svetikd/E+ via Getty Images

After its 2022 Annual Shareholders meeting, Shopify (NYSE:SHOP) approved a 10-for-1 stock split. I discuss the potential reasoning for the stock split as well as what shareholders can expect going forward. SHOP remains a shadow of its former self as decelerating growth rates have come at a time when the tech sector overall is crashing. While it is unclear if this stock split will alone be enough to catalyze an upward move in the stock price, the current valuation presents an attractive buying opportunity and is one I am taking advantage of.

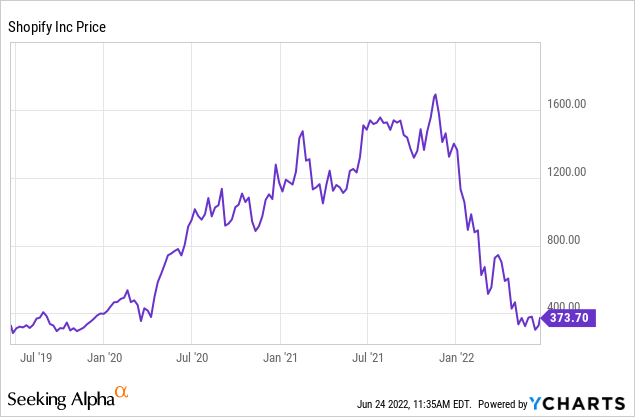

SHOP Stock Price

SHOP peaked above $1700 per share in late 2021 but most recently traded below $400 per share.

The stock has fallen so much that its pandemic gains have all but disappeared.

I last covered SHOP in February when I called it a strong buy on account of the long growth runway. My outlook hasn’t changed, but the 48% plunge since then has added multiple expansion potential to an already attractive value proposition.

