CHUNYIP WONG

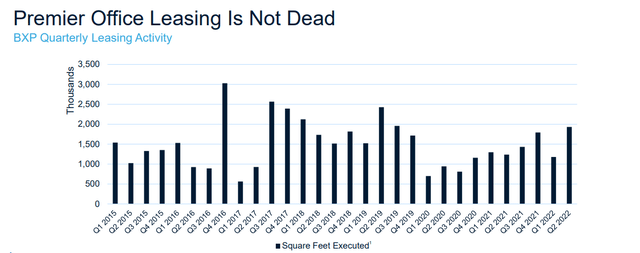

Boston Properties (NYSE:BXP) just published their most recent Q3 results, and while it beat expectations for EPS and revenue, we find guidance relatively weak, and more importantly, we see evidence of continued work-from-home headwinds in the declining occupancy. Boston Properties delivered Q3 FFO of $1.91, beating expectations by four cents, and revenue of $790.5 million exceeded expectations by $27 million. Importantly, the company continues doing a great job in this challenging environment on the leasing from, managing to sign 1.4 million square feet of leases in Q3. The company is also continuing to expand its life sciences portfolio, which has been less impacted by the work-from-home trend.

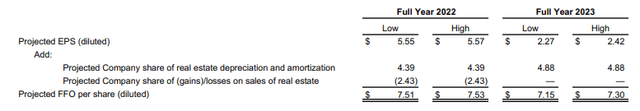

The table below summarizes the company’s guidance for 2022 and 2023, note that at the midpoint of guidance both EPS and FFO are projected to be lower for next year compared to 2022. Together with a lower occupancy, and higher refinancing costs, this reflects the challenges the company is facing, and that it does not expect them to subside anytime soon.

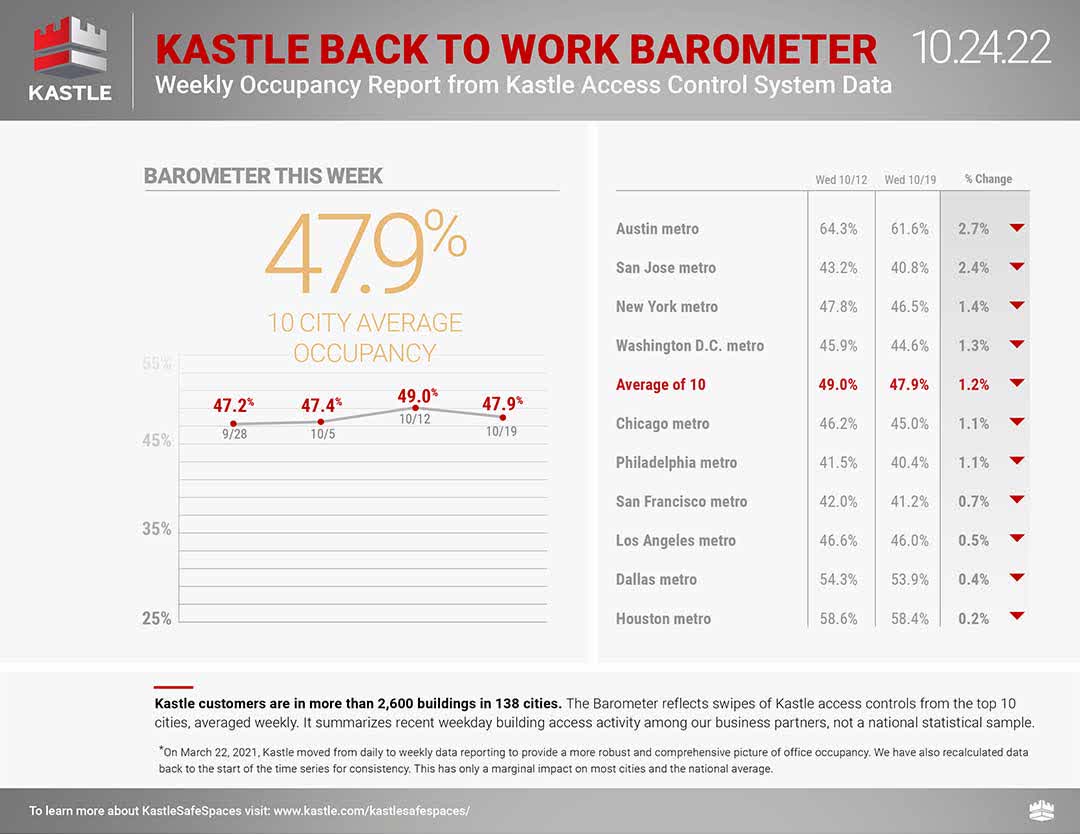

We have to give the company credit that it has managed to deliver relatively decent results when the work-from-home trend remains so strong. In our opinion, one of the best indicators to judge how widespread this trend is, is the Kastle index. They generate an occupancy report from their access control systems. Their ten major cities average occupancy barometer was recently at 47.9%. Given this low level of office utilization, it is impressive that Boston Properties is managing to sign leases at a decent rate.

