Justin Sullivan

SoFi’s (NASDAQ:SOFI) shares soared 28% after the personal finance company submitted better than expected Q2’22 earnings and, despite continual pressure on the firm’s student loan originations, SoFi unexpectedly raised its guidance for FY 2022. SoFi also benefited from strong customer acquisition momentum in Q2’22 that resulted in 450 thousand new members joining SoFi’s ecosystem. With growth remaining this resilient after the pandemic and with the FY 2022 guidance seeing a nice raise, investors are getting a wake-up call that shares of SoFi have a lot more potential!

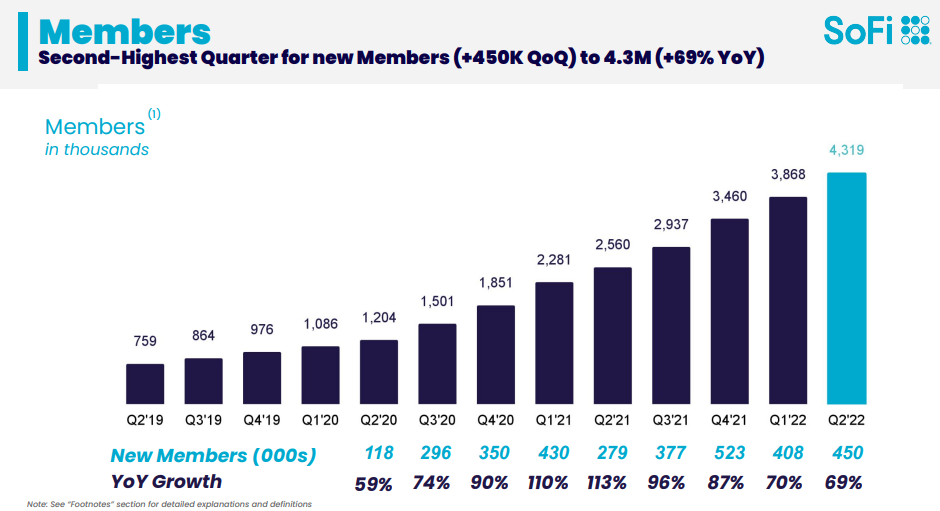

Momentum in member acquisition

SoFi benefited from strong customer acquisition rates in the second-quarter. SoFi acquired 450 thousand new members in Q2’22 which was the second most successful quarter ever for the personal finance company… only in Q4’21 did SoFi sign on a larger number of new members: 523 thousand. In the last twelve months, SoFi added an average of 440 thousand new member to its ecosystem each quarter (147 thousand monthly) and while growth is slowing down in a post-pandemic world, the absolute number of new members is rapidly increasing. This growth is due to SoFi achieving critical scale and growing from a much larger account base than just two years ago. SoFi’s member growth rate decelerated only slightly in Q2’22, dropping 1 PP to 69% quarter over quarter, showing that SoFi remains an attractive place for people to do their banking.

SoFi’s strong Q2’22 customer acquisition drove total members to a record 4.3M and the firm is well on its way to exceed my estimate of 4.7-4.8M members by the end of the year. Because of SoFi’s strong customer sign-up momentum, I am raising my estimate for the company’s member count from 4.7-4.8M to 5.0-5.2M by year-end.

SoFi: Q2’22 Member Growth

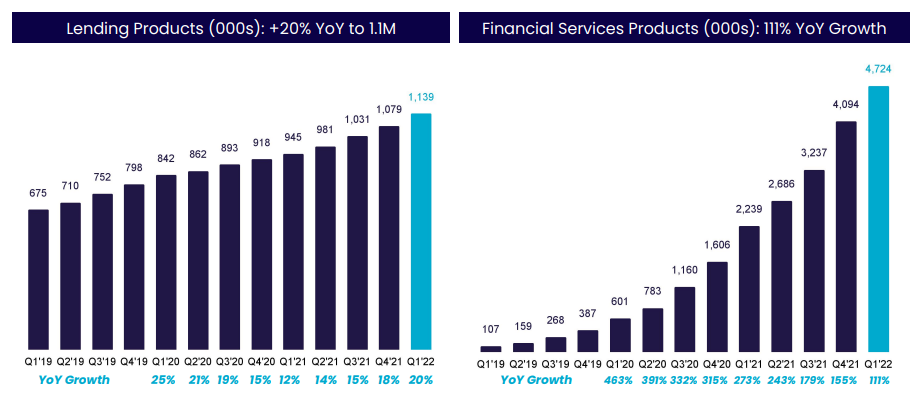

SoFi’s expansion was again driven by aggressive growth in the financial services/FS product category which has been a key driver for SoFi’s member sign-ups. Financial services products grew 111% year over year to a record 4.7M… and FS products grew 5.5 times faster than SoFi’s traditional lending products. While financial services products are key to attracting new members into SoFi’s ecosystem, traditional lending products continue to do well for the company: SoFi’s Q2’22 was the fourth straight quarter of product growth acceleration in the lending business.