SHOP Stock Key Metrics

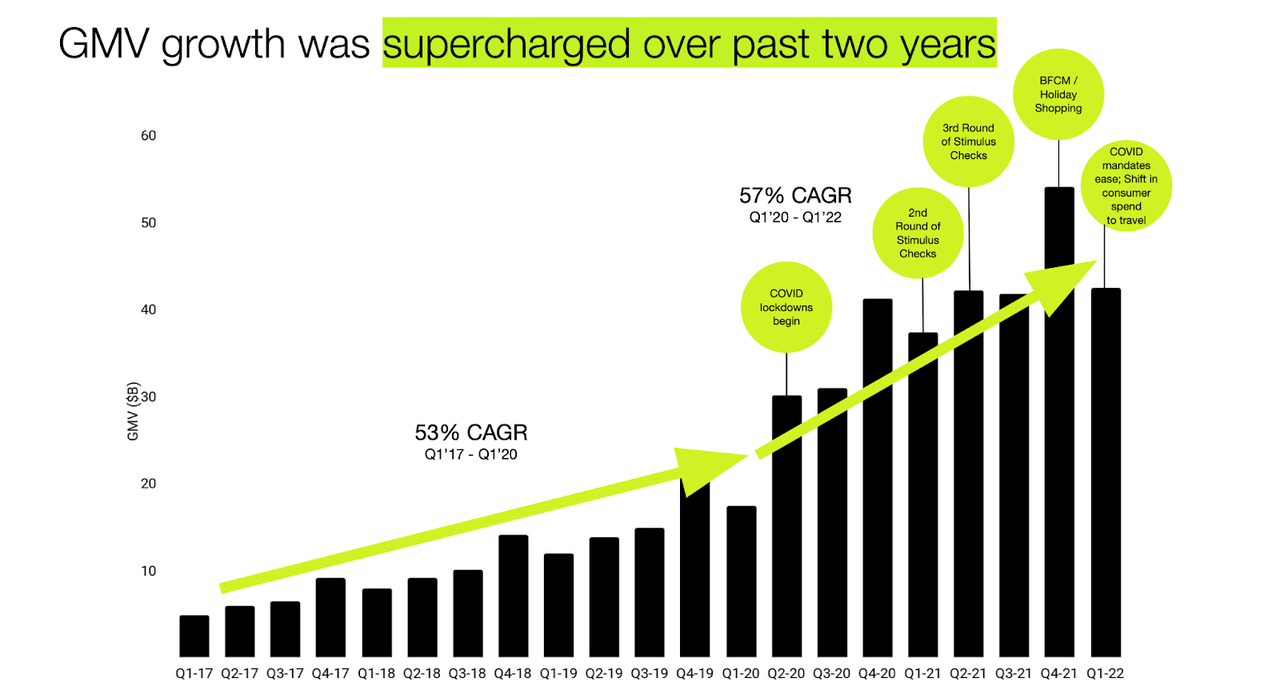

SHOP’s recent earnings reports have shown a steep deceleration in growth rates. As we can see below, SHOP was able to supercharge growth from 2020 to 2021, boosted both by the pandemic and stimulus checks.

2022 Q1 Presentation

It makes sense that growth is slowing down over the near term. It will take some time for the company to move past the strong results of the past two years.

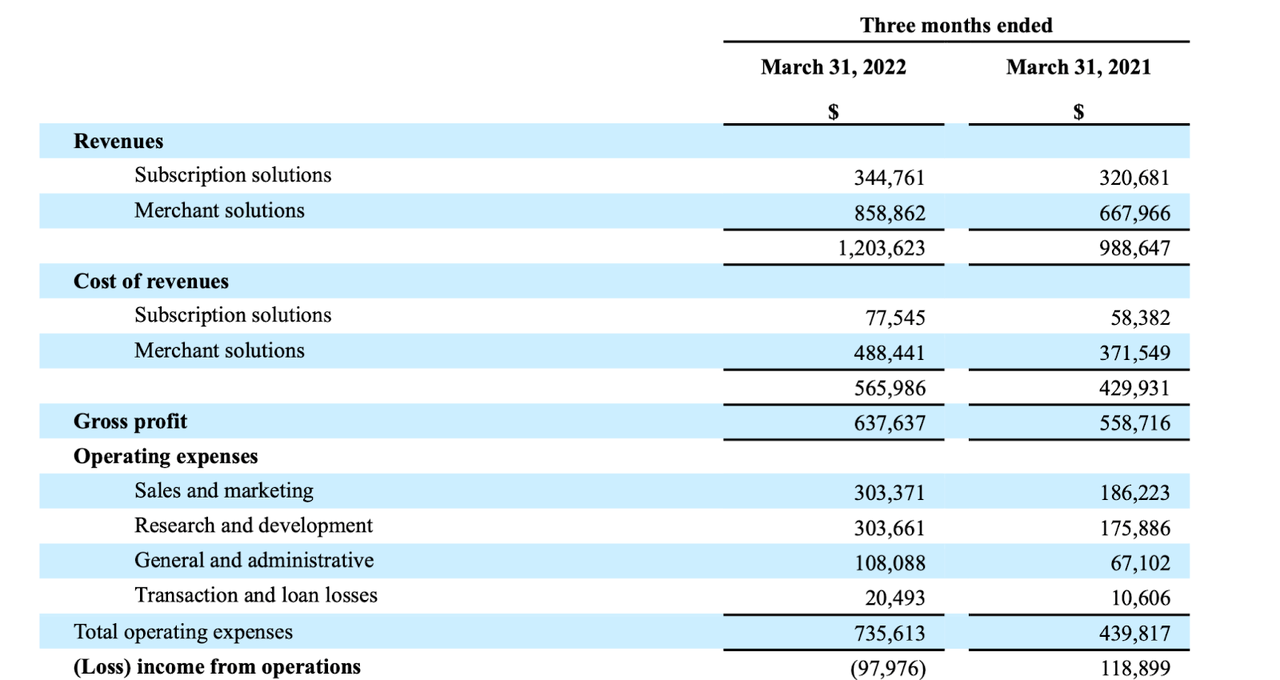

Total revenue in the first quarter grew 22% to $1.2 billion, which represents a two-year compound annual growth rate of 60%. I see many investors criticizing the company for the fact that profitability turned negative. Operating loss for the first quarter of 2022 was $98.0 million, or 8% of revenue, versus positive income of $118.9 million, or 12% of revenue, for the comparable period a year ago.

