Cristi Croitoru/iStock Editorial via Getty Images

After our initiation of coverage in which we indicated Ryanair (NASDAQ:RYAAY) as our bet on travel recovery and our follow-up on its Q1 three-month results, today we are looking at the company’s latest news. We start with some competitor announcements. During a company visit to Italy, Wizz Air CEO confirmed that they “want to become the second-largest airline in Italy within a year“. Explaining also that they heavily “invested in the market during the pandemic when no one had the courage to do so“. He visited carrier bases in Bari, Catania, Palermo, Naples, Venice and Milan to promote the company ahead of the summer season (the first without COVID-19 restrictions).

According to the latest ENAC data, Wizz Air transported 5.1 million passengers on national and international connections in 2021, jumping to third place from the fifth and now behind Ryanair with 20.7 million and ITA-Airways (ex-Alitalia). Today, in the Bel paese, Wizz has 7 bases with 21 dedicated aircraft.

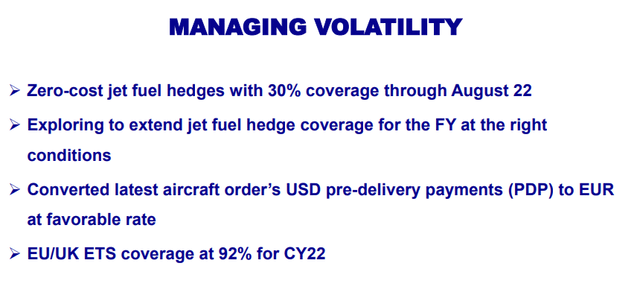

In our first Ryanair article, we indicated Wizz Air as a real threat to our target price. At the same time, after having analyzed the Hungarian low-cost company, we discovered that Wizz is late in taking necessary actions against rising fuel prices and is only now adopting a shield through hedging contracts to protect itself from price volatility. The hedging instrument has already been introduced by other companies, like Ryanair, which for instance is 80% covered at $63 a barrel and has said that the policy will help keep costs down and gain an edge over its rivals. We noticed that Wizz was one of the last to adopt it at the beginning of the COVID crisis, and we will face some consequences. The airline has also decided to use hedging contracts for its exposure to dollars, the currency in which jet fuel is paid for airplanes (once again quite late).

Ahead of the summer, Ryanair needs to manage a new strike schedule for the 25th of June. The protest is part of a coordinated mobilization at European level, in which pilots and flight attendants based in Spain, Portugal, France, Italy and Belgium will also abstain from work. Unions have asked for “decent work contracts which adequate guarantee conditions and salaries at least in line with the minimum wages provided by the respective national air transport contract”. In the meantime, O’Leary, Ryanair’s CEO, has asked for army intervention in the airports to guarantee the lack of personnel at least for the next three or four months. This is a complicated situation due to a lack of staff that forces departing passengers to face long lines for hours at security checks. O’Leary’s comment was also a response to statements by British Transport Minister Grant Shapps, who accused airlines of selling tickets knowing that they could not guarantee flights.

Conclusion

Ryanair’s stock price sell-off is not justified. The company is very well managed and even if there is some threat due to competition and strike announcement, we are sure that this will pass too. Ahead of summer, with Ryanair being the clear leader in low-cost fares, thanks to its Gamechanger strategy, we confirm our valuation with an underlying net profit at the end of the current year of €1 billion.

Be the first to comment