Carl Court/Getty Images News

The pandemic created crazy distortions in many different sectors of the economy with some companies greatly benefiting from the pandemic and other sectors of the economy being severely impacted. One of the sectors of the economy that was severely impacted was the Travel & Leisure industry. Just in the USA alone, nearly $500 billion was lost in travel spending during 2020, according to the U.S. Travel Association.

Over the course of 2021, as COVID-19 vaccines were distributed and the virus began to go from pandemic to endemic, the situation began to reverse and companies that did well in the early part of the pandemic began to come back to earth, while companies in industries severely impacted by the pandemic began to recover. Travel is among the biggest industries severely impacted by the pandemic that began to recover over the course of 2021.

As quarterly results over the last year have shown, Airbnb (NASADAQ:ABNB) is among the best ways to profit from the travel industry recovering from the pandemic. The latest quarterly report from Airbnb revealed the company’s best quarter ever for revenues, net income and adjusted EBITDA. The Q4 2021 results show that Airbnb is rebounding from the pandemic even faster than many other players in the travel industry. In addition, the company gave guidance that indicated the recovery remains strong into 2022, all of which sent the stock up 3.6% the next day after the report was released.

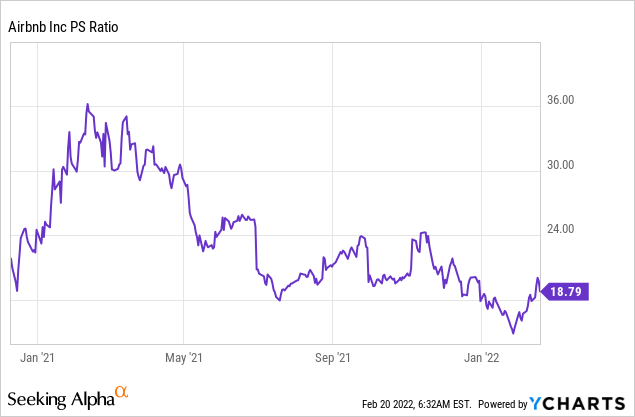

Since the company came public in December of 2020, Airbnb’s PS ratio has ranged from 15.5 to 36. Currently, Airbnb is trading at the lower end of its PS range at 18.8 as I write this. Considering how rapidly Airbnb is currently growing on the tailwinds of a recovery that is expected to vastly exceed pre-pandemic levels, the fact that the company is nearing profitability and the optimistic outlook given by Airbnb management moving forward, I consider the company a buy at the current valuation.

Airbnb’s Data Advantage

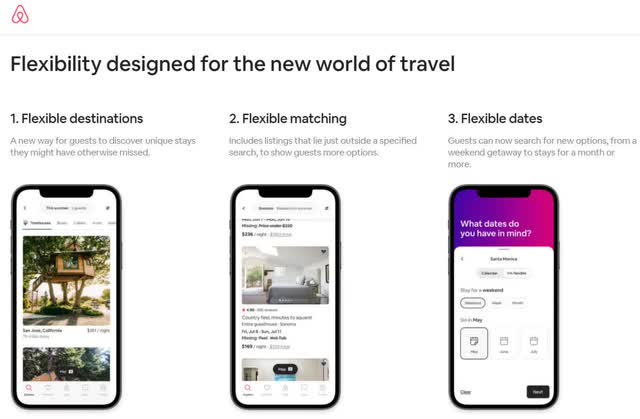

Airbnb gains a lot of data through its platform which it then uses to create new features tailored toward the trends that it is discovering. There are few companies collecting as much data on travel trends and then adjusting their business to those trends as fast as Airbnb. Over the course of 2020 and 2021, Airbnb has been using the down time in the travel industry by investing both in preparation for the eventual recovery in the travel and by investing in the newest trends in travel that the company has gleaned from the data that it has been collecting. There are three big insights that Airbnb has gained from the data it has collected so far:

Anyone that listens to enough Airbnb Earnings calls or Investor presentations will hear the CEO consistently hit on the theme of the three fundamental ways in which travel is changing, which are:

- People can travel at any time – Data on Airbnb shows that people are becoming far less rigid on the dates they are available to travel.

- People are travelling everywhere – Especially notable in Airbnb’s data is that net growth in travel to low density urban areas, suburbs and small towns, which has been accelerating since 2018.

