Just_Super/iStock via Getty Images

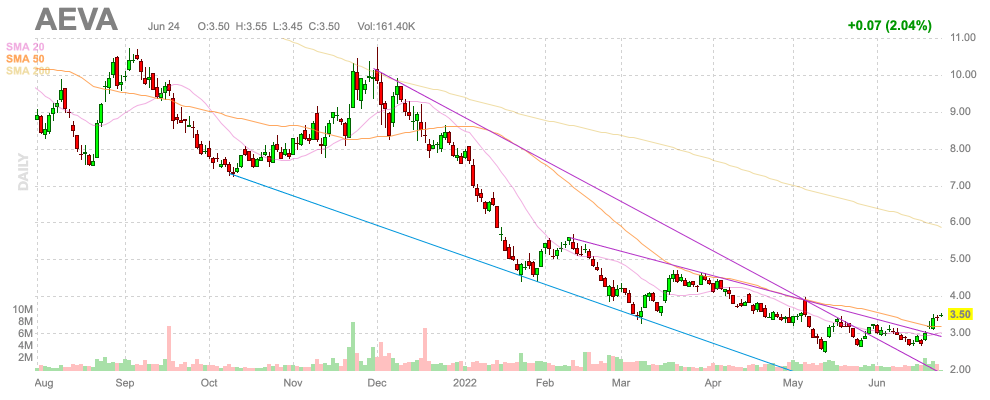

A lot of the Lidar sensor companies haven’t necessarily hit aggressive financial targets when completing SPAC deals, but nevertheless, the long-term business model remains on track. Aeva Technologies (NYSE:AEVA) remains a poster child for a company chugging along with building an impressive backlog for the future while not necessarily impressing with short-term numbers. My investment thesis remains Bullish on this Lidar sensor stock now trading at only $3.50 following the market retreat from unprofitable business models despite the ultimate promise.

FinViz

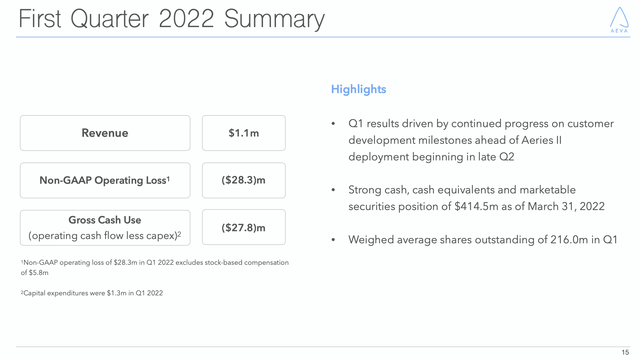

Meager Q1 Numbers

As expected, Aeva reported meager Q1’22 revenues at just $1.1 million. The company is in the process of Aeries II deliveries and ramping up production of 4D sensors similar to most business plans in the sector for production plans to start in the late 2022 or early 2023 timeline with full-scale projects launching in the 2024/5 timeframe.

The Lidar sensor company had operating losses of $28.3 million in the quarter, but Aeva has a cash balance of $415 million to fund operations for years. The whole plan from the start was to raise a lot of cash from the SPAC to fund development for years, but the market suddenly doesn’t like this business plan, or any business involving investing for the future.

With 216 million shares outstanding, the stock has a market cap in the $750 million range. The stock only has an EV in the $335 million range, but of course, Aeva will burn a substantial portion of this cash balance to reach positive cash flows from operations, possibly by 2024 and definitely in 2025 when auto OEMs launch advanced ADAS or autonomous driving programs requiring premium Lidar chips.

Heading Towards Scaled Production

The Aeries II chip provides a unique 4D Lidar on-chip solution delivering velocity measurements for every pixel with 500 meters of range and a resolution designed for automotive demands. The company plans its first deliveries during the current period leading to a launch of scale deployments later this year.

Aeva has deals with 2 vehicle companies including the announced Plus deal. The company didn’t provide much in the way of details on the Q1’22 earnings call other than confirming plans to announce both an automotive and non-automotive deal along with the un-announced production deal already in the bag. Back on the Q4’21 earnings call, Aeva CEO Soroush Salehian forecasted these additional deals to match the capacity size of the Plus deal:

Yeah. Sure, Pierre. So, first of all, as we talked about in the past quarters, so, Plus, of course, is one of the programs on the production side that we have converted, also undisclosed customer that we talked about last year, which we continue to make progress with and hitting our milestones with working through together through development into production. And so, it’s similar types of programs we’re talking about here in terms of programs towards production. And we’re planning to bring in additional two types of programs that are similar in this — similar capacity.

As a reminder, the Plus deal has plans for 100,000 vehicles to use the driver-in autonomous trucking solution by 2025. The PlusDrive solution would need to top 20,000+ units per year by 2025 while most Lidar sensor firms only sell thousands of sensors per quarter now, at most.

A few more similar deals announced will quickly change the financial equation here for this stock. Innoviz Technologies (INVZ) signed a deal with an automotive firm forecast at $4+ billion worth of backlog bringing the total backlog to $6.6 billion, so the deals proposed by Aeva appear very reasonable.

In addition, partnerships with the NVIDIA (NVDA) DRIVE autonomous platform, Nikon (OTCPK:NINOF) in industrial precision and NASA creating mobile terrain mapping tools provide another set of platforms to expand beyond direct automotive deals.

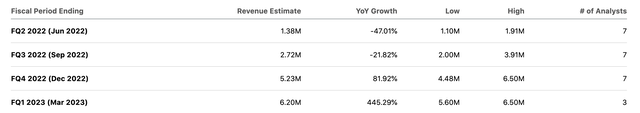

A big key to changing the valuation equation on all of these Lidar sensor stocks is a ramp-up in sales beyond these initial minimal levels. Sales nearly tripled in Q1’22 from last year, but the amount was down sequentially. Even the quarterly forecasts for the year don’t get Aeva to a materially higher plane until Q4 when revenues are forecast to finally top $5 million. After that, analysts still have 2023 numbers reaching just $33 million with massive growth in the years ahead.

Takeaway

The key investor takeaway is that as the backlog continues to build in sector stocks and revenue arrives as some initial production deals launch, the market will start becoming more friendly to the Lidar sensor stocks. Investors need to focus on process over perfection over the next couple of years. Results could easily be lumpy over this period with delays along the way, but ultimately the world is moving towards forms of autonomous driving and advanced safety products and Aeva will benefit.

Be the first to comment