Petar Chernaev/E+ via Getty Images

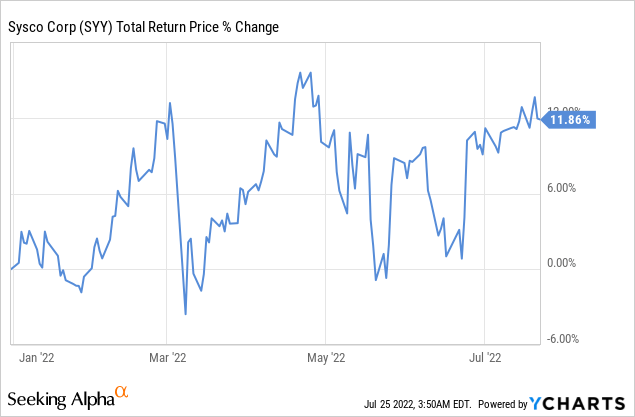

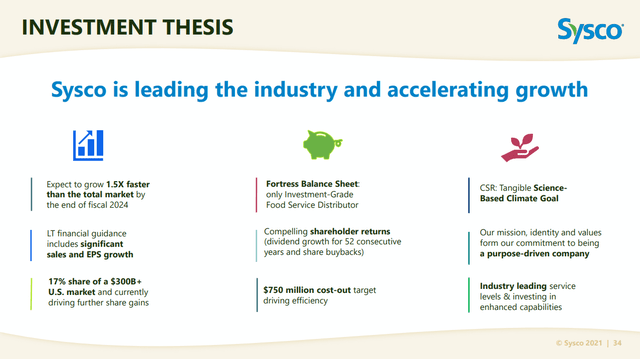

US food service distributor Sysco (NYSE:SYY) is one of the few stocks that has gone up significantly year to date. One of the reasons is that the current inflationary environment is making restaurants and other “food away from home” businesses search for efficiencies to compensate as much as possible for price increases. This is where Sysco’s cost advantages come into play, since thanks to its scale it can offer better prices than competitors. Sysco is leveraging these cost and efficiency advantages to gain market share, and it has been successful so far. For example, in the US Sysco has ~17% market share of these fragmented $300 billion food distribution industry, up a full point y/y reflecting the strong market share gains.

Sysco has a competitive moat thanks to its cost advantages. The company benefits from lower distribution cost given its closer proximity to customers, complemented by scale-enabled cost advantages such as purchasing power.

Further strengthening its competitive moat, Sysco is aiming to become even more efficient. It has a plan to increase efficiency with a $750 million of cost-out targets to be achieved between FY21 and FY24. Reinvesting the savings into better prices and services for customers should allow Sysco to grow 1.5 times faster than the overall food-service market by fiscal 2024, according to the company. If it was already difficult to compete with Sysco, it is going to become even harder as the company makes enormous efforts like this one to become more efficient, despite already being incredibly efficient thanks to its massive scale. Sysco has more than 650,000 customers, 343 distribution facilities, 58,0000 associates, and 7,000 sales consultants. This is why some refer to Sysco as the backbone of the food-away-from-home industry.

Current Environment

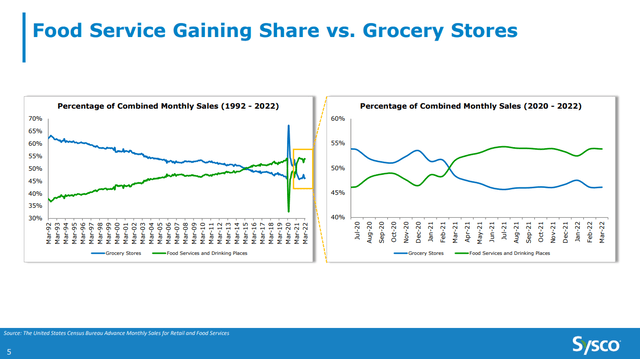

Covid created a very challenging environment for Sysco, with people eating a lot more at home, and its restaurant customers struggling. Since then, however, the US food service market has fully recovered, with volumes exceeding pre-pandemic levels, and Sysco coming out of the crisis with a 10% increase in independent restaurant customers. Now food service is once again gaining share versus grocery stores, what had been a very long term trend is now continuing.

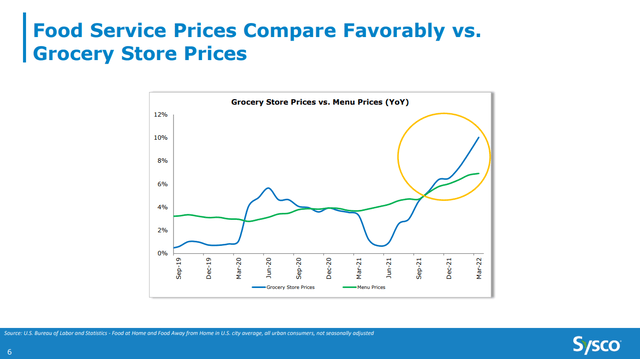

Interestingly, it is grocery store food prices where inflation is running hotter, with menu prices rising at more modest rates. This helps restaurants remain competitive in this complicated environment of high inflation and a weakening purchasing power for consumers. The fact that restaurants are becoming increasingly competitive is great news for Sysco, as it means the share of food-away-from-home will continue expanding.

