J. Michael Jones/iStock Editorial via Getty Images

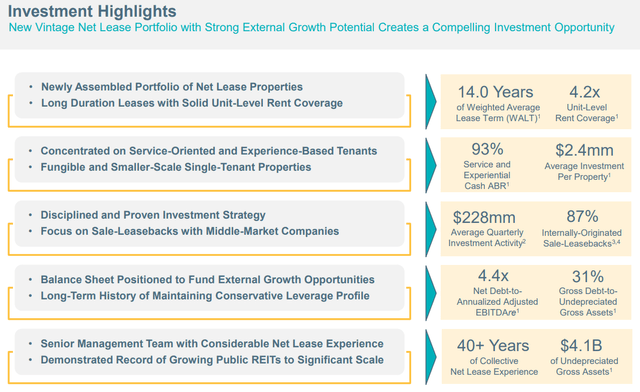

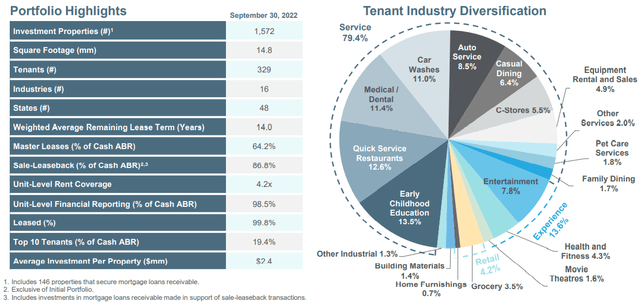

Essential Properties Realty Trust (NYSE:EPRT) is a unique triple-net lease REIT that specializes in sale-leasebacks with private, middle-market corporate tenants primarily in the service industry.

Because most of its acquisitions are sale-leasebacks in which EPRT works directly with businesses to buy their self-occupied and owned real estate assets, EPRT is able to insist upon a number of landlord-friendly lease terms such as long lease durations, master leases, annual rent escalations, and property-level financial reporting.

Since EPRT overwhelmingly focuses on non-investment grade service and experience-based tenants and property types, it is an ideal stock to hold in tandem with net lease REITs focused on investment grade goods retail properties like Agree Realty (ADC) or NETSTREIT (NTST).

In what follows, I’ll explain why I am building EPRT into one of my largest holdings and also why it looks like a good buy on the current dip.

Essential Properties Overview

EPRT has a few major things going for it, starting with its overwhelmingly e-commerce-resistant service industry tenants.

Moreover, the fact that EPRT focuses on sale-leasebacks with otherwise bank-dependent, middle-market firms gives it the negotiating leverage to obtain many landlord-friendly lease terms like unit-level / property-level financial reporting and long lease durations.

Notice also that EPRT’s average purchase price per property is $2.4 million. This is the lowest in its peer group, aside from Getty Realty (GTY), which focuses almost exclusively on gas stations and convenience stores.

Having smaller, more generalized properties makes EPRT’s portfolio more fungible, reduces the downside in a re-tenanting situation, and gives the REIT a wider buyer pool into which to dispose of assets.

When it comes to private, middle-market tenants, it is generally prudent to remain largely diversified across tenants, industries, and property types, and EPRT does just that. The top ten tenants, for example, make up a little less than 20% of total NOI.

This despite the fact that nearly 50% of the portfolio is in four industries: pre-Ks, fast food, medical/dental, and car washes.

Notice also the 14-year weighted average remaining lease term. That is the longest in the net lease REIT space.

In an environment of low interest rates and inflation, term or lease duration is immensely valuable – the longer, the better. If we return to a low rates / low inflation environment in the coming years, EPRT’s valuation should theoretically shoot back up. Not to mention the fact that in such an environment, growth is rewarded more than value, and EPRT is one of the most “growthy” net lease REITs.

However, even if inflation only settles back to a moderate level of 3-4%, EPRT is still better positioned than the average net lease REIT with its 1.6% weighted average annual rent escalation. Since all expenses are paid by the tenant, this 1.6% organic rent growth flows straight into same-store NOI growth.

While this organic growth wouldn’t keep up with moderate inflation on its own, it would in combination with the 1-3% organic growth from reinvestment of EPRT’s retained cash / free cash flow after dividends.

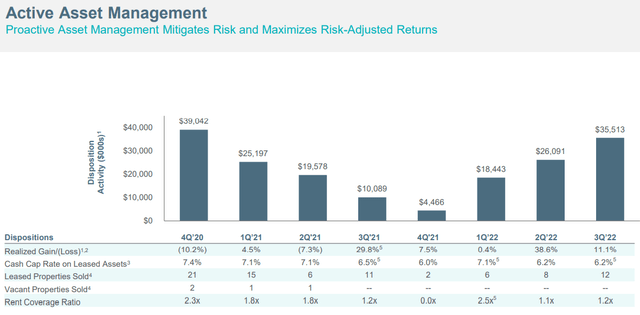

Yet another form of internal growth is accretive capital recycling, which basically amounts to EPRT’s ability to regularly sell properties at a lower cap rate than the one at which it buys properties.

