DUOBLA M MARCIN MALEK /iStock Editorial via Getty Images

Introduction

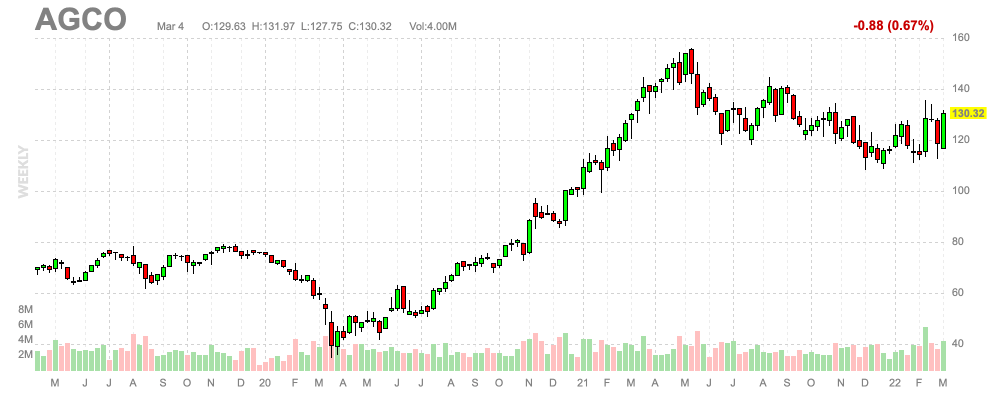

I’m guilty of ignoring AGCO Corp. (AGCO) since July of 2021 when I wrote my most recent article covering this agriculture giant. Since that article, the stock has gone sideways with some volatility as the market has been hit by a wave of uncertainty from high inflation, the Fed’s (expected) response, and the escalating war in East Europe. Yet, AGCO continues to be in a good spot. While supply chain issues could remain persistent, we see that crop prices are exploding, hence providing fertile ground for new equipment purchases. In this case, AGCO sells some of the world’s most popular tractor brands and equipment for grain storage and protein production. In this article, I will dive into the numbers and explain why I like the stock as a long-term investment.

So, bear with me!

Agriculture Bull Market

The western agriculture industry is dominated by three companies. Number one is Deere & Company (DE) with a market cap of $116 billion. It owns the Deere brand and smaller brands that complement its agriculture products. Like the German Kemper company, which builds headers for forage harvesters. Number two is CNH Industrial (CNHI). This American/Italian company owns Case IH, New Holland, and the smaller Steyr brand. The third player is AGCO ($9.6 billion), which owns Massey Ferguson, Fendt, Valtra, and Challenger, as well as GSI, the grain bin (storage) company.

Generally speaking, this means that in times of increasing crop and food prices, there is a big tailwind for companies operating in this space. Right now, that is the case. What started as a bull market in 2020 based on returning demand after lockdowns have turned into a gut-wrenching bull market that risks sending billions (not millions) into food insecurity.

On Friday, March 4, I covered these issues in my daily newsletter. Basically, because Ukraine is a key producer of wheat, corn, sunflower (seeds), and other crops, we’re dealing with steep increases in prices. Chicago CBOT Wheat futures (graph below) are trading at an all-time high!

TradingView

Because of the war, exports cannot leave Ukraine, and planting season is in danger because of labor shortages (men are being drafted), fuel shortages, material shortages, and the fact that in some growing areas, there’s fighting going on.

This means even the 2023 supply is in danger.

On top of that, Russia halted fertilizer exports, which is causing prices to skyrocket even further as it hurts planting season on a global scale.

But for the sake of this article, please be aware that the agriculture bull market accelerated last year because of higher demand and higher fertilizer prices. The war only makes it much worse, but it didn’t cause the bull case.

Value In AGCO

The world needs food. Farmers are the ones who supply it. Since 2021, we have entered an entirely new environment as farmers were finally able to replace old equipment after years of subdued crop prices.

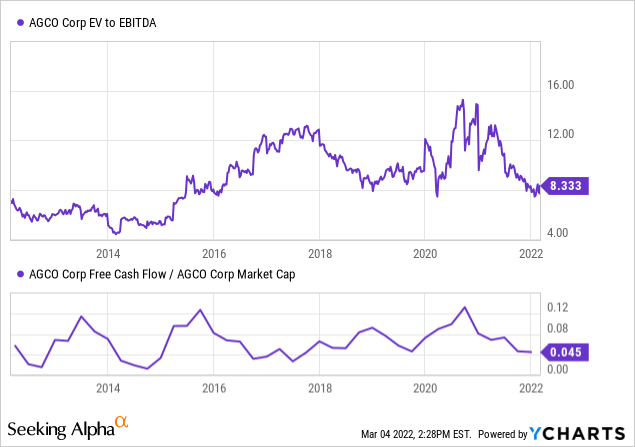

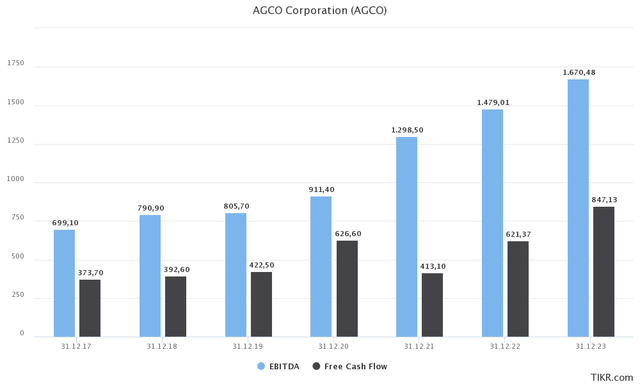

The graph below shows that the company is constantly increasing EBITDA and free cash flow, yet in 2021, it took things to a whole new level. The company did close to $1.3 billion in EBITDA. 2023 EBITDA is expected to reach $1.7 billion.