Financials

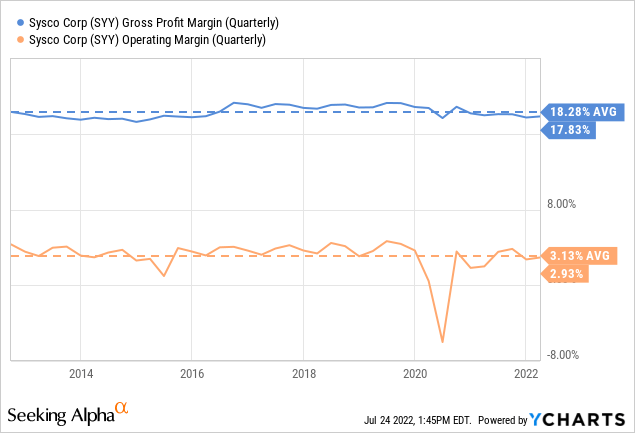

One thing we can see from the margins is that food distribution is a tough business where small efficiency advantages can make a huge difference. At least margins tend to be relatively stable, with operating margins close to the 3.1% average of the last ten years, with the exception of the Covid crisis, where they had a big dip as expected.

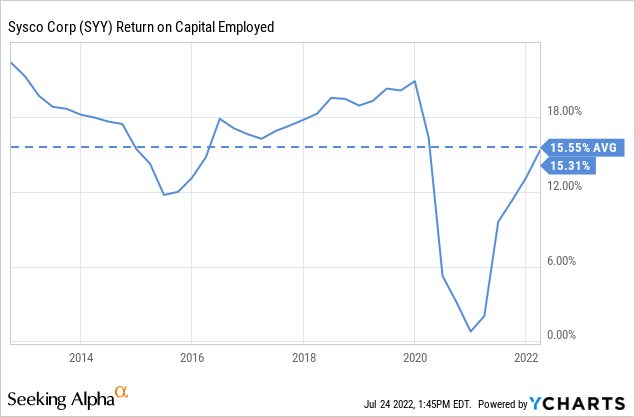

Despite the tough margins, Sysco is not a bad business. It has delivered excellent returns on capital employed, with a ~15.5% average over the last ten years. This is a quality business, but one that requires high efficiency and scale advantages to be successful.

Growth

Going forward Sysco expects to grow 1.5x faster than the total market from now to the end of fiscal 2024. This should be enabled by the reinvesting of efficiency gains into more competitive pricing and even better service to customers. For example, Sysco is launching teams that specialize in various cuisines (Italian, Asian, Mexican) that should drive market share gains in ethnic restaurants. Sysco also has a new leadership team in place for its international operations.

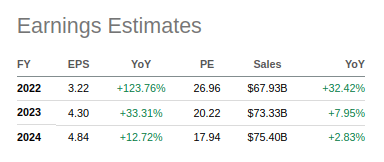

This market share gains should translate to significant sales and EPS growth. By 2024 Sysco expects that EPS will exceed pre-Covid all-time high EPS by more than 30%. The growth in earnings per share should also drive higher dividend increases, which have been growing for 52 consecutive years, giving the company a dividend aristocrat status.

