JamesBrey

Thesis: Selloff Creates 8%+ Yields

In the wake of the Bureau of Labor Statistics’ recent report that June 2022 CPI reached an astounding 9.1% year-over-year growth rate, it is more important than ever for income investors to find sources of high and reliable yield. With everything getting more expensive at a rapid pace, retirees and other income-seekers may want to find higher yields than they otherwise would in order to increase their portfolio income.

One source of 8%+ dividend yields are certain preferred stocks. Preferred equity commands higher seniority in the capital stack than common equity, though lower seniority than all forms of debt. That makes their yields safer and more reliable than the common stock dividends of the same companies.

Enter two preferred equity series of the retail-focused real estate investment trust, The Necessity Retail REIT (RTL):

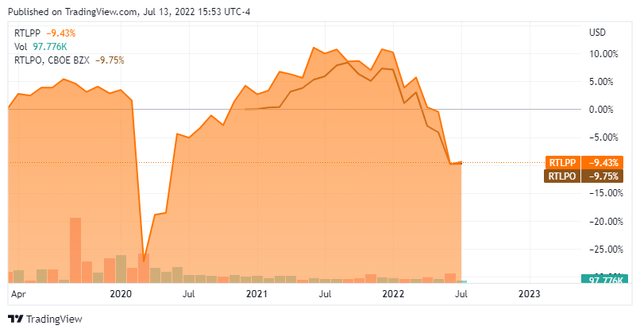

Both of these preferreds are trading nearly 10% below their $25 par value, which pushes their market dividend yields up above 8%.

Seeking Alpha

You might be tempted by RTL’s (the common shares’) sky-high dividend yield of 11.6%, but I would not recommend investing in RTL this way. The common dividend is by no means safe or reliable. After being flat for years, RTL cut its dividend the first month into the COVID-19 pandemic, exemplifying how ill-prepared the REIT was for any economic disruption.

As we’ll discuss below, however, the two classes of preferred shares offer a covered dividend that looks safe and secure. As such, the selloff appears to offer an excellent entry point for investors to capture 8%+ yields on top of 10% or more upside to par value.

Solid And Well-Covered Preferred Income

There are some companies wherein both the common stock and preferred stock are good investments. In other cases, neither make a good investment. But in some cases, the preferred stock makes a fine investment choice, while the common stock should be avoided.

RTLPP and RTLPO are in that third category, in my opinion.

For more information about why the common shares (trading under the symbol RTL) are a dangerous investment liable to generate poor returns going forward, see my article on RTL from March 2022. In short, it comes down to severely misaligned interests between management and shareholders.

As the article explains, a large portion of management’s compensation is tied to equity issuance, which means that they are literally getting paid to dilute shareholders. Whether equity issuance produces accretive profit growth on a per-share basis does not matter.

Hence, we find that, since going public, RTL has turned in abysmal adjusted funds from operations (“AFFO”) per share results. Here’s AFIN/RTL’s history of AFFO per share over the years:

- 2016 AFFO/share: $1.22

- 2017 AFFO/share: $1.18

- 2018 AFFO/share: $0.98

- 2019 AFFO/share: $0.99

- 2020 AFFO/share: $0.90

- 2021 AFFO/share: $1.02

In the first quarter of 2022, despite absorbing part of a giant acquisition, AFFO per share was flat year-over-year at $0.24. That is despite total AFFO 24% YoY from $25.5 million to $31.8 million.

And even after cutting its dividend at the beginning of the pandemic, RTL’s payout ratio in Q1 2022 remained quite high at 87.5%.

At the same time, the retail real estate portfolio that supports both the common and preferred dividends appears to be performing well. The portfolio is made up of about 90% retail, 9% industrial/distribution, and 1% office properties. Occupancy in the multi-tenant segment increased to 87.6% in Q1 2022 from 86.8% in Q1 2021.

