Fertnig/E+ via Getty Images

Introduction

Aerojet Rocketdyne (NYSE:AJRD) is an aerospace and defense company known for rocket engines such as RS-25 (main engine for the Space Shuttle), RL10 (Centaur rocket stage of Atlas V), and RS-68 (largest hydrogen rocket engine ever flown). One notable development is the X3 Ion Thruster, which broke records for the maximum power, thrust, and operating current achieved to date by a Hall thruster. Furthermore, the company is known for developing the Multi-mission Radioisotope Thermoelectric Generator for the Mars Curiosity Rover, and a second flight unit is powering the Perseverance Rover.

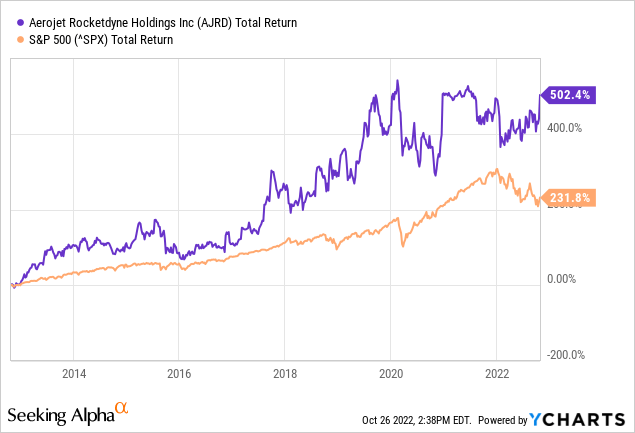

These strong developments are driving continued demand for Aerojet Rocketdyne’s products. Their company growth is reflected in the growth of the share price. Over the past 10 years, the stock has risen an average of 19.6% per year, while the S&P500 rose an average of 12.7% per year over the same period.

Aerojet Rocketdyne was about to be acquired by Lockheed Martin for $56 per share, but was canceled in February of this year. Elliot Capital Management has taken a position in Aerojet Rocketdyne. Aerojet Rocketdyne is open to offers from other companies, which makes the stock interesting to look at. The war between Russia and Ukraine will create additional demand for defense products, which is positive for Aerojet Rocketdyne. The share’s valuation is slightly higher than the 5-year median. Despite the slightly elevated valuation, I believe the stock is a buy.

Aerojet Rocketdyne Is A Takeover Opportunity

Aerojet Rocketdyne was about to be acquired by Lockheed Martin (LMT) for $4.4 billion. The acquisition would create strong synergies that would benefit efficiency, delivery speed and lower costs for the U.S. government and other stakeholders. The Federal Trade Commission filed a lawsuit in late January to block the deal because Lockheed could use its control of Aerojet to hurt other defense contractors. In February, Lockheed Martin walked away from the deal amid regulatory roadblocks.

Despite the cancellation of the deal, Aerojet Rocketdyne is open to takeover offers. The Lockheed Martin deal was accompanied by a 20% equity premium, making $56 per share appear to be a suitable acquisition price for future takeover candidates. If Aerojet Rocketdyne finds an offered price too low, it can still abandon the acquisition.

Possible candidates include Howmet Aerospace (HWM). Elliot Capital Management owns 9.89% of Howmet’s outstanding shares and took a 3.7% stake in Aerojet Rocketdyne last quarter. Elliot Capital Management is considered a feared activist investor, and as Forbes describes it:

And it had built a reputation as a company not to be trifled with, a company not afraid to chastise business leaders and publicly call for a sales process, a new CEO or other major strategic shifts.

Elliot Capital Management can turn Aerojet Rocketdyne into a company that is highly profitable and will create more value for their shareholders. The large investment in Howmet makes it interesting for both Aerojet and Howmet shareholders.

Strong Results In Recent Years

Aerojet is known for its solid rocket engines and liquid rocket engines. In 2020, Aerojet produced as many as 70,000 solid rocket engines.

Aerospace and Defense is Aerojet Rocketdyne’s main business and is fueled by defense contracts from the US government. In the air and missile defense division, Aerojet Rocketdyne has a 5-year $1 billion strategic agreement with Raytheon Missiles and Defense to provide propulsion for the U.S. Navy’s Standard Missile program.