- People are staying longer – In the first quarter of 2021, 24% of nights booked were for long term stays, defined as 28 days or longer. People are increasingly using Airbnb to establish long-term living arrangements and not just for short term rentals.

Most of the new consumer facing features that Airbnb has built into the Airbnb 2021 release introduced in May 2021 are specifically designed to cater towards these three above trends.

Airbnb – A New World Of Travel (Airbnb 2021 Release)

Airbnb Hosts: Part of A Network Effect

Before the pandemic, there were many different reasons why people might become Airbnb Hosts that ranged from saving money for a kid’s college fund, to saving money for a vacation fund, to simply enhancing a person’s income. The pandemic and the after effects from COVID-19 have only created additional reasons. The pandemic forced many different people out of work across a wide swath of different industries. This created dire circumstances for some people who were without a job but still had mortgages, medical bills, utilities and other bills to pay. Many people, because of their financial circumstances, began seeing Airbnb as a way to provide income to simply pay their bills during tough times and some people even began seeing a full-time business opportunity in becoming an Airbnb Host.

In many ways the pandemic really hurt Airbnb, primarily because of the disruption to the travel industry but in other ways the pandemic has put Airbnb on the path to becoming a much stronger company. In fact, I believe Airbnb might have a chance to become one of the most dominant companies in the travel industry. One of the biggest benefits from the pandemic is that it has made it far easier for Airbnb to recruit Hosts and the recruitment of more Hosts is the secret sauce that helps build a strong moat around the Airbnb business that will make it difficult for fast-follower copycat competitors to compete against Airbnb.

Airbnb does have strong competitors like VRBO (NASDAQ:EXPE) but often when it comes time for a consumer to choose which service to use, having the most and widest variety of properties to choose from becomes a competitive advantage, as the consumer, more often than not, will select from the service that gives them the most choices. This also works in reverse because Hosts will more often choose to be on Airbnb because the company has the most potential customers. Airbnb has what is called a two-sided market with network effects. This is a powerful barrier to entry against competitors attempting to enter Airbnb’s business.

As of July 2021, there were more than 4 million Airbnb hosts on the company’s platform. Airbnb also has far more listings than any other company. The closest competitor to Airbnb is VRBO. As of April of 2021, VRBO had 2 million properties in 190 countries versus Airbnb having 7 million properties across 191 countries, according to website Upgraded Points. So, the battle between Airbnb and VRBO occurs heavily on the side of which platform makes their platform more attractive for Hosts because this business is all about “He who has the most Hosts and therefore the most properties will win”.

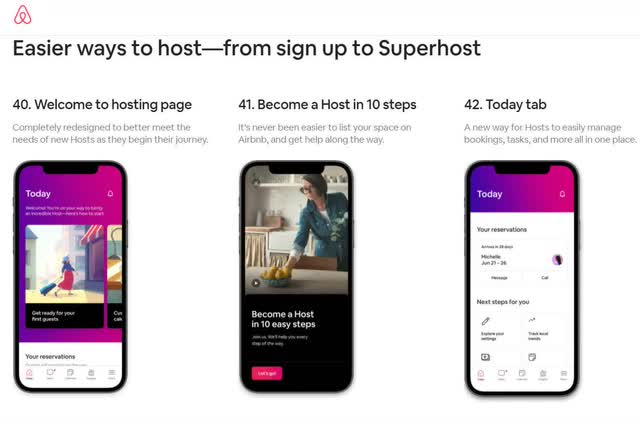

This is why during earnings calls, investor days, and analyst meetings, Airbnb will consistently stress Airbnb Hosts as being one of their priorities. I actively look at the things that Airbnb does for their Hosts and the relationship Airbnb has with their Hosts because that relationship is a key part of Airbnb’s competitive advantage. Part of the Airbnb 2021 Release included improvements directed towards making things better for Hosts.

