tracielouise

It was the best of times. It was the worst of times. This is consistent with what investors have experienced in the general market, coming off a euphoric 100% plus rally in 18 months with a sudden descent into an unforgiving cyclical bear market. For the Gold Miners Index (GDX), it was the worst of times of 2021, it was an even worse time in 2022, and Q3 2022 has been so ugly that it’s led most investors to give up all hope. Sentiment for gold is in the dumps, and sentiment for miners in the incinerator.

In fact, the GDX has slid 47% in five months, an annualized decline of (-) 78%. This would place it near zero if this persists for another six months, something that many investors might actually be starting to believe is possible given how disgusted they’ve become with the space. Admittedly, some of the declines across the sector are justified, with several producers becoming un-investable and others mismanaging projects so poorly that they’ve diluted shareholders by criminal levels.

However, in the case of Agnico Eagle Mines Limited (NYSE:AEM), the company posted blowout results in H1 2022. It is ahead of plans on synergies and reported a massive increase in reserves at what could be a million-ounce per annum mine. Meanwhile, it has a track record that most can’t match, going from a one-mine company to an eleven-mine company in 16 years with very modest dilution, with an additional three mines in the wings. Given the extreme valuation disconnect (~7.0x cash flow) for a business with peer-leading margins, organic growth, and jurisdictional risk, I see AEM as a Strong Buy below $40.00.

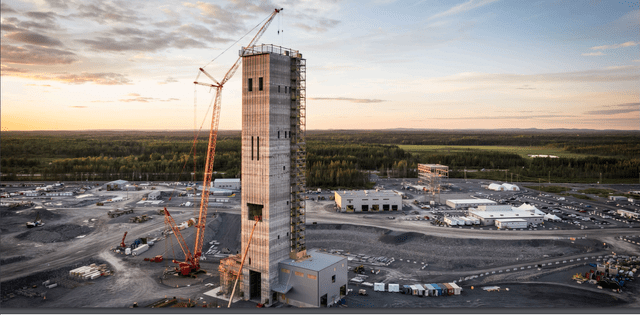

Canadian Malartic Mine (Company Presentation)

San Nicolás Partnership With Teck

Agnico Eagle announced last week that it would be partnering with Teck Resources (TECK) on its advanced-stage San Nicolás Project in southeast Zacatecas in Mexico, ~250 kilometers south of Penasquito, and arguably the most attractive mining jurisdiction in Mexico. San Nicolás was discovered by Teck in 1997 and is one of the most significant undeveloped volcanic-hosted massive sulfide deposits globally. Historically, VHMS deposits have contributed significantly to the world’s zinc, copper, and leader production. Notably, this is a project Teck has spent considerable time on. Agnico also has dedicated lots of time to it, having conducted dozens of site visits and looking at the project for three years before making this deal.

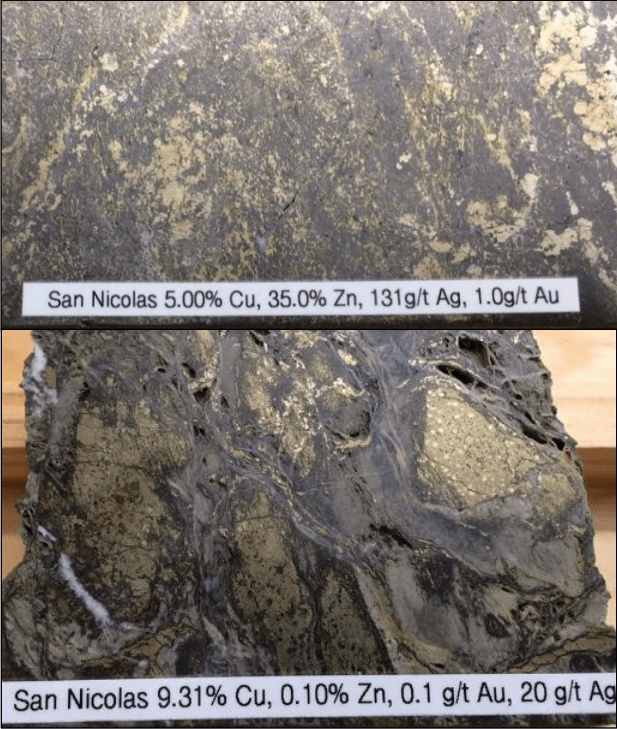

San Nicolás Mineralization (Teck Resources Presentation)