Kastle

Occupancy

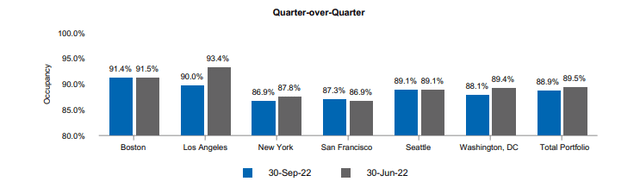

Despite the robust leasing activity, Boston Properties still lost some occupancy during the quarter. From June 30th to September 30th the company lost 60 bps in occupancy, dropping to 88.9% from 89.5%. It will be very difficult for the company to deliver solid financial performance if the occupancy trend does not start moving in the opposite direction soon.

Leasing

Boston Properties likes to point out to the robust leasing activity as proof that there is a future for the office. As can be seen below, the company is right that after a significant drop during the worst of the Covid crisis, leasing is almost back to normal. The graph below does not include Q3, but based on the just release numbers, leasing activity for the third quarter was 1.4 million square feet. Less than Q2, but still a very respectable amount of leases, and not too different of what would be expected pre-Covid.

Balance Sheet

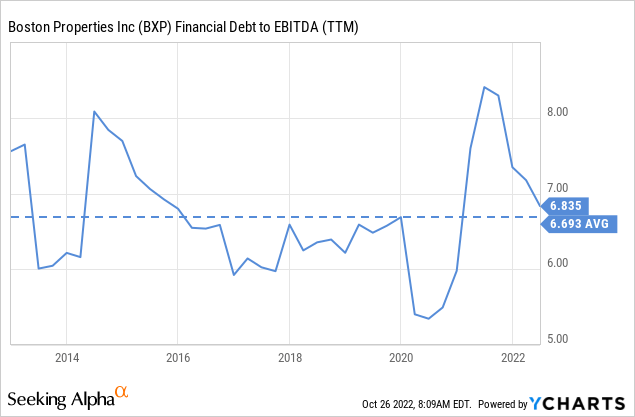

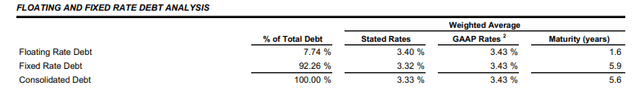

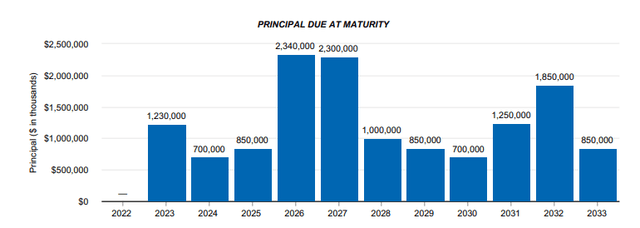

Fortunately for Boston Properties investors, the company has a solid financial position. This gives the company some time while it waits for the situation to improve, but of course, the question is if things will ever return to ‘normal’. It is possible that the company will have to accept lower occupancy levels and make extra concessions to its tenants, but at least its immediate survival is not at risk. Boston Properties is relatively well protected from increasing interest rates with 92.2% of its debt fixed rate, and an average 5.6 years weighted average maturity.

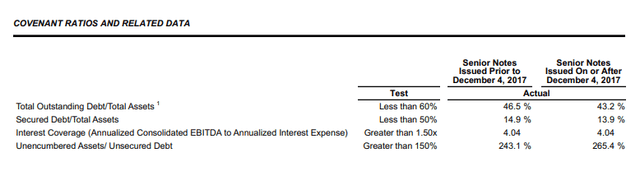

The company is far from breaching its covenants, with an interest coverage ratio of 4.04x compared to a requirement of more than 1.5x. The rest of the covenant ratios have also a good margin of safety, as can be seen below.

The company continues to have unsecured Senior Debt Ratings that are investment grade, with BBB+ from S&P and Baa1 from Moody’s. Its debt is well laddered, making refinancing any given year less challenging.

