JasonDoiy

Investment Thesis

- Among Tesla’s (NASDAQ:TSLA) growth drivers are its strong brand image and high customer loyalty, its artificial intelligence and its culture of innovation, as well as its software and own supply chain.

- However, in my opinion, Tesla’s valuation is currently not attractive enough in order to receive my buy rating.

- My DCF Model calculates a fair value of $206.99 for Tesla. At the company’s current stock price of $207.47, this implies a downside of 0.2%.

- However, if you do decide to invest in Tesla, I would recommend to invest a maximum of 5% of your overall portfolio into the company due to the risk factors I describe in this analysis.

Tesla’s Competitive Advantages and Growth Drivers

In my opinion, Tesla has strong competitive advantages that serve as the company’s growth drivers. In the following, I will discuss some of these growth drivers:

Tesla’s strong Brand Image and High Customer Loyalty

As according to Brand Finance, Tesla is currently ranked 28th in the list of the most valuable brands in the world. The company’s brand value is estimated to be around $46,010M. When comparing Tesla’s brand value from 2022 with 2021 (which is $31,986M), an increase of 43.48% can be highlighted. I see Tesla’s high brand value as one of the company’s competitive advantages.

Tesla’s Artificial Intelligence and its Culture of Innovation

Tesla CEO, Elon Musk, mentioned that in the long run, people will think about Tesla not as a car company or as an energy company, but as an Artificial Intelligence [AI] company. In the field of Artificial Intelligence, Tesla is working on a wide range of projects: one of these projects for example, is Tesla’s supercomputer Dojo, which trains AI systems to complete complex tasks like Tesla’s driver-assistance system ‘Autopilot’. On Tesla’s previous AI Day, detailed technical explanations of the company’s work in this field were presented with the aim of attracting leading engineers. Another project of Tesla in the area of Artificial Intelligence is the Tesla Bot: the Tesla Bot aims to develop the next generation of automation: a robot that is able to perform tasks which are, according to the company, unsafe, repetitive or boring.

Furthermore, Elon Musk has established a company culture with a relentless focus on innovation. I expect Tesla’s Artificial Intelligence and its relentless culture of innovation to be an additional growth driver for the company over the next years.

Tesla’s Software and its Own Supply Chain

While General Motors (NYSE:GM) and Ford (NYSE:F), for example, had to close factories back in 2021, particularly due to a shortage of computer chips, Tesla was able to significantly increase its revenue in 2021 when compared to the previous year.

When Tesla was not able to get the necessary computer chips that it needed, it took the computer chips that were available and rewrote the software which operated them. In contrast to Tesla, larger automobile manufacturers were not able to do the same, since they were relying on outside suppliers for their software. In addition to that, other car manufacturers also relied on suppliers in order to deal with chip manufacturers.

I expect that Tesla’s software and its own supply chain will also be one of the growth drivers for the company in the years to come.

The Valuation of Tesla

Discounted Cash Flow [DCF]-Model

I have used the DCF Model to determine the intrinsic value of Tesla. The method calculates a fair value of $206.99 for the company. Its current stock price of $207.47 implies a downside of -0.2%.

In the calculation below, I calculated with a Revenue and EBIT Growth Rate of 25% for Tesla in the following 5 years and with a Perpetual Growth Rate of 4% afterwards. Despite the fact that Tesla’s Average Revenue Growth Rate over the last 5 years has been 42.46%, I prefer to make more conservative assumptions.

According to Beyond Market Insights, the Global Electric Vehicle Market will grow with a compound annual growth rate [CAGR] of approximately 22.5% between 2022 and 2030. I expect Tesla to grow at a higher growth rate than the Global Electric Vehicle Market due to its strong competitive advantages that serve as the company’s growth drivers.

My calculations are based on these assumptions as presented below (in $ millions except per share items):

|

Tesla |

|

|

Company Ticker |

TSLA |

|

Tax Rate |

11% |

|

Discount Rate [WACC] |

9.50% |

|

Perpetual Growth Rate |

4% |

|

EV/EBITDA Multiple |

44.3x |

|

Current Price/Share |

$207.47 |

|

Shares Outstanding |

3,158 |

|

Debt |

$5,874 |

|

Cash |

$19,532 |

|

Capex |

$6,514 |

Source: The Author

Based on the above, I have calculated the following results for Tesla:

Market Value vs. Intrinsic Value

|

Tesla |

|

|

Market Value |

$207.47 |

|

Upside |

-0.2% |

|

Intrinsic Value |

$206.99 |

Source: The Author

Internal Rate of Return for Tesla

Below you can find the Internal Rate of Return as according to my DCF Model assuming a Revenue and EBIT Growth Rate of 25% for the following five years and a Perpetual Growth Rate of 4% afterwards. I assume different purchase prices for the Tesla stock.

