cokada

Investment Thesis

The rise in awareness of environmental sustainability has driven the demand for a global green economy. This demand is amplified by improved Li-Ion technology for Electric Vehicles (“EV”) and other energy storage infrastructure.

There are many types of raw materials required to build a green economy. We have observed that policymakers in the world’s largest economy appear to regard lithium as one of the most important raw materials. Hence, we expect lithium production companies like Alpha Lithium Corporation (OTCPK:APHLF) to benefit from this tailwind.

APHLF owns strategic areas of the Lithium Triangle. Its close proximity to the largest and longest producing “salar” (salt flats) in Argentina implies it is able to benefit from the infrastructures that already exist for Lithium mining.

Company Overview

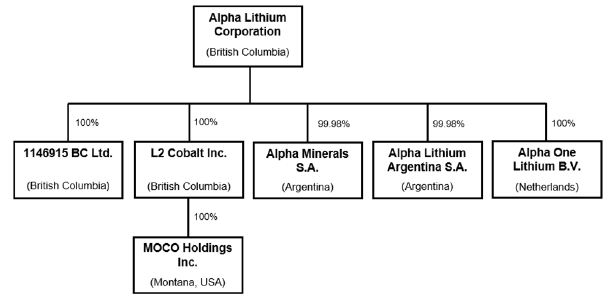

APHLF is a Canada-based lithium exploration company. The company has 6 subsidiaries:

- L2 Cobalt Inc.

- 1146915 BC Ltd.

- Alpha Minerals,

- Alpha One Lithium B.V

- MOCO Holdings Corp

- Alpha Lithium Argentina S.A.

The intercorporate relationships of the different subsidiaries can be inferred from this chart:

ANNUAL INFORMATION FORM (www.sedar.com)

Development of Green Economy Led by Lithium

The Biden administration published a “100-Day Reviews under Executive Order 14017” report that outlines steps to strengthen the critical supply chains of America, the largest economy in the world. We can use this report to understand the most important raw materials required in the development of the Green Economy. If we infer from Visual Capitalist, the raw materials required to build a green economy include copper, silicon, aluminum, lithium, cobalt, rare earth, and silver. For each of the raw materials mentioned, I checked the number of times they are found in the report, and here are the findings:

- Copper – 28

- Silicon – 93

- Aluminum – 0

- Lithium – 315

- Cobalt – 166

- Rare Earths – 14

- Silver – 2.

We can see that there is much more emphasis on the raw material of lithium, as it was mentioned the most number of times (315).

Indeed, the main drivers of lithium in the green economy are the demand for energy storage and electric vehicles. While these clean energy solutions are not new, their demand has surged in recent years due to the falling costs of Li-ion batteries. This observation was also explicitly mentioned in the executive order’s review report:

“The cost per kilowatt-hour ((kWh)) of lithium-ion batteries has declined more than 80 percent over the last decade, and this cost decrease has made these batteries very attractive to new and growing markets including the electric vehicle (EV) and stationary storage markets. The cost reduction has been, and continues to be, driven by advances in material technology, cell manufacturing, and economies of scale. Demand from the EV and stationary storage markets is projected to increase the size of the lithium battery market by another factor of five to ten by 2030.”

When the supply of lithium does not rise in tandem with the demand for Li-ion battery products, naturally, the price will increase with demand.

Companies that are in the business of providing the supply of Lithium in the clean energy market are expected to benefit greatly from this tailwind.

