imaginima

(Note: This article was in the newsletter on September 5, 2022 and has been updated as needed.)

(Note: This is a Canadian company that reports in Canadian dollars)

Advantage Energy (OTCPK:AAVVF) has long been a company that has been interested in growth. That interest has persisted despite a market emphasis on returning capital to shareholders. Management has a lot of prospects to show for the strategy. So, when Mr. Market gets past this current demand on dividends and stock repurchases (as Mr. Market usually does), a company like this may well provide a superior return.

As was noted in the Peyto (OTCPK:PEYUF) monthly president’s letter, there is an emphasis on wealth building that usually prevails in any form of investment. Wealth builders do not want their capital back because then they need to find another use for that capital that makes an adequate return. The implication appears to be that the aborted recovery in 2018 scared the capital and debt markets enough to want to get their capital back before they lose it.

But the entities that have been lending in the market for some time and have the required experience to make deals were not the entities posting most of the losses that occurred once the boom times ended in 2015 (give or take). It was “new” money interested in making a fast buck that “lost its shirt”. That same money is now screaming for adequate return of capital before it gets lost again. But what was really needed was disciplined investing from the start.

Investing in this industry requires low costs and careful planning to achieve payback plus a decent return. When too much money pours into the industry to bring about the next cyclical downturn, the experienced money is on the sidelines. Good deals will always find capital or debt despite the headlines at times proclaiming that the markets are closed to the industry. I have followed many companies that proved that one time and again.

Superior Returns

Advantage Energy has long had some of the lowest costs as well as highly profitable leases in the business.

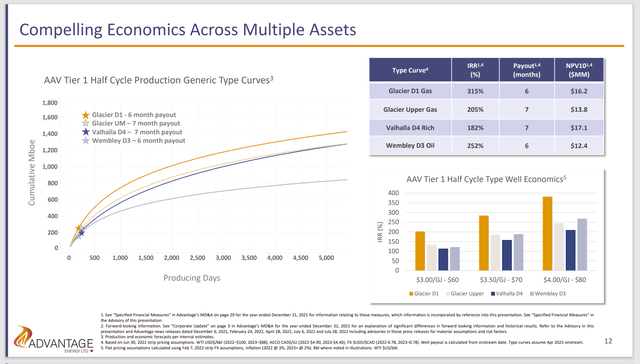

Advantage Energy Well Profitability (Advantage Energy October 2022, Corporate Presentation)

Advantage Energy has long had superior profitability that often enabled the company to drill when many in the industry essentially stopped all but essential activities while waiting for better prices. In the current environment, those lower costs that enable the superior profitability have enabled some fantastic returns.

Anytime the payout is less than two years, the project is generally considered worth doing. These wells payout considerably under two years. In most cases, the company can drill two wells with the same capital because of the fast payback. That allows for fast cash flow growth that others dream about.

Improved Operating Results

This company continues to keep its leadership position by improving the results of wells drilled.

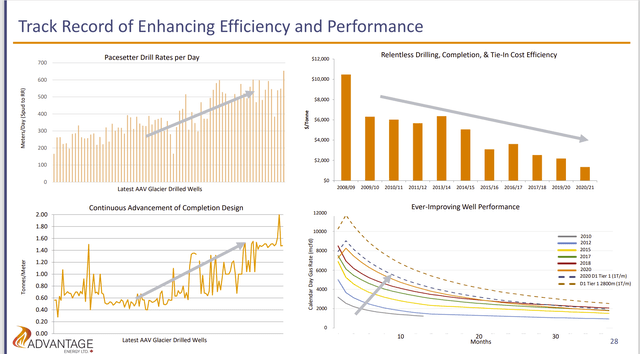

Advantage Energy Summary Of Improved Operating Results (Advantage Energy October 2022, Corporate Presentation)

This company has long posted superior results. Some rather significant improvements in well performance should keep the profitability of this company among the best of the natural gas producers.

Management long ago began diversifying into rich gas production because some of the intervals that were not producing became commercial while having more than dry gas. But then the dry gas leases improved so much that the rates of return actually exceeded the rich gas prospects by a comfortable margin. That is not an often-repeated accomplishment.

Nonetheless, management has wisely continued to diversify into more liquids production because things can change rapidly in this industry that liquids rich leases are more profitable. The diversification gives management the flexibility to drill for higher profitability under a wider variety of conditions.

Management also tries hard to keep the low lease operating expenses constant while achieving the value-added production of the liquids rich areas. So far, this goal appears to be very achievable on this acreage.

Integration Advantage

This company also owns a large majority interest in its midstream holdings. The midstream operations help to decrease earnings volatility while providing a cash flow cushion during industry downturns. As the green revolution proceeds, there may be opportunities to further diversify into crackers to provide needed raw materials for the plastic industry.

The ownership of the midstream ends where the long-haul pipeline connections begin. This company tends to want to send the natural gas to more profitable markets (usually outside of Canada). So, management earns stronger United States dollars for its product while incurring costs in Canadian dollars.

There are some expansion plans underway as this company is likely to grow production in the current environment.

Growth Priority

This company is likely to continue to prioritize growth in the future. Management has earned a fantastic return on the money it invests into more wells and infrastructure. That has been the case for most of the years that I have followed this company. As long as superior returns can be obtained, then there is really no need to return capital to shareholders despite market demands.

The market has long gone through phases demanding what it wants at the time. Strong focused management will usually provide good long-term returns despite the whimsical market demands that appear from time to time.

The Future

Management also has a carbon capture subsidiary that now has financing to get itself up and running. The first working equipment is now operational. Any new venture is risky. However, should this subsidiary succeed, there could be additional value to shareholders. At the very lease this new venture should allow the company to reduce carbon emissions.

The upstream and midstream operations have a lot of profitable possibilities for growth in the future. Therefore, a change in current management strategy is not at all likely. This investment is for those who believe that long-term growth can lead to adequate investment returns. Income investors can look elsewhere.

The other consideration would be that a well-run company like this may become a takeover candidate at the right price in the future. Buyers like a deal that has few problems. This company meets a lot of potential buyer requirements.

The leases still have unexplored intervals. There is therefore every indication that this acreage will be producing long past the reserves indicated on the reserve report as long as technology continues to move forward.

In any event, at the current price, there are a lot of ways to profit from this investment in the future. Unlike many in the industry, this company does unusually well during industry downturns because the wells are that profitable. That provides a margin of safety for investors that like to buy and hold cyclical growth companies.

Be the first to comment