Moreover, when it comes to the safety of the preferred equity dividends, common equity issuance isn’t a bad thing. That is, while increasing common equity may make it more difficult to pay out the same common dividend per share, it does not directly make it more difficult to pay out preferred stock dividends, because preferred dividends must be paid first in any case.

What does erode the safety of preferred dividends is increased debt issuance, because interest on debt must be paid before either common or preferred stock dividends.

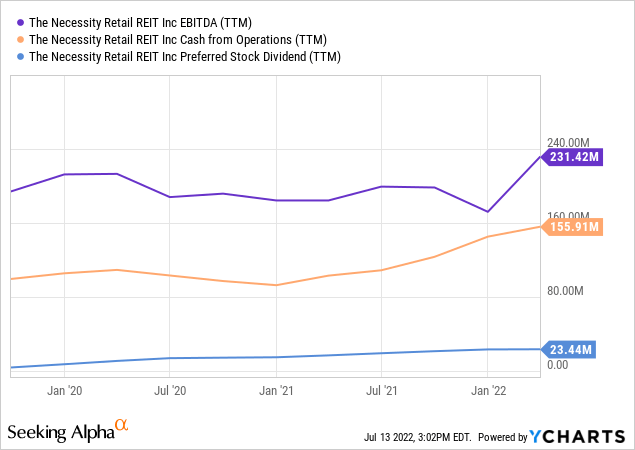

Fortunately for preferred shareholders, both operating cash flow and EBITDA are rising while preferred dividends are stable (because no new preferred shares have been issued recently).

This shows that the preferred dividends paid out by RTLPP and RTLPO remain well-covered and are becoming even better covered in 2022.

Here are some additional details about the two series of preferreds, with each one’s earliest possible redemption date on the far right.

| Par Yield | Current Yield | Redemption Date | |

| RTL Pfd Series A (RTLPP) | 7.5% | 8.5% | 3/26/2024 |

| RTL Pfd Series C (RTLPO) | 7.375% | 8.1% | 12/18/2025 |

As you can see, RTLPO offers a somewhat lower dividend yield, but one that is locked in for longer, as the redemption date is over a year and a half after that of RTLPP. Meanwhile, in exchange for only a little less than 2 years of guaranteed (or, at least, likely) income, RTLPP offers a higher yield.

The market appears to have sold off RTLPP and RTLPO (along with most other high-yielding securities) because the company carries a fairly heavy debt load. Net debt to EBITDA in the first quarter stood at a sky-high 9.4x.

As interest rates rise, interest expenses will rise with them and steadily crowd out dividend coverage. To illustrate this, RTL’s interest coverage ratio dipped slightly from Q4 2021’s 3.0x to Q1 2022’s 2.9x.

There are three pieces of good news for preferred shareholders:

- Rents are also rising at RTL’s multi-tenant retail properties, which should offset at least some of the increase in interest expenses.

- The common dividend for RTL would be cut before the preferred dividends for RTLPP and RTLPO would be. Thus, preferred shareholders would most likely be able to see it coming in advance if the preferred dividend became liable for a cut.

- Both series of preferred shares are cumulative, which means that the company is obligated to pay any missed preferred dividends in arrears. All scheduled dividends must be paid before the preferred shares can be redeemed.

Bottom Line

RTL looks to me like a classic yield trap. The 11%+ yield looks attractive, and the payout ratio of 87.5% makes it appear as though it is relatively safe. But between misaligned management incentives and the crowd-out effect of rising interest rates, that dividend suddenly appears much less safe.

Why gamble your hard-earned dollars on a dividend so risky? After all, if the dividend did need to be cut, it’s almost certain that the stock price would likewise decline, delivering investors a double whammy of poor returns.

The preferred stocks, on the other hand, offer both well-covered 8%+ dividend yields and over 10% upside to par value. One might gripe that investors lose the potential upside from solid performance of the real estate portfolio, but they also avoid the downside from poor financial performance due to management’s shareholder-unfriendly actions.

RTLPP and RTLPO are good buys for income investors looking to step up their yield game.

Be the first to comment