Airbnb Host improvements (Airbnb 2021 release)

Airbnb estimates that 90% of the over 4 million Hosts on the platform are simply individuals simply looking to enhance their income, with 55% of Hosts being women. Airbnb Hosts come from all walks of life and many of them have careers in other professions. The key point is most Airbnb Hosts are not professional lessors. Through the Airbnb 2021 release, the company made it even easier for non-professionals to become Hosts by releasing 45 new features specific to making everything easier for Hosts to do business. The recruitment of Hosts is among the most important things that Airbnb is doing in advance of the travel recovery going into full swing because Airbnb needs to have a large inventory of desirable locations before travel really takes off again. The last thing Airbnb wants is to be supply constrained, so it is key that Airbnb builds out a large enough supply of properties to take care of the high demand that the company is expecting in a travel rebound.

If you build it; they will come.

Source: Movie Field Of Dreams

Airbnb Q4 2021 Earnings Report

Airbnb Q4 2021 Financial Highlights (Airbnb Q4 2021 Shareholder Letter)

One of the side effects of the pandemic is that it severely impacted a program that Airbnb calls Experiences, which the company defines as in-person or online activities hosted by local experts. Airbnb gives some examples of Experiences on their website:

In Paris, visiting the Louvre with an art historian who’s also a comedian. In Cape Town, mountain biking with views of Table Mountain alongside a pro bike racer. In Barcelona, making paella based on an old family recipe in a private garden.

Source: Airbnb website

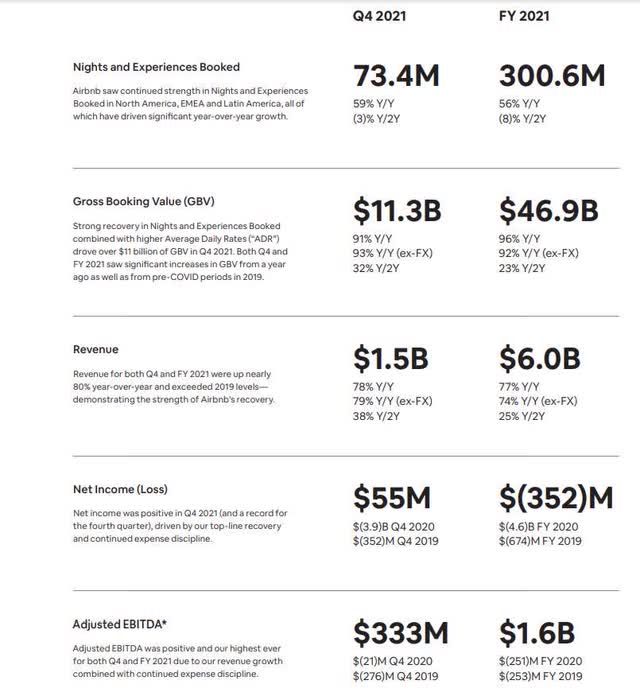

Airbnb measures how popular the Experiences service is with a metric called Nights and Experiences Booked, which is defined as the sum of the total number of nights booked for stays and the total number of seats booked for Experiences, net of cancellations and alterations that occurred in that period. The website Statista shows how Nights and Experiences Booked dropped 41% from 326.9 million in 2019 to 193.2 million in 2020 as a result of the pandemic. Nights and Experiences Booked then rebounded 56% to 300.6 million at the end of 2021, which is a direct result of lockdown restrictions being eased throughout 2021. It is likely that by the end of 2022, the Nights and Experiences Booked metric will be above pre-pandemic levels.

The next highlight in the Airbnb earnings report is the Gross Booking Value (GBV), which is similar to a metric used on ecommerce websites named Gross Merchandise Value (GMV). The GBV metric is great for determining the overall health of the Airbnb marketplace. What we want to see here is a rapidly expanding GBV because the faster the GBV growth is, the healthier the overall revenue growth is. Last year, GBV growth was only 37% on both a Q4 2020 and a FY 2020 Y/Y basis. This year, GBV has very noticeably improved by showing 91% growth on a Q4 2021 Y/Y basis and 96% growth on a FY 2021 Y/Y basis.

One of the most important metrics used in the rental industry is a metric called the average daily rate (ADR), which for Airbnb is defined as the average rental income per paid occupied property over 30 days. Airbnb’s ADR averaged $154 in Q4 2021, which is a 20% increase compared to Q4 2020, and a 36% increase compared to Q4 2019. This number is very strong and Airbnb admitted in its Shareholder Letter that the ADR outperformed the company’s expectations.

