Max Zolotukhin/iStock via Getty Images

Aircraft are complex machines that are worth tens of millions of dollars and the bigger wide body aircraft even have sales prices north of $150 million. Financing such aircraft can be challenging for airlines. Therefore, airlines often lease aircraft instead of owning the aircraft which also provides the operator with some flexibility. Also in Russia, many aircraft are leased through Western lessors. Following the invasion of Ukraine, sanctions have been imposed against Russia with the aerospace and airline industry being one of the main targets. The sanctions require lessors to wind down their business with Russian airlines but the way the sanctions have been implemented have made it nearly impossible to repossess a large quantity of aircraft.

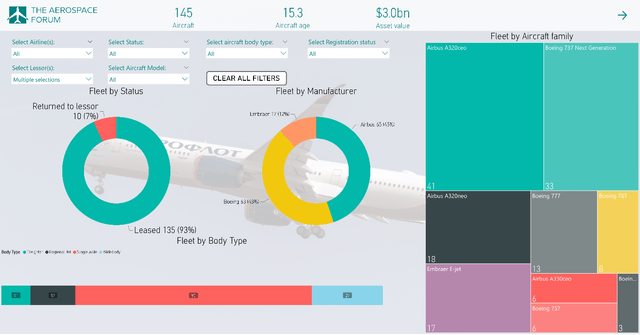

In a recent report, I explained why Russia is highly dependent on leased aircraft and using the TAF Airline Fleet Monitor Russia I provided an estimate of the complete Russian airline fleet as well as the leased asset value, which stands at $20.4 billion dollars. In this report, I will have a closer look at the AerCap (NYSE:AER) fleet in Russia, the insurance policy and I will provide a fair value estimate on shares of AerCap.

Russian airlines smaller in the big picture

In order to get somewhat of an impression of the flight equipment that is exposed to Russian operators and laws that pave the way for the leased assets to be nationalized, we use the TAF Airline Fleet Monitor Russia.

Airline fleet Russia for AerCap (AeroAnalysis)

Our research covering nearly 950 aircraft resulted in an estimated value of $22.5 billion worth of flight equipment operated by Russian airlines. Of this $22.5 billion, $18.8 billion worth of equipment is leased and this can be narrowed down further when excluding Russian lessors. By doing so, we obtained an estimated $13.1 billion leased to Russian airlines by foreign lessors using a 25-year straight line depreciation and 5% salvage value. So, 70% of the leased flight equipment is provided by lessors outside of Russia. However, if we narrow this down to AerCap, we get to $3 billion for the combination of GECAS and AerCap. Some aircraft seem to be stored outside of Russia, which makes repossession easier and when keeping this into account we saw around $2.7 billion worth of flight equipment currently locked in Russia for world’s biggest aircraft lessor. Using a steeper method, the value would be around $2.1 to $2.3 billion.

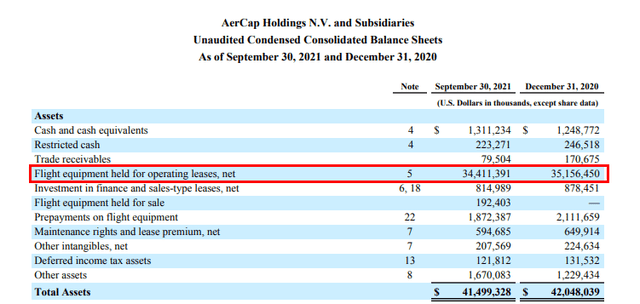

AerCap flight equipment (AerCap)

Further context needs to be provided by expressing this as a percentage of the flight equipment. Since AerCap has yet to provide its Q4 2021 and full year results we don’t know the exact value of the flight equipment by year-end but we do know that the value was $34.4 billion in Q3 2021. To that we should also add the flight equipment held for operating lease by GECAS which including adjustments would amount to $23.6 billion according to pro forma statements bringing the combined value to roughly $58 billion. This includes the helicopter and engine leasing business. Expressed as a percentage of all flight equipment value, AerCap had 5.1% of its fleet positioned in Russia and 5.7% when expressed as a percentage of commercial aircraft (does not included engine leases and helicopter leases). When keeping into mind lease returns, the percentages are 4.6 to 5.1 percent.

That is fairly consistent with the 5% that AerCap claims to be its portfolio exposure to Russia. Reasons for the difference between our estimates and that of AerCap likely are the actual year-end value of the flight equipment as well as the depreciation formula used. Whether we are looking at 4.6% or 5.7%, what holds is that around 95% of the flight equipment value is placed outside of Russia and to me that would indicate that if you like the aircraft leasing landscape and its prospects, Russia itself is not going to make investment in aircraft lessors less attractive to the extent that these companies are not investable.