At Tesla’s current stock price of $207.47, my DCF Model indicates an Internal Rate of Return of approximately 9% for the company. (In bold you can see the Internal Rate of Return for Tesla’s current stock price of $207.47.)

|

Purchase Price of the Tesla Stock |

Internal Rate of Return as according to my DCF Model |

|

$160.00 |

17% |

|

$170.00 |

15% |

|

$180.00 |

13% |

|

$190.00 |

12% |

|

$200.00 |

10% |

|

$207.47 |

9% |

|

§210.00 |

9% |

|

$220.00 |

8% |

|

$230.00 |

7% |

|

$240.00 |

6% |

|

$250.00 |

4% |

|

$260.00 |

3% |

Source: The Author

Please note that the Internal Rates of Return below are a result of the calculations of my DCF Model and changing its assumptions could result in different outcomes.

Tesla’s Fundamentals

Tesla’s strong competitive position within the Automobile Manufacturers Industry is underlined by its high EBIT Margin of 16.66%, which is significantly higher than most of its competitors: while Toyota’s (TM) EBIT Margin is 8.07%, the one of General Motors is 8.17% and Ford’s is 7.03%.

When taking a closer look at Tesla’s Return on Equity of 32.24%, we discover that it’s higher than that of Ford (22.49%), General Motors (14.55%) and Toyota (10.15%), providing us with a strong indicator that Tesla is very efficient in using its shareholder’s equity in order to generate income.

However, Tesla’s P/E [TTM] Ratio of 61.32 is significantly higher than the one of General Motors (5.69) and Ford (8.19), indicating that the risk of investing in Tesla is considerably higher than the risk of investing in these competitors.

The relatively high risk factor when investing in Tesla supports my investment thesis to only invest a limited amount of your total investment portfolio in the company.

When it comes to growth, however, it can be highlighted that Tesla is superior in comparison to its opponents:

Tesla shows an Average Revenue Growth Rate of 47.41% over the last five years. In contrast to this number, the Average Revenue Growth Rate over the last five years of Toyota is 2.62%, the one of General Motors is -0.08% and Ford’s is -0.31%.

In addition to that, Tesla’s EPS Growth Rate Diluted [FWD] of 96.93% is far superior when compared to Ford (63.57%), General Motors (7.65%) and Toyota (3.87%). This strongly underlines that Tesla is able to raise its profits at a higher growth rate than its competitors.