The company also mentioned that Q4 ADR represented a sequential increase in ADR from $149 recorded in Q3. The increase was attributed to both price appreciation and a significant mix shift towards bookings in North America, entire homes, and non-urban destinations, all of which have a higher ADR than other locations. Price appreciation occurred because of strong demand from people that want to get out of their house after being cooped up for so long. This demand did not just affect Airbnb but also the overall hospitality industry, which showed sector-wide price appreciation.

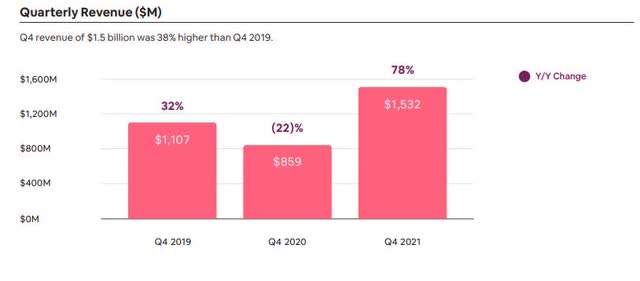

Airbnb Quarterly Revenue (Airbnb Q4 2021 Shareholder Letter)

Airbnb Q4 2021 revenue came in at $1.5 billion, an increase of 78% year-over-year. This result beat Wall Street analyst expectations by $70M and was the company’s best fourth quarter ever. The company attributed the Y/Y increase in revenue to the recovery in Nights and Experiences Booked, combined with a higher ADR. Revenue in Q4 2021 increased 38% over Q4 2019 revenue, a result driven by higher ADR offsetting slightly fewer nights stayed.

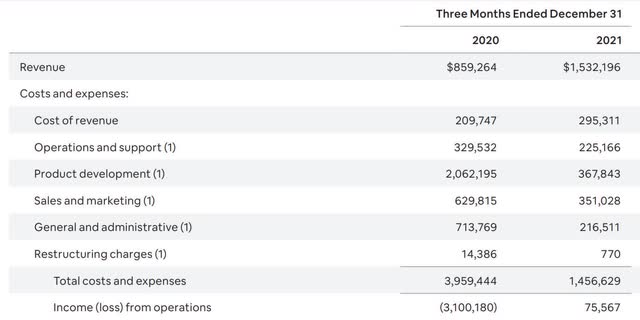

Airbnb P&L statement (Airbnb Shareholder Letter)

Airbnb achieved a significant improvement in the company’s cost structure over FY 2021 and the reasons for the improvement were explained in the Airbnb Shareholder letter.

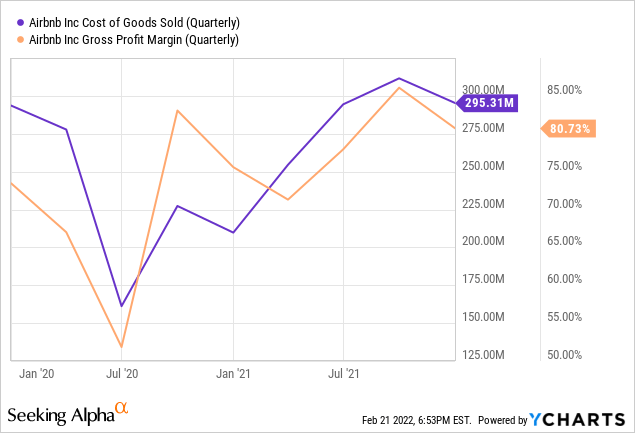

Airbnb’s cost of revenue for Q4 2021 came in at $295 million an increase of 41% year-over-year and the Shareholder letter attributed this to an increase in merchant fees driven by higher Nights and Experiences Booked.

Airbnb Q4 2021 Gross Profit margin came in at 80.73% versus 75.58% in Q4 2020 which the company explained was driven by lower payment processing costs, lower chargeback expenses and lower foreign exchange expenses. Also, Airbnb’s cost savings initiatives helped improve gross margins in Q4.