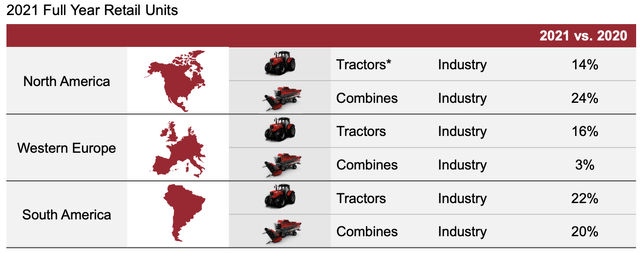

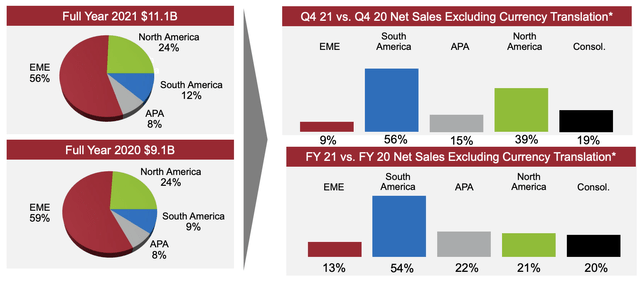

While this is partially due to inflation, the company did a great job exploiting a strong industry in 2021. Last month, the company reported its FY2021 numbers, showing double-digit retail units (excludes pricing) in all segments but Western Europe combines (harvesters). Especially South America saw strong growth, as countries like Brazil are expected to supply the world with soybeans when supply in the US is barely growing.

This is what 4Q21 and FY21 sales growth look like. These numbers basically combine unit sales growth as seen above and pricing.

In 4Q21, the company boosted its production hours by 24% and expects 5-10% production growth in 2022. In its smaller grain/seed/protein segment, the company saw 19% growth on a full-year basis. Longer-term, AGCO expects sales growth to remain high due to strong protein demand and demand for storage.

With that said, 2022 is expected to be strong. Management expects free cash flow to come in at $600 million. Analysts have established a consensus at $620 as my TIKR chart shows. This would imply a free cash flow yield of 6.5% based on the $9.6 billion market cap. That’s a big deal for a number of reasons:

- The company is expected to have only $300 million in net debt by the end of this year. That’s 0.2x EBITDA. 2023 net debt is expected to be negative (net cash). Hence, no need to focus on debt reduction.

- AGCO’s dividend yield is 0.6%, which means 6.5% implied FCF yield indicates a lot of room to hike the dividend.

- FCF is expected to increase further, it’s not just 1-2 good years.

Hence, on April 23, 2021, AGCO raised its base dividend by 25%. That resulted in the current yield of 0.6%. It’s not high and even longer-term hikes won’t give you a satisfying yield. However, the company used a special dividend to distribute cash. It announced a $4.0 special dividend. When adding that to 4x$0.20 per share in annual regular dividends, we get a yield of 3.7% based on a $130 stock price. That’s not too bad, is it?

With that said, I cannot promise anything, but I expect a special dividend in 2022 as well and frankly in any year that sees high demand. That would beat Deere’s 1.1% yield and make AGCO more attractive to investors who prefer dividends over buybacks.

Management expects to boost FCF in 2022 – as I already mentioned – based on 5-10% unit growth in North America, 5-10% unit growth in South America, and 0-5% unit growth in Western Europe. Pricing gains are expected to be close to 7-8%, which would protect the company against inflation. AGCO also expects market share gains.

So, what about the valuation?

Valuation

The company has a $9.6 billion market cap and it will have close to $300 million in net debt by the end of this year according to expectations. This gives us an enterprise value of $9.9 billion. That’s 6.6x 2022 expected EBITDA ($1.5 billion). Given the company’s historical valuation range, we can assume that this gives the stock close to 30-35% upside. Additionally, I calculated a 6.5% implied free cash flow yield. That, too, is not overvalued as it means investors are not overpaying to get access to the company’s free cash flow.

Takeaway

AGCO is in one of the strongest agriculture environments in recent history. The company benefits from high crop prices and a desperate need to increase global crop production. The stock went from less than $80 prior to the pandemic to almost $160 in 2021. Now, the company is bottoming and working its way to higher prices. I believe that the company has at least 30% upside potential due to its ability to generate free cash flow, high (expected) EBITDA, and a favorable valuation.

FINVIZ

The stock is not very suitable for dividend investors as the yield is low (0.6%) and while dividend growth will be very high, I doubt that most investors are willing to rely on special dividends.

For now, I believe that agriculture equipment producers will continue to do well. The risk/reward is favorable and I could see AGCO hit $170 this year – unless the economy enters a recession that hurts crop prices.

(Dis)agree? Let me know in the comments!

Be the first to comment