Alpha Lithium’s competitive advantage

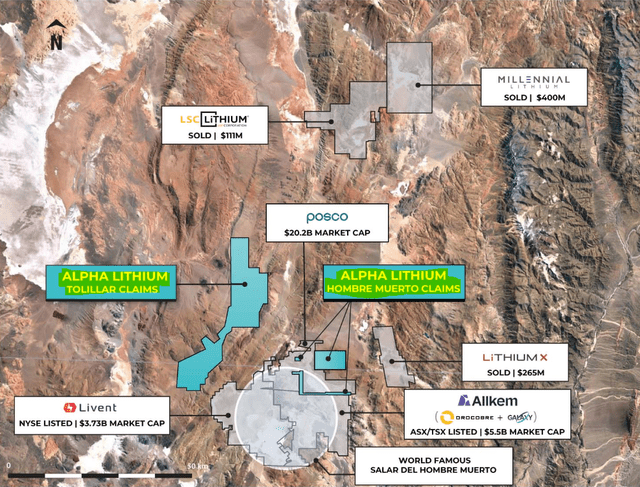

Lithium is most commonly mined from salt brines located in the Lithium Triangle. “Salar” refers to “salt flat” in Spanish. The company owns 100% of Tolillar Salar, which is “one of the last remaining undeveloped salars in Salta Province, Argentina.” This provides its mining business with a very large scale of production.

Salar Tolillar Project (Company Website)

“Salar del Hombre Muerto” is another salt flat in Argentina and is regarded as one of the “world’s most important sources of lithium.” As reported on the company’s website, it recently acquired 985 hectares of properties from this salt pan, and this further increased its scale of production significantly:

“With this latest acquisition, Alpha has become one of the largest lithium developers in Salta Province’s Hombre Muerto salar, second only to Korean giant, POSCO, who is expected to have a commercial plant producing in Hombre Muerto in 2023.”

Not only does “Salar del Hombre Muerto” contribute to the company’s scale of production its lithium deposits are also of the “highest quality,” as reported by the company:

“Hombre Muerto is the highest quality and longest producing salar in Argentina and it benefits from an extensive amount of infrastructure developed to support Livent Corporation’s 25 years of production history.”

APHLF’s mining projects are 10 km from Livent Corp, the largest and longest producing salar in Argentina. This allows it to benefit from the infrastructure already built for Livent Corp.

Financial Comparison And Valuation With Peers

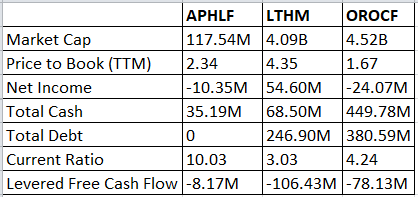

We will compare the financials of the company with Livent Corporation (LTHM) and Allkem Limited (OTCPK:OROCF) using figures that are found on Seeking Alpha.

Author’s own tabulation (Seeking Alpha)

From this comparison we can observe that:

- Although APHLF is the smallest player in terms of market capitalization,

- If we value the company using the P/B ratio, APHLF is the cheapest stock on the comparison list.

- Looking at Net Income, it is currently not profitable. LTMN is the most profitable.

- Although it is still not profitable, APHLF also has no debt. Overall, the company still maintains a “net cash” financial position. This is a positive contrast to the profitable peer of LTMN, which is in a “net debt” position.

- It has the most favorable current ratio which suggests it has much more assets compared to its peers. This might translate to higher top and bottom lines generated in the long run.

In my opinion, the company exhibits the profile of a small player that has the advantage of being more nimble in financial management compared to its larger peers.

Investment Risk

It was mentioned on one of the company’s website cites earlier that “Up to 504 mg/L identified from limited previous testing on <10% of claim area.”

This implies that there are still 90% of areas which is not been explored, which presents a risk that other a large part of unexplored mining areas might not contain as much concentration of Lithium as expected.

This risk is relatively mild as it was also mentioned that “Recent studies have shown the region is underlain by an extensive magma chamber at 4 to 8 km deep (de Silva, 1989).” According to this article:

“Lithium deposits are found mainly in old, dormant volcanic systems, particularly in what are called supervolcanoes or, more scientifically, large caldera systems.”

In my opinion, the existence of a magma chamber increases the likelihood of lithium being deposited through volcanic ashes.

Conclusion and Key Takeaway

APHLF is a relatively small Lithium mining company that is strategically located in one of the world’s largest lithium salt flat deposits. It has a cash-positive balance sheet. Looking at the current ratio, it is also asset rich. Overall it is in a very good position to benefit from the tailwind of rising global demand for Lithium.

By P/B ratio, it appears to be undervalued and unknown by most investors. This presents an opportunity for early investors to be richly rewarded if APHLF becomes a major player in the long run.

Be the first to comment