For example, while EPRT’s cash cap rate on Q3 acquisitions was 7.1%, the REIT sold a dozen properties during the quarter at a cash cap rate of 6.2%.

Notice also that the rent coverage ratio at properties sold stood at 1.2x, well below the portfolio-wide average of 4.2x.

Dispositions, then, serve a dual purpose for EPRT: They raise accretive capital by selling at cap rates below their acquisition cap rates, and they also serve as a risk mitigation tool by pruning many of the worst performing properties.

To be clear, these are performing worse for the tenant even while they remain current on rent to EPRT, but properties performing worse for the tenant are more likely to eventually see a default or non-renewal.

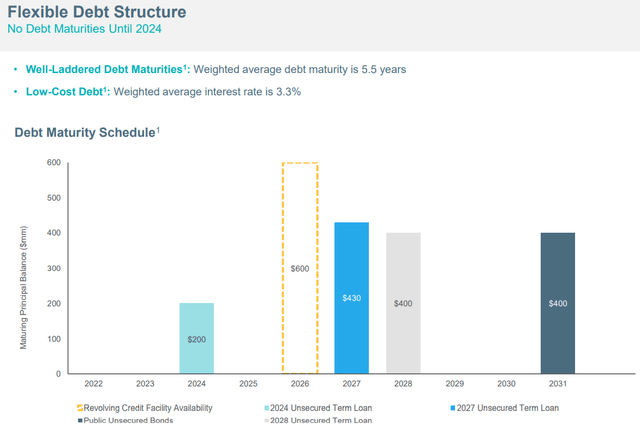

Finally, when it comes to the balance sheet, EPRT enjoys one of the strongest capital structures in the net lease space. For starters, the debt maturity schedule is well-laddered with no maturities in 2023 and only $200 million from now until 2027.

What’s more, 100% of EPRT’s debt is now fixed rate, giving the REIT enviably fixed interest costs for years to come.

The REIT is also one of the least leveraged in the net lease space, ending Q3 with a net debt to EBITDA of 4.4x.

As of mid-Q4, EPRT had nearly $750 million in total liquidity, including $600 million available on the credit facility and $144 million in cash.

Between the $150 million drawn on the 2028 term loan drawn after quarter-end and the $144 million in cash, EPRT had around $294 million in long-term capital going into Q4. Compare that to the $275 million of investments already closed or signed for the fourth quarter. Depending on how much ATM equity issuance is used, EPRT will probably need to raise more capital sometime in the first or early second quarter of 2023.

In short, what EPRT sacrifices in terms of tenant credit quality, it more than makes up for (in my judgment) in landlord-friendly lease provisions, highly fungible real estate, and conservative financial management.

Recent Performance

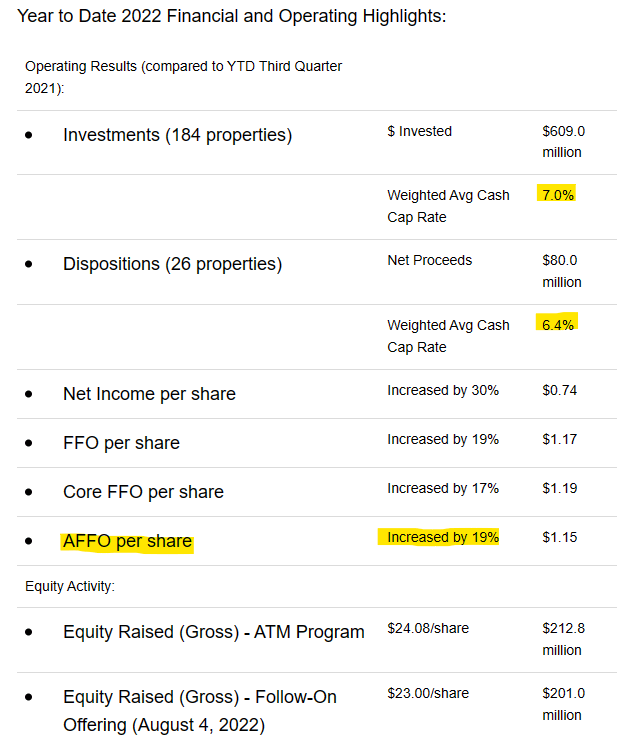

This year has been a phenomenal one for EPRT in terms of growth. In the first nine months, the REIT closed a slightly lower level of acquisitions than its recent year average, but AFFO per share growth has surged by 19%, driven by deferred rent collections and highly accretive capital recycling.

EPRT Q3 Presentation

Compare 2022’s AFFO per share guidance of $1.53 at the midpoint to 2023’s initial guidance of $1.61 at the midpoint. If it proves accurate, that will represent 5.2% AFFO per share growth next year, a slowdown from this year’s double-digit growth rate. However, this slowdown in growth appears to be motivated by an appropriate level of caution.