AerCap’s insurance coverage and reserves

Layering on top of a 4%-6% of AerCap’s flight equipment leased by Russian operators is an insurance policy providing some way to recoup losses:

Our lessees are required under our leases to bear responsibility, through an operational indemnity subject to customary exclusions, and to carry insurance for any liabilities arising out of the operation of our aircraft or engines, including any liabilities for death or injury to persons and damage to property that ordinarily would attach to the operator of the aircraft. In addition, our lessees are required to carry other types of insurance that are customary in the air transportation industry, including hull all risks insurance for both the aircraft and each engine whether or not installed on our aircraft, hull war risks insurance covering risks such as hijacking and terrorism and, where permitted, including confiscation, expropriation, nationalization and seizure (in each case at a value stipulated in the relevant lease which typically exceeds the net book value by 10%, subject to adjustment or fleet aggregate limits in certain circumstances). Our lessees are also required to carry aircraft spares insurance and aircraft third party liability insurance, in each case subject to customary deductibles and exclusions. We are named as an additional insured on liability insurance policies carried by our lessees, and we or our lenders are designated as a loss payee in the event of a total loss of an aircraft. We monitor the compliance by our lessees with the insurance provisions of our leases by securing confirmation of coverage from the lessees’ insurance brokers.

With Russia having paved the way for nationalizing leased aircraft, it should be easier for AerCap to show that the insurance policy applies and what is interesting here is that the aircraft are insured for 10% above the book value, which further provides support to our observation that the book value of the aircraft is lower than the actual market value of the aircraft. So, the $1.7 billion book value that AerCap has in Russia according to its own statements would be worth around $1.9 billion when the 10% markup is applied. So, the insurance policy is one that really covers AerCap to some extent. AerCap’s insurance policy is rare in the sense that it does not have a 7-day cancellation notice. That means that while insurers might have started excluding or cancelling insurance policies for some lessors well before President Putin signed the measure that would allow airlines to seize leased assets, this was not possible for AerCap. However, the loss rate is capped at $1.2 billion it seems which means that the full asset value is not covered even though the insurance policy that AerCap has is a pretty strong one and definitely stronger than most of its peers.

Insurers will try to keep the payout at a minimum and AerCap will likely maximize its claims, so we likely will be seeing a legal battle that might take a while to be resolved and if AerCap deems it fit it can even decide to sell legal claims to get its hands on funds faster.

So, AerCap is partially covered by the insurance policy. The other buffer AerCap has are maintenance reserves that airline pay as well as any deposits made my lessees. Exact amounts are not known, but chances are high that these will be considered non-refundable.

AER stock price: The ugly truth

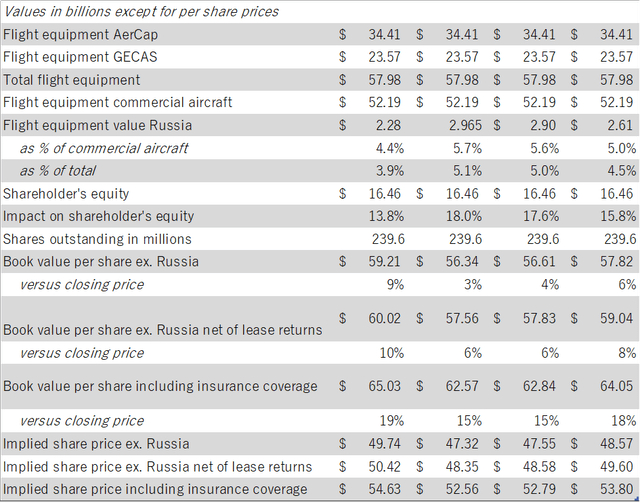

AerCap Valuation (The Aerospace Forum)

Shares of AerCap were trading at roughly $66 per share before the war in Ukraine started, and are now trading at $54.50 which is roughly 17.5% lower. As of June 2021, AerCap had a pro forma shareholders’ equity of $16 billion and correcting for the most recent known shareholders’ equity we get to $16.5 billion. That already provides some scope on why a 5% portfolio exposure should not result in a 5% reduction in share prices. Any reduction in flight equipment value would be at the expense of shareholders’ equity and measured against that the impact on shareholders’ equity would be around 14 to 18 percent. That would still produce a discounted trading level of 3 to 9 percent and if we incorporate lease return, this would grow to 8 to 10 percent. If we then also include the $1.2 insurance loss cap for insurers and assume that AerCap will be successfully claiming that amount the book value has a 15 to 20 per cent premium over the most recent closing price.

That would imply that AerCap’s shares have some room to appreciate in value, were it not that shares of AerCap tend to trade at a discount of roughly 16% compared to the book value per share and that really does mean that currently shares are valued according to the scenario where AerCap can successfully claim the $1.2 billion.

Further upside should be provided from other successful insurance claims of which it is not known how fruitful that can or will be and further future repossessions of aircraft.

Conclusion

Initially, I expected that a combination of the value of the flight equipment, the insurance policy and the selloff in AerCap would provide three solid reasons to buy shares of world’s biggest lessor. However, after doing the research and running the numbers, I have come to the conclusion that a strong investment thesis cannot be made for AerCap at this time. Reason being that solely looking at the situation in Russia, further upside only exists if AerCap is successful with repossessing more aircraft than it has done today and more insurance claims on top of the $1.2 billion but it could take a long time before there will be any legal agreement on that.

That is not to say that shares of AerCap do not provide value as air travel markets are opening up (with China being a new spot for concern) and particularly for Russia there still could be successful repossessions of aircraft, but the support in higher share prices will be much more incremental than I initially anticipated. With that in mind, I continue holding share of AerCap for now but for the short to medium term I will be considering it a Hold instead of a Buy. AerCap will be sharing its full year results before the opening bell on the 30th of March, and I am eagerly awaiting further updates and details regarding the situation of AerCap’s aircraft in Russia.

Be the first to comment