SoFi: Lending/FS Product Growth

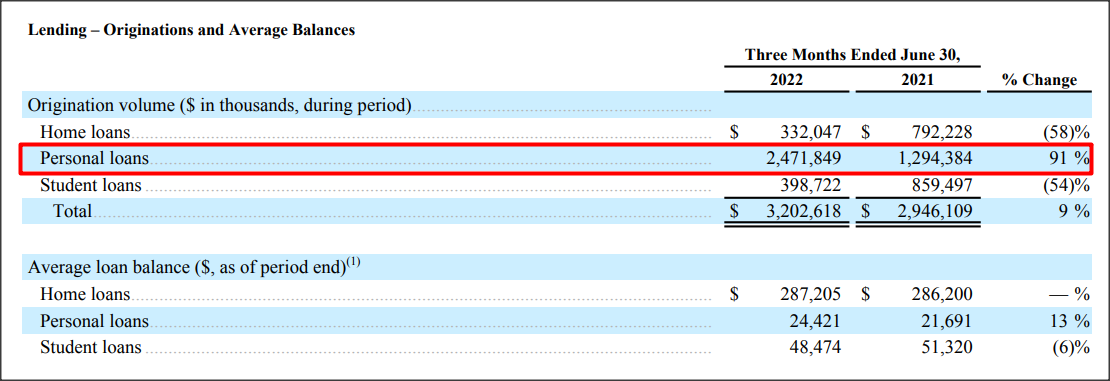

Loan originations

The extension of the Federal Student Loan Payment Moratorium in April has weighed on SoFi’s valuation in recent months since the company used to originate a large amount of student loans. With the extension of the Moratorium, however, the origination of student loans declined rapidly for SoFi. In Q2’22, SoFi’s student loan originations declined 54% year over year to $398.7M and the origination share dropped to just 12%. In FY 2021, SoFi originated more than $4.0B in student loans and had an origination share of more than one-third.

What helped SoFi to offset declines in student loan originations, however, were personal loans which saw 91% year over year origination growth to $2.47B. Q2’22 was the second consecutive quarter in which SoFi originated more than $2.0B in personal loans which helped the company keep its total origination volume above $3.0B.

SoFi: Q2’22 Origination Volume

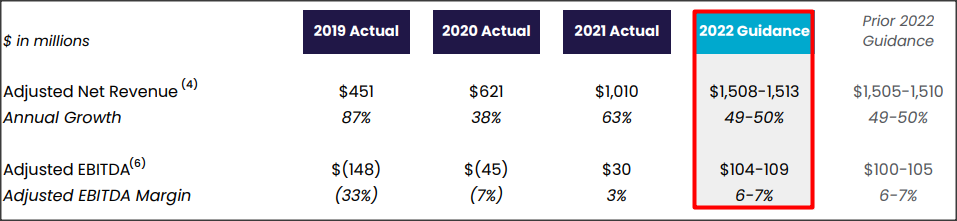

Raised guidance for FY 2022

SoFi’s finance platform generated Q2’22 revenues of $356M which compares favorably against a guidance of $330-340M. What is even more impressive than beating its own guidance, and which was unexpected heading into earnings, is that SoFi raised its guidance for FY 2022.

Previously, SoFi increased its second-quarter net revenue guidance to $1,505-1,510M, up from $1,470M. SoFi lowered its guidance in April in the wake of the extension of the Federal Student Loan Payment Moratorium which is weighing on student loan repayments and SoFi’s earnings. The Moratorium is expiring at the end of August and will likely again be extended by the current administration.

The new guidance for FY 2022 calls for net revenues of $1,508-1,513M, showing an increase of $3M, and adjusted EBITDA of $104-109M, showing an increase of 4M over the prior guidance.

