lindsay_imagery

Today’s analysis pertains to market anomalies and momentum in particular. Managing portfolios based on anomalies require a market participant to observe investors’ behavior instead of assessing a security’s underlying entity. Although anomalies are effective, they can go very wrong, which is why we spend countless hours doing anomaly-based research for ourselves and our readers.

We stumbled upon an ETF that we believe provides lucrative prospects due to its evidence-based methodology. The Virtus Terranova U.S. Quality Momentum ETF (NASDAQ:JOET) is an investment vehicle that utilizes additional factors to enhance the total return prospects of its momentum-based portfolio. In our opinion, this exchange-traded fund (“ETF”) could deliver stunning risk-adjusted returns over the long haul; here’s why.

The Fund’s Methodology

Virtus Terranova U.S. Quality Momentum ETF leverages a long-only cross-sectional momentum strategy by incrementally seeking the top 250 momentum stocks within the S&P 500 (SP500). The fund’s mandate takes matters a step further by reducing its long positions with a “quality overlay.” Its quality overlay seeks companies with robust financial statements by tracking metrics such as return on equity, CapEx, EBITDA margins, and debt-to-equity ratios.

Virtus Terranova U.S. Quality Momentum ETF’s management team believes it can phase out momentum crash risk by adding a quality factor to its stock selection. It emphasizes assets secured by high return on equity, low debt-to-equity, and significant sales growth.

Theoretical evidence indicates that Virtus’ strategy is cutting-edge with a reasonable basis. A big concern about the momentum anomaly is a crash risk, and analysts believe “quality stocks” possess non-cyclical traits, allowing them to outperform the market over multiyear periods.

Relative Performance

Continuing our discussion with quantitative evidence displays the effectiveness of Virtus Terranova U.S. Quality Momentum ETF’s strategy.

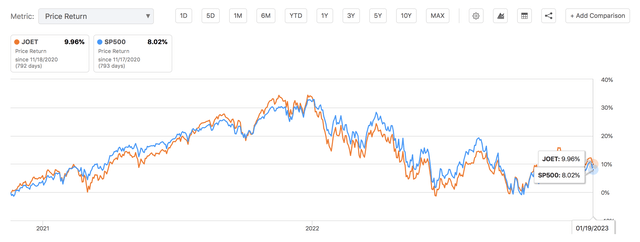

The ETF has outperformed the S&P 500 since its inception. More importantly, the ETF faced volatile markets during its tenure, with a substantial bull market followed by an abrupt bear market putting it to the test. Yet, it displayed robust results.

Performance Vs. S&P 500 (Seeking Alpha)

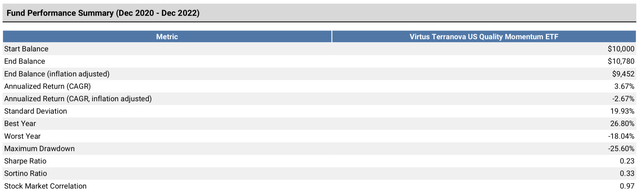

Furthermore, the ETF’s risk attribution paints a stunning picture. Emphasizing its positive Sortino Ratio (of 0.33) shows that the vehicle copes with bearish volatility. In addition, its positive Sharpe Ratio (of 0.23) illustrates its excess return potential during bull markets.

Author in Portfolio Visualizer

Lastly, the Virtus Terranova U.S. Quality Momentum ETF has a positive information ratio and negative kurtosis. The prior suggests “managerial skill” is high, while the latter implies that the ETF’s return distributions are low-risk.

Although the ETF’s risk metrics are sound, we consider its negative skewness a critical risk as it illustrates potential excess drawdowns in bear markets.

Author in Portfolio Visualizer

Portfolio Constituents

Virtus Terranova U.S. Quality Momentum ETF tracks the Terranova U.S. Quality Momentum Index, meaning the metrics in exhibit 1 should not be confused with the S&P 500’s.

Collectively speaking, the ETF hosts solid constituents, which is to be expected with its mandate. The vehicle is diversified into various sectors, diluting idiosyncratic risks.

Our birds-eye opinion says stocks such as Freeport-McMoRan (FCX), Broadcom (AVGO), D.R. Horton (DHI), and Charles Schwab Corp. (SCHW) might all rebound this year amid their alluring dividends and compressed technical levels. Yet, further research is required on individual constituents, which stretches beyond the scope of today’s analysis.

Dividends & Expenses

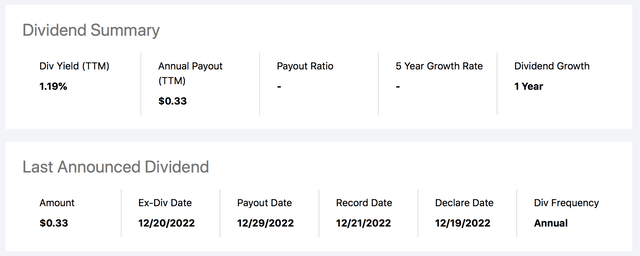

The ETF’s dividend yield is slightly underwhelming. However, readers need to consider that it is a relatively newly listed fund, and dividend distributions could increase in due course as the ETF’s constituents are typically total-return assets instead of price-return pure plays.

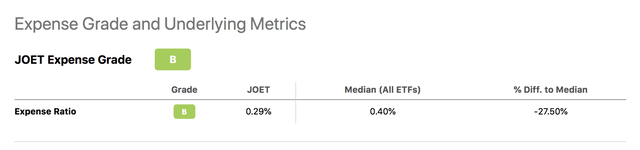

In terms of cost, Virtus Terranova U.S. Quality Momentum ETF’s expense ratio is in sound territory. Regardless of its expense ratio, the ETF provides access to a broad range of securities at a lower cost than you would incur by investing in each security yourself.

Risks

Virtus Terranova U.S. Quality Momentum ETF’s technical approach has several limitations, attaching risk from an investors’ vantage point.

Firstly, the ETF follows a technical approach, neglecting the importance of idiosyncratic risk, especially concerning qualitative risk. In essence, the ETF does not consider important events that could deter the trajectory of its constituents.

Furthermore, the Virtus Terranova U.S. Quality Momentum ETF assumes a retrospective approach. Although its cross-sectional methodology is evidence-based, metrics such as ROE, Debt to Equity, and Sales growth are cyclical. Therefore, a time-series forecasting strategy would have been more productive in ensuring the ETF’s constituents’ key metrics are sustainable.

Final Word

We are firm advocates of momentum crash-risk reduction by employing a quality overlay. The Virtus Terranova U.S. Quality Momentum ETF’s retrospective performance illustrates its ability to outperform the market throughout various stages of the economic cycle. Moreover, key metrics imply that the Virtus Terranova U.S. Quality Momentum ETF is well-managed, with downside risk management being a key feature.

Be the first to comment