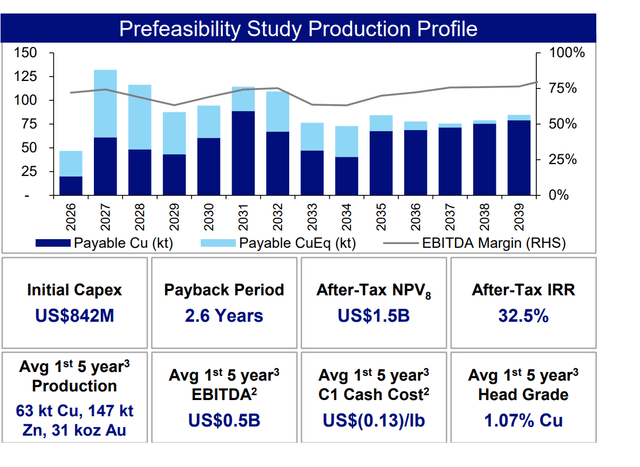

Some investors might wonder why Agnico would veer away from a gold focus toward a potential open-pit copper-zinc project with gold/silver by-product credits. The answer should be quite simple when looking at the economics and the partnership. In the case of San Nicolás, this project is well advanced, with Teck having completed a Pre-Feasibility Study in Q1 2021 and an Environmental Impact Assessment (EIA) in Q3 2021, and it boasts a very long mine life in a jurisdiction where Agnico has a long history of success with Pinos Altos and La India in Mexico.

Digging into the economics and resource, the project is home to 105.2 million tonnes of reserves at a 1.12% copper grade, 1.48% zinc grade, 0.40 gram per tonne gold grade, and 22 gram per tonne silver grade, of ~2.0% copper-equivalent. The project is expected to produce copper and zinc in concentrate if developed and will produce 63,000 tonnes of copper, 147,000 tonnes of zinc, 31,000 ounces of gold, and a silver contribution, or approximately ~125,000 copper equivalent tonnes. Given the extremely high margins of (-) $0.16/lb copper or $0.44/lb over the mine life and reasonable capex (~$1.0 billion), the project has a 33% after-tax IRR even at conservative metals prices ($3.50/lb copper and $1.15/lb zinc).

San Nicolás Project Economics – Pre-Feasibility Study (Teck Resources Presentation)

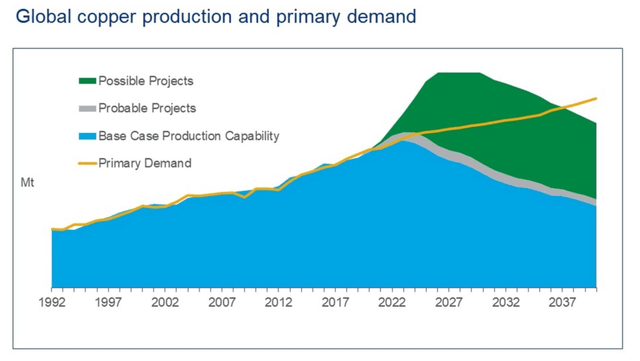

Although some investors may not like this added exposure to copper/zinc, I think the move is brilliant, especially the way it was done with a shared approach. Besides, Agnico has confirmed that it is not abandoning its gold-focused strategy but that this was a unique opportunity given the exceptional economics and long mine life in a jurisdiction where it’s already present. Besides, whether one prefers solely gold or not, one cannot deny the attractive supply/demand picture for copper, with a sharp rise in demand due to the trend towards electrification and declining grades and declining production due to lower head grades, long build times, and the fact that most projects need at least $4.25/lb to be worth building given their high capex.