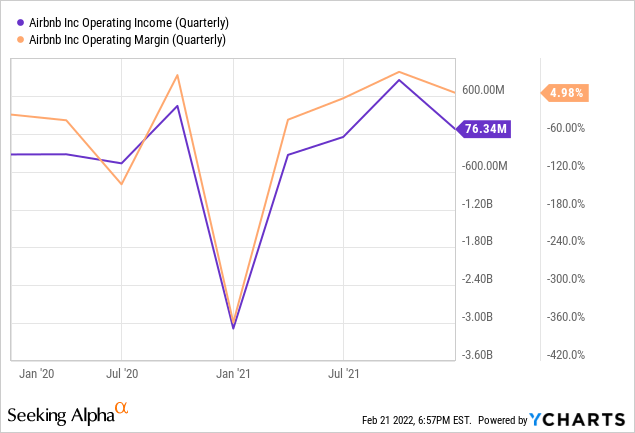

Airbnb recorded a GAAP Q4 2021 operating income of $76 million versus a $3.1 billion GAAP operating loss in Q4 2020.

Airbnb GAAP operations and support costs for Q4 2021 decreased by 32% year-over-year to $225 million. However, non-GAAP operations and support costs, which excludes stock-based compensation (SBC) and stock-settlement obligations, increased by 16% year-over-year to $214 million. Operations and support costs were driven by the increase in both customer support and Host protection related costs resulting from the increase in nights stayed relative to Q4 2020.

Airbnb GAAP product development expense for Q4 2021 decreased by 82% year-over-year to $368 million. However, non-GAAP product development expense, which excludes the impact of SBC and stock-settlement obligations, increased 20% year-over-year to $242 million.

Airbnb GAAP Sales and Marketing (S&M) expense for Q4 2021 decreased 44% year-over-year to $351 million. However, non-GAAP S&M, which excludes the impact of SBC and other non-cash or one-time items, increased by 119% year-over-year to $324 million due primarily to an increase in brand marketing expense. When comparing Non-GAAP Q4 2021 S&M expense to Q4 2019 expenses there was a decrease of 25%, primarily due to a reduction in performance marketing expenses.

Airbnb GAAP General and Administrative (G&A) expense for Q4 2021 decreased by 70% year-over-year to $217 million. However, non-GAAP S&M, which excludes the impact of SBC and stock-settlement obligations, decreased by 9% year-over-year to $155 million.

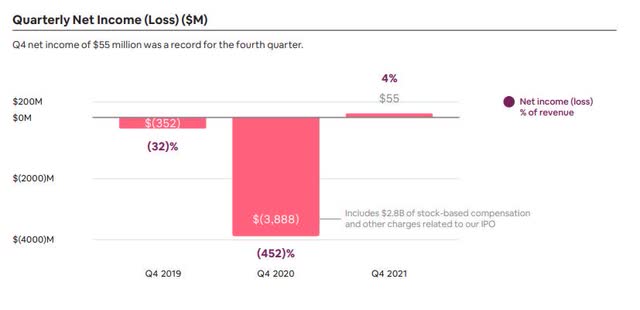

Airbnb Net Income (Airbnb Shareholder Letter)

Airbnb recorded a Q4 2021 GAAP net income of $55 million, which is 4% of revenue versus a $3.9 billion net loss in Q4 2020, which is -452% of revenue.

Airbnb Surprise & Estimates (Seeking Alpha)

Airbnb Q4 GAAP EPS was $0.08 which beat analyst estimates by $0.04. Next, we look at EBITDA.

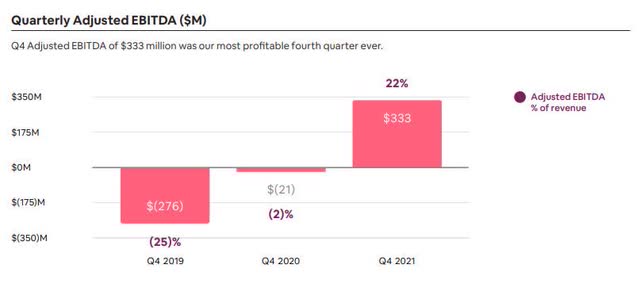

Airbnb Quarterly EBITDA (Airbnb Shareholder Letter)

EBITDA is usually stressed by the management of younger companies as a better metric to follow over net income because the early life stages of a company will often include a lot of financing and capital expenditures, which often makes it hard to compare quarter-over-quarter and year-over-year operational profitability and efficiency.