|

Tesla, Inc. |

Toyota Motor Corporation |

General Motors Company |

Ford Motor Company |

||

|

General Information |

Ticker |

TSLA |

TM |

GM |

F |

|

Sector |

Consumer Discretionary |

Consumer Discretionary |

Consumer Discretionary |

Consumer Discretionary |

|

|

Industry |

Automobile Manufacturers |

Automobile Manufacturers |

Automobile Manufacturers |

Automobile Manufacturers |

|

|

Market Cap |

721.61B |

188.47B |

55.19B |

53.31B |

|

|

Profitability |

EBIT Margin |

16.66% |

8.07% |

8.17% |

7.03% |

|

ROE |

32.24% |

10.15% |

14.55% |

22.49% |

|

|

Valuation |

P/E Non-GAAP [TTM] |

61.32 |

– |

5.69 |

8.19 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

45.27% |

1.53% |

0.55% |

-1.33% |

|

Revenue Growth 5 Year [CAGR] |

47.41% |

2.62% |

-0.08% |

-0.31% |

|

|

EBIT Growth 3 Year [CAGR] |

334.55% |

0.66% |

13.31% |

24.95% |

|

|

EPS Growth Diluted [FWD] |

96.93% |

3.87% |

7.65% |

63.57% |

|

|

Dividends |

Dividend Yield [FWD] |

– |

– |

0.93% |

4.52% |

|

Dividend Growth 3 Yr [CAGR] |

– |

-18.15% |

-61.02% |

-9.14% |

|

|

Dividend Growth 5 Yr [CAGR] |

– |

-10.16% |

-43.18% |

-5.59% |

|

|

Consecutive Years of Dividend Growth |

– |

0 Years |

0 Years |

0 Years |

|

|

Income Statement |

Revenue |

74.86B |

235.35B |

147.21B |

151.74B |

|

EBITDA |

15.98B |

30.28B |

18.01B |

16.65B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

14.28% |

102.68% |

165.46% |

308.31% |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

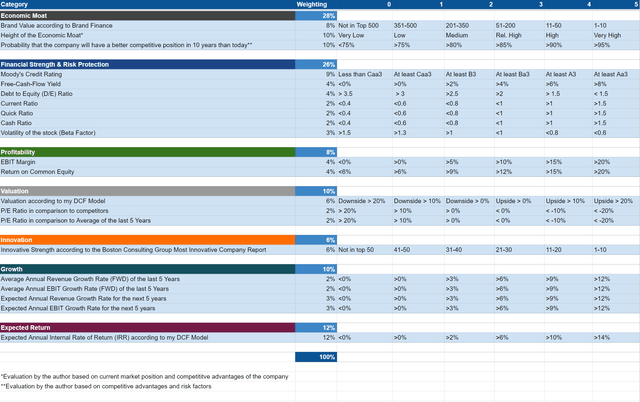

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

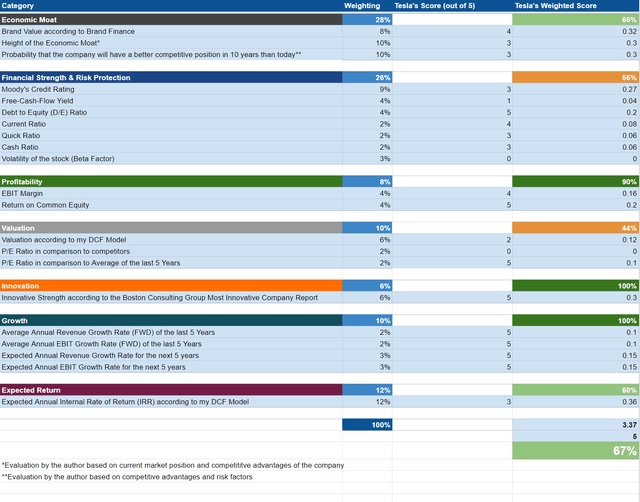

Tesla According to the HQC Scorecard

According to the HQC Scorecard, Tesla is rated as attractive in terms of risk and reward: the company receives an attractive overall rating of 67/100 points.

In the categories of Innovation (100/100), Growth (100/100) and Profitability (90/100), the company receives a very attractive overall rating.

For Economic Moat (60/100) and Expected Return (60/100), the company is rated as attractive.

Only in the categories of Financial Strength (55/100) and Valuation (44/100), is Tesla rated as moderately attractive.

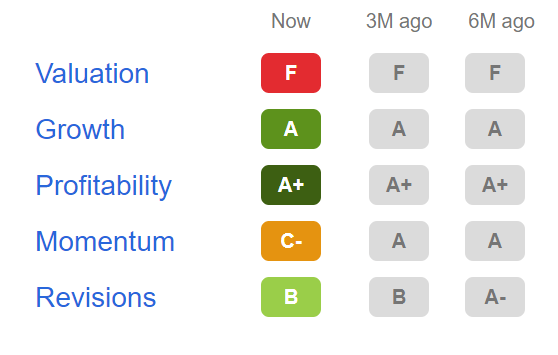

Tesla According to the Seeking Alpha Quant Factor Grades

According to the Seeking Alpha Quant Factor Grades, Tesla is currently rated with an F in terms of Valuation. This rating further indicates that the risk of investing in Tesla is relatively high and once again supports my investment thesis to only invest a limited amount of your overall portfolio in the company.

For Growth, Tesla is rated with an A and for Profitability, it receives an A+. For Momentum, Tesla receives a C- and for Revisions, a B.