Here’s CEO Pete Mavoides from the Q3 earnings report:

Looking ahead to 2023, our newly issued guidance assumes continued balance sheet discipline and a moderated level of investment activity, which we see as prudent given the uncertain economic outlook and challenged capital markets environment.

The spike in interest rates is a big part of this cautious guidance. EPRT fortunately trades at a high enough valuation that it is usually able to issue equity for accretive acquisitions. Perhaps EPRT will still be able to lean heavily on equity issuance for portfolio growth in 2023, but it would be preferable to add non-dilutive forms of capital to the mix.

Dividend Growth

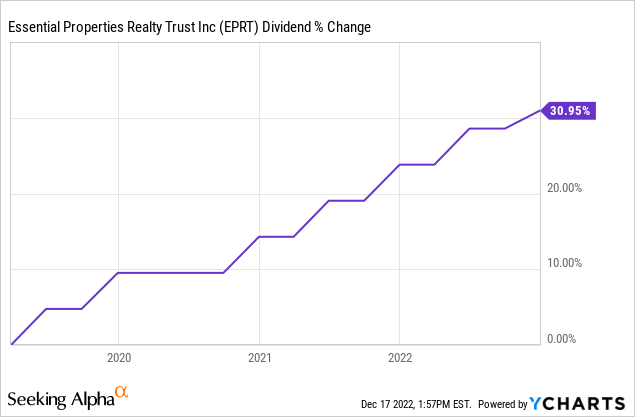

One of the most attractive aspects of EPRT is the REIT’s strong dividend growth.

The dividend appears to be abundantly safe, given the 2022 AFFO payout ratio of 70.6% and 2023 AFFO payout ratio of 67.5%. This should give management the room to continue EPRT’s rapid dividend growth streak that has been achieved since its IPO.

Over the past four years, the dividend has grown at a CAGR of 7.75%. Because of a skipped biannual dividend hike in the first half of 2020, most of the dividend growth has occurred in the last two years.

Since management has guided for lower AFFO per share growth in 2023, it makes sense that the most recent biannual dividend hike was only 1.9%.

Bottom Line

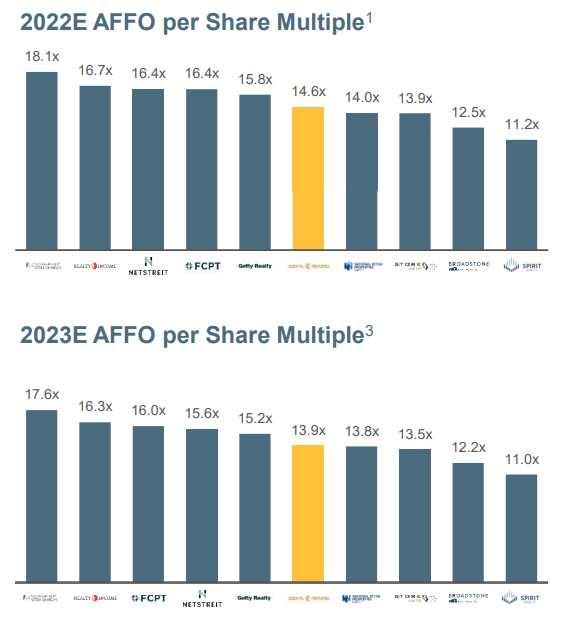

EPRT’s valuation relative to its growth rate is the most attractive in the net lease REIT space. Despite the second highest growth rate in recent years, it trades at an AFFO multiple around the middle of the pack.

EPRT Q3 Presentation

This chart is based on November 11th market prices, which have shifted a bit since then, but the relative valuations remain around the same.

Overall, EPRT has a well-thought-out investment strategy and portfolio design paired with a peer-leading cost of capital and fortress balance sheet.

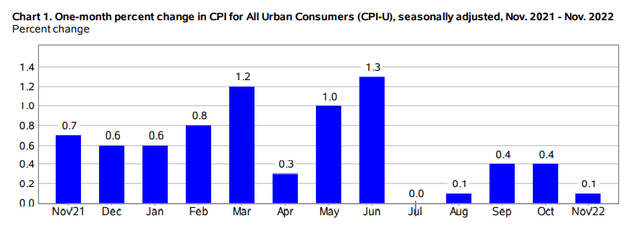

So, what makes EPRT a good buy today? In short, despite the Federal Reserve’s aggressive rhetoric today, I believe interest rates will ultimately fall over the course of 2023. That is because there are increasing signs that the post-COVID inflationary surge is over. Month-over-month growth in the CPI, for instance, is now only being held in positive territory by the lagging “shelter cost” measurements that lag actual housing costs by around 6 months.

By the middle of 2023, the year-over-year CPI should be significantly lower, allowing interest rates to come down, likewise lowering the cost of debt for companies like EPRT.

As such, the current dip is a great buying opportunity.

Be the first to comment