Balance Sheet

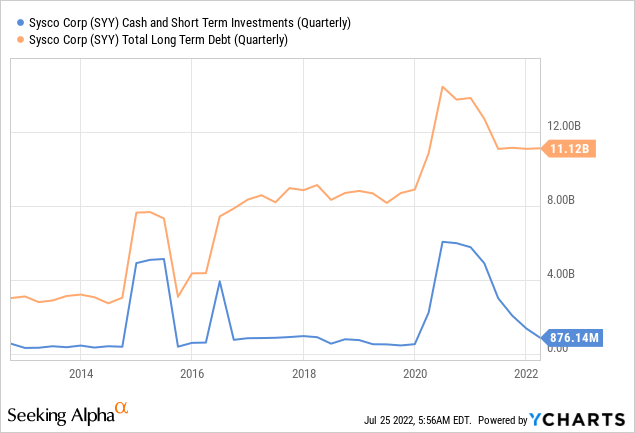

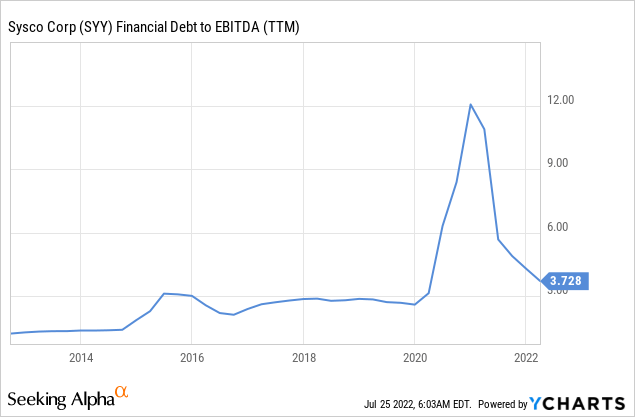

Sysco does carry a significant amount of debt on its balance sheet, with ~$11 billion in total long-term debt, and about $876 million in cash and short term investments.

Leverage has been coming down, it spiked mostly due to the profitability impact that the Covid crisis had, but remains high at a ~3.7x debt/EBITDA. The company has said that it remains committed to a strong investment grade credit rating, and it is targeting a net leverage ratio of 2.5x to 2.75x net debt to adjusted EBITDA, so it still has some work to do, but we do believe it will get there.

Valuation

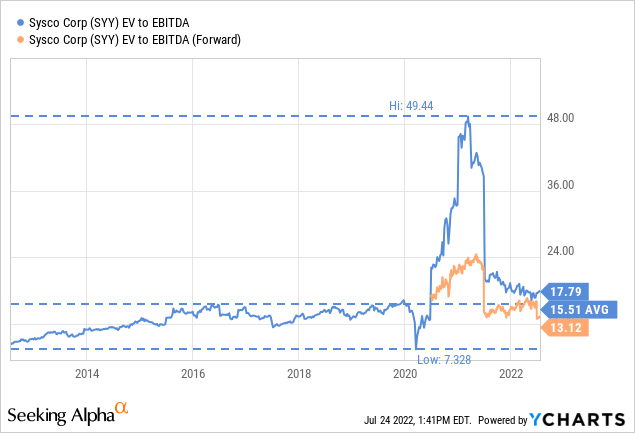

At an EV/EBITDA ratio of ~17.7x shares are trading above the ten year average of ~15.5x, but given the share gains the company is currently delivering we do not think this is completely unreasonable. In fact the forward EV/EBITDA is below the ten year average at ~13x. This gives us the impression that shares are fairly valued.

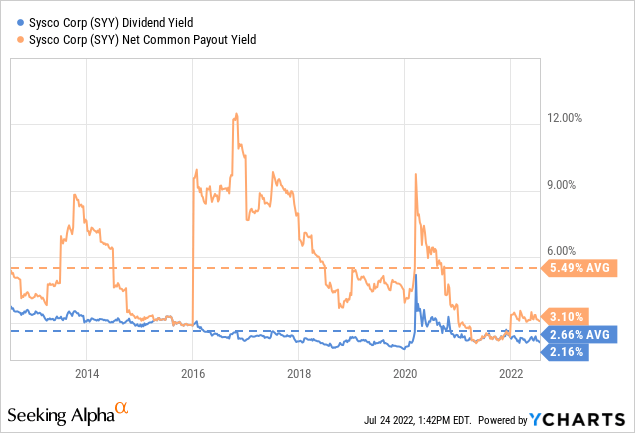

The current dividend yield of ~2.1% is a little below the ten year average of ~2.6%. The company does a lot of buying back of its own shares, which means the net common payout yield is above the dividend yield. Combining net buyback yield and dividend yield, shares currently have a net common payout yield of ~3.1%, which is not bad but below its historical average of almost 5.5%.

We do expect significant dividend growth given the earnings growth expectations. Analysts are estimating on average an EPS of $4.84 in 2024, significantly higher than the $3.22 they are estimating for FY22. This growth in earnings should allow the company to continue delivering significant dividend increases in the next few years.

Seeking Alpha

Risks

We believe Sysco is a below average risk stock, and it certainly has provided excellent diversification to those that have held it in the first part of 2022. The company does have a significant amount of debt, and that is a risk that should be monitored. Another risk is that the valuation already assumes some market share gains. Should the company fail to deliver the expected market share gains, the shares could suffer significantly.

Conclusion

Sysco’s competitive moat, cost advantage, and growth strategy are delivering significant market share gains. As restaurants seek efficiencies in this inflationary environment they are increasingly turning to Sysco, one of the few companies that can help them improve their cost efficiency to mitigate some of the cost pressures. Shares are far from being a bargain, but we believe the valuation is justified by the expected growth. Shares have also provided excellent diversification in this tough inflationary environment. This is an excellent company that should at least be in the watch list, if not in the portfolio.

Be the first to comment