Matt Hunt

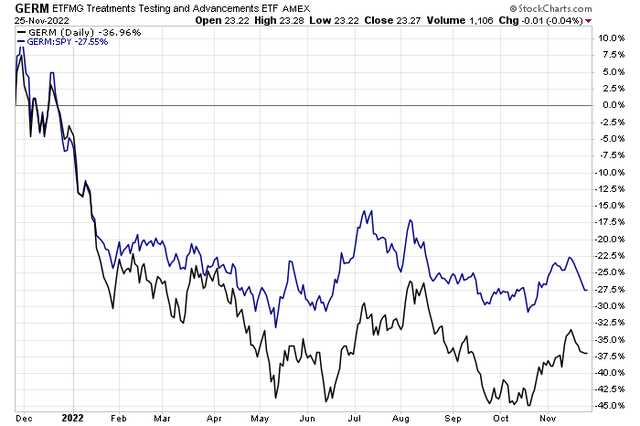

Healthcare treatments and testing are suddenly out of favor in a post-Covid world. The ETFMG Treatments, Testing and Advancements ETF (GERM) is down 37% in 2022, sharply underperforming the S&P 500. One of its largest holdings, though, features recent bullish price action and a decent valuation and yield. Is Quest Diagnostics still a buy? Let’s investigate.

Healthcare Treatments ETF Down Huge As Covid Subsides

According to Bank of America Global Research, Quest Diagnostics (NYSE:DGX) is the largest provider of clinical diagnostic testing and related services in the U.S., delivered through a national network of full-service clinical laboratories and over 2,200 patient service centers (PSCs).

The New Jersey-based $17.0 billion market cap Health Care Providers & Services industry company within the Health Care sector trades at a slightly below-market GAAP price-to-earnings multiple of 14.7 and pays a 1.8% dividend yield, according to The Wall Street Journal.

Back in October, the company beat on both earnings and revenue forecasts along with raising its FY22 guidance, according to Seeking Alpha. That positive news helped send the stock soaring above key resistance, which we’ll discuss later. It was also announced that Jim Davis will become the new CEO of the firm. Despite the upbeat earnings news and following a shakeup in the C-suite, Citi downgraded the stock on valuation after a strong Q4 rally.

Quest still has the help of ongoing Covid-19 testing, driving some demand for its services, and overall trends in domestic clinic testing are a boon for this healthcare name, but that trend is obviously waning. With synergies from contract research organizations, there is also earnings upside potential. BofA notes that lab reimbursement consolidation could take place due to Medicare reimbursement cuts. Finally, Quest can take advantage of retail clinic opportunities and profit from its key lab data. Downside risks include weaker testing volume, higher tax rates, data privacy risks, and greater competition, which could reduce margins.

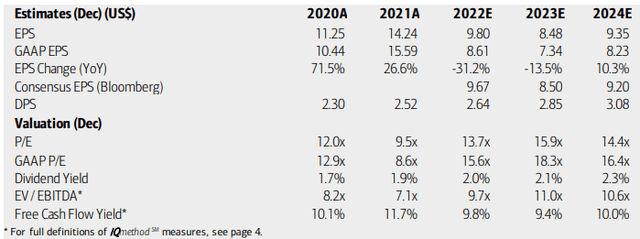

On valuation, analysts at BofA see earnings having fallen more than 30% in 2022, with another sizable per-share profit drop in 2023. EPS should then normalize by 2024. The Bloomberg consensus forecast is about on par with BofA’s outlook. Dividends, meanwhile, are expected to rise steadily in the coming years.

Both DGX’s operating and GAAP P/Es look ok going forward, but it’s not overly cheap given the earnings situation. Hence, I am less bullish today than a few months ago after the rally. Nevertheless, investors get a decent yield with Quest, and it trades at a below-market EV/EBITDA multiple while producing solid free cash flow.

Quest: Earnings, Valuation, Dividend Forecasts

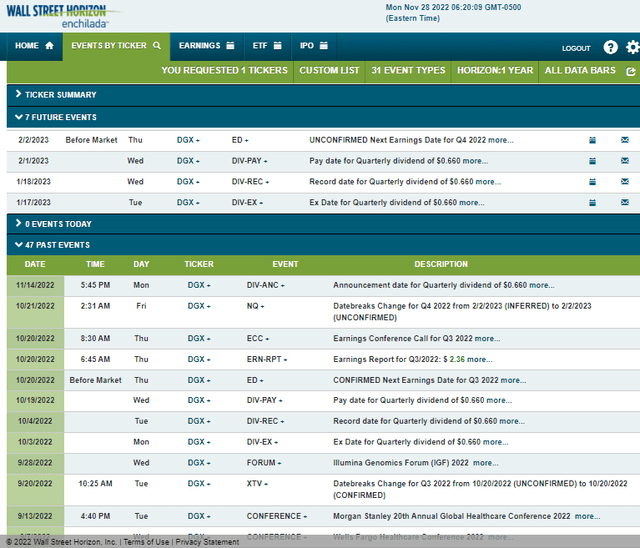

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 2 BMO. Before that, the stock trades ex-div on January 17, 2023.

Corporate Event Calendar

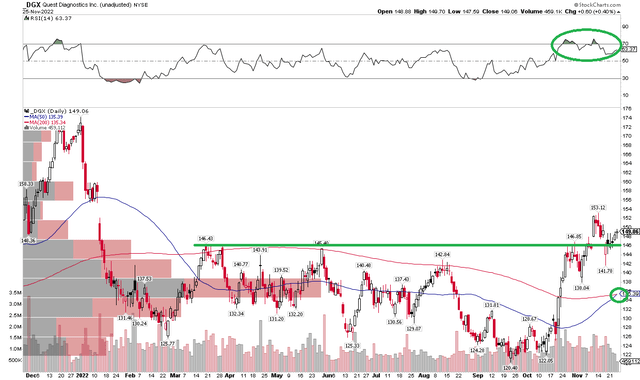

The Technical Take

DGX held important support in the low- to mid-$120s during its September swoon. Now, the stock has rallied above important resistance and looks better technically. Notice in the chart below that price recently notched a fresh multi-month high and the move was confirmed by strong RSI momentum.

Moreover, the 50-day moving average is crossing above the longer-term 200-day moving average in what technicians deem a bullish golden cross. Finally, the 200-day had been a point of selling on three past approaches this year, but the fourth time was the charm. So, there are signs the trend is changing in the bulls’ favor.

There’s an old price gap near $160 that could be in play along with the all-time high at $174, which is another area of possible profit taking. Overall, long from a technical perspective with a stop under the November low of $138 make sense.

DGX: Shares Rise Above the 200-Day Moving Average, Near Highs Since January

The Bottom Line

Quest appears more expensive today versus my September analysis, but the technical picture has improved. Thus, I am maintaining my buy recommendation. 2023 will be a key year to see how profitability shapes up for this Covid beneficiary.

Be the first to comment