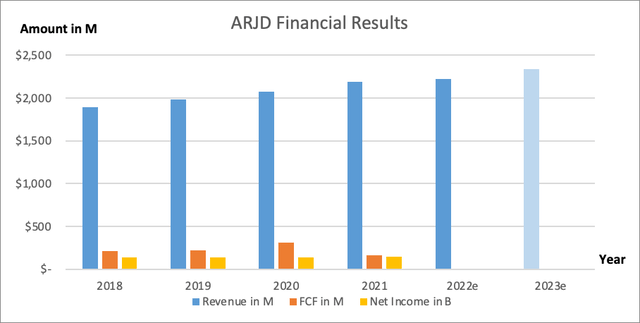

Aerojet Rocketdyne’s results in recent years show steadily growing sales, profits and free cash flow. Profit and free cash flow decreased slightly in 2021 compared to previous years. CAPEX consists mainly of facility expansion for next-generation development wins. Aerojet Rocketdyne aims to generate free cash flow in excess of net income. The company expects further pressure on free cash flow in 2023 due to higher CAPEX figures.

The war between Russia and Ukraine is creating additional demand for defense goods. Aerojet has a strong position in this with the production of standard missiles, patriots, next-generation inceptors, sentinels and THAADs. The order book for 2Q22 came in strong at $6.9B with multi-year awards of RS25, RL10, standard rocket, PAC-3 and THAAD.

Aerojet Rocketdyne Financial Results (SEC and Author’s Own Graphical Representation)

AJRD Stock Valuation Metrics

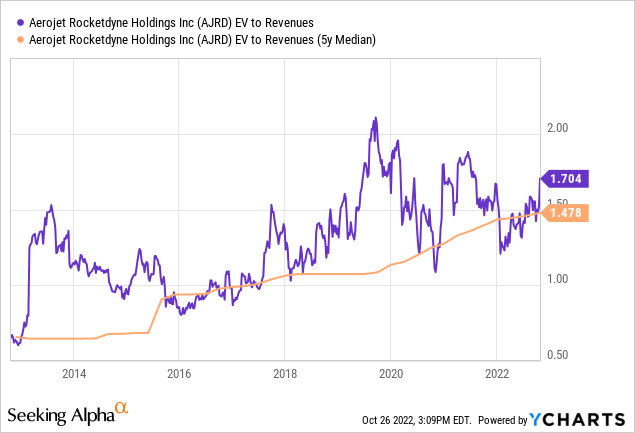

Aerojet Rocketdyne generated negative free cash flows in the first half because the company invested heavily in facilities for future developments. Therefore, I chose enterprise value to revenues as an appropriate valuation metric.

Aerojet Rocketdyne is slightly overvalued based on enterprise value to revenue compared to the 5-year median.

Despite the slight overvaluation, I think Aerojet is an interesting investment because there is speculation that Aerojet Rocketdyne may merge with Howmet. In addition, the war between Russia and Ukraine will create more demand for defense equipment, which favors Aerojet Rocketdyne.

Conclusion

Aerojet Rocketdyne has launched many astronauts into space with its rocket engines and rocket motors. The company is known for the RS-25 rocket engine (the Space Shuttle Main Engine), and the RL10 (Atlas V Centaur Rocket Stage engine). The company innovates heavily, which attracted the interest of Lockheed Martin. They offered $56 per share for Aerojet Rocketdyne, but the deal was canceled due to regulatory roadblocks. Aerojet is open to other candidates, and Elliot Capital Management has taken a stake in the company. This stake suggests that Elliot may want to merge Aerojet with Howmet. Furthermore, Aerojet Rocketdyne has been growing steadily in revenue, profit and free cash flow in recent years. Free cash flow is expected to be depressed through 2023 by investments in facility expansion to enable future development. Valuation figures show that the stock’s EV to Revenue ratio is slightly higher than the 5-year median. Elliot’s investment, the acquisition opportunity and bright prospects make the stock a buy.

Be the first to comment