Ironically, I view the decline in profit margins to be highly bullish for shareholders over the long term. Think about it this way: these companies could either show profits now and distribute it to shareholders via share repurchases or dividends at a 2% to 3% yield. Otherwise, the company could reinvest profits into growth, which may enable it to sustain above-market annual growth over the long term. I have the view that the latter will create more value. We can see below that SHOP aggressively increased its fixed cost structure as R&D and S&M expenses went up significantly.

2022 Q1 Press Release

As of March 31, 2022, Shopify had $7.25 billion in cash, cash equivalents and marketable securities versus $900 million of 0.125% convertible notes (convertible at a price of $1440.09 per share). The stock is trading like it is an unprofitable tech stock with no path to profitability. In reality, this is a cash flow monster choosing to hide profits for the sake of creating long-term value. The best businesses in the world are the ones which can deploy large amounts of capital at high rates of return. Amazon (AMZN) has been one such business. SHOP is the only company in the world that can invest its capital into the Shopify business – that is a distinction that should be celebrated, not punished.

When Will Shopify’s Stock Split?

SHOP is set to split on June 28th. This will be a 10-for-1 stock split, meaning that shareholders will receive 9 additional shares on that day.

How Many Times Has Shopify Stock Split?

This is the first time SHOP has ever done a stock split.

What Is Shopify’s Outlook After The Stock Split?

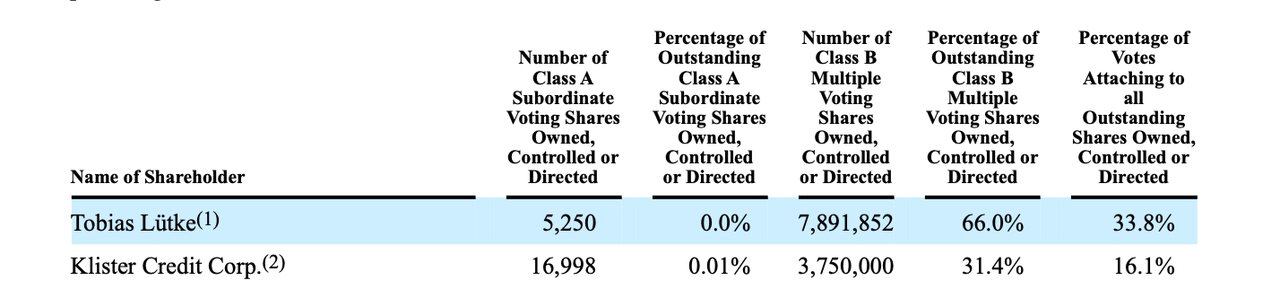

One question to ask is the purpose for the stock split. After the crash in the stock price, it is hard to believe that the stock will benefit from increased liquidity. Instead, this stock split appears to be done in order to ensure that CEO Lutke retains voting power. Here’s how it works.

Prior to the stock split, CEO Lutke owned 7,891,852 Class B restricted voting shares and 34,867 Class A subordinate voting shares, representing approximately 33.8% of the total voting power.

2022 Management Information Circular

After the split, CEO Lutke will also have one “Founder share” which, combined with his existing holdings, would give him 40% voting power.

There is a “sunset provision” which states that CEO Lutke would lose his founder share if his holdings drop below 2,367,556 shares, representing 30% of the amount of shares currently held. It appears that the point of the stock split is to allow CEO Lutke to sell as many as 5.5 million shares and still retain 40% voting power. This may confuse some investors because he had bought $10 million of stock just a month earlier.