Copper Supply/Demand Picture (Wood Mackenzie Research)

In terms of the deal, Agnico Eagle has subscribed for 50% of the project for $290 million, or $580 million when including its first half of project costs. Teck will benefit from Agnico’s mine-building and operating experience in Mexico while Agnico will benefit from Teck’s base metals expertise and marketing leadership. Given the relatively modest capex on a shared basis (~$500 million) and sharing the project, this does not disrupt Agnico’s capital allocation plans (dividend & buyback plus aggressive portfolio-wide exploration), nor does it disrupt its organic growth plans.

Like most deals in the sector, each one draws criticism. However, I see this deal as a great move, given that it is not easy to find projects with these economics in the gold sector. This project offers high single-digit production growth attributable to Agnico on a gold-equivalent basis at Fosterville-like cash cost margins over 15+ years. In fact, on an attributable basis over the mine life, the cash cost margins would be over 80%, equivalent to producing gold at cash costs of less than $250/oz (Agnico’s current cash costs are ~$800/oz).

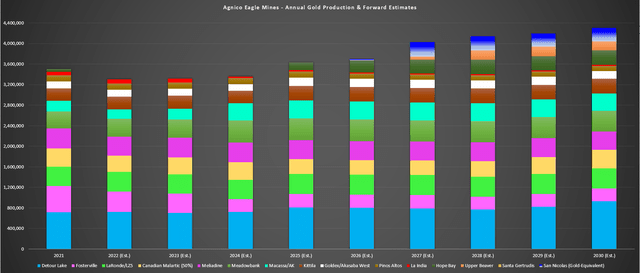

Agnico Eagle Mines – Current Production & Forward Production Potential (Company Filings, Author’s Estimates & Chart)

Based on the current schedule, the hope is to see the first production in 2026, with the first full year of commercial production likely to be in 2027. The contribution from San Nicolás is shown in the bar’s blue/white gradient area, and contribution from this asset, combined with growth at Macassa/Amalgamated Kirkland (#4 Shaft) and Hope Bay coming back online, could push Agnico’s production to ~3.9 million ounces in 2027. Assuming the company can add additional ounces in the Kirkland Lake Camp (Upper Beaver, existing Holt Mill, Upper Canada) and leverage off existing infrastructure in the area, there’s a path to ~4.0 million ounces by 2028 potentially.

Just as importantly, this project will pull down consolidated costs for Agnico at a time when many other producers are struggling to keep costs below $1,275/oz, with Agnico potentially having paved a path to maintain sub $1,000/oz costs. I believe this makes Agnico Eagle stand out relative to its peer group, with up to 20% production growth this decade at lower costs, as it benefits from lower unit costs due to economies of scale at Macassa, higher throughput at Detour, and the possibility of lower costs due to by-product credits at Upper Beaver, in addition to San Nicolás. If we look elsewhere among the 3.0+ million-ounce producers, it’s much harder to find growth, meaning Agnico is a nice combination of growth & value, which we’ll discuss later.

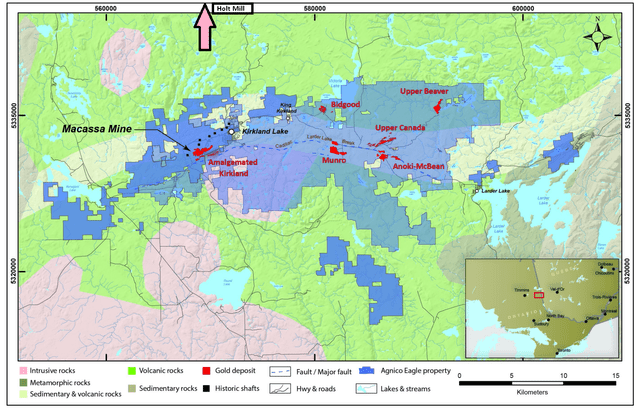

Kirkland Lake Camp – A New Complex (Company Presentation)

Overall, I see this deal as very positive, given that it is consistent with Agnico’s risk-averse growth strategy and ensures it doesn’t pay for growth at any price as some other producers have in the past couple of years. In fact, this deal is a very nice deviation from the deals we saw in the past cycle for gold in the 2007-2012 period, which were major acquisitions done near the top of the cycle with massive capex bills, and high prices paid. In many cases, these projects required high metal price assumptions to work. In the case of San Nicolás, this project works even at $2.75/lb copper, given its margins, with five times the copper-equivalent grade of other development projects globally.