Dividend Coverage

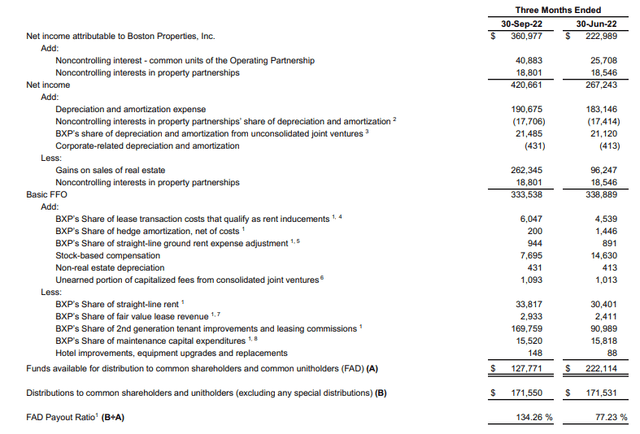

While the dividend appears safe at first glance, given that funds from operations are still higher than the dividend, based on the company’s estimate of funds available for distribution (FAD) things are getting a lot tighter. The FAD payout ratio for the quarter increased to 134%, meaning the company distributed more in dividends than it could afford. The main reason for this excessive payout ratio appears to be the expenses related to tenant improvements and leasing commissions, which went from $90 million in the previous quarter to $169 million in the most recent quarter. We don’t want to make too much about it, as these types of expenses can vary significantly from quarter to quarter, but it does seem than the company is having to spend more in tenant improvements to keep them happy, and that is reducing the cash flow available for dividends.

Valuation

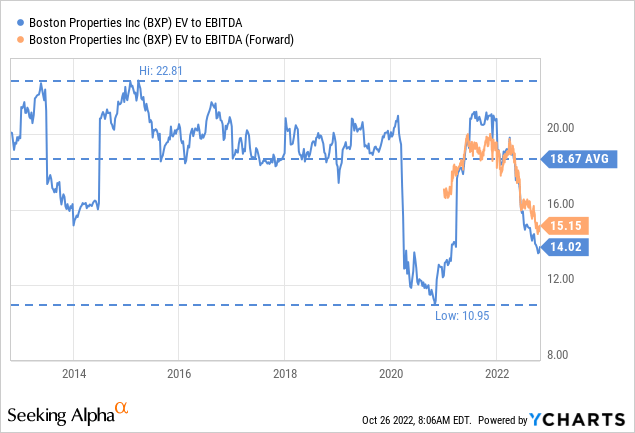

While share look extremely cheap compared to its historical valuation, in absolute terms, the multiples are not really that low, especially given the enormous headwinds. EV/EBITDA is at ~14x, and its forward version is at ~15x, given that analysts expect earnings to deteriorate in the coming year.

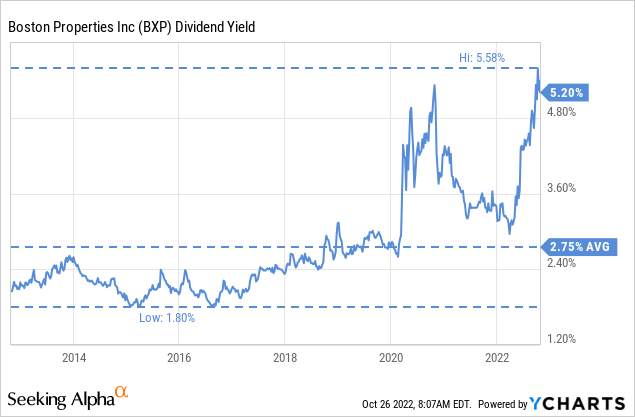

The dividend is quite high, at ~5.2%, significantly higher than the ten-year average of 2.75%. Unfortunately, we are not too confident the company can avoid a dividend cut, given that the dividend coverage is deteriorating.

Risks

As a company with a good amount of leverage, small changes in occupancy and financial performance can get amplified. If the work-from-home trend starts having a more meaningful impact on leasing and occupancy, things could deteriorate quite quickly.

Conclusion

We are seeing increasing evidence that work from home is eroding fundamentals for the company, while at the same time the valuation remains quite low. We are adjusting our rating to ‘hold’, as we believe the risk/reward is relatively well balanced at the moment. How occupancy and leasing progress the next few quarters will be critical for the company, and whether it can regain its lost valuation.

Be the first to comment