per contract. These bearish bets would suggest that the ETF will be trading below $45 by the middle of September for all of the contracts to be profitable if held until the expiration date.

Interestingly, part of this put position was closed out already. The open interest for the September 16 $48 puts fell by 19,033 contracts on August 11. The data shows that the puts were sold on the bid for $2.25 per contract.

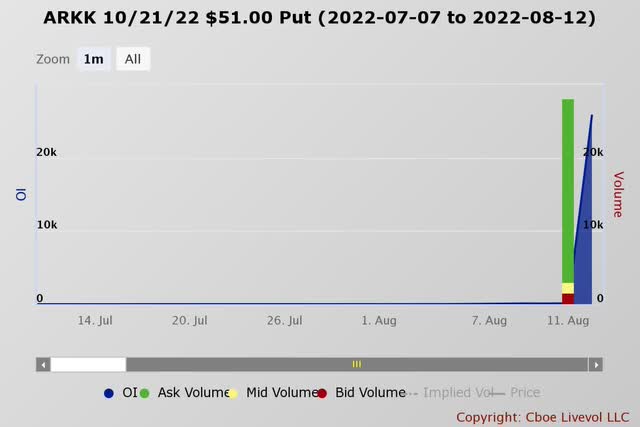

However, data on the morning of August 12 shows the open interest for the October 21, $51 puts rose by 25,625 contracts. The data shows the puts were bought on the ASK for between $4.00 and $4.50 per contract. This would suggest the stock is trading below $45.50 by the middle of October for the trader to achieve gains if held until the expiration date.

Technical Reversal In ARKK ETF

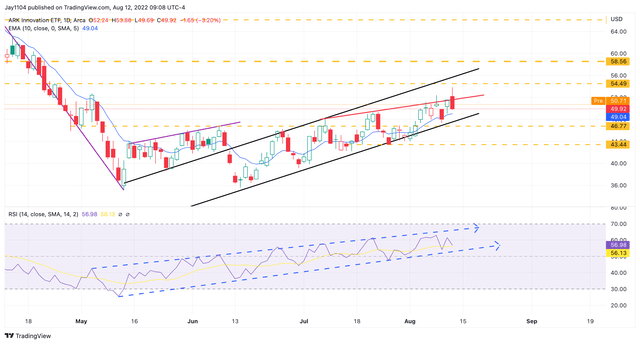

Technically, the ETF has been rising steadily in a trading channel. But more recently, the rising channel has shifted into a rising wedge. That is a bearish reversal pattern. Additionally, the relative strength index has steadily risen, signaling bullish momentum. However, the recent decline in the ETF has pushed the RSI towards the lower end of the rising trend line, and, if broken, this would signal that the bullish momentum has also failed.

The rising wedge and the potential shift in momentum could signal that the rally in ARKK is near its end, and a move lower is approaching. A break of support at $48 may push the ARKK ETF down to around $43.50, a decline of about 13%.

For now, the ARKK ETF has been steadily rising and benefitted from falling yields and hopes of a dovish pivot by the Fed. But as soon as that narrative changes, the hopes of the ARKK rally carrying on, are likely to end.

Be the first to comment