Dilok Klaisataporn

Let’s face it, building a well-diversified portfolio of dividend payers takes time and engagement with the market. While that’s what draws many investors to the market, it’s not everyone’s cup of tea. For those who want to take a hands off approach, there are a slate of ETFs for nearly every investment strategy.

This brings me to Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), which is a great option for those investors who seek automatic diversification with large cap value stocks that pay dividends. SCHD moves more or less in line with the market, and as seen below, is now down again below $75, falling in sympathy with the rest of the market in recent weeks.

Those focused on the long-run and income know that downturns are not necessarily a bad thing, especially when it comes to diversified income generators. This article highlights why SCHD is a buy on recent price weakness, so let’s get started.

Why SCHD?

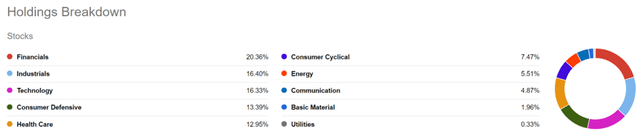

SCHD is an index ETF that tracks the performance of U.S. large-cap value stocks. It has a broader scope than the S&P 500 (SPY), as it covers the field of the Russel 1,000. As one would expect from the dividend focused ETF, SCHD has higher exposure to Financials, Industrials, Consumer Defensive, and Healthcare. However, SCHD has something for techies as well, with Technology being its third largest segment, as shown below.

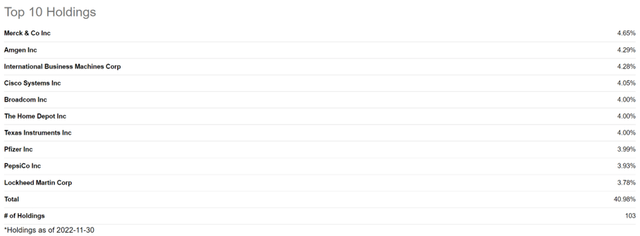

SCHD’s top 10 holdings are comprised of well-respected divided payers and growers, such as Merck (MRK), Amgen (AMGN), Broadcom (AVGO), Home Depot (HD), and Texas Instruments (TXN). As one would expect, the top 10 list is constantly changing based on equity market caps, which is correlated with share price performance. Given the rally in healthcare stocks over the past several months, it’s no surprise that Merck and Amgen are in the top 2 spots.

SCHD Top 10 Holdings (Seeking Alpha)

These top holdings rank high in investor interest, as evident by their followings on Seeking Alpha, and for good reason too. That’s because a number of them have exhibited high dividend growth over the years. For example, Amgen has a 5-year dividend CAGR of 11%, while Broadcom and Texas Instruments have 5-year CAGRs of 32% and 17%, respectively.

Having exposure to a high number of these big time growers has translated to market beating results. As shown below, SCHD has given investors a 255% total return over the past decade, beating the 227% total return of the S&P 500 over the same timeframe.

SCHD Total Return (Seeking Alpha)

At the same time, SCHD now gives investors a respectable 3.4% dividend yield, which is more twice that of the S&P 500 (SPY). The dividend has also grown every year since SCHD’s inception in 2011, and comes with a high 5-year CAGR of 14%.

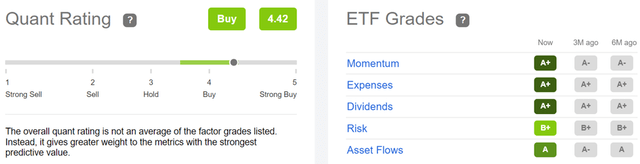

Moreover, SCHD charges a well below average expense ratio of just 0.06%, sitting far below the 0.39% median across the ETF universe. As shown below, SCHD scores a Buy rating from SA’s Quant Rating System, and A+/A grades for momentum, expenses, and asset flows, and a B+ grade for risk.

SCHD Quant Rating (Seeking Alpha)

A big driver for the B+ risk is the C grade that SCHD scores for having the Top 10 holdings comprise 41% of the total holdings, sitting well above the 31% median across all ETFs. I’m not too concerned, however, as it’s better to have higher exposure to high quality names than to “diworsify” just for diversification’s sake.

Risks to SCHD include general macroeconomic risks, driven by higher interest rates. However, most of SCHD’s top holdings have very strong balance sheets that makes them less vulnerable to higher rates. In addition, many of its top names such as Amgen and Cisco (CSCO) are active repurchasers of their stocks, and can simply divert some of the capital returns from equity buybacks to bond repurchases, to further mitigate their risks from higher rates.

Investor Takeaway

Schwab Strategic Trust ETF is looking interesting on recent price weakness, whether one seeks to add income and/or diversification to their portfolio. Its top holdings comprise many “dividend dream” stocks that should be core holdings to any long-term dividend growth portfolio, all while charging investors a very low expense ratio. Considering all the above, I find SCHD to be an attractive option for dividend growth investors after the recent price drop.

Be the first to comment