Twitter

The key point to understand here is that the stock split gives CEO Lutke the flexibility to sell if he chooses, but there is no obligation to immediately sell. Moreover, CEO Lutke currently owns over $3 billion worth of stock – it is understandable that he would want to diversify his net worth.

Is SHOP A Good Long-Term Investment?

Over the long term, SHOP continues to cement itself as the most worthy e-commerce competitor to Amazon.

During the quarter, the company announced that it was acquiring Deliverr to accelerate its fulfillment plans.

2022 Q1 Presentation

That may have surprised some investors, but it was consistent with SHOP’s game plan of accelerating product rollout – this was also seen with SHOP’s partnership with Affirm (AFRM).

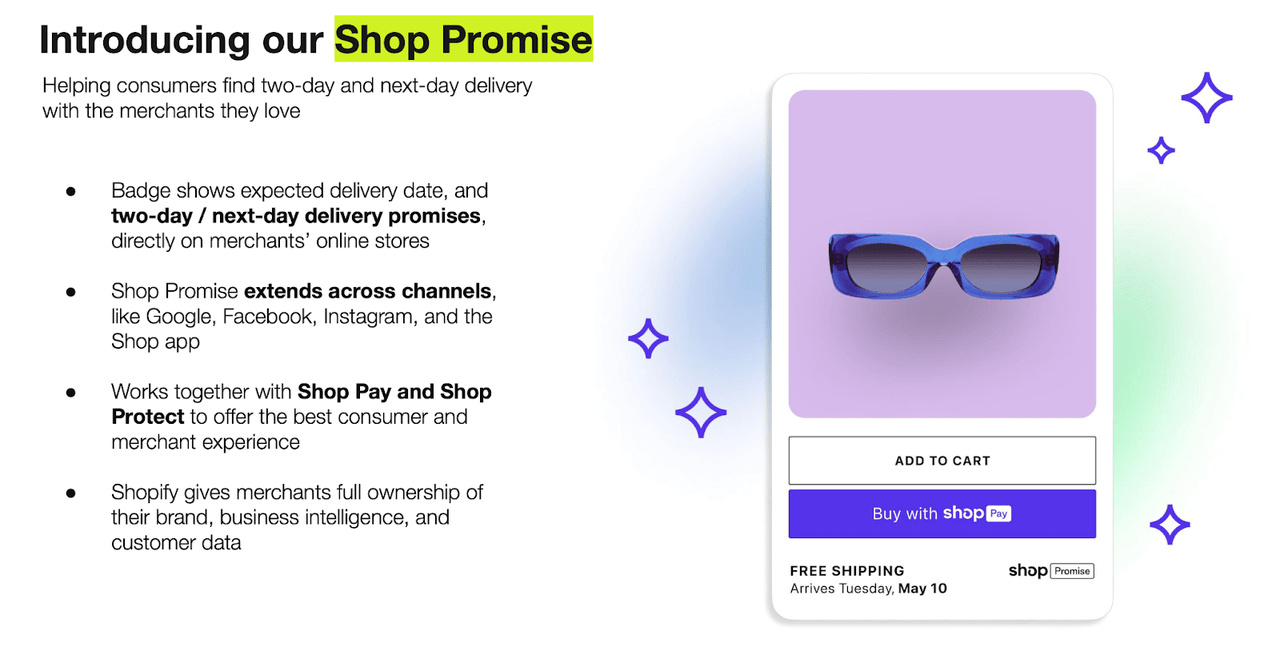

SHOP is rolling out “Shop Promise” which is its answer to Amazon Prime.