So, when it comes to marrying the strengths of both companies and sharing the capex risk, I think this is a model that could be embraced by the market. It allows the companies to add growth in a period of extreme pessimism without any share dilution and with limited risk due to partnering. Hence, I think this was an A+ deal by Agnico Eagle, even if it’s something I would never have expected.

A Long-Term Track Record Worth Betting On

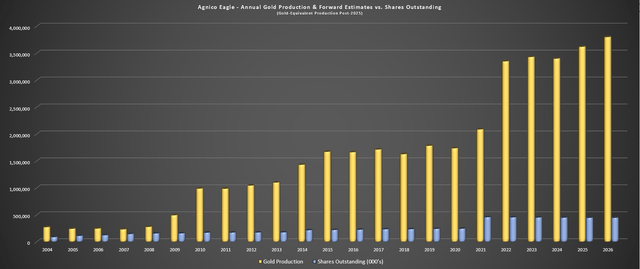

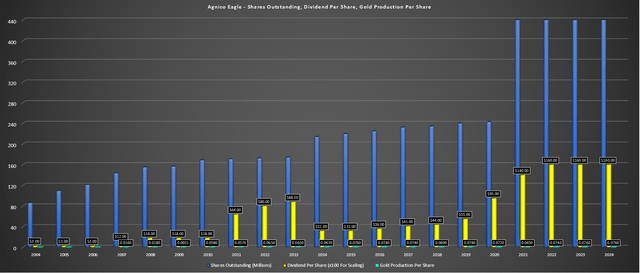

If we look at the charts below, we can see that Agnico Eagle has arguably the best track record sector-wide among its peers, growing from one mine in 2005 (LaRonde) to 11 mines today without sacrificing on jurisdictional risk and with relatively low share dilution. This is evidenced by the fact that Agnico Eagle has grown production from ~271,000 ounces in 2004 to ~3.30 million ounces in 2022 (1100% growth), while its share count has increased from just ~86.0 million shares to 455 million shares. The result is an industry-leading production growth per share rate, and if a company is not growing production per share, it is better to hold the physical metal itself.

However, it’s important to note that this growth from 0.022 ounces of gold production per share held in 2005 to 0.074 ounces in 2022 does not do this figure justice. The reason is that Agnico has another 1.0+ million ounces bought and paid for within its portfolio without the need for any additional share dilution, suggesting significant further production per share growth on deck. In fact, production growth per share could accelerate, with the company recently approving opportunistic share buybacks as a new tool to return capital.

The 1.0+ million ounces of growth in the tank is related to organic growth at Detour Lake, Meliadine, and Macassa/AK, as well as Hope Bay (permitted, pat producer, infrastructure in place), Upper Beaver (advanced-stage, benefits from regional infrastructure), Santa Gertrudis (low-capex growth), and San Nicolás (advanced stage, now shared with Teck).

Agnico Eagle Mines – Shares Outstanding & Gold Production + Forward Estimates (Company Filings, Author’s Chart) Agnico Eagle – Production Growth Per Share, Dividend Per Share, Shares Outstanding (Company Filings, Author’s Chart)

Digging into the second chart, we can see that while Agnico’s production growth per share has been phenomenal, its dividend growth rate has rivaled that of Dividend Champions, which is especially impressive for a stock in a cyclical industry. The company’s annualized dividend has grown from $0.03 per share in 2004 to $1.60 in FY2022, a ~24% compound annual growth rate that is in line with Apple (AAPL) and only just behind that of Starbucks (SBUX) since they began paying dividends in 2010 and 2012, respectively. In fact, Agnico has consistently paid a dividend since 1983 and is a clear outlier in the sector.

