phototechno

Ares Capital Corporation (NASDAQ:ARCC) reported strong third-quarter earnings, including improved dividend coverage, a well-positioned and performing loan portfolio, and a dividend increase.

In the third quarter, Ares Capital paid out only 75% of its net investment income, and the company increased its regular dividend payout to $0.48 per share per quarter, resulting in a 10.3% dividend yield. Importantly, the BDC’s portfolio continued to perform well, and non-accruals remained consistent.

ARCC is still trading at net asset value, making it an appealing entry point for income investors.

Ares Capital Has A Strong And Well Performing Credit Portfolio

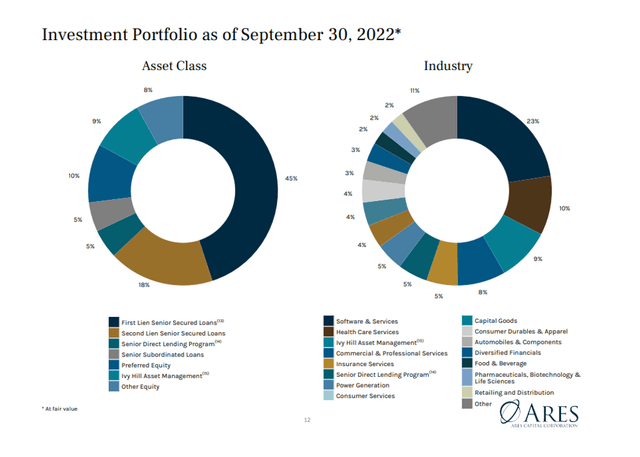

In the third quarter, Ares Capital’s First Lien-focused investment portfolio saw no significant changes. Approximately 45% of investments were in First Lien Senior Secured Loans (no change from the previous quarter) and 18% were in Second Lien Senior Secured Loans (down 1% from the previous quarter).

Ares Capital’s total portfolio was valued at $21.3 billion, representing a net increase of $169 million over the BDC’s 2Q-22 portfolio value.

Portfolio Overview (Ares Capital Corp)

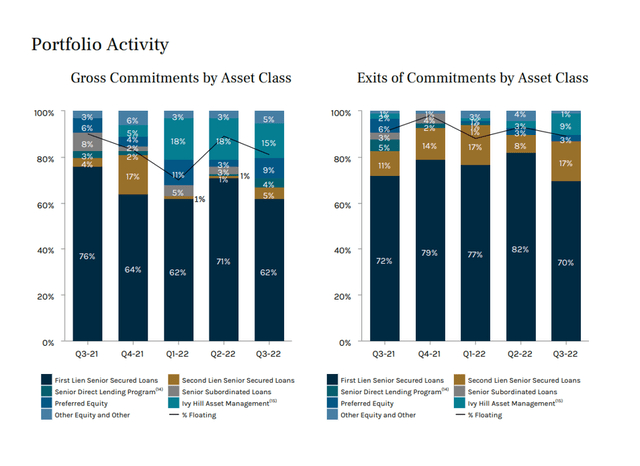

In terms of portfolio activity, 62% of new investment commitments were made in First Lien Senior Secured Loans, which received the majority of new commitments. Ares Capital made $2.2 billion in new gross commitments and exited $2.0 billion in investments, resulting in a net commitment increase of $246 million.

Portfolio Activity (Ares Capital Corp)

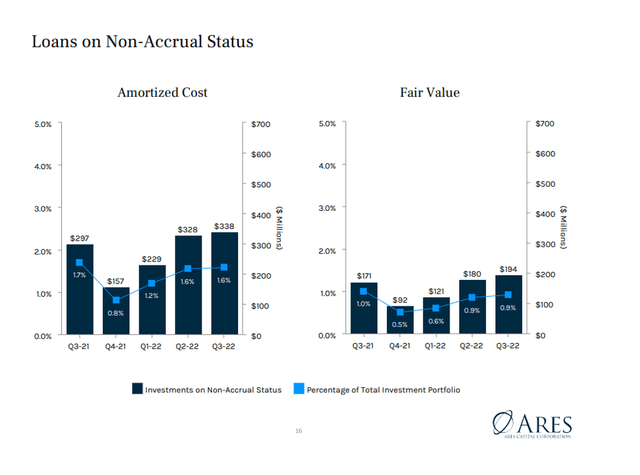

Stable Portfolio Quality

Ares Capital’s non-accruals remained consistent QoQ, with 0.9% of investments in non-accrual status. In the third quarter, non-accruals totaled $194 million in at-risk investments (based on fair value). Ares Capital’s portfolio credit remained stable in the fourth quarter.

Loans On Non-Accrual Status (Ares Capital Corp)

Ares Capital Maintained Solid Dividend Coverage in 3Q-22

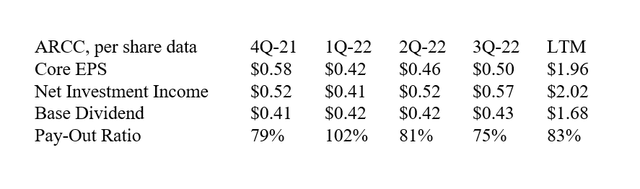

Ares Capital continued to pay its dividend in 3Q-22 and maintained strong dividend coverage in the third quarter. The business development company earned $0.57 per share in net investment income while paying out a $0.43 per share base dividend.

Net investment income easily covered the special distribution of $0.03 per share per quarter declared earlier this year. Ares Capital had a dividend pay-out ratio of 75% in the third quarter, compared to 83% in the previous twelve months.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

ARCC Now Trading At Book Value

Since I last covered the business development company in my article ‘Every Dip Is A Strong Buy Opportunity’, the discount to net asset value has vanished.

Ares Capital’s net asset value was $18.56 at the end of 3Q-22, implying that the stock is now trading at book value.

Given Ares Capital’s strong dividend coverage and the fact that the BDC recently increased its total regular dividend pay-out by 12% to $0.48 per share per quarter, I believe ARCC is a compelling value proposition at book value.

Why Ares Capital Could See A Lower/Higher Valuation

Obviously, the BDC’s underlying portfolio/credit quality has a significant impact on Ares Capital’s stock valuation. If Ares Capital’s portfolio continues to perform well and non-accruals remain low, the BDC’s stock can trade at a premium to net asset value, especially if Ares Capital continues to cover its dividend pay-out with net investment income.

A decline in credit quality, on the other hand, would provide investors with a compelling reason to value the BDC’s stock at a discount to net asset value. I haven’t seen any evidence of deteriorating credit quality, so I believe the BDC is slightly undervalued.

My Conclusion

Ares Capital reported strong third-quarter earnings, resulting in a 12% dividend increase to $0.48 per share and a new forward dividend yield of 10.3%.

The dividend was also covered by net investment income, and the pay-out ratio actually decreased from 81% in 2Q-22 to 75% in 3Q-22, providing income investors with a higher margin of safety.

The stock is still reasonably priced, as investors only pay attention to the BDC’s high dividend yield.

I believe the discount will narrow in the coming weeks as yield seekers attempt to purchase the BDC’s 10.3% dividend yield and drive up the stock price. Buy.

Be the first to comment