AJ_Watt/E+ via Getty Images

One of the more interesting companies that I’ve come across in recent years is SP Plus Corporation (NASDAQ:SP). This firm focuses on providing various mobility solutions, largely centered around the management of parking lots, the oversight of parking meter collection and other forms of parking enforcement services, and a variety of other related activities. Despite concerns of the economy weakening, SP Plus seems to be doing quite well for itself. Even as the market has plunged in recent months, shares of the business have risen nicely, driven in large part by strong top line and bottom line performance. Although it’s clear that the easy money has been made, shares are cheap enough that the company does seem to offer some additional upside potential moving forward. And because of that, I have decided to retain my ‘buy’ rating on the firm for now.

The picture just keeps getting better

Back in April of this year, I wrote a bullish article about SP Plus. In that article, I called the company a unique play on mobility. I acknowledged that, over the years, the firm had been on a bumpy ride from a fundamental perspective. But on the whole, performance had been robust and positive. The company was especially showing signs of recovery following the worst of the COVID-19 pandemic, leading to upside potential for investors in the near term. This argument was further bolstered by the fact that I viewed shares as being attractively priced. As a result of my findings, I rated the business a ‘buy’, reflecting my opinion that it would likely generate returns that would outperform the broader market for the foreseeable future. Since then, my call has ended up looking pretty good. While the S&P 500 is down by 7.2%, shares of SP Plus have generated a profit for investors of 15.3%.

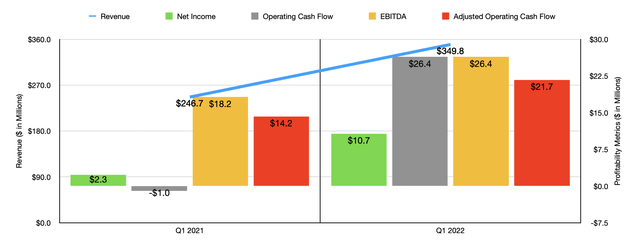

When I last wrote about the firm, we had data covering through the entirety of the firm’s 2021 fiscal year. Fast forward to today, and we now have data for one additional quarter, the first quarter of 2022. So far, the picture has been really impressive. Consider revenue. In the first quarter of the year, revenue came in at $349.8 million. That represents an increase of 41.8% over the $246.7 million the business generated the same quarter just one year earlier. Based on the data provided, this increase in revenue was driven by a couple of different factors. For instance, during the quarter, services revenue came in at $184.4 million. That’s 43.3% above the $128.7 million generated just one year earlier. According to management, this increase in services revenue was driven by growth across both lease-type contracts and management-type contracts. The company also saw a significant improvement in reimbursed management type contract revenue, a figure that rose from $118 million in the first quarter of 2021 to $165.4 million the same time this year. All of these improvements were driven in large part by increased volume at the properties in which it operates thanks to the reopening of the economy.

As revenue rose, profitability for the company followed suit. Net income in the first quarter totaled $10.7 million. That’s significantly higher than the $2.3 million reported just one year earlier. Operating cash flow went from a negative $1 million to a positive $26.4 million. If we adjust for changes in working capital, it would have risen More modestly from $14.2 million to $21.7 million. Meanwhile, EBITDA for the business also improved, climbing from $18.2 million to $26.4 million. Profitability for the company has been so impressive that, in the month of May, the company even decided to announce a new share buyback program in the amount of $60 million. Although this may not seem like much, at current pricing, exercising this in full would buy back about 7.6% of the company’s shares.

When it comes to the 2022 fiscal year, management has some pretty high hopes for the business. Net income, for starters, should come in at between $56 million and $61 million, with a midpoint of $58.5 million. That midpoint figure would translate to an 84.5% rise over the $31.7 million generated in 2021. Operating cash flow last year was $53.4 million, with the adjusted figure for it coming in at $83.7 million. Management is forecasting a reading of between $83 million and $98 million, with a midpoint of $90.5 million. And then we have the issue of EBITDA. The current expectation is for this to come in at between $110 million and $120 million, implying a midpoint reading of $115 million. Last year, this metric was just $95.2 million.

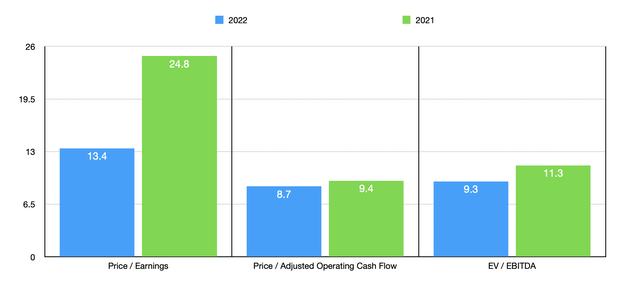

Using this data, it becomes pretty easy to value the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 13.4. That’s down from the 24.8 reading that we get if we use 2021 results. The price to adjusted operating cash flow multiple should drop from 9.1 last year to 8.7 this year. And the EV to EBITDA multiple should decline from 11.3 to 9.3. To put this in perspective, I also compared the company to the same five firms that I compared to in my last article. Only four of those five companies had positive financial results. On a price-to-earnings basis, these companies range from a low of 11.8 to a high of 95.8. Only one of the four companies was cheaper than SP Plus. Using the price to operating cash flow approach, the range was from 6.3 to 84.5. And using the EV to EBITDA approach, the range was from 6.7 to 13.8. In both of these scenarios, two of the four firms were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| SP Plus | 13.3 | 7.7 | 8.8 |

| Heritage-Crystal Clean (HCCI) | 11.8 | 7.4 | 6.7 |

| Harsco (HSC) | 93.7 | 6.3 | 7.5 |

| CECO Environmental (CECE) | 95.8 | 84.5 | 13.8 |

| BrightView Holdings (BV) | 34.1 | 11.2 | 10.0 |

| Li-Cycle Holdings (LICY) | N/A | N/A | N/A |

Takeaway

All the data provided right now suggests to me that SP Plus is doing pretty well for itself. Although the company has been through some tough times, it has rebounded nicely and the future looks rather bright. Add on top of this how cheap shares are, especially on a forward basis, and the fact that they are probably closer to fair value compared to other comparable firms, and I cannot help but rate it a ‘buy’ even after shares have risen nicely in recent months.

Be the first to comment