Source: Seeking Alpha

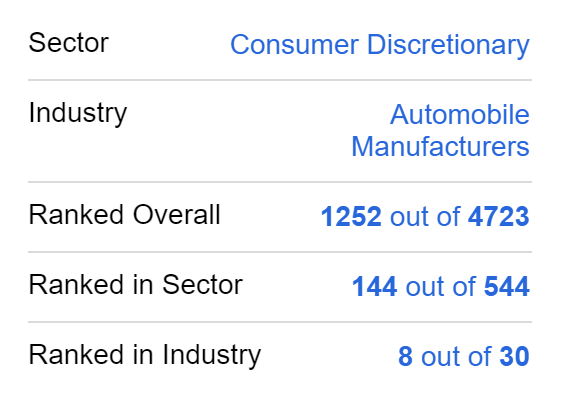

Tesla According to the Seeking Alpha Quant Ranking

According to the Seeking Alpha Quant Ranking, Tesla is ranked 8th out of 30 within the Automobile Manufacturers Industry and 144th out of 544 within the Consumer Discretionary Sector.

Source: Seeking Alpha

Tesla According to the Seeking Alpha Quant Rating

According to the Seeking Alpha Quant Rating, Tesla is rated as a hold. This further underlines my own hold rating for the company.

Tesla According to the Seeking Alpha Authors Rating and Wall Street Analysts Rating

Considering the Seeking Alpha Authors Rating, it can be highlighted that Tesla is rated as a hold and when taking into account the Wall Street Analysts Rating, Tesla is rated as a buy.

Source: Seeking Alpha

Risks

One of the main risk factors that I see for Tesla investors would be in the case that the company was not able to achieve its growth targets, which could have an enormous impact on its stock price. This is in particular due to the fact that Tesla’s valuation is relatively high (with a P/E [TTM] ratio of 61.32). The high valuation of the Tesla stock is an indicator that high growth expectations are priced in.

For my DCF Model I calculated with a Revenue and EBIT Growth Rate of 25%, indicating an Internal Rate of Return for Tesla of 9%. This shows that the Internal Rate of Return for Tesla would be below 9% if the company were to achieve an Average Revenue and EBIT Growth Rate of below 25% over the next 5 years. This demonstrates that the risk of investing in the company is relatively high, which contributes to my hold rating for the Tesla stock at this moment in time.

However, Tesla’s P/E Non-GAAP [FWD] Ratio is currently 55.03, which is significantly lower than its Average P/E Non-GAAP [FWD] Ratio of 138.57 over the last five years. This indicates that the risk of investing is currently lower than it has been over the past 5 years. This is due to the fact that the growth expectations, which were included in the price of the Tesla share, were still significantly higher on average in the last 5 years than they are at this moment in time.

Another risk factor that I see for investors is the risk related to its CEO Elon Musk: since the Tesla brand is closely associated with Elon Musk, a resignation, for example, could have an enormous impact on its stock price.

In addition to that, I also see other events that could cause Tesla’s brand value to decline as being risk factors for investors. This is because the valuation of Tesla is also based on its high brand value and a lower brand value could cause lower customer loyalty, have an impact on the profits of the company and could cause the price of the Tesla stock to drop significantly.

In the case that you decide to invest in the company, I recommend that you invest a maximum of 5% of your overall portfolio into Tesla. This is due to the risk factors mentioned in this section of my analysis.

The Bottom Line

In this analysis, I have shown some of Tesla’s growth drivers, which I expect will contribute to the company’s growth in the future: some of them are its strong brand image, customer loyalty, the company’s artificial intelligence and its culture of innovation as well as its software and independent supply chain.

However, the calculation of my DCF Model (in which I assume a Revenue and EBIT Growth Rate of 25% for Tesla over the next 5 years and a Perpetual Growth Rate of 4% afterwards) indicates an Internal Rate of Return of 9%. Based on this calculation, I have come to the conclusion that the reward is currently not worth the risk when thinking about investing in Tesla.

However, if you do decide to invest in Tesla, I would recommend that you invest only a limited amount of your overall portfolio into the company due to the risk factors mentioned in this analysis: I particularly see the relatively high valuation of Tesla as a risk factor for investors.

I am invested in Tesla, but my investment is currently less than 3% of my overall portfolio. I would sell some of my positions when the amount exceeds 5% of my overall portfolio, since I consider the risk of investing in the company as being relatively high.

Be the first to comment