winhorse/iStock Unreleased via Getty Images

Marks and Spencer (OTCQX:MAKSY) has seen its share price perform well over the past year and a half, contrary to my expectations. Nonetheless I remain bearish on Marks and think its perennially strained business model is losing relevance.

The Company Outlook is Improving

First for the good news. At the half-year stage, the company provided an upbeat outlook for the remainder of the year. It said it was moving from the ‘fixing the basics’ phase of its transformation and is confident of its ability to drive shareholder value in the next phase.

It expects strong demand but also headwinds from inflationary cost pressure. However, it guided that absent any further pandemic disruption (which I see as a declining risk in the U.K. at this point), profit before tax and adjusting items for the year to be ahead of expectations and in the region of £500m.

Given the company’s £3bn market capitalisation is only six times that number, that sounds like the shares potentially offer good value, although of course the inclusion of “adjusting items” means that this figure has limited utility. After all, last year it reported a £41.6m profit before tax and adjusting items, yet on a statutory basis that amounted to a pre-tax loss of £201.2m. Those are very different numbers.

But Problems Continue to Dog Marks

For the past couple of decades, Marks seems to have gone through a never-ending cycle of “fixing the basics” and reorienting its business. On the positive side, it has a longstanding reputation for quality beloved of a national customer base in the U.K. But there have been significant challenges to its model, some though not all of its own making. I see these as threefold:

- The quality slipped. Marks used to manufacture mostly in the U.K. and had a rightly deserved reputation for quality at a decent value though not cheap pricepoint. It moved most manufacturing to low cost overseas bases, the quality fell and customers (many lifelong Marks loyalists) voted with their feet. This is a problem for the clothing not food business, but on the clothing side, Marks had an incredible market position and threw it away with a race to the bottom which arguable was avoidable.

- The business concept arguably makes little sense. The combination of food and clothing retail has always made little sense except to those who are used to it. Marks is not alone in this regard: French supermarket Monoprix and others do something similar. But I think this tension is central to Marks’ sidewards drift in the past two or three decades. A standalone food business could have been a Waitrose (and increasingly looks like it might yet be). A standalone clothes business might have had the right focus and done a better job preserving its strong market position. But the combination, with a large dose of arrogance, has meant in my view that the clothing business is in slow managed decline, and the company now sees the food business as its future without saying as much directly.

- The move from high street to online shopping. With its large high street estate, this has been and remains an ongoing problem for the company. It is addressing this, notably with the Ocado (OTCPK:OCDGF) tie-up on the food side. Still, a younger digitally focused generation of shoppers has failed to engage with the Marks brand in the way that the older generation did for most of the twentieth century.

I think this is heading to a slowburning existential crisis (although in fairness the same could have been said a decade ago – albeit in the decade from 2011 to 2021, revenue fell 6% and earnings per share fell from 38.8p to -10.10p). What is the point for Marks to exist? It is a pure retailer, not a manufacturer (unlike some U.K. competitors such as Morrisons) so essentially is a badge of quality and desirability, with a logistics operation to deliver that. But the quality has slipped, especially on clothing, in my subjective opinion, and the comparative quality is smaller than it used to be since competitors in the U.K. have dramatically raised the quality of their food products over the past twenty years. The desirability is also slipping in my view: younger customers seem far less engaged with Marks than earlier generations.

If Marks ends up as a brand, stamped on outsourced manufacturing and sold increasingly through outsourced channels such as Ocado, that is a viable business model in my view. It has been growing its standalone food outlet estate, but increasingly I see M&S as a brand more than a shop operator. That is a different business model to the historical Marks, and one with far less proven ability to generate substantial, sustainable profits.

Valuation Looks Overblown to Me

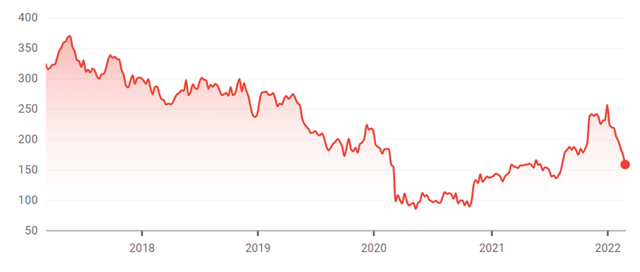

The last time I wrote about Marks was in June 2020, with a bearish note Marks And Spencer: A SWOT Analysis. Since then, the shares have confounded my rating and increased 58%. In the first week of this year, they were as high as 158% above their price when that note was published. Apparently my previous bearishness was not vindicated by market movements. What happened?

Last year, revenue declined for the third consecutive year and profits fell for the second consecutive year, pushing Marks to a sizeable (£201m) post-tax loss. The dividend was slashed in 2020 before falling last year fell to zero and remaining suspended at the interim stage this year. So in terms of business performance, it is hard to understand drivers for the share movement over the past couple of years. But undeniably, a 158% increase suggests that my bearishness was either wrong or mistimed (which amounts to the same thing), unless the market has made a massive mistake in valuing Marks, which I doubt.

Source: Google Finance

Depending on what the “adjustments” turn out to be, Marks (or Markies as it’s known in Aberdeen) is currently trading on a P/E ratio in the mid single digits to low teens. That sounds attractive, but I think this is a cigar butt. In the long-term, revenues and earnings have been going the wrong way. The clothing and homewares business has an uncertain future, while on the food front the company is in a hotly competitive market which could lead to growing profit margin pressure in the coming years, as we have seen in the U.K. supermarket space over the past twenty years or so. For that reason, I remain bearish on Marks and Spencer.

Be the first to comment