2022 Q1 Presentation

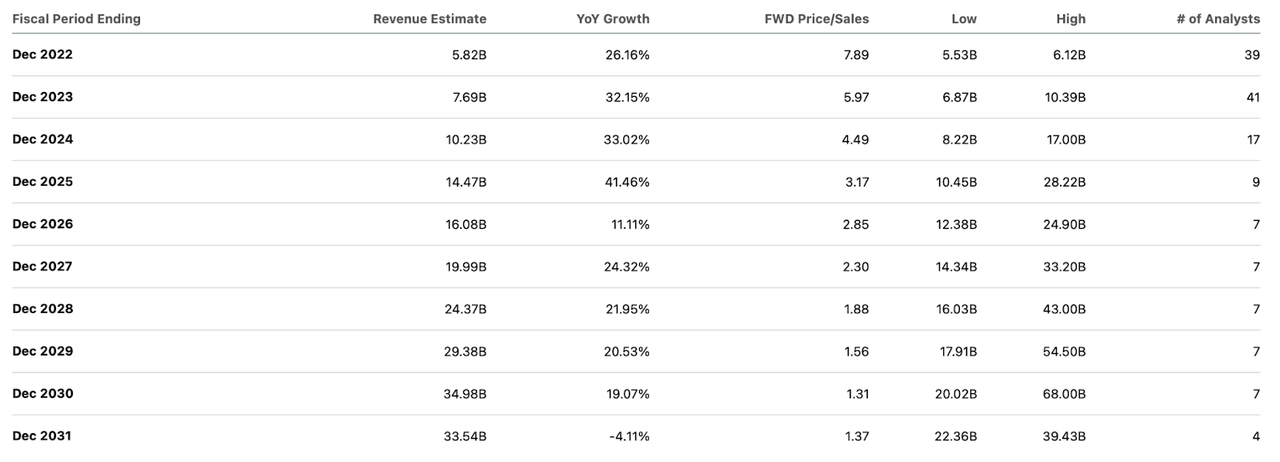

SHOP represents a legitimate threat to AMZN’s domination. Merchants have a love/hate relationship with AMZN because, on the one hand, it offers an efficient sales funnel, but on the other hand, it takes a huge 15% commission fee and oftentimes competes directly with its customers. SHOP on the other hand represents the “good guys” in that it empowers direct-to-consumer sales while only taking a 2.9% fee. Eventually, SHOP will create its own marketplace platform from which it could take much higher fees. SHOP continues to take market share in a growing e-commerce market – these trends help explain why consensus estimates call for robust double-digit growth over the next decade.

Seeking Alpha

Is SHOP Stock A Buy, Sell, Or Hold?

At recent prices, SHOP is now trading at around 19x gross profits. Even without the marketplace long-term opportunity, the stock is priced to deliver stellar returns. Yet I could see the average take rate rising to at least 6% over the long term as marketplace sales become more significant. Here’s an indication for what that could do to the bottom line. Based on 2021 results, SHOP might earn around $3 billion in incremental net income. The stock is currently trading at a $47 billion market cap. The stock is trading at 16x that $3 billion number – and this does not include any future earnings from simple operating leverage. SHOP is a name which should be among the leaders in any tech sector rally – in spite of not trading as cheap nor as risky as some peers. I could see SHOP earning at least a 70% long-term net margin based on gross profits. Assuming a 15% long-term growth rate and 1.5x price-to-earnings growth ratio (‘PEG ratio’), SHOP might trade at 15.8x gross profits in 2030. That represents a stock price of around $2,260 per share, or 25% compounded returns over the next eight years. Yet, as previously discussed, the long-term growth opportunity may be understated on account of the company’s marketplace ambitions. In the near term, economic recession remains a key risk. Consumer spending would likely decline in the near term which, coupled with SHOP’s increasing headcount, may lead the company to report operating losses for some time. The longer-term risk is if AMZN proves to be insurmountable. I am less concerned with risks from other e-commerce providers because I view Shop Pay as having a similar stickiness as PayPal. SHOP represents one of the lower risk – higher return opportunities in the market today and is a core holding in the Best of Breed portfolio. I rate shares a strong buy for long-term investors.

Be the first to comment