In Q4 2021, Airbnb delivered $333 million in adjusted EBITDA, which was Airbnb’s most profitable Q4 ever. This Q4 2021 number is versus a $21 million EBITDA loss in Q4 2020 and a $276 EBITDA loss in Q4 2019. This shows that despite the pandemic, Airbnb has consistently become more profitable over the last 3 years. The Q4 2021 adjusted EBITDA margin was 22% versus -2% in Q4 2020 and -25% in Q4 2019.

Airbnb FY 2021 Adjusted EBITDA margin came in at 27%, which is a 32% Adjusted EBITDA margin expansion relative to 2019. Airbnb attributed the margin improvement to both a recovery in revenues and more disciplined cost control.

Overall, we estimate that approximately three fourths of this margin expansion was driven by our financial discipline and optimized marketing strategy, and the remaining one fourth driven by favorable unit economics related to our significantly higher ADR.

Airbnb Guidance

In the Guidance section of the Shareholder letter, Airbnb indicated that consumers are already booking for the summer travel season, with the U.S. and Europe showing lead-time for bookings made in Q1 2022 returning to pre-pandemic levels. The company also expects Q1 2022 Nights and Experiences Booked to significantly exceed Q1 2019 levels. Gross Booking Value is also projected to reach record levels in Q1 2022.

Airbnb also gave some guidance on the average daily rate (ADR), which is a metric that is extremely important because it ultimately has an effect on both revenues and bottom-line profitability. Airbnb is currently projecting Q1 2022 ADR to be up approximately 4% from Q1 2021. The ADR across 2022 is expected to remain elevated compared to 2019, but below 2021 because of an expected mix shift to areas that have a lower ADR. The USA is a country with the highest ADRs but as other areas of the world with lower ADRs open up, it will lower the overall ADR. For instance, Asia Pacific has not fully recovered yet because there are still many areas that have heavy travel restrictions but eventually Asia Pacific will recover and that will affect Airbnb’s results by raising bookings and lowering ADR.

We are incredibly proud of the progress we’ve made over the last years in reducing variable costs, increasing marketing efficiency and tightly managing fixed expenses. This substantial improvement of our cost structure combined with higher ADRs has allowed us to deliver significant margin expansion. Due to these improvements, we expect to achieve our first positive Q1 Adjusted EBITDA in Airbnb history.

Source: Airbnb Q4 2021 Shareholder Letter

In the earnings call, in response to an analyst question asking about potential flat margins in FY 2022, CFO Dave Stephenson responded by saying something to the effect that Airbnb made substantial progress improving marketing expenses as a percentage of revenue in 2021 but that level of improvement should not be expected moving forward. However, he expects Airbnb to continue improving variable costs, while gaining leverage on fixed costs.

Last but not least, Airbnb is reluctant to project results beyond Q1 because COVID-19 is still creating uncertainties in the market.