Finally, it’s important to note that Agnico Eagle has been very disciplined when it comes to allocating capital. While its share count grew quite rapidly during its high-growth phase, it made very modest bets in early-stage stories to build itself into the company it is today. These bets have paid off multiple times over, with approximately ~$3.0 billion spent on acquisitions (Riddarhyttan (Kittila), Pinos Altos, Cumberland (Meadowbank), Meliadine, Grayd (La India), Malartic (50%), Upper Beaver/Hammond Reef). Many of these assets have already been in production for nearly a decade and have generated considerable free cash flow, and sporting a combined estimated net asset value of more than $8.5 billion.

This is the definition of creating shareholder value in a sector where this has not been the norm. The latest move by Agnico to make a low-risk bet in a jurisdiction where it’s successfully operated for years is consistent with this history of disciplined capital allocation. Just as importantly, its track record lets investors sleep easy at night knowing that this is a team that doesn’t make aggressive, stupid, or risky bets. Instead, the company is laser-focused on paying/growing dividends, returning additional capital, and steadily and sustainably growing its business.

Valuation

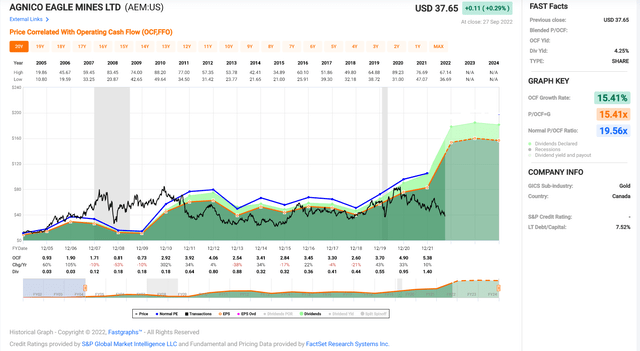

Despite this glowing track record and what looks to be a boost to the medium-term production profile (post-2025) at very attractive margins, Agnico Eagle trades at a massive discount to historical multiples. This is evidenced by the fact that it has historically traded at ~19x cash flow due to its disciplined growth profile, Tier-1 jurisdictions, and industry-leading margins. It currently trades at just ~7.1x FY2023 cash flow estimates, which assumes a $1,680/oz gold price, which I consider a very conservative assumption. Notably, the current multiple is below Q3 2015 levels at the stock’s bottom, when gold was below $1,100/oz, and margins were relatively non-existent.

AEM Historical Cash Flow Multiple (FASTGraphs.com)

In my view, this valuation disconnect is completely nonsensical and has arguably opened the best buying opportunity in Agnico Eagle in the past decade. This is because the company could easily command a cash flow multiple of 12.0 given its more diversified portfolio, peer-leading growth profile, low jurisdictional risk (Australia, Canada, Finland, Mexico), industry-leading margins, and industry-leading GHG emissions (lowest among peers). However, this cash flow multiple doesn’t capture growth waiting to come online, which I’ve discussed in previous updates, and from a P/NAV multiple perspective, I see a fair value for AEM above US$70.00 per share.

For readers interested, I have discussed Agnico’s growth opportunities in previous updates below:

Summary

The best time to buy is when blood is in the streets. While it’s certainly not popular to invest in the sector, being a contrarian can pay off, assuming one can stick to the highest-quality names with blemish-free track records.

Within the gold sector, I see the premier pick as Agnico Eagle, given that it’s a business that’s been run conservatively under CEO (now Chairman) Sean Boyd and continues to be under new CEO Ammar Al-Joundi. Given the significant valuation disconnect, I have continued to build my position and see the stock as a Strong Buy at current levels. Additionally, given the recent deal with Teck and continued exploration success across all jurisdictions, I remain more confident in the team’s ability to grow at a rate well above its peer group.

Be the first to comment