SoFi: New FY 2022 Guidance

Why the market is right this time

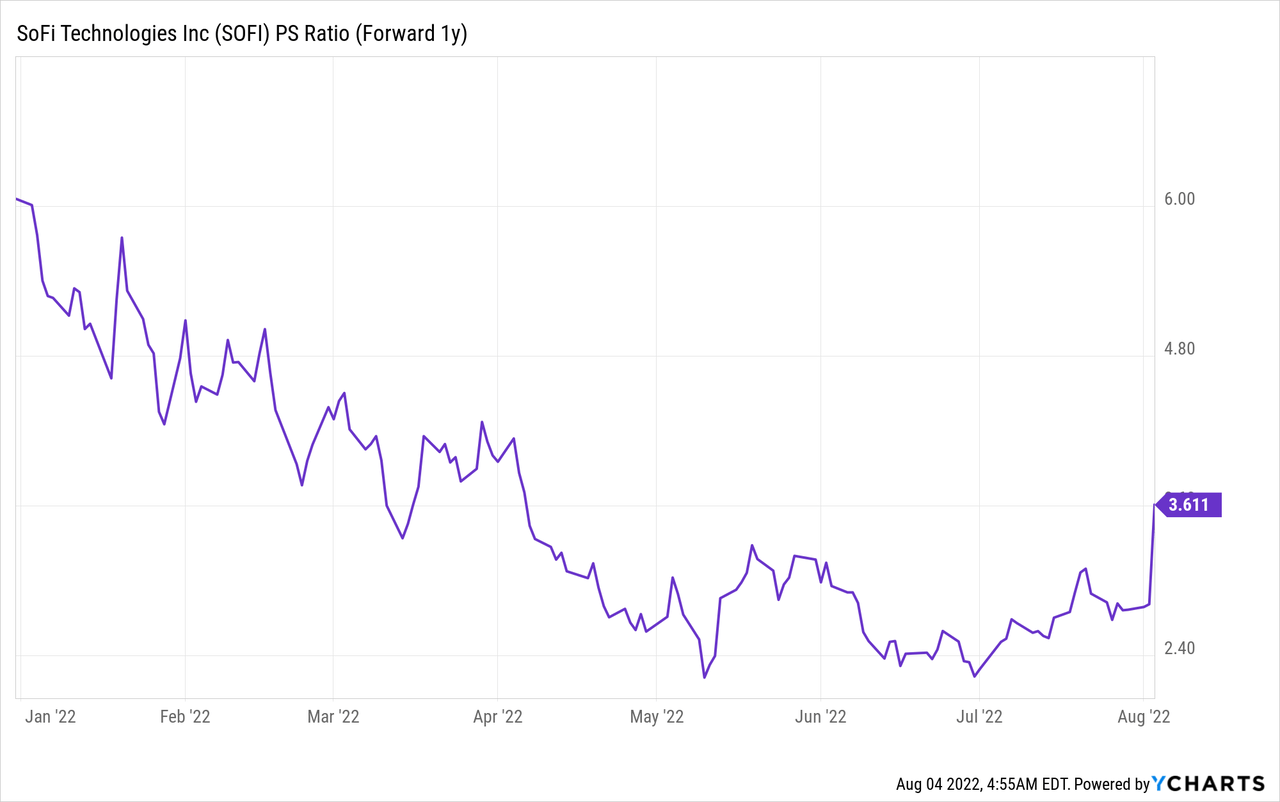

It is expected that SoFi will grow revenues to $1.51B in FY 2022 and $2.09B in FY 2023, implying top line growth rates of 49% and 38%. Revenue estimates may increase going forward since SoFi just raised its guidance. Additionally, the end of the Federal Student Loan Payment Moratorium and the restart of student loan repayments could drive a reevaluation of SoFi’s earnings prospects… which would likely be a catalyst for shares of SoFi as well. The 28% increase in pricing post-earnings acknowledges that the market is waking up to SoFi’s value offering it presents in the personal finance industry.

While not cheap at a P-S ratio of 3.6 X, investors pay for SoFi’s future growth potential. And with close to 5M expected users by the end of the year, SoFi could make a big impact in the personal finance industry going forward.

Risks with SoFi and other fintechs

The rate at which fintechs, including SoFi, are signing up new members is slowing down after the pandemic. However, in absolute numbers, SoFi is signing on more members to its platform than during the height of the pandemic, largely because SoFi is now operating from a much higher account base.

Going forward, slowing member and top line growth are still risks for SoFi and the stock. Additionally, the Federal Student Loan Payment Moratorium is likely to get extended again this month which indicates a continual delay in the repayment of student loans. While I believe this extension is already priced into SoFi’s valuation, the announcement of an extension may create negative sentiment overhang for SoFi in the short term.

Final thoughts

Shares of SoFi soared 28% after earnings and it was a wake-up call for investors to not discount SoFi’s growth prospects in a post-pandemic world. The personal finance brand continues to benefit from exceptionally strong customer acquisition rates, even without the pandemic boosting sign-ups, indicating a strong value offering for members. SoFi’s members continue to be attracted to SoFi’s increasingly dense product offering that includes all kinds of differentiated lending and FS products. Since the firm also raised its guidance, shares of SoFi have a lot more potential to revalue higher!

Be the first to comment