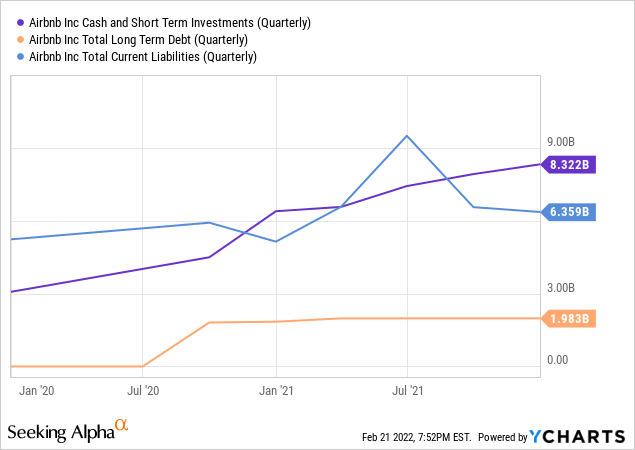

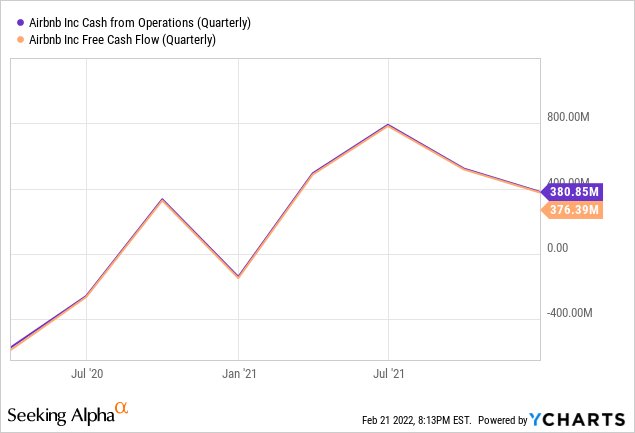

Airbnb Balance Sheet & Cash Flows

Airbnb reported 8.3 billion of cash, cash equivalents, marketable securities, and restricted cash on the balance sheet at the end of Q4 2021.

Airbnb had approximately $2 billion of long-term debt on the balance sheet. Airbnb’s long-term debt to total assets is 0.17, according to TradingView. Long-term debt to total assets is a solvency ratio, where a ratio result of less than 0.5 is considered good, according to Investopedia.

The $6.4 billion in current liabilities included $3.7 billion of funds held on behalf of guests at the end of Q4 2021 and unearned fees totaling $904 million. Airbnb has a Quick Ratio of 1.89, where a number above 1.0 means a company can easily pay short term liabilities.

Airbnb Q4 2021 Cash Flow from Operations was $381 million and Free Cash Flow was $376 million. Airbnb FY2021 Cash Flow from Operations and Free Cash was $2.2 billion.

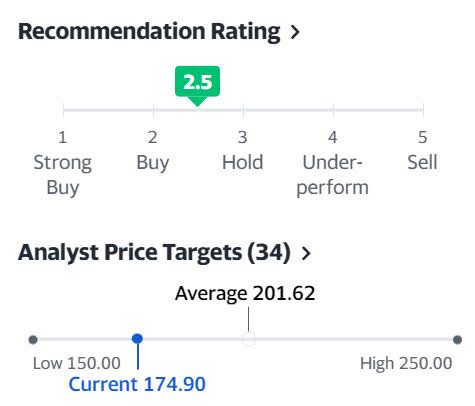

Airbnb Analyst Price Targets

ABNB Analyst Price Targets (Yahoo Finance)

The above is based on 34 Wall Street analysts offering 12-month price targets for Airbnb in the last 3 months. The average price target is $201.62 with a high forecast of $250.00 and a low forecast of $150.00. The average price target represents a 15% increase from the last price of $174.90.

Airbnb Risks

Short Term Risk – The biggest short-term risk is that a COVID-19 variant evades current vaccines, which could potentially create another wave of COVID-19 infections that results in the travel recovery losing steam.

A secondary short-term risk is hotels competing more effectively. In 2019, Marriott (NYSE:MAR) started a pilot program that they call Homes and Villas with 340 properties in four European cities but as of June 2021, the program had 30,000 properties versus Airbnb’s over 7 million properties. This is where Airbnb’s double sided network effect creates a barrier because even Marriot will likely have difficulty recreating a network as large as Airbnb’s network, especially when Airbnb is running hard to attract even more Hosts into its network.

Long Term Risks – The biggest long-term risk for Airbnb, in my opinion, is regulatory. Airbnb is not legal in every location around the world and even in the areas in which it is legal, there might be a lot of restrictions.

Airbnb has also run into a number of scandals both on the part of hosts and on the part of guests. Airbnb has dealt with both complaints about fraudulent listings and complaints about the poor conditions of dwellings on the Host side, as well as complaints of wild parties, property damage and other illegal activity coming from the guest side. There are even many, many accusations of sexual assaults on Airbnb properties. On top of that, both Hosts and Guests had complained in the past about bad customer service when many of these issues were brought up to the company. Continued bad publicity could eventually crimp Airbnb’s growth.

Conclusion

As the stocks of many companies that benefited from the pandemic continue to collapse as their growth slows, investors will likely soon be identifying and investing in the industries that are due for a strong recovery from the pandemic. Travel & Leisure is one industry which will likely benefit the most from economies around the world reopening and within travel, Airbnb is one of the best positioned companies to benefit from a strong recovery. Unlike many companies in the travel industry so far, Airbnb’s results are already showing a strong recovery back to normality. Airbnb is a strong buy for long-term growth investors that are looking for investments that best benefit from the